How Much Does Homeowners Insurance Cost

Homeowners insurance is a crucial aspect of protecting your property and belongings. The cost of this insurance can vary significantly depending on numerous factors. Understanding the factors that influence the price can help homeowners make informed decisions when choosing an insurance policy. In this comprehensive guide, we will delve into the specifics of homeowners insurance costs, providing an in-depth analysis and valuable insights.

The Cost Factors of Homeowners Insurance

The expense of homeowners insurance is influenced by a myriad of variables. These factors can be broadly categorized into three main groups: the characteristics of the home, the location, and the policyholder’s personal details.

Home Characteristics

The specific features of a home play a pivotal role in determining the insurance cost. Here are some key aspects that insurance providers consider:

- Home Value: The higher the value of your home, the more it will cost to insure. Insurance companies assess the replacement cost, which includes the value of the land, the structure, and any permanent fixtures.

- Age of the Home: Older homes may require more maintenance and could have outdated electrical or plumbing systems, increasing the risk of accidents and subsequent insurance claims.

- Construction Materials: Homes built with fire-resistant materials or reinforced against natural disasters may qualify for discounts, as they pose lower risks.

- Square Footage: Generally, larger homes cost more to insure due to the increased value of belongings and potential for more extensive damage.

- Home Upgrades: Upgrades like burglar alarms, smoke detectors, and fire suppression systems can lower insurance costs by reducing the likelihood and impact of claims.

Location-Based Factors

The geographical location of a home significantly influences insurance costs. Here’s how:

- Crime Rates: Areas with higher crime rates may see increased insurance premiums due to the elevated risk of theft or vandalism.

- Natural Disaster Risk: Homes located in regions prone to natural disasters like hurricanes, floods, or earthquakes often carry higher insurance costs due to the increased likelihood of claims.

- Proximity to Fire Stations: Homes closer to fire stations may benefit from lower insurance rates, as the proximity reduces the response time in case of a fire emergency.

- Distance from Coastline: Coastal areas are often at higher risk of storms and flooding, leading to increased insurance premiums.

Policyholder Details

The personal details and preferences of the policyholder also impact the cost of homeowners insurance. These factors include:

- Claims History: A history of insurance claims can lead to higher premiums, as it indicates a higher risk to the insurance company.

- Credit Score: Insurance providers often consider credit scores when determining rates. A higher credit score may result in lower insurance costs.

- Marital Status: Married couples often receive discounts on their insurance policies, as they are statistically less likely to file claims.

- Bundle Discounts: Policyholders who bundle their insurance policies, such as combining homeowners and auto insurance, often qualify for significant discounts.

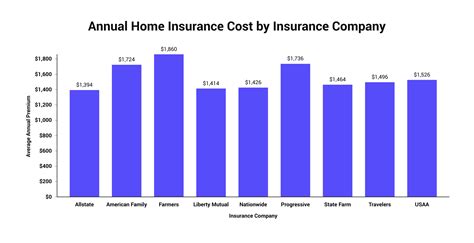

Average Homeowners Insurance Costs

The average cost of homeowners insurance in the United States is approximately 1,300 per year. However, this average can vary significantly depending on the region and the specific coverage needs. For instance, the average annual premium in Texas is around 2,500, while in Iowa, it’s closer to $1,000.

| State | Average Annual Premium |

|---|---|

| Texas | $2,500 |

| Florida | $2,200 |

| California | $1,500 |

| Iowa | $1,000 |

It's important to note that these averages provide a broad overview, and the actual cost for an individual policyholder can vary greatly. Insurance companies use complex algorithms to assess risk and determine premiums, taking into account the factors discussed earlier.

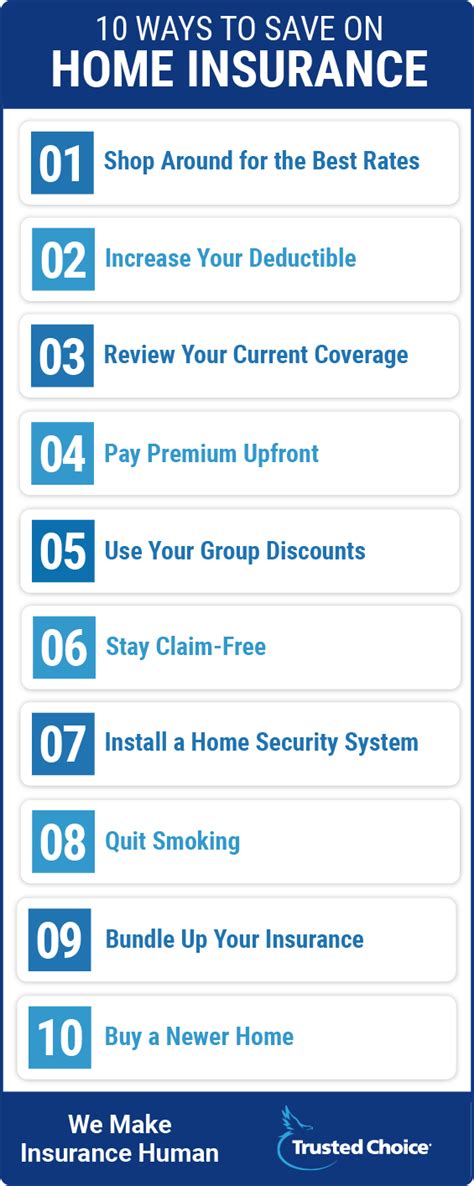

Tips for Reducing Homeowners Insurance Costs

While the cost of homeowners insurance is influenced by various factors, there are strategies that policyholders can employ to potentially reduce their premiums. Here are some tips:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and coverage. This competitive approach can often lead to significant savings.

- Increase Deductibles: Choosing a higher deductible can lower your monthly premiums. However, it’s important to ensure you can afford the higher out-of-pocket costs in the event of a claim.

- Maintain a Good Credit Score: As mentioned earlier, insurance companies often consider credit scores. Maintaining a good credit score can lead to lower insurance rates.

- Bundle Policies: Combining multiple insurance policies, such as auto and homeowners insurance, often results in substantial discounts.

- Make Home Improvements: Investing in home improvements like burglar alarms, fire suppression systems, or impact-resistant windows can lead to insurance discounts by reducing the risk of claims.

The Impact of Deductibles

The deductible is the amount a policyholder must pay out-of-pocket before the insurance coverage kicks in. Choosing a higher deductible can lead to lower premiums, as it reduces the insurer’s financial exposure. However, it’s crucial to strike a balance, as a higher deductible means the policyholder will have to pay more in the event of a claim.

| Deductible Amount | Average Annual Premium |

|---|---|

| $500 | $1,500 |

| $1,000 | $1,300 |

| $2,000 | $1,100 |

The table above illustrates how increasing deductibles can lead to lower premiums. However, it's essential to carefully consider your financial situation and risk tolerance when choosing a deductible amount.

Understanding Coverage Limits

Homeowners insurance policies come with coverage limits, which define the maximum amount the insurer will pay for specific types of claims. It’s crucial to understand these limits and ensure they align with your needs. For instance, the coverage limit for personal property might not be sufficient to replace all your belongings in the event of a total loss.

Common Coverage Types

- Dwelling Coverage: This covers the physical structure of the home, including any attached structures like a garage.

- Personal Property Coverage: Covers the cost of replacing personal belongings like furniture, clothing, and electronics.

- Liability Coverage: Protects the policyholder from lawsuits arising from accidents or injuries that occur on the insured property.

- Additional Living Expenses: Covers the cost of temporary housing and other expenses if the home becomes uninhabitable due to a covered loss.

It's important to review these coverage types and ensure they meet your specific needs. Policyholders can often increase coverage limits for an additional cost, providing more comprehensive protection.

Conclusion

Homeowners insurance is a vital investment for any homeowner. The cost of this insurance can vary widely, influenced by factors such as home characteristics, location, and personal details. By understanding these factors and implementing strategies to reduce costs, policyholders can find an insurance policy that provides adequate coverage at a competitive price. Remember, it’s essential to regularly review and update your insurance coverage to ensure it aligns with your changing needs and circumstances.

What is the average cost of homeowners insurance in my state?

+The average cost of homeowners insurance varies by state. You can find state-specific averages online or by contacting insurance providers. It’s important to note that your personal circumstances and the characteristics of your home will also impact your premiums.

Can I get discounts on my homeowners insurance policy?

+Yes, there are various discounts available for homeowners insurance. These may include discounts for bundle policies (combining homeowners and auto insurance), good credit scores, home safety features, and loyalty discounts for long-term policyholders. It’s worth exploring these options with your insurance provider.

What should I do if I think my homeowners insurance premium is too high?

+If you believe your premium is too high, you can shop around for alternative quotes from other insurance providers. Additionally, you can review your policy to ensure you’re not paying for unnecessary coverage. Consider increasing your deductible to lower your premium, but be aware that this means you’ll pay more out-of-pocket in the event of a claim.