How Does Homeowners Insurance Work

Homeowners insurance is an essential protection for one of the most significant investments in a person's life - their home. It provides financial security and peace of mind, safeguarding homeowners against a wide range of potential risks and unforeseen circumstances. In this comprehensive guide, we will delve into the intricate workings of homeowners insurance, exploring its coverage, benefits, and the factors that influence its operation.

Understanding Homeowners Insurance Coverage

Homeowners insurance is a policy designed to cover a broad spectrum of risks associated with homeownership. It serves as a safety net, offering protection for the structure of the home itself, as well as the personal belongings within it. The coverage extends beyond the physical assets, providing liability protection and covering additional living expenses in the event of a covered loss.

Structural Coverage

The primary coverage offered by homeowners insurance is for the dwelling itself. This includes the main structure, attached structures like garages and sheds, and even outdoor fixtures like fences and pools. The policy ensures that, in the event of damage or destruction caused by a covered peril, the home can be repaired or rebuilt.

It's crucial to note that homeowners insurance policies typically cover a specific list of perils, which may include fire, lightning, windstorms, hail, vandalism, and more. However, it's important to review the policy to understand the specific perils covered and any exclusions.

| Perils Covered | Examples |

|---|---|

| Fire | Damage caused by fire, including smoke damage. |

| Lightning | Damage resulting from lightning strikes. |

| Windstorms | Covering damage from strong winds, including hurricanes and tornadoes. |

| Hail | Protection against damage caused by hailstones. |

| Vandalism | Repairs or replacements due to intentional damage. |

Personal Property Coverage

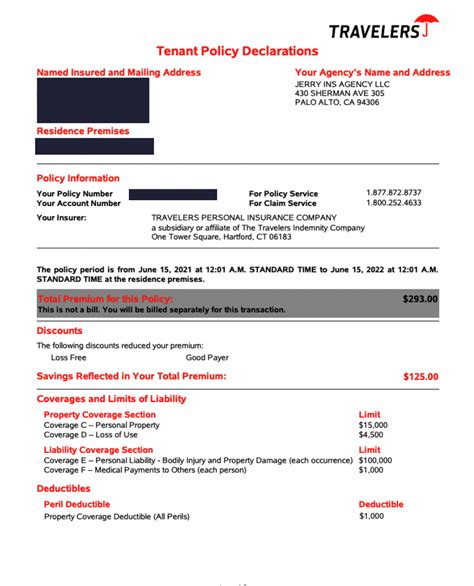

Homeowners insurance also provides coverage for personal belongings within the home. This includes furniture, appliances, electronics, clothing, and other valuable items. The policy ensures that, in the event of a covered loss, the homeowner can replace or repair these items.

The coverage amount for personal property is usually a percentage of the overall dwelling coverage, typically around 50-70%. However, it's essential to review the policy to understand the specific coverage limits and any special provisions for high-value items like jewelry or artwork.

Liability Coverage

A critical aspect of homeowners insurance is liability coverage. This provides protection in the event that someone is injured on the insured property or if the homeowner is held legally responsible for an injury or damage to another person’s property.

Liability coverage typically includes legal defense costs and the payment of damages up to the policy limits. It's an essential safeguard against potentially devastating financial consequences arising from accidental injuries or property damage caused by the homeowner or their family members.

Additional Living Expenses

In the event that a homeowner’s residence becomes uninhabitable due to a covered loss, homeowners insurance also provides coverage for additional living expenses. This coverage reimburses the insured for the cost of temporary housing, meals, and other necessary expenses incurred while the home is being repaired or rebuilt.

The coverage amount for additional living expenses is usually a specified daily or monthly limit, and it's important to review the policy to understand the specific coverage limits and any time constraints.

Factors Influencing Homeowners Insurance

The operation of homeowners insurance is influenced by various factors, including the location of the property, the value of the home, and the specific coverage needs of the homeowner. These factors determine the policy’s cost, coverage limits, and deductibles.

Location

The location of the property is a significant factor in homeowners insurance. Homes located in areas prone to natural disasters like hurricanes, earthquakes, or wildfires may face higher premiums and more restrictive coverage. Additionally, homes in high-crime areas may also see increased costs due to the higher risk of theft or vandalism.

Value of the Home

The value of the home is another crucial factor. The higher the value of the home, the more it will cost to rebuild or repair, which directly impacts the insurance premium. Homeowners should ensure that their policy limits match the actual replacement cost of the home to avoid being underinsured in the event of a loss.

Coverage Needs

Every homeowner has unique coverage needs. Some may require additional coverage for high-value items, while others may need specialized coverage for specific risks, such as flood or earthquake insurance. It’s essential to review the policy and understand the specific coverages to ensure adequate protection.

Filing a Claim

In the event of a covered loss, homeowners can file a claim with their insurance provider. The process typically involves the following steps:

- Notifying the insurance company as soon as possible after the loss occurs.

- Providing a detailed description of the damage and any supporting documentation, such as photographs or repair estimates.

- Waiting for the insurance adjuster to assess the damage and determine the extent of coverage.

- Receiving a settlement offer from the insurance company, which may be paid out in a single sum or in installments as repairs progress.

It's important to note that homeowners should take steps to mitigate further damage and protect their property after a loss. This may include boarding up windows, covering damaged roofs, or securing valuable items. However, it's crucial to consult with the insurance company before making any permanent repairs or disposing of damaged property.

The Importance of Regular Policy Review

Homeowners insurance policies should be reviewed regularly to ensure that they continue to meet the changing needs of the homeowner. Life events such as marriage, the birth of a child, or significant home improvements may require adjustments to the policy.

Regular policy review also ensures that the homeowner is aware of any changes in coverage, premiums, or deductibles. It's an opportunity to assess the adequacy of the coverage limits and make any necessary adjustments to ensure proper protection.

Conclusion

Homeowners insurance is a vital tool for protecting one’s home and personal belongings. By understanding the coverage, benefits, and factors that influence homeowners insurance, homeowners can make informed decisions to ensure they have the right level of protection. Regular policy review and staying informed about insurance options can help homeowners navigate the complex world of insurance with confidence.

What is the difference between replacement cost and actual cash value coverage for personal property?

+Replacement cost coverage reimburses the policyholder for the full cost of replacing damaged personal property without deducting for depreciation. Actual cash value coverage, on the other hand, reimburses the policyholder for the replacement cost minus depreciation, meaning the policyholder receives less than the full replacement cost.

How often should I review my homeowners insurance policy?

+It is recommended to review your homeowners insurance policy annually or whenever there are significant changes to your home or personal circumstances. Regular reviews ensure that your coverage remains adequate and up-to-date.

What should I do if I’m unsure about the coverage limits in my policy?

+If you have questions or concerns about your coverage limits, it’s best to consult with your insurance agent or company. They can provide guidance and help you understand the specifics of your policy, ensuring that you have the appropriate coverage for your needs.