Independent Insurance Agency

Unveiling the Power of Independent Insurance Agencies: A Comprehensive Guide

In today’s dynamic insurance landscape, understanding the role and benefits of independent insurance agencies is crucial. These agencies offer a unique and flexible approach to insurance, providing clients with tailored solutions and expert guidance. This comprehensive guide will delve into the world of independent insurance agencies, exploring their structure, advantages, and the impact they have on the industry.

Understanding the Independent Insurance Agency Model

An independent insurance agency is a business entity that operates independently from any specific insurance carrier. These agencies are owned and managed by insurance professionals who have the freedom to represent multiple insurance companies, offering a diverse range of policies to their clients. Unlike captive agencies, which are tied to a single insurance provider, independent agencies can provide unbiased advice and a broader selection of coverage options.

The Benefits of Independence

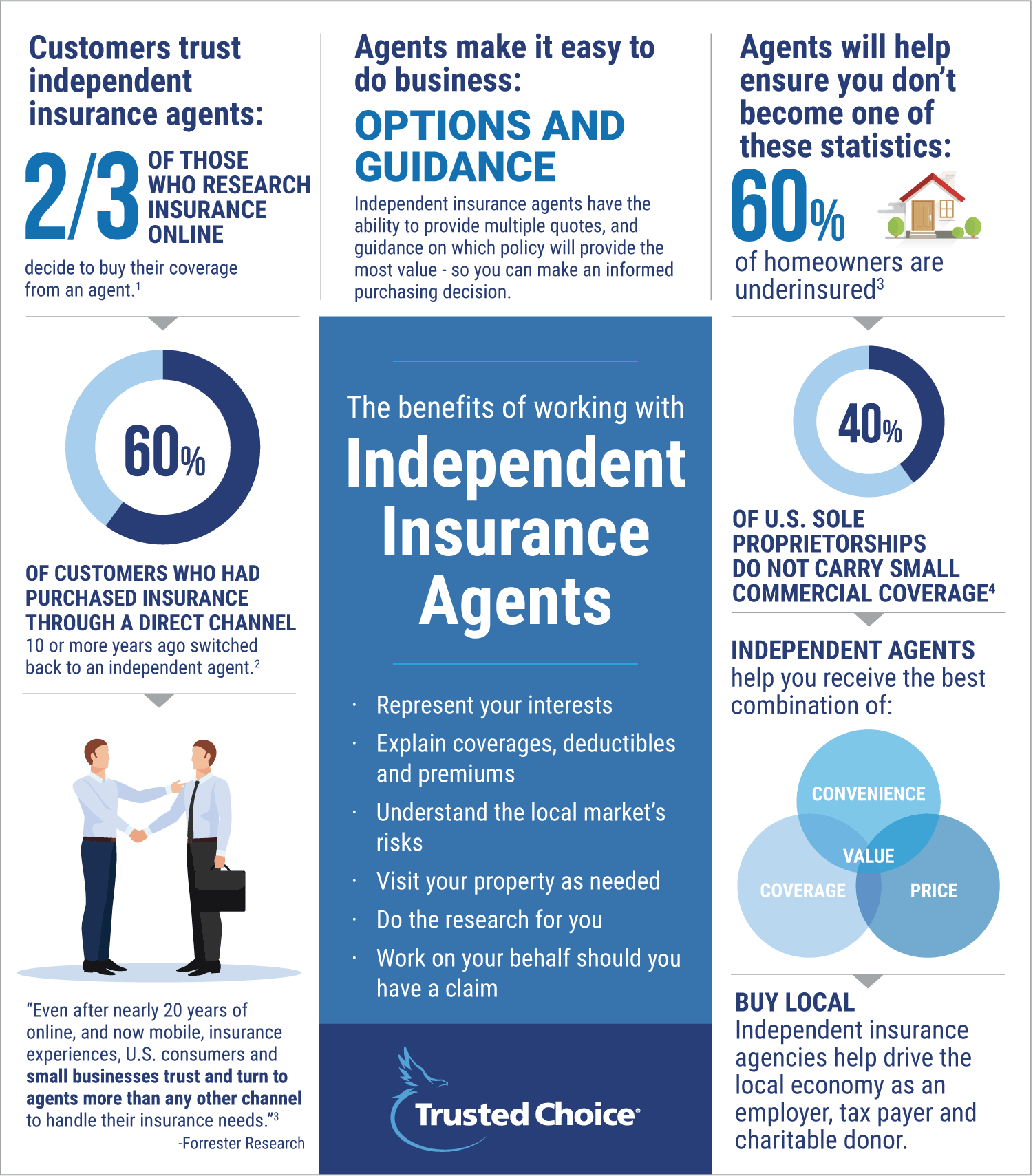

Unbiased Advice: Independent agents are not beholden to any particular insurance company, allowing them to provide impartial recommendations based solely on the client’s best interests. This ensures that clients receive the most suitable coverage, without any influence from carrier-specific incentives.

Broad Coverage Options: With access to multiple carriers, independent agencies can offer a wide array of insurance products. This includes specialized policies, such as high-risk auto insurance, workers’ compensation, or unique coverage for niche industries. The ability to tailor policies to individual needs is a significant advantage.

Personalized Service: Independent agents often develop long-term relationships with their clients, offering personalized service and support. They can provide ongoing advice, risk management strategies, and claim assistance, ensuring a seamless insurance experience.

Competitive Pricing: By representing multiple carriers, independent agencies can shop around for the best rates, often securing competitive prices for their clients. This is particularly beneficial for businesses or individuals with complex insurance needs.

The Structure and Operations of Independent Agencies

Agency Ownership and Management

Independent insurance agencies are typically owned and operated by experienced insurance professionals. These individuals have extensive knowledge of the industry, allowing them to provide expert guidance and strategic advice. Agency owners often have a team of licensed agents and support staff, ensuring a comprehensive and efficient operation.

Carrier Relationships

The strength of an independent agency lies in its carrier relationships. Agencies carefully select carriers based on their financial stability, reputation, and the specific coverage options they offer. By partnering with a diverse range of carriers, agencies can provide a comprehensive portfolio of insurance products to meet various client needs.

Client Acquisition and Retention

Independent agencies employ various strategies to attract and retain clients. This includes networking within the community, building relationships with local businesses, and leveraging digital marketing techniques. By offering exceptional service and tailored coverage, agencies can foster long-lasting client relationships.

Case Study: The Impact of Independent Agencies

Example Agency: XYZ Insurance Group

XYZ Insurance Group is a renowned independent agency with a strong presence in the Midwest region. With over 20 years of experience, the agency has built a reputation for excellence, providing insurance solutions to a diverse range of clients, from small businesses to high-net-worth individuals.

Client Success Story:

One of XYZ’s clients, ABC Manufacturing, a small-scale precision engineering firm, faced unique insurance challenges due to the specialized nature of their business. XYZ’s independent status allowed them to secure a customized policy with enhanced coverage for equipment breakdown and product liability. This tailored approach not only protected ABC’s assets but also gave them peace of mind, allowing them to focus on their core business operations.

The Future of Independent Insurance Agencies

Industry Trends and Innovations

The insurance industry is evolving, and independent agencies are at the forefront of these changes. With the rise of digital technologies, agencies are embracing innovative tools for efficient operations and enhanced client engagement. This includes the use of advanced software for policy management, digital quoting tools, and online client portals for convenient access to policy information.

Regulatory Landscape and Compliance

Independent agencies must navigate a complex regulatory environment, ensuring compliance with state and federal insurance laws. Staying up-to-date with changing regulations is crucial to maintain a competitive edge and provide accurate guidance to clients. Agencies often invest in ongoing training and education to stay informed about industry developments.

FAQ Section

How do independent insurance agencies differ from captive agencies?

+Independent agencies are not tied to a single insurance carrier, allowing them to offer a wider range of policies and unbiased advice. Captive agencies, on the other hand, represent a specific insurance company and may have limited coverage options.

What are the advantages of working with an independent insurance agent?

+Independent agents provide personalized service, tailored coverage, and competitive pricing. They offer unbiased advice and can assist with complex insurance needs, ensuring clients receive the best protection.

How do independent agencies select insurance carriers to partner with?

+Agencies carefully evaluate carriers based on financial stability, reputation, and the coverage options they offer. The goal is to provide clients with a diverse range of high-quality insurance products.

What role do independent agencies play in risk management?

+Independent agents are trusted advisors who can assess a client's unique risks and provide tailored strategies to mitigate those risks. They offer ongoing support and guidance to ensure clients are adequately protected.

In conclusion, independent insurance agencies offer a powerful alternative to traditional insurance models, providing clients with expert guidance, personalized service, and tailored coverage options. With their ability to adapt to changing market conditions and client needs, independent agencies are well-positioned for continued success in the dynamic insurance landscape.