How To Get Insurance On A Car

Insuring your vehicle is a crucial step for any vehicle owner, offering financial protection and peace of mind. Understanding the process and key considerations can help you navigate the world of car insurance and find the right coverage for your needs. This comprehensive guide will walk you through the steps, from assessing your requirements to choosing the best policy.

Understanding Car Insurance

Car insurance is a contractual agreement between an individual and an insurance provider. In exchange for regular payments known as premiums, the insurer promises to financially protect the policyholder in the event of accidents, theft, or other specified mishaps. This protection extends to cover the cost of repairs, medical expenses, and potential legal liabilities.

The primary goal of car insurance is to provide financial security and ensure that vehicle owners can manage the costs associated with unforeseen incidents. It's a vital aspect of vehicle ownership, mandated by law in many regions and a practical necessity for any driver.

Types of Car Insurance Coverage

Car insurance policies can vary significantly, offering different levels of coverage to suit diverse needs and budgets. Here’s a breakdown of the primary types of car insurance coverage:

- Liability Coverage: This is the most basic form of car insurance, covering the costs you may be legally responsible for in the event of an accident, including bodily injury and property damage. It's mandatory in most states and provides protection against lawsuits arising from accidents.

- Collision Coverage: This coverage pays for repairs to your vehicle after an accident, regardless of who's at fault. It's an optional coverage but is often recommended, especially for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive insurance covers damage to your vehicle that's not caused by a collision, such as theft, vandalism, natural disasters, or damage caused by animals. It's also optional but highly beneficial for comprehensive protection.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers after an accident, regardless of fault. It's mandatory in some states and can be a valuable addition to your policy.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the costs. It's another optional coverage that can provide significant peace of mind.

When choosing car insurance, it's essential to consider your specific needs and the value of your vehicle. Some policies offer package deals that combine multiple coverages, providing a more cost-effective solution. Always review the policy details and ensure you understand the exclusions and limitations of your chosen coverage.

The Process of Getting Car Insurance

Securing car insurance involves a series of steps, from comparing policies to finalizing your coverage. Here’s a detailed guide to help you navigate the process:

Assess Your Insurance Needs

Before shopping for car insurance, it’s crucial to understand your specific requirements. Consider the following factors:

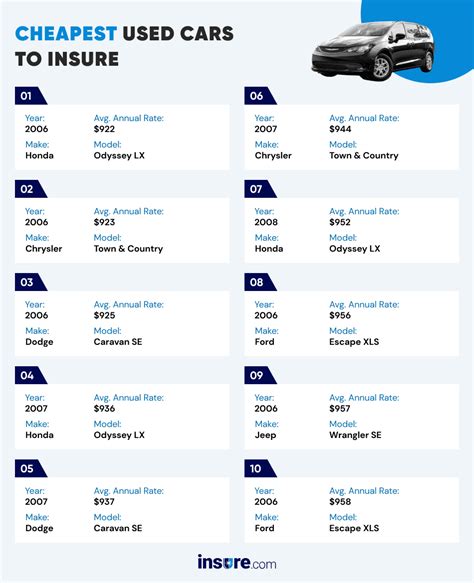

- Vehicle Value: The value of your vehicle will influence the cost of your insurance and the level of coverage you need. Newer or more expensive cars may require more extensive coverage.

- Driver Profile: Your age, driving history, and credit score can all impact your insurance rates. Younger drivers or those with a history of accidents may face higher premiums.

- Usage: How and where you use your vehicle can affect your insurance needs. If you primarily drive in urban areas or have a long commute, you may require more comprehensive coverage.

- State Requirements: Different states have varying mandatory insurance requirements. Ensure you understand the minimum coverage levels mandated in your state.

- Budget: Determine how much you're willing and able to spend on car insurance. While it's essential to have adequate coverage, you also want to ensure it's affordable.

By evaluating these factors, you can better understand the type and amount of insurance coverage you need.

Research and Compare Policies

Once you’ve assessed your insurance needs, it’s time to research and compare different policies. Consider the following steps:

- Online Comparison Tools: Utilize online comparison websites that allow you to enter your details once and receive quotes from multiple insurers. This can be a quick and efficient way to compare prices and coverage options.

- Direct Insurers: Visit the websites of well-known insurance companies and request quotes. Many insurers offer online quote tools, making it convenient to compare their offerings.

- Insurance Brokers: Consider working with an insurance broker who can provide personalized advice and shop around for the best policy on your behalf. Brokers often have access to multiple insurers and can negotiate better rates.

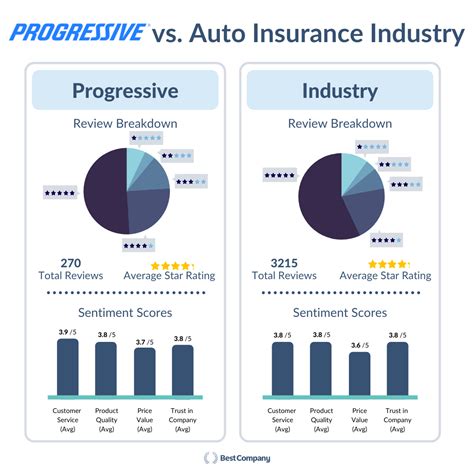

- Read Reviews: Research insurer reviews and ratings to get an idea of their customer service, claims process, and overall reputation. This can help you avoid potential pitfalls and choose a reputable insurer.

- Policy Details: Pay close attention to the policy details, including the coverages, exclusions, and limitations. Ensure the policy meets your specific needs and provides the protection you require.

When comparing policies, don't just focus on the price. While cost is an essential consideration, you also want to ensure you're getting adequate coverage and choosing a reputable insurer.

Choose Your Insurer and Policy

After thorough research and comparison, it’s time to choose your insurer and select your policy. Here are some steps to guide you through this process:

- Read the Policy: Before finalizing your decision, carefully read the policy documents. Ensure you understand the terms and conditions, including any exclusions and limitations.

- Compare Quotes: Review the quotes you've received from different insurers. Consider not only the price but also the coverage and reputation of the insurer.

- Choose the Right Coverage: Select a policy that provides the level of coverage you need. Don't skimp on essential coverages just to save a few dollars.

- Bundle Policies: If you have multiple insurance needs (e.g., home and auto), consider bundling your policies with the same insurer. This can often lead to significant discounts.

- Consider Add-Ons: Depending on your needs, you may want to add optional coverages to your policy. These could include roadside assistance, rental car coverage, or coverage for specific items (e.g., custom equipment or accessories) in your vehicle.

Once you've made your choice, you can proceed to purchase your car insurance policy. Most insurers offer online purchase options, making the process convenient and efficient.

Finalizing Your Car Insurance

After selecting your insurer and policy, there are a few final steps to ensure your car insurance is fully activated and meets your needs:

Purchase Your Policy

Once you’ve chosen your insurer and policy, it’s time to make the purchase. Most insurers offer online payment options, allowing you to pay your initial premium and activate your coverage quickly.

When purchasing your policy, ensure you understand the payment terms and conditions. Some insurers offer flexible payment plans, while others may require a single upfront payment. Choose the option that best suits your financial situation.

Review Your Policy Documents

After purchasing your policy, take the time to thoroughly review the policy documents. Ensure that all the information is correct, including your personal details, vehicle information, and coverage limits.

If you notice any errors or discrepancies, contact your insurer immediately to have them corrected. It's crucial to have accurate information on your policy to ensure you're properly covered.

Understand Your Coverage and Exclusions

Familiarize yourself with the specifics of your coverage and the exclusions in your policy. Understand what events and circumstances are covered and what situations are not. This knowledge can help you make informed decisions and avoid unexpected gaps in coverage.

If you have any questions or concerns about your coverage, don't hesitate to reach out to your insurer. Their customer service representatives should be able to provide clarity and guidance.

Set Up Automatic Payments (if applicable)

Many insurers offer the option to set up automatic payments for your insurance premiums. This can be a convenient way to ensure your payments are always on time and avoid the risk of late fees or policy cancellation.

If you choose to set up automatic payments, ensure you have sufficient funds in your account to cover the premiums. Some insurers may also offer discounts for setting up automatic payments, so it's worth considering this option.

Maintaining and Adjusting Your Car Insurance

Car insurance is not a one-time purchase. It’s an ongoing relationship with your insurer, and your needs and circumstances may change over time. Here’s how to maintain and adjust your car insurance effectively:

Regularly Review Your Policy

It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and aligns with your current needs.

Consider factors such as changes in your vehicle value, driving habits, or personal circumstances. If you've made significant improvements to your vehicle or have added new safety features, you may be eligible for additional discounts or coverage options.

Report Changes to Your Insurer

Whenever your circumstances change, it’s essential to inform your insurer. This includes changes in your personal details (e.g., address, marital status), vehicle details (e.g., new modifications, mileage), or driving habits (e.g., increased or decreased annual mileage).

Failing to report changes can lead to gaps in coverage or unexpected increases in your premiums. Keep your insurer informed to ensure your policy remains up-to-date and accurate.

Explore Discounts and Savings

Insurance companies often offer a variety of discounts and savings opportunities. These can include discounts for safe driving, bundling multiple policies, or enrolling in usage-based insurance programs. Regularly review your policy and explore these options to see if you’re eligible for any additional savings.

Additionally, consider comparing your policy with other insurers annually. This can help you ensure you're still getting the best value for your money and allow you to switch insurers if necessary.

File Claims When Necessary

If you’re involved in an accident or experience a covered event, it’s important to file a claim with your insurer. Follow their claims process carefully and provide all the necessary information and documentation.

Keep in mind that filing frequent claims can lead to increased premiums or even policy cancellation in some cases. Use your insurance coverage wisely and only file claims when necessary.

FAQs

What factors influence car insurance rates?

+Car insurance rates can be influenced by various factors, including your age, driving history, credit score, the make and model of your vehicle, the area you live in, and the level of coverage you choose. Insurers use these factors to assess the risk associated with insuring you and determine your premium.

How can I lower my car insurance premiums?

+There are several ways to potentially lower your car insurance premiums. These include maintaining a clean driving record, increasing your deductible, bundling policies with the same insurer, taking advantage of discounts (e.g., safe driver discounts, student discounts), and shopping around for the best rates.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Call the police to report the accident and exchange information with the other driver(s). Take photos of the scene and any damage to your vehicle. Notify your insurer as soon as possible and provide them with all the necessary details.

Can I switch car insurance companies mid-policy term?

+Yes, you can switch car insurance companies mid-policy term. However, be aware that you may be subject to cancellation fees or a short-rate penalty, which can increase the cost of your policy. It’s essential to review the terms of your current policy and understand any potential fees before making the switch.

How do usage-based insurance programs work?

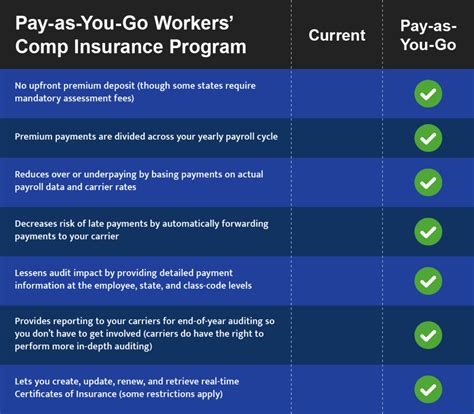

+Usage-based insurance programs, also known as pay-as-you-drive or telematics insurance, use technology to track your driving behavior. Insurers install a device in your vehicle or use an app on your smartphone to monitor factors like mileage, driving speed, and time of day. Your premiums are then adjusted based on your driving habits, with safer driving often resulting in lower rates.

Understanding the process of getting car insurance and maintaining your policy is essential for ensuring you have the right coverage at the right price. By following these steps and staying informed, you can navigate the world of car insurance with confidence and protect yourself and your vehicle effectively.