House Insurance Cheapest

When it comes to house insurance, finding the cheapest option is often a top priority for homeowners. With a variety of providers and policies available, it can be a daunting task to navigate the market and identify the most cost-effective coverage. This comprehensive guide aims to provide an in-depth analysis of the factors influencing the cost of house insurance, offering valuable insights to help you secure the best value for your money.

Understanding the Fundamentals of House Insurance

House insurance, or homeowners insurance as it is often called, is a type of property insurance that protects an individual's home against damages or losses caused by various perils. These perils can include natural disasters like storms, floods, or fires, as well as human-induced incidents such as burglaries or accidents. House insurance policies typically cover the structure of the home itself, as well as its contents, providing financial protection against a range of unforeseen events.

The primary objective of house insurance is to safeguard homeowners from the potentially devastating financial consequences of unexpected damage or loss. By paying regular premiums, homeowners can gain peace of mind, knowing that they are protected against the high costs of repairing or replacing their homes and possessions.

Key Factors Influencing House Insurance Costs

The cost of house insurance is determined by a multitude of factors, each of which can significantly impact the overall premium. Understanding these factors is crucial for homeowners seeking the most affordable coverage.

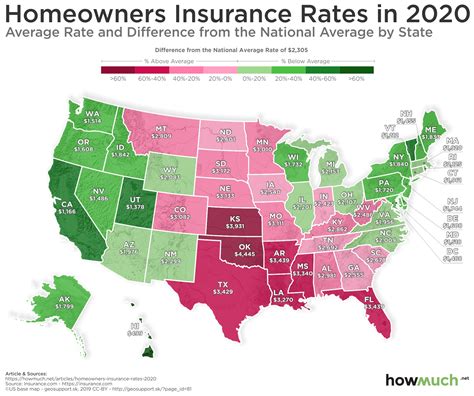

Location

The location of your home is one of the most influential factors when it comes to house insurance costs. Insurance providers assess the risk associated with different areas based on a range of factors, including the likelihood of natural disasters, crime rates, and the cost of living in the area. For instance, homes in areas prone to hurricanes or floods will typically have higher insurance premiums due to the increased risk of damage.

| Location Type | Average Annual Premium |

|---|---|

| Urban Areas | $1,200 - $2,000 |

| Suburban Areas | $1,000 - $1,500 |

| Rural Areas | $800 - $1,200 |

Home Value and Size

The value and size of your home are significant determinants of your insurance premium. Larger homes generally require more materials and labor to rebuild, and therefore command higher insurance costs. Similarly, homes with higher market values will typically have higher premiums, as the insurance company would need to provide more coverage to replace the home in the event of a total loss.

Age of the Home

The age of your home can also impact insurance costs. Older homes may have outdated wiring, plumbing, or structural components, which can increase the risk of accidents or damage. As a result, insurance providers may charge higher premiums for older homes to account for these potential risks.

Construction Materials

The type of materials used in the construction of your home can influence insurance costs. For instance, homes built with brick or concrete may be considered more durable and therefore attract lower insurance premiums compared to homes built with wood or other less resilient materials.

Deductibles and Coverage Limits

The deductibles and coverage limits you choose for your policy will directly affect your insurance premium. Higher deductibles (the amount you pay out of pocket before your insurance coverage kicks in) typically result in lower premiums, as you are taking on more financial responsibility in the event of a claim. Conversely, lower deductibles mean you pay more in premiums but have less financial burden if you need to make a claim.

Similarly, the coverage limits you choose will impact your premium. Higher coverage limits provide more financial protection in the event of a claim, but they will also result in higher premiums. It's essential to strike a balance between the coverage you need and the cost you can afford.

Tips for Finding the Cheapest House Insurance

While the cost of house insurance is influenced by various factors, there are strategies you can employ to secure the most affordable coverage.

Shop Around

One of the most effective ways to find the cheapest house insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three different insurers can help you identify the most competitive option.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies together. For instance, you may be able to save money by combining your house insurance with your auto insurance or other policies. This strategy can lead to significant cost savings, so it's worth considering if you have multiple insurance needs.

Improve Your Home's Security

Insurance providers often offer discounts for homes with improved security features. This can include measures such as installing a monitored alarm system, reinforcing doors and windows, or adding security lighting. By taking steps to enhance your home's security, you may be eligible for lower insurance premiums.

Maintain a Good Credit Score

Your credit score can influence the cost of your house insurance. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring a homeowner. Generally, individuals with higher credit scores are considered lower risk and may be offered more favorable insurance rates.

Review Your Policy Regularly

Insurance needs and costs can change over time. It's essential to review your house insurance policy regularly to ensure it still meets your needs and to identify opportunities for cost savings. For instance, if you've made significant home improvements or renovations, you may need to adjust your coverage to reflect the increased value of your home.

Choosing the Right Coverage for Your Needs

While finding the cheapest house insurance is important, it's equally crucial to ensure you have the right level of coverage to protect your home and possessions. Here are some key considerations when selecting a house insurance policy.

Assess Your Risks

Evaluate the specific risks your home and possessions may face. Consider factors such as the location's vulnerability to natural disasters, the prevalence of crime in the area, and any unique features of your home that may increase the risk of damage. By understanding these risks, you can select a policy that provides adequate coverage.

Choose the Right Coverage Type

House insurance policies come in various types, including HO-1 (basic form), HO-2 (broad form), HO-3 (special form), and HO-5 (comprehensive form). Each type offers different levels of coverage, with HO-5 providing the most comprehensive protection. Assess your needs and choose a policy type that aligns with your requirements.

Consider Additional Coverages

Standard house insurance policies may not cover certain perils or specific items. For instance, many policies do not provide coverage for flood damage, which may be necessary if you live in a high-risk flood area. Consider adding additional coverages to your policy to ensure you have the protection you need.

Understand Your Policy's Limitations

While it's important to have sufficient coverage, it's also crucial to understand the limitations of your policy. Carefully read through your policy documents to understand what is and isn't covered. This can help you identify any gaps in coverage and make informed decisions about additional coverages you may need.

The Future of House Insurance

The house insurance market is continually evolving, driven by technological advancements and changing consumer needs. Here are some insights into the future of house insurance.

Technology Integration

Insurance providers are increasingly leveraging technology to enhance their services. This includes the use of artificial intelligence and machine learning to analyze risk and price policies more accurately. Additionally, many providers are now offering digital tools and platforms to streamline the insurance process, from quoting to claims management.

Increased Focus on Prevention

There is a growing trend among insurance providers to encourage risk prevention rather than simply providing coverage for losses. This shift is driven by the understanding that preventing damage or loss is more cost-effective than repairing or replacing after the fact. As a result, insurance providers are offering incentives and discounts for homeowners who take proactive measures to reduce risks, such as installing smoke detectors or reinforcing roofs against storms.

Personalized Insurance

With the advent of advanced data analytics, insurance providers are increasingly able to offer personalized insurance policies tailored to individual homeowners' needs. By analyzing a wide range of data points, including home characteristics, location, and homeowner behavior, insurers can provide more accurate and personalized coverage and pricing.

Sustainability and Environmental Considerations

As environmental concerns continue to grow, insurance providers are also paying more attention to sustainability and environmental factors. This includes offering incentives for homeowners who take steps to reduce their environmental impact, such as installing solar panels or adopting energy-efficient practices. Additionally, some providers are exploring ways to incorporate environmental risk assessments into their underwriting processes.

Frequently Asked Questions

What is the average cost of house insurance in the US?

+The average cost of house insurance in the US varies depending on factors such as location, home value, and coverage limits. On average, homeowners can expect to pay between $1,000 and $2,000 annually for house insurance.

How can I lower my house insurance premium?

+There are several strategies to lower your house insurance premium. These include shopping around for quotes, bundling policies, improving your home's security, maintaining a good credit score, and regularly reviewing your policy to ensure it still meets your needs.

What factors influence the cost of house insurance?

+The cost of house insurance is influenced by various factors, including location, home value and size, age of the home, construction materials, deductibles and coverage limits, and the homeowner's credit score.

Are there any additional coverages I should consider for my house insurance policy?

+Yes, depending on your specific needs and risks, you may want to consider additional coverages such as flood insurance, earthquake insurance, or coverage for high-value items like jewelry or artwork. It's important to carefully assess your risks and choose coverages that provide adequate protection.

How often should I review my house insurance policy?

+It's recommended to review your house insurance policy at least once a year, or whenever there are significant changes to your home or your personal circumstances. This ensures that your coverage remains up-to-date and continues to meet your needs.

By understanding the fundamentals of house insurance and the factors influencing its cost, you can make informed decisions to secure the best value for your money. Remember, while finding the cheapest insurance is important, it’s equally crucial to ensure you have the right level of coverage to protect your home and possessions.