Individual Insurance Health Plans

Navigating the World of Individual Health Insurance Plans: A Comprehensive Guide

In today's dynamic healthcare landscape, understanding the intricacies of individual health insurance plans is more important than ever. As a knowledgeable expert in the field, I aim to provide an in-depth analysis and guide to help individuals navigate this complex yet crucial aspect of personal finance and well-being.

Understanding Individual Health Insurance

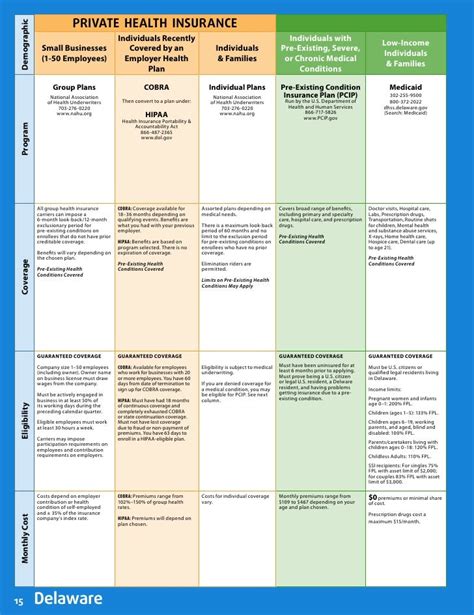

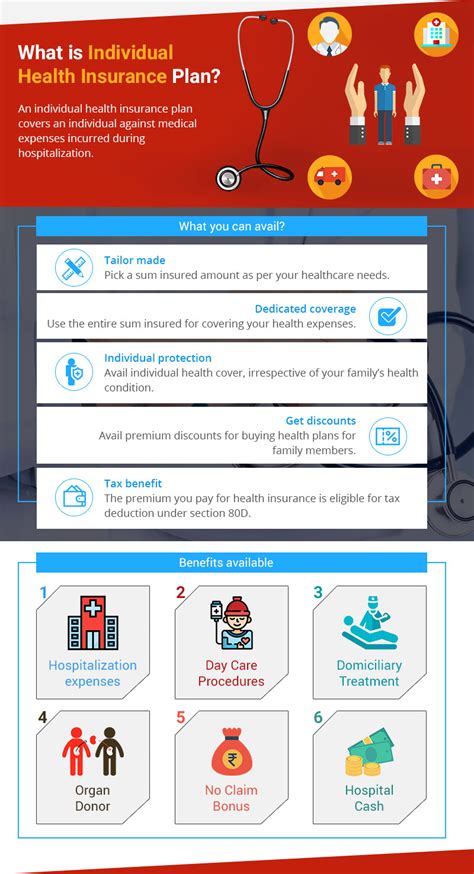

Individual health insurance plans are a type of coverage designed to protect individuals and their families from the financial risks associated with unexpected medical expenses. Unlike group plans offered by employers, these plans are purchased directly by individuals, making informed decision-making crucial.

The market for individual health insurance is vast and diverse, offering a range of options tailored to different needs and budgets. From comprehensive plans covering a wide array of services to more focused options, the choices can be overwhelming. Let's delve into the key aspects to consider when navigating this landscape.

Coverage Options and Customization

One of the key advantages of individual health insurance is the flexibility it offers. Plans can be customized to fit individual needs, allowing for a more tailored approach to healthcare coverage. Here are some key coverage options to consider:

- Comprehensive Plans: These plans offer a wide range of benefits, typically covering hospital stays, physician visits, prescription drugs, and preventive care. They provide extensive coverage but may come with higher premiums.

- Catastrophic Plans: Aimed at younger, healthier individuals, these plans offer limited coverage for basic services but provide protection against high-cost, unexpected medical events. They are often more affordable but may not cover routine care.

- Specialty Plans: For individuals with specific health needs or conditions, specialty plans can provide focused coverage. This includes dental, vision, or mental health plans, offering comprehensive care for specific areas of concern.

When evaluating coverage options, it's essential to consider your current and potential future health needs. Assess the frequency of doctor visits, prescription requirements, and any ongoing medical conditions. Understanding your healthcare patterns will help you choose a plan that aligns with your needs without overspending on unnecessary coverage.

Understanding Premiums and Deductibles

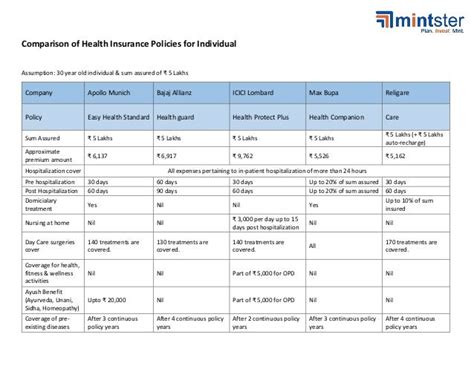

Premiums and deductibles are two critical financial aspects of individual health insurance plans. Premiums are the regular payments made to maintain coverage, while deductibles are the out-of-pocket expenses you incur before your insurance coverage kicks in.

| Plan Type | Average Premium | Average Deductible |

|---|---|---|

| Comprehensive | $450/month | $2,000 |

| Catastrophic | $250/month | $6,500 |

| Specialty (Dental) | $120/month | $50 |

Premiums and deductibles can vary widely depending on the plan and your location. It's essential to strike a balance between affordable premiums and manageable deductibles. While lower premiums may be attractive, they often come with higher deductibles, meaning you'll pay more out of pocket before your insurance coverage takes effect.

Consider your financial situation and medical history when choosing a plan. If you have a consistent income and a history of frequent medical needs, a plan with higher premiums but lower deductibles might be more suitable. Conversely, if you're young and healthy, a plan with lower premiums and higher deductibles could be a more cost-effective option.

Network Providers and Out-of-Network Coverage

When selecting an individual health insurance plan, understanding the network of providers is crucial. Most plans have a network of healthcare providers, including hospitals, clinics, and physicians, with whom they have negotiated rates. Utilizing in-network providers ensures you receive the full benefit of your insurance coverage.

However, not all plans cover out-of-network providers. If you have a preferred healthcare provider or specialist outside your plan's network, it's essential to understand the out-of-network coverage options. Some plans may cover a portion of the costs, while others may not provide any coverage. Ensure you clarify this aspect during your plan selection process.

Prescription Drug Coverage

Prescription drug coverage is a critical aspect of health insurance plans. Many individuals rely on medications to manage chronic conditions or recover from illnesses. Understanding how your plan covers prescription drugs is essential for managing your healthcare expenses.

Most plans offer prescription drug coverage, but the specifics can vary. Some plans have preferred drug lists, known as formularies, which categorize drugs into tiers based on cost. Drugs in lower tiers are typically more affordable, while those in higher tiers may require a higher co-pay or co-insurance.

When selecting a plan, consider your prescription needs. If you require multiple medications, choose a plan with comprehensive drug coverage and a favorable formulary. Additionally, check for any restrictions or prior authorization requirements for specific medications to ensure seamless access to your necessary prescriptions.

Maximizing Your Health Insurance Benefits

Understanding Your Policy

Before fully utilizing your health insurance benefits, it's crucial to have a comprehensive understanding of your policy. Take the time to carefully read and review your plan's terms and conditions. Pay attention to the coverage limits, exclusions, and any specific requirements or restrictions.

Familiarize yourself with the plan's network providers and their locations. Understand the process for obtaining referrals and prior authorizations, if required. By having a clear understanding of your policy, you can navigate the healthcare system more efficiently and avoid unexpected out-of-pocket expenses.

Preventive Care and Wellness Programs

Many individual health insurance plans offer preventive care and wellness programs as part of their coverage. These programs aim to promote healthy lifestyles and prevent illnesses before they occur. Take advantage of these offerings to maintain your well-being and potentially reduce future healthcare costs.

Preventive care services, such as annual check-ups, vaccinations, and screenings, are often covered at little to no cost. Utilize these services to detect potential health issues early on, when they are more manageable and less costly to treat. Additionally, explore the wellness programs offered by your plan, which may include fitness incentives, smoking cessation programs, or nutritional guidance.

Managing Chronic Conditions

If you have a chronic condition, effective management is crucial for maintaining your health and controlling costs. Work closely with your healthcare providers to develop a comprehensive treatment plan. Ensure your plan covers the necessary medications, treatments, and specialist visits required for your condition.

Stay informed about any changes to your plan's coverage or network providers. Regularly review your medication list and discuss any concerns or questions with your healthcare team. By actively managing your chronic condition, you can maintain better control over your health and potentially reduce the frequency and severity of flare-ups or complications.

Future Trends and Considerations

The world of individual health insurance is constantly evolving, influenced by advancements in technology, changing healthcare regulations, and shifting consumer needs. Here are some trends and considerations to keep in mind as you navigate this dynamic landscape.

Telehealth and Virtual Care

The rise of telehealth and virtual care services has transformed the healthcare industry. Many individual health insurance plans now offer coverage for virtual consultations, remote monitoring, and digital health solutions. These services provide convenient access to healthcare professionals and can be particularly beneficial for individuals with limited mobility or those living in remote areas.

Consider the telehealth options offered by your plan and explore how they can enhance your healthcare experience. From virtual check-ins with your primary care physician to specialized telehealth services for mental health or chronic condition management, these offerings can provide efficient and cost-effective care.

Consumer-Driven Health Plans

Consumer-driven health plans (CDHPs) are gaining popularity as a cost-effective alternative to traditional health insurance plans. CDHPs typically have higher deductibles but offer tax-advantaged savings accounts, such as Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs), to help individuals manage their healthcare expenses.

These plans empower individuals to take a more active role in their healthcare decisions and spending. By encouraging prudent healthcare choices and promoting preventive care, CDHPs can potentially lower overall healthcare costs. However, it's essential to carefully evaluate your financial situation and medical needs before opting for a CDHP to ensure it aligns with your long-term goals.

Integrating Technology for Improved Care

Advancements in technology are revolutionizing the healthcare industry, and individual health insurance plans are embracing these innovations. From digital health records to wearable health devices, technology is enhancing the efficiency and effectiveness of healthcare delivery.

Many plans now offer incentives or discounts for using digital health tools and participating in wellness programs. By leveraging technology, you can better manage your health, track your progress, and receive personalized recommendations. Additionally, digital health solutions can facilitate better communication with your healthcare providers, leading to more informed decision-making and improved outcomes.

Frequently Asked Questions

What is the difference between individual and group health insurance plans?

+Individual health insurance plans are purchased directly by individuals, offering flexibility and customization. Group plans, on the other hand, are typically offered by employers and provide coverage to a larger group of people, often with more standardized benefits and lower premiums.

How do I choose the right individual health insurance plan for my needs?

+When selecting a plan, consider your current and potential future health needs, budget, and preferred healthcare providers. Evaluate coverage options, premiums, deductibles, and network providers to find a plan that aligns with your specific requirements.

Can I switch my individual health insurance plan if I'm not satisfied with my current coverage?

+Yes, you can switch your individual health insurance plan during the open enrollment period or if you experience a qualifying life event, such as a change in employment or marital status. However, it's important to review your options carefully and consider any potential penalties or waiting periods associated with switching plans.

What happens if I have a pre-existing condition when applying for individual health insurance?

+Under the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. However, it's important to disclose any pre-existing conditions during the application process to ensure accurate coverage and avoid any potential issues with your policy.

How can I reduce my healthcare costs while maintaining adequate coverage?

+To reduce healthcare costs, consider a plan with a higher deductible and take advantage of tax-advantaged savings accounts like HSAs. Additionally, prioritize preventive care, stay informed about your policy's coverage, and explore telehealth options for cost-effective access to healthcare services.

Navigating the world of individual health insurance plans requires careful consideration and a thorough understanding of your needs and options. By exploring the coverage options, understanding the financial aspects, and staying informed about the latest trends, you can make informed decisions to protect your health and finances.