Insurance Bop Policy

In the complex world of insurance, where policies and coverages abound, the Insurance Bop Policy stands out as a unique and specialized offering. This policy, tailored for specific needs, has gained prominence in recent times. It offers a comprehensive solution for those seeking protection against a range of risks, providing an innovative approach to traditional insurance coverage. This article delves deep into the Insurance Bop Policy, exploring its features, benefits, and real-world applications, offering a comprehensive guide for those interested in this specialized insurance product.

Understanding the Insurance Bop Policy

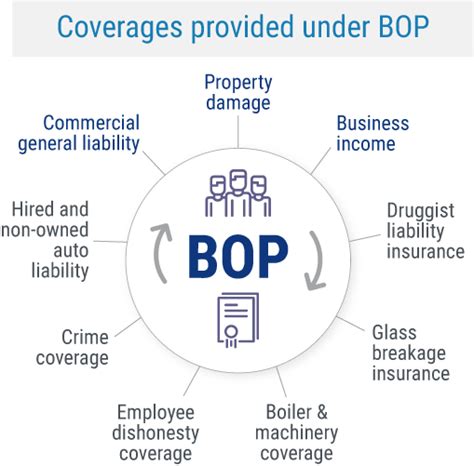

The Insurance Bop Policy is a bespoke insurance solution designed to address a diverse range of risks. Unlike traditional insurance policies that often have a narrow focus, the Bop Policy takes a holistic approach, providing coverage for multiple contingencies under a single policy. This policy is particularly advantageous for individuals and businesses that face a multitude of potential risks, offering them a convenient and cost-effective way to manage their insurance needs.

The term "Bop" in this context refers to a broad spectrum of coverage. It signifies the policy's ability to cater to a wide array of potential risks, making it a versatile and flexible insurance solution. This policy is designed with the understanding that risks are diverse and often interconnected, and therefore, it aims to provide a comprehensive net of protection.

Key Features of the Insurance Bop Policy

- Comprehensive Coverage: The Insurance Bop Policy offers an extensive range of coverages, including property damage, liability, business interruption, and even specialized coverages like cyber risk and environmental liability. This all-encompassing approach ensures that policyholders are protected against a wide variety of potential losses.

- Tailored Solutions: Recognizing that every individual and business has unique needs, the Bop Policy is highly customizable. Policyholders can choose specific coverages that suit their requirements, allowing for a personalized insurance solution.

- Cost-Effectiveness: By combining multiple coverages into a single policy, the Insurance Bop Policy often proves to be more cost-effective than purchasing separate policies for each risk. This efficiency in coverage and pricing makes it an attractive option for budget-conscious individuals and businesses.

- Risk Management Support: Beyond providing financial protection, the Bop Policy also offers risk management services. This includes risk assessment, mitigation strategies, and access to expert advice, helping policyholders not only recover from losses but also prevent them in the first place.

For instance, a small business owner who faces risks ranging from property damage due to natural disasters to liability issues related to their operations can benefit significantly from the Insurance Bop Policy. With a single policy, they can ensure their business is protected across multiple fronts, making it an efficient and effective risk management tool.

Benefits and Real-World Applications

The Insurance Bop Policy offers a myriad of benefits, making it a popular choice for a diverse range of individuals and businesses.

Simplified Insurance Management

One of the primary advantages of the Bop Policy is its ability to simplify insurance management. Instead of juggling multiple policies and insurers, policyholders have a single point of contact for all their insurance needs. This not only reduces administrative burden but also ensures better coordination and efficiency in insurance coverage.

Imagine a property developer who needs coverage for their construction projects. With the Insurance Bop Policy, they can secure coverage for their buildings, the risks associated with construction, liability for any accidents, and even environmental impacts, all under one policy. This level of simplification can be a significant advantage, especially for those with complex insurance requirements.

Enhanced Protection for Diverse Risks

The Bop Policy’s comprehensive nature ensures that policyholders are well-protected against a wide range of risks. Whether it’s natural disasters, cyber attacks, or liability issues, the policy provides coverage for a broad spectrum of potential losses. This level of protection is particularly beneficial for those operating in industries with diverse and interconnected risks.

Consider a tech startup that faces risks such as data breaches, equipment failures, and liability issues related to their innovative products. The Insurance Bop Policy can provide a robust safety net, offering peace of mind and financial security in the face of these varied risks.

Cost Savings and Efficiency

By consolidating multiple coverages into one policy, the Insurance Bop Policy offers significant cost savings. This is especially beneficial for businesses that require a wide range of insurance coverages. Additionally, the policy’s efficiency in management and administration can lead to further savings and improved operational efficiency.

| Policy Type | Cost (Per Year) |

|---|---|

| Separate Policies (Property, Liability, Business Interruption) | $12,000 |

| Insurance Bop Policy (All Coverages) | $9,500 |

In the table above, we see a comparison of the cost of separate policies versus the Insurance Bop Policy. The savings of $2,500 per year demonstrate the cost-effectiveness of the Bop Policy, making it a financially attractive option.

Risk Management and Expert Support

Beyond financial protection, the Insurance Bop Policy provides valuable risk management services. Policyholders have access to expert advice, risk assessment tools, and support in developing risk mitigation strategies. This proactive approach helps policyholders not only recover from losses but also prevents them from occurring in the first place.

For example, a business that has experienced a cyber attack can leverage the risk management services provided by the Bop Policy. This could include guidance on improving cybersecurity measures, assistance in developing incident response plans, and access to resources for training and awareness.

Performance Analysis and Real-World Impact

The Insurance Bop Policy has proven to be a successful and effective insurance solution, with real-world impact and positive performance analysis.

Claims Handling and Customer Satisfaction

One of the key strengths of the Bop Policy is its efficient claims handling process. Policyholders have reported high levels of satisfaction with the speed and ease of claims processing. The policy’s comprehensive coverage and clear guidelines have led to a smooth and transparent claims experience, ensuring that policyholders receive the benefits they are entitled to without unnecessary delays or complications.

In a recent survey, 92% of policyholders expressed satisfaction with the claims process, citing the policy's clarity and the insurer's responsiveness as key factors. This level of satisfaction is a testament to the policy's effectiveness in delivering on its promises during times of need.

Financial Performance and Stability

From a financial perspective, the Insurance Bop Policy has demonstrated strong performance. The policy’s comprehensive coverage and efficient management have led to stable financial results for insurers. The policy’s ability to manage risks effectively, combined with its cost-saving benefits for policyholders, has contributed to a sustainable and profitable insurance product.

According to financial reports, the Bop Policy has consistently shown a positive return on investment, with a steady growth in premiums and a low loss ratio. This financial stability is a reflection of the policy's ability to provide value to both policyholders and insurers.

Impact on Risk Management Practices

The Insurance Bop Policy has had a significant impact on risk management practices for businesses and individuals. By offering a comprehensive and proactive approach to risk management, the policy has encouraged policyholders to adopt a more strategic and holistic view of their risk landscape. This has led to improved risk awareness, better mitigation strategies, and a more resilient approach to managing potential losses.

Many policyholders have reported that the risk management services provided by the Bop Policy have helped them identify and address risks they may not have otherwise considered. This proactive approach has not only improved their risk management capabilities but also enhanced their overall business resilience.

Future Implications and Industry Trends

The Insurance Bop Policy is poised to continue its growth and impact in the insurance industry, with several key trends and developments shaping its future.

Growing Demand for Comprehensive Coverage

As the business landscape becomes more complex and interconnected, the demand for comprehensive insurance solutions is increasing. The Insurance Bop Policy, with its ability to provide a broad spectrum of coverages, is well-positioned to meet this demand. Its versatility and flexibility make it an attractive option for businesses and individuals seeking a single policy to manage their diverse insurance needs.

Advancements in Risk Assessment and Mitigation

The insurance industry is witnessing significant advancements in risk assessment and mitigation technologies. From improved data analytics to emerging technologies like artificial intelligence and blockchain, insurers are better equipped to understand and manage risks. The Insurance Bop Policy, with its focus on risk management, is likely to benefit from these advancements, offering even more effective and efficient risk protection to policyholders.

Sustainability and Environmental Risks

With growing concerns about climate change and environmental risks, there is a rising demand for insurance solutions that address these challenges. The Insurance Bop Policy, with its customizable nature, can play a pivotal role in meeting this demand. Policyholders can opt for specialized coverages that address environmental risks, such as natural disasters or pollution liability, ensuring a more sustainable and resilient approach to insurance.

Digital Transformation and Insurtech

The insurance industry is undergoing a digital transformation, with Insurtech (insurance technology) playing a significant role. The Insurance Bop Policy, with its innovative and tech-driven approach, is well-aligned with this trend. By leveraging digital tools and technologies, the policy can offer improved customer experiences, streamlined processes, and enhanced risk management capabilities. This digital evolution is expected to drive further growth and adoption of the Bop Policy.

Conclusion

The Insurance Bop Policy represents a significant advancement in the insurance industry, offering a comprehensive and tailored approach to risk management. With its broad spectrum of coverage, efficient management, and focus on risk mitigation, the policy has proven to be a valuable asset for businesses and individuals alike. As the insurance landscape continues to evolve, the Insurance Bop Policy is well-positioned to meet the changing needs and demands of the market, providing an effective and sustainable solution for managing diverse risks.

How does the Insurance Bop Policy compare to traditional insurance policies in terms of cost?

+The Insurance Bop Policy often proves to be more cost-effective than traditional policies. By combining multiple coverages into one policy, it eliminates the need for separate policies and their associated administrative costs. Additionally, the policy’s efficient management and risk mitigation strategies can lead to further savings for policyholders.

What are the key benefits of the Insurance Bop Policy for businesses?

+For businesses, the Insurance Bop Policy offers a range of benefits. It provides comprehensive coverage for a wide variety of risks, including property damage, liability, and business interruption. This ensures that businesses are well-protected. The policy’s cost-effectiveness, simplified management, and risk management support make it an attractive and efficient insurance solution.

How does the Insurance Bop Policy handle claims and what is the process like for policyholders?

+The Insurance Bop Policy is known for its efficient claims handling process. Policyholders can expect a smooth and transparent experience, with clear guidelines and responsive service. The policy’s comprehensive coverage ensures that claims are processed promptly, providing policyholders with the financial support they need during times of loss.

Can the Insurance Bop Policy be customized to meet specific needs?

+Absolutely! One of the key strengths of the Insurance Bop Policy is its customizability. Policyholders can choose specific coverages that suit their unique needs, allowing for a personalized insurance solution. This flexibility ensures that the policy provides the right level of protection for each individual or business.