Quote Insurance Home

Home insurance is a fundamental aspect of protecting one's property and assets. It offers a safety net against unforeseen events that can cause significant financial burdens. In this comprehensive guide, we delve into the intricacies of quote insurance home, exploring the factors that influence quotes, the coverage options available, and the steps to obtaining the most suitable home insurance policy. By understanding the nuances of this process, homeowners can make informed decisions to safeguard their homes and valuables effectively.

Understanding the Fundamentals of Home Insurance

Home insurance, often referred to as property insurance or homeowners insurance, is a contract between a homeowner and an insurance provider. This contract outlines the terms and conditions under which the insurance company agrees to provide financial protection for the policyholder’s home and its contents. It serves as a vital safeguard against potential risks, including damage caused by natural disasters, theft, or accidental occurrences.

The primary purpose of home insurance is to offer financial reimbursement to homeowners in the event of a covered loss. This coverage extends to the structure of the home, as well as its contents, including personal belongings, furniture, and appliances. Additionally, home insurance policies often include liability coverage, which protects the homeowner against legal claims arising from accidents or injuries that occur on their property.

Key Components of Home Insurance Policies

Home insurance policies are typically structured around several key components, each designed to address specific aspects of homeownership. These components include:

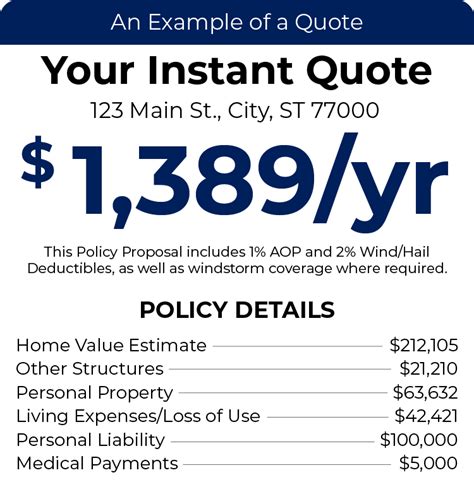

- Dwelling Coverage: This aspect of the policy covers the physical structure of the home, including the walls, roof, and foundations. It provides financial protection in the event of damage or destruction caused by covered perils.

- Personal Property Coverage: This coverage applies to the contents of the home, such as furniture, clothing, electronics, and other personal belongings. It ensures that, should these items be damaged or stolen, the homeowner can receive compensation to replace or repair them.

- Liability Coverage: This is a critical component, as it protects the homeowner from legal claims and lawsuits arising from accidents or injuries that occur on their property. It covers medical expenses and legal fees associated with such incidents.

- Additional Living Expenses: In the event that a home becomes uninhabitable due to a covered peril, this coverage provides for additional living expenses, such as hotel stays or temporary rental costs, until the home is restored.

- Optional Coverages: Many home insurance policies offer optional coverages that can be added to the base policy. These might include coverage for specific high-value items, such as jewelry or fine art, or additional liability coverage for unique circumstances.

Factors Influencing Home Insurance Quotes

The process of obtaining a quote for home insurance involves an assessment of various factors that can influence the final cost of the policy. These factors are used by insurance providers to evaluate the level of risk associated with insuring a particular home. Understanding these factors can help homeowners anticipate and potentially mitigate some of the influences on their insurance quotes.

Location and Environmental Factors

The geographic location of a home is a significant factor in determining insurance quotes. Homes located in areas prone to natural disasters, such as hurricanes, tornadoes, or wildfires, will generally face higher insurance premiums. Similarly, homes situated in regions with high crime rates may also see an increase in insurance costs due to the elevated risk of theft or vandalism.

Environmental factors, such as the proximity to bodies of water (for flood risks) or the presence of certain types of trees (for potential falling branch hazards), can also impact insurance quotes. Insurance providers carefully consider these factors to assess the likelihood of various types of claims.

Home Characteristics and Construction

The physical characteristics of a home, including its age, size, and construction materials, play a role in determining insurance quotes. Older homes may require more extensive coverage due to potential outdated wiring, plumbing, or roofing materials. Similarly, larger homes generally require more insurance coverage as they contain more assets that need protection.

The construction materials used in a home can also impact insurance quotes. For instance, homes built with fire-resistant materials or reinforced against natural disasters may qualify for lower insurance rates. Conversely, homes with older or less durable materials may face higher premiums.

Personal Factors and Claim History

Insurance providers also consider personal factors when determining insurance quotes. These can include the homeowner’s age, occupation, and credit history. For instance, homeowners with excellent credit scores may be viewed as lower-risk and thus qualify for more favorable insurance rates.

The claim history of a homeowner or their property is another critical factor. Homes with a history of frequent claims or major incidents may be seen as higher-risk, leading to increased insurance premiums. Conversely, homeowners who have maintained a clean claim history may benefit from lower insurance rates.

Coverage Options and Deductibles

The coverage options chosen by a homeowner can significantly impact their insurance quotes. Policies with higher coverage limits, broader coverage types, or additional endorsements will generally result in higher premiums. Conversely, selecting a policy with lower coverage limits or excluding certain coverage types can lead to more affordable insurance quotes.

The deductible chosen by the homeowner also influences insurance quotes. A higher deductible typically results in lower premiums, as the homeowner assumes a larger portion of the financial risk. On the other hand, a lower deductible means the homeowner pays less out of pocket in the event of a claim but results in higher insurance premiums.

Obtaining Accurate Home Insurance Quotes

To obtain an accurate quote for home insurance, homeowners should engage with reputable insurance providers or brokers who can offer a comprehensive assessment of their unique needs. This process often involves a detailed discussion of the homeowner’s specific circumstances, including the location and characteristics of their home, their personal factors, and their desired coverage options.

Gathering Relevant Information

Before seeking a home insurance quote, it’s beneficial to gather as much relevant information as possible. This includes details about the home, such as its age, size, construction materials, and any recent renovations or upgrades. Additionally, having a clear understanding of one’s personal factors, such as age, occupation, and credit history, can help provide a more accurate quote.

It's also important to consider the specific coverage needs of the homeowner. This might involve evaluating the value of their home and its contents, as well as any unique circumstances, such as the need for flood insurance or coverage for high-value items. By having a clear idea of the desired coverage, homeowners can ensure they receive quotes that align with their needs.

Comparing Multiple Quotes

To ensure they obtain the most competitive and suitable home insurance quote, homeowners should compare quotes from multiple insurance providers. This process allows them to assess the range of coverage options, premiums, and deductibles offered by different companies. By comparing these factors, homeowners can make an informed decision about which policy best meets their needs at the most affordable price.

When comparing quotes, it's essential to pay attention to the details of the coverage provided. While the premium is a critical factor, it's equally important to ensure that the coverage offered aligns with the homeowner's specific requirements. This includes verifying that the policy covers the full replacement cost of the home and its contents, as well as any additional coverages or endorsements that may be necessary.

Maximizing Value in Home Insurance Policies

Obtaining a home insurance policy is not just about securing coverage; it’s also about maximizing the value of that coverage. By understanding the nuances of their policy and taking certain proactive steps, homeowners can ensure they are adequately protected while also optimizing the cost-effectiveness of their insurance.

Understanding Policy Coverage and Exclusions

A crucial aspect of maximizing the value of a home insurance policy is understanding its coverage and exclusions. Homeowners should carefully review their policy documents to identify what is and is not covered. This includes understanding the limits of their coverage, such as the maximum amount payable for certain types of claims, and any specific exclusions or limitations that may apply.

Being aware of the coverage and exclusions allows homeowners to make informed decisions about their insurance needs. For instance, if they identify a gap in their coverage, they can work with their insurance provider to add appropriate endorsements or additional coverages to address those gaps. This ensures they have the protection they need without paying for coverage they don't require.

Bundling Policies for Cost Savings

Many insurance providers offer the option to bundle multiple policies, such as home and auto insurance, to provide cost savings. By bundling policies, homeowners can often take advantage of multi-policy discounts, which can significantly reduce their overall insurance premiums.

Bundling policies also simplifies the insurance process, as homeowners only need to deal with one insurance provider for all their insurance needs. This can be particularly beneficial for those who prefer a streamlined approach to insurance management.

Implementing Risk Mitigation Measures

Homeowners can often reduce their insurance premiums by implementing risk mitigation measures that make their homes less susceptible to damage or loss. These measures might include installing security systems, upgrading to fire-resistant roofing materials, or taking steps to reduce the risk of water damage, such as by adding sump pumps or improving drainage around the home.

By taking proactive steps to mitigate risks, homeowners can demonstrate to their insurance provider that their home is a lower-risk investment. This can lead to more favorable insurance rates, as the insurance company perceives a reduced likelihood of having to pay out on claims.

Navigating the Claims Process

While the primary goal of home insurance is to prevent financial loss, there may be instances when a homeowner needs to file a claim. Understanding the claims process and having the necessary information ready can streamline this process and ensure a smoother recovery.

Preparing for a Potential Claim

Being prepared for a potential claim is an essential aspect of home insurance. This involves having a clear understanding of the claims process outlined by one’s insurance provider, as well as the necessary documentation and information required to initiate a claim.

Homeowners should maintain an up-to-date inventory of their possessions, including photos or videos, to facilitate the claims process in the event of a loss. This inventory should detail the items, their value, and any relevant receipts or appraisals. Additionally, homeowners should keep their insurance policy documents and contact information for their insurance provider readily accessible.

Filing a Claim and Collaborating with the Insurance Provider

When a loss occurs, it’s crucial to notify one’s insurance provider promptly. Most insurance companies have dedicated claims departments that can guide homeowners through the claims process. This typically involves providing a detailed description of the incident, including any photos or videos of the damage, and submitting any necessary documentation to support the claim.

Throughout the claims process, homeowners should maintain open and transparent communication with their insurance provider. This includes promptly responding to requests for information and being honest and accurate in their descriptions of the incident and the resulting damage. Collaboration with the insurance provider can help ensure a fair and timely resolution to the claim.

Post-Claim Considerations and Policy Adjustments

After a claim has been resolved, it’s beneficial for homeowners to review their insurance policy and consider any necessary adjustments. This might involve increasing coverage limits, adding new coverages, or adjusting deductibles to better align with their changing needs and circumstances.

Additionally, homeowners should regularly review their policy to ensure it remains current and reflects any changes in their home or personal situation. This might include updates to the home's value, the addition or removal of possessions, or changes in personal circumstances that could impact their insurance needs.

Future Trends and Innovations in Home Insurance

The home insurance landscape is continuously evolving, driven by advancements in technology and changing consumer needs. Understanding these future trends and innovations can help homeowners stay informed and make more strategic decisions about their insurance coverage.

Technological Advancements in Home Insurance

Technology is playing an increasingly significant role in the home insurance industry. From the use of advanced analytics to assess risk more accurately to the integration of smart home technologies for monitoring and prevention, technology is transforming the way home insurance is delivered and experienced.

For instance, some insurance providers are now using telematics devices or smart home sensors to monitor homes in real-time, providing early warnings of potential risks and even offering discounts to policyholders who install such devices. Additionally, the use of artificial intelligence and machine learning is enhancing the efficiency and accuracy of claims processing, leading to faster resolutions for policyholders.

Changing Consumer Preferences and Expectations

Consumer preferences and expectations are also evolving, with a growing emphasis on personalized, digital, and environmentally conscious solutions. Homeowners are increasingly seeking insurance policies that offer flexibility and customization to meet their unique needs. This includes the ability to choose specific coverages, adjust deductibles, and access policy information and services digitally.

Additionally, there is a rising interest in insurance solutions that align with sustainability and environmental initiatives. This might involve coverage options that support eco-friendly renovations or incentives for policyholders who adopt energy-efficient practices in their homes.

The Role of Government Policies and Regulations

Government policies and regulations can also influence the future of home insurance. Changes in building codes, environmental regulations, or disaster preparedness initiatives can impact the risk landscape and, consequently, insurance coverage and premiums.

For instance, stricter building codes that mandate the use of more resilient construction materials or the implementation of energy-efficient standards can lead to reduced risk and potentially lower insurance premiums. Conversely, changes in environmental regulations or disaster preparedness requirements may increase the cost of insurance, particularly in areas that are deemed higher-risk.

What is the average cost of home insurance in the United States?

+The average cost of home insurance in the U.S. varies widely based on location, home characteristics, and coverage options. As of recent data, the national average for annual home insurance premiums is approximately 1,300, but this can range from around 700 to over $3,000 depending on individual circumstances.

Are there any ways to lower my home insurance premiums?

+Yes, there are several strategies to potentially reduce your home insurance premiums. These include increasing your deductible, bundling policies, implementing risk mitigation measures (such as installing security systems or upgrading to fire-resistant materials), and maintaining a clean claim history.

What should I do if I disagree with my home insurance quote?

+If you believe your home insurance quote is inaccurate or disagree with the factors considered, it’s important to discuss your concerns with your insurance provider. They can explain the rationale behind the quote and potentially adjust it based on new information or different coverage options.