Inexpensive Auto Insurance Companies

When it comes to finding affordable car insurance, there are several factors to consider. While the cost of auto insurance can vary greatly depending on individual circumstances and location, there are insurance providers that are known for offering competitive rates without compromising on coverage. This article aims to explore some of the most inexpensive auto insurance companies, providing valuable insights and information to help you make an informed decision.

Understanding Inexpensive Auto Insurance

Inexpensive auto insurance is often sought by budget-conscious individuals and families looking to minimize their insurance expenses. While price is a significant factor, it’s essential to strike a balance between affordability and adequate coverage to ensure financial protection in the event of an accident or vehicle-related incident. Some insurance companies have gained a reputation for offering competitive rates without sacrificing coverage quality.

It's important to note that the definition of "inexpensive" can vary depending on individual circumstances. Factors such as driving history, age, vehicle type, and location can significantly impact insurance rates. Therefore, it's crucial to obtain multiple quotes and compare coverage options to find the best deal that suits your specific needs.

Top Inexpensive Auto Insurance Companies

Let’s delve into some of the leading insurance providers known for their competitive rates and reliable coverage.

State Farm

State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products, including auto insurance. Known for its excellent customer service and competitive rates, State Farm provides personalized coverage options to suit various needs. With a strong focus on customer satisfaction, State Farm offers discounts for safe driving, multiple policy bundles, and loyalty programs, making it an attractive option for budget-conscious individuals.

State Farm's Discount Double Check program is particularly noteworthy. This initiative ensures that customers receive all the discounts they are eligible for, helping to lower their insurance premiums. Additionally, State Farm offers a Drive Safe & Save program that uses telematics to monitor driving behavior, potentially leading to further discounts for safe driving habits.

GEICO

GEICO, an acronym for Government Employees Insurance Company, has gained a reputation for providing affordable insurance rates to a wide range of customers. With a focus on simplicity and convenience, GEICO offers online quotes and a user-friendly interface, making it easy for customers to obtain coverage quickly. The company’s Military Discount is particularly appealing to active and retired military personnel, offering significant savings on insurance premiums.

GEICO's Paperless Discount is another unique offering, providing a discount for customers who choose to receive policy documents and communications digitally. This environmentally friendly option not only saves paper but also reduces costs for both the customer and the company.

Progressive

Progressive is a well-known insurance provider that has built its reputation on offering innovative insurance solutions. The company provides a wide range of coverage options, including auto, home, and life insurance. Progressive’s Name Your Price tool allows customers to set their desired price range for coverage, making it a popular choice for those seeking affordability without compromising on quality.

Progressive's Snapshot program is an interesting initiative that uses telematics to monitor driving behavior. By installing a small device in your vehicle, Progressive can track your driving habits and offer discounts based on safe driving practices. This program encourages safer driving while potentially reducing insurance costs for responsible drivers.

Esurance

Esurance, a subsidiary of Allstate, is known for its focus on digital innovation and customer convenience. The company offers a seamless online experience, allowing customers to obtain quotes, purchase policies, and manage their insurance needs entirely online. Esurance’s DriveSense program utilizes telematics to monitor driving behavior, offering discounts for safe driving habits.

One of Esurance's unique offerings is its E-sign feature, which allows customers to electronically sign their insurance documents, eliminating the need for paper and streamlining the policy purchase process. This environmentally conscious approach not only saves time but also reduces costs associated with traditional paper-based processes.

USAA

USAA (United Services Automobile Association) is a highly respected insurance provider that caters specifically to military members, veterans, and their families. Known for its exceptional customer service and competitive rates, USAA offers a wide range of insurance products, including auto insurance. The company’s Military Discount is particularly appealing, providing significant savings for those who have served or are actively serving in the military.

USAA's SafePilot program is an innovative approach to auto insurance. By using a mobile app to monitor driving behavior, SafePilot provides real-time feedback and insights to help drivers improve their skills. This program not only promotes safer driving but also offers potential discounts for participating customers.

| Insurance Company | Discounts Offered |

|---|---|

| State Farm | Discount Double Check, Drive Safe & Save |

| GEICO | Military Discount, Paperless Discount |

| Progressive | Name Your Price, Snapshot |

| Esurance | DriveSense, E-sign |

| USAA | Military Discount, SafePilot |

Factors Affecting Auto Insurance Rates

It’s important to understand the various factors that influence auto insurance rates. These factors can vary depending on the insurance company and your individual circumstances. Here are some key considerations:

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance rates. Insurance companies view responsible drivers as lower risk, resulting in more affordable premiums.

- Age and Experience: Younger drivers, especially those under 25, often face higher insurance rates due to their lack of driving experience. As drivers gain more years of experience, their rates may decrease.

- Vehicle Type and Usage: The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars and luxury vehicles may have higher premiums due to their higher repair costs. Additionally, vehicles used for business purposes or frequent long-distance travel may incur higher rates.

- Location: Insurance rates can vary significantly based on your geographic location. Urban areas with higher population density and a higher risk of accidents or theft may have higher insurance costs.

- Credit Score: In some states, insurance companies consider credit scores when determining insurance rates. A higher credit score may result in lower premiums, as it is often correlated with responsible financial behavior.

Tips for Finding Affordable Auto Insurance

Here are some additional tips to help you find the most affordable auto insurance that suits your needs:

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and coverage options. Online quote tools can be a convenient way to quickly compare multiple providers.

- Bundle Policies: Consider bundling your auto insurance with other insurance products, such as home or life insurance. Many providers offer discounts for bundling multiple policies.

- Increase Deductibles: Opting for a higher deductible can lower your insurance premiums. However, ensure that you can afford the higher out-of-pocket expenses in the event of a claim.

- Maintain a Good Driving Record: A clean driving record is crucial for keeping insurance rates low. Avoid speeding, reckless driving, and driving under the influence to maintain a positive driving history.

- Explore Discounts: Insurance companies offer various discounts, such as safe driver discounts, good student discounts, loyalty discounts, and discounts for safety features in your vehicle. Ask your insurance provider about the discounts you may be eligible for.

FAQ

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the U.S. varies depending on factors such as location, age, and driving history. According to recent data, the national average for auto insurance premiums is approximately 1,674 per year, or about 139 per month. However, rates can range significantly, with some drivers paying as little as 500 per year while others pay over 3,000 annually.

Are there any state-specific auto insurance companies that offer affordable rates?

+

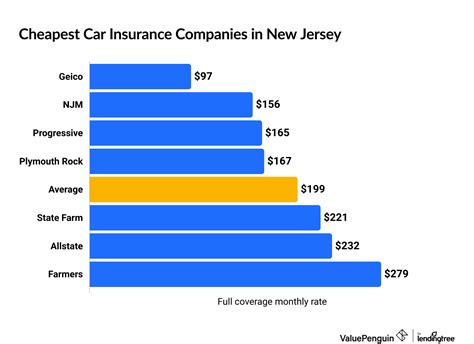

Yes, there are state-specific insurance companies that cater to local markets and offer competitive rates. For example, in California, companies like Mercury Insurance and Farmers Insurance are known for their affordable options. In Florida, companies like GEICO and Progressive offer tailored coverage for the unique insurance needs of the state. It’s always worth exploring local insurance providers to find the best rates for your specific location.

Can I get auto insurance without a down payment?

+

Some insurance companies offer payment plans that allow you to pay your insurance premiums monthly without requiring a down payment. This can be a convenient option for those who prefer to spread out their payments. However, keep in mind that certain providers may charge a small fee for this service, so be sure to inquire about any additional costs.