Individual Health Insurance California

In the vast landscape of healthcare coverage, the Golden State stands out with its unique approach to individual health insurance. California, known for its progressive policies and diverse population, has crafted a comprehensive and innovative system to cater to the healthcare needs of its residents. This article delves into the intricacies of individual health insurance in California, exploring the key features, benefits, and considerations that make it a model for healthcare accessibility and affordability.

Understanding Individual Health Insurance in California

Individual health insurance in California refers to plans purchased directly by individuals and families, distinct from employer-sponsored group plans. The state’s commitment to healthcare reform and its active role in the Affordable Care Act (ACA) marketplace have shaped a robust and competitive individual insurance market. California’s approach aims to provide accessible, quality healthcare coverage to all its residents, ensuring peace of mind and financial protection in times of medical need.

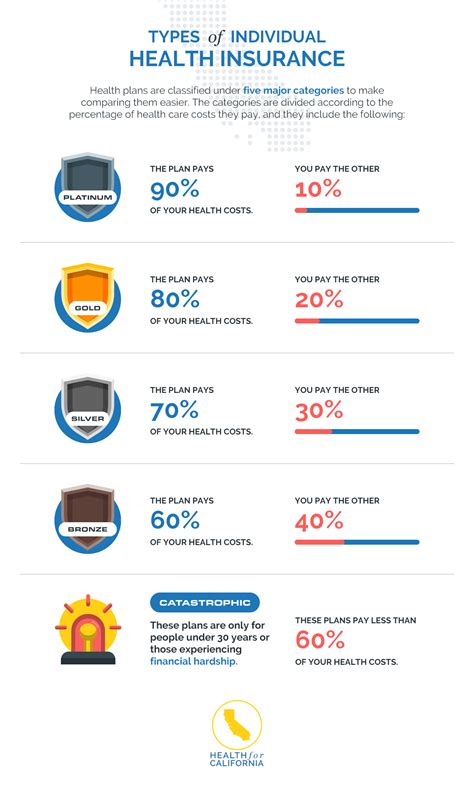

The state's individual insurance market offers a wide array of plans, catering to diverse needs and budgets. From comprehensive coverage with extensive networks to more cost-effective options with higher deductibles, California's market provides flexibility and choice. Additionally, the state's emphasis on consumer protection ensures that plans are transparent, easy to understand, and adhere to strict quality standards.

Key Features of California’s Individual Health Insurance Market

California’s individual health insurance market is characterized by several key features that set it apart from other states:

- State-Run Marketplace: California operates its own health insurance marketplace, Covered California, providing a centralized platform for residents to compare and purchase plans. This state-run marketplace offers additional consumer protections and benefits beyond the federal marketplace.

- Comprehensive Coverage: California's plans are required to cover a wide range of essential health benefits, including preventive care, prescription drugs, mental health services, and more. This ensures that residents receive comprehensive coverage, regardless of their chosen plan.

- Community Rating: Insurance companies in California use a community rating system, which means that premiums are based on the average cost of care in a particular region, rather than an individual's health status. This approach aims to make insurance more affordable and accessible for all, regardless of pre-existing conditions.

- Consumer Protections: The state has implemented strong consumer protection measures, ensuring that insurance companies cannot discriminate based on health status, gender, or other factors. Additionally, California requires plans to provide clear and concise summaries of benefits and coverage, empowering consumers to make informed choices.

- Financial Assistance: California offers generous financial assistance to eligible residents, helping to make insurance more affordable. Subsidies are available to those with lower incomes, reducing the cost of premiums and out-of-pocket expenses. This support ensures that healthcare coverage is within reach for a wider range of individuals.

| Financial Assistance Program | Eligibility Criteria |

|---|---|

| Premium Tax Credits | Household income between 100% and 400% of the federal poverty level |

| Cost-Sharing Reductions | Household income below 250% of the federal poverty level |

| Medi-Cal (California's Medicaid Program) | Household income below 138% of the federal poverty level |

Choosing the Right Plan

With a plethora of options available, selecting the right individual health insurance plan in California can be a daunting task. Here are some key considerations to guide your decision:

- Your Health Needs: Assess your current and future health needs. If you anticipate frequent medical care or have specific conditions, consider plans with lower deductibles and broader networks. Conversely, if you're generally healthy, a plan with a higher deductible and lower premiums might be more cost-effective.

- Preferred Providers: Check if your preferred doctors, hospitals, or specialists are in-network with the plan you're considering. Out-of-network care can result in higher costs.

- Prescription Drugs: Review the plan's formulary to ensure your necessary medications are covered. Some plans offer better coverage for prescription drugs, which can be crucial for managing chronic conditions.

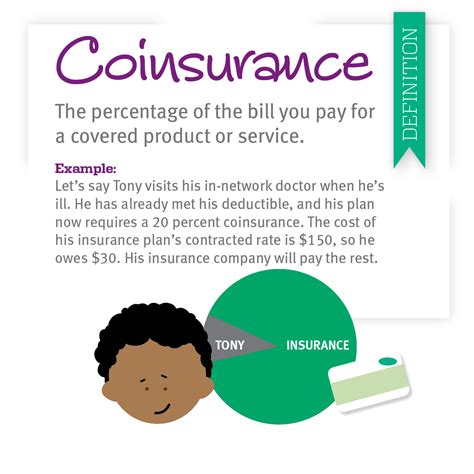

- Cost: Compare premiums, deductibles, and out-of-pocket maximums. Remember that a lower premium might result in higher out-of-pocket costs if you require medical services. Balance your budget with your health needs to find the right fit.

- Benefits and Coverage: Carefully read the plan's summary of benefits and coverage to understand what's included. Look for plans that offer additional benefits, such as dental, vision, or wellness programs, which can enhance your overall healthcare experience.

Navigating the Enrollment Process

Enrolling in individual health insurance in California is streamlined and consumer-friendly. Here’s a step-by-step guide to navigate the process:

- Determine Eligibility: Check if you're eligible for financial assistance or Medi-Cal. You can use the Covered California website's eligibility tool to assess your options.

- Choose Your Marketplace: If you're not eligible for Medi-Cal, visit the Covered California website to compare and select plans. You can also use licensed insurance agents or brokers for personalized assistance.

- Gather Information: Have your personal details, income information, and Social Security number ready for a smooth enrollment process.

- Compare Plans: Use the plan comparison tool on Covered California to evaluate premiums, deductibles, and benefits. Consider your health needs and budget when making your selection.

- Apply and Enroll: Fill out the application, providing accurate information. You can apply online, by phone, or with the assistance of an agent. Once your application is approved, you can enroll in your chosen plan.

- Understand Your Coverage: Carefully read your plan documents to understand your coverage, benefits, and out-of-pocket costs. Ensure you know your network providers and any required prior authorizations.

Open Enrollment and Special Enrollment Periods

California follows the federal government’s open enrollment timeline, typically from November 1st to December 15th each year. During this period, you can enroll in a new plan or make changes to your existing coverage without a qualifying event. If you miss the open enrollment period, you may still be able to enroll through a special enrollment period (SEP) if you experience certain life events, such as:

- Loss of other health coverage (e.g., job loss or divorce)

- Moving to a new state

- Changes in household size (e.g., birth, adoption, or legal guardianship)

- Qualifying income changes

- Changes in immigration status

To qualify for a SEP, you must apply within 60 days of the qualifying event. It's important to note that California may offer additional SEP opportunities beyond the federal guidelines, so it's advisable to check with Covered California for the most up-to-date information.

Exploring Alternative Options

While individual health insurance through the state marketplace is a popular choice, California residents may also explore alternative options, depending on their circumstances:

Short-Term Health Insurance

Short-term health insurance plans offer a more flexible and cost-effective option for those who don’t qualify for premium subsidies or prefer a less comprehensive coverage. These plans typically have lower premiums but may have limited coverage and higher out-of-pocket costs. They are suitable for those with transitional needs or who are between jobs.

Association Health Plans (AHPs)

AHPs are group plans offered through professional associations or trade groups. They can provide more affordable coverage options for small businesses and self-employed individuals. However, AHPs are not subject to the same regulations as individual market plans, and their benefits and protections may vary.

Health Sharing Ministries

Health sharing ministries are faith-based organizations where members share medical expenses. These plans are not considered insurance and may have restrictions on pre-existing conditions and coverage for certain services. Members must adhere to the ministry’s religious beliefs and lifestyle requirements.

Off-Market Plans

Some insurance companies offer individual health plans directly, outside of the state marketplace. While these plans may offer more flexibility, it’s crucial to carefully review the coverage and benefits to ensure they meet your needs and adhere to state regulations.

The Future of Individual Health Insurance in California

California’s commitment to healthcare reform and accessibility is evident in its proactive approach to individual health insurance. The state’s ongoing efforts to expand coverage, enhance consumer protections, and provide financial assistance demonstrate its dedication to ensuring all residents have access to quality healthcare. As the healthcare landscape continues to evolve, California’s innovative policies and initiatives will likely continue to shape the future of individual health insurance, serving as a model for other states to follow.

Frequently Asked Questions

Can I enroll in individual health insurance outside of the open enrollment period?

+

Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event, such as losing your job or getting married. These events trigger a special enrollment period (SEP), allowing you to enroll in a new plan or make changes to your existing coverage. It’s important to act within 60 days of the qualifying event to take advantage of the SEP.

How can I find out if I’m eligible for financial assistance or Medi-Cal in California?

+

You can use the eligibility tool on the Covered California website to determine if you’re eligible for financial assistance or Medi-Cal. The tool will guide you through a series of questions to assess your income, household size, and other factors to determine your eligibility for subsidies or Medi-Cal coverage.

Are there any penalties for not having health insurance in California?

+

California no longer imposes a penalty for not having health insurance. However, it’s important to note that having health insurance provides financial protection and ensures access to necessary medical care. While there is no legal penalty, the financial implications of going without insurance can be significant in the event of an unexpected medical emergency.

Can I keep my individual health insurance plan if I move to another state?

+

Individual health insurance plans are typically designed for residents of the state in which they are purchased. If you move to another state, you may need to enroll in a new plan that complies with the regulations of your new state of residence. However, some plans may offer out-of-state coverage, so it’s essential to review your plan’s details and consult with your insurance provider.

How do I know if my preferred doctor or specialist is in-network with my chosen plan?

+

When selecting an individual health insurance plan, it’s crucial to verify if your preferred doctors, specialists, and hospitals are in the plan’s network. You can typically find this information on the insurance company’s website or by contacting their customer service. Being in-network ensures that you receive discounted rates and avoid higher out-of-pocket costs.