How To Cancel My Marketplace Insurance

Are you considering canceling your insurance policy on a popular insurance marketplace? It's important to understand the process and potential consequences to make an informed decision. This comprehensive guide will walk you through the steps to cancel your marketplace insurance and provide valuable insights to help you navigate this journey.

Understanding the Process of Canceling Marketplace Insurance

Canceling insurance through an online marketplace can be straightforward, but it’s essential to follow the correct procedures to avoid any legal or financial complications. Here’s a step-by-step guide to help you cancel your policy effectively.

Step 1: Review Your Policy and Terms

Before initiating the cancellation process, take the time to review your insurance policy thoroughly. Understand the terms and conditions, including any cancellation fees or penalties that may apply. Familiarize yourself with the specific requirements and timelines for canceling your policy.

| Policy Type | Cancellation Fees |

|---|---|

| Health Insurance | Varies by plan; some plans may have a grace period or require a 30-day notice. |

| Auto Insurance | Typically a prorated amount based on the remaining policy term. |

| Homeowners Insurance | Similar to auto insurance, a prorated fee may apply. |

Note: These fees are examples and may vary depending on your insurance provider and policy terms.

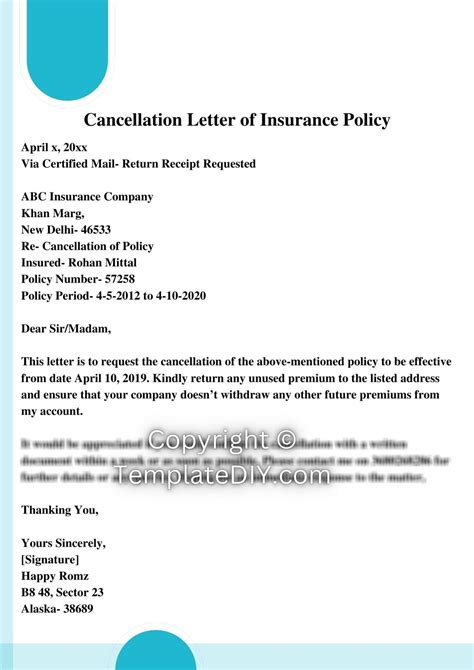

Step 2: Contact Your Insurance Provider

Reach out to your insurance company’s customer service department to initiate the cancellation process. You can do this via phone, email, or online chat, depending on your preference and the provider’s available channels.

When contacting your insurance provider, have your policy number and personal details ready. Explain your intention to cancel the policy and provide any necessary reasons or documentation. Be prepared to answer any questions they may have about your decision.

Step 3: Follow the Provider’s Instructions

Once you’ve communicated your intention to cancel, your insurance provider will guide you through the specific steps required to complete the process. This may involve filling out a cancellation form, providing written confirmation, or following additional procedures outlined by the company.

Ensure you follow these instructions carefully to avoid any delays or misunderstandings. Keep records of all communications and documentation for your records.

Step 4: Verify Cancellation and Receive Confirmation

After completing the cancellation process, it’s crucial to verify that your policy has been canceled effectively. Request written confirmation from your insurance provider, which should include the cancellation date, any remaining balances, and details of any refunds or adjustments to your account.

Review this confirmation carefully to ensure accuracy and address any discrepancies promptly. Keep this documentation as a record of your cancellation for future reference.

Step 5: Manage Your Transition Period

During the transition period after canceling your insurance, it’s important to ensure you have adequate coverage. If you’re switching to a new insurance provider, ensure your new policy starts immediately after the cancellation date to avoid any gaps in coverage.

If you're canceling insurance due to a life change, such as moving or changing employment, research and understand your options for alternative coverage. Explore government programs, employer-provided insurance, or other suitable alternatives to ensure you're protected during this transition.

Common Reasons for Canceling Marketplace Insurance

Understanding why individuals cancel their marketplace insurance policies can provide valuable insights into the decision-making process. Here are some common reasons people choose to cancel their insurance:

- Change in Employment: Many insurance policies are tied to employment, and when individuals change jobs or become self-employed, they may need to cancel their current insurance and seek new coverage.

- Relocation: Moving to a new state or country often requires adjusting insurance policies. Local regulations and provider availability may prompt individuals to cancel their existing insurance and explore options in their new location.

- Life Changes: Significant life events such as marriage, divorce, or the birth of a child can impact insurance needs. Individuals may cancel their current policies and opt for new coverage that better suits their changing circumstances.

- Cost Considerations: Insurance premiums can be a significant financial burden, especially for those on a tight budget. Individuals may choose to cancel their policies to reduce expenses, especially if they can find more affordable alternatives.

- Policy Dissatisfaction: If an insurance policy fails to meet expectations or provide adequate coverage, individuals may decide to cancel and explore other options that better align with their needs.

Potential Consequences and Considerations

Canceling insurance can have both immediate and long-term implications. It’s essential to consider these potential consequences before making a final decision:

Financial Impact

Canceling insurance may result in immediate financial consequences, such as cancellation fees or penalties. Additionally, you may need to pay for any remaining balances or outstanding claims. Consider your financial situation and ensure you have the necessary funds to cover these expenses.

Coverage Gaps

Canceling insurance can leave you without coverage during the transition period. This gap in coverage can be risky, especially if an unexpected event occurs. Ensure you have alternative arrangements in place to bridge this gap, such as short-term insurance or emergency funds.

Legal Obligations

Depending on your insurance type and jurisdiction, canceling a policy may have legal implications. For example, canceling auto insurance may require you to surrender your license plates and registration. Be aware of any legal requirements associated with canceling your specific policy.

Future Insurance Options

Canceling insurance may impact your future insurance options. Some insurance providers may view cancellations negatively, especially if they perceive it as a high-risk behavior. This could result in higher premiums or difficulty finding suitable coverage in the future. Research alternative providers and understand their policies before canceling.

Exploring Alternative Insurance Options

If you’re considering canceling your marketplace insurance, it’s crucial to explore alternative options to ensure you maintain adequate coverage. Here are some popular alternatives to consider:

Employer-Provided Insurance

Many employers offer insurance benefits as part of their compensation packages. If you’re changing jobs, explore the insurance options provided by your new employer. These policies often offer competitive rates and comprehensive coverage tailored to your profession.

Government-Sponsored Programs

Depending on your income and circumstances, you may be eligible for government-sponsored insurance programs. These programs, such as Medicaid or Medicare, provide affordable or free insurance coverage to qualifying individuals and families. Research your eligibility and apply for these programs if applicable.

Private Insurance Brokers

Working with an independent insurance broker can be a valuable option for finding the right insurance coverage. Brokers have access to a wide range of insurance providers and can help you compare policies, negotiate rates, and find the best fit for your needs. Their expertise can simplify the insurance-shopping process.

Online Insurance Marketplaces

Similar to the marketplace you’re considering canceling, there are numerous online platforms that aggregate insurance policies from various providers. These marketplaces allow you to compare policies, get quotes, and purchase insurance online. Explore different marketplaces to find the best deals and coverage options.

Tips for a Smooth Cancellation Process

To ensure a smooth and stress-free cancellation process, consider the following tips:

- Give yourself ample time to research and explore alternative insurance options before canceling your current policy.

- Keep accurate records of all communications and documentation related to your cancellation.

- Read and understand your policy's terms and conditions, including cancellation fees and penalties.

- If you're canceling due to a life change, ensure you understand the impact on your insurance coverage and explore alternatives promptly.

- Seek advice from insurance professionals or financial advisors if you're unsure about your options or have complex circumstances.

Conclusion: Making an Informed Decision

Canceling marketplace insurance is a significant decision that requires careful consideration. By understanding the process, potential consequences, and alternative options, you can make an informed choice that aligns with your unique circumstances. Remember to review your policy, explore alternatives, and seek professional advice when needed.

With the right approach, you can effectively cancel your marketplace insurance and transition to a new policy that better meets your needs and budget. Stay informed, stay protected, and make the best decision for your future.

Can I cancel my insurance anytime, or are there specific timeframes I need to follow?

+Insurance cancellation policies vary depending on the type of insurance and your provider. Some policies may allow cancellation at any time, while others have specific timeframes or notice periods. Review your policy documents or contact your insurance provider to understand the cancellation guidelines applicable to your situation.

What happens if I cancel my insurance and have outstanding claims or balances?

+When you cancel your insurance policy, you may still be responsible for any outstanding claims or balances. Your insurance provider will typically provide a breakdown of these amounts, and you’ll need to settle them before the cancellation is finalized. Ensure you have the necessary funds to cover these expenses.

Can I switch to a new insurance provider immediately after canceling my current policy?

+It’s generally recommended to have a seamless transition when switching insurance providers. Ensure your new policy starts immediately after canceling your current one to avoid any gaps in coverage. Work with your new provider to coordinate the effective dates of your policies.

Are there any legal implications if I cancel my insurance due to non-payment of premiums?

+Canceling insurance due to non-payment of premiums can have legal implications. Some jurisdictions may require you to notify the insurance provider of your intention to cancel, and you may be subject to penalties or legal actions if you fail to do so. Check your local regulations and consult with legal professionals if needed.

What if I change my mind after canceling my insurance policy?

+Insurance policies often have a grace period during which you can reinstate your coverage. Contact your insurance provider promptly if you change your mind and want to reinstate your policy. They’ll guide you through the necessary steps and requirements for reinstatement.