Homeowners Insurance Coverage Types

Homeowners insurance is an essential safeguard for every homeowner, providing financial protection against a range of potential risks and liabilities. With the right coverage, you can protect your home, your belongings, and your family from unexpected events. However, navigating the various types of homeowners insurance coverage can be a complex task, as policies often differ in their scope and limits. In this comprehensive guide, we'll delve into the different coverage types, helping you understand the options available and make informed decisions to secure your home and peace of mind.

Understanding the Core Coverages

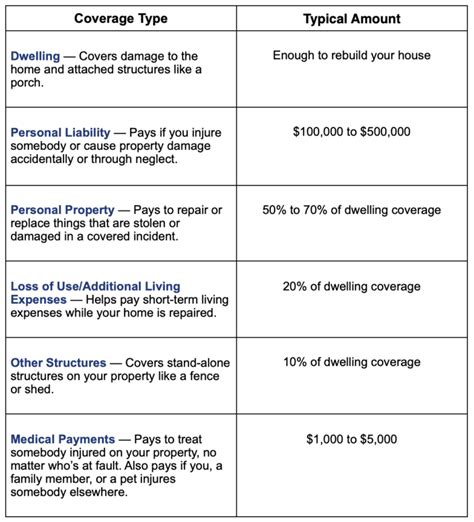

At the heart of every homeowners insurance policy are a few key coverages that form the foundation of protection. These core coverages are designed to address the most common risks and losses that homeowners may face.

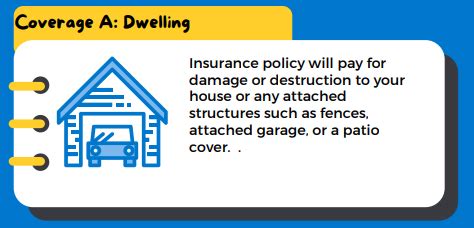

Dwelling Coverage

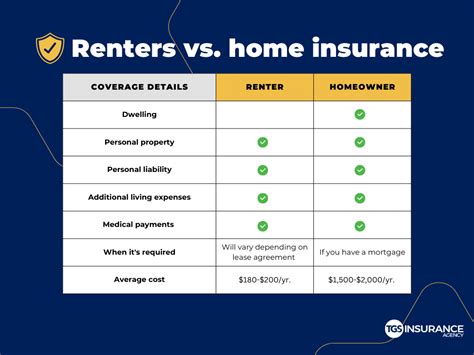

One of the primary components of homeowners insurance is dwelling coverage, which provides financial protection for the physical structure of your home. This coverage typically extends to the main dwelling, including any attached structures like garages and carports. It’s essential to ensure that your dwelling coverage limit aligns with the current replacement cost of your home. In the event of a covered loss, such as fire, wind damage, or vandalism, dwelling coverage helps cover the cost of repairing or rebuilding your home.

| Dwelling Coverage Type | Description |

|---|---|

| Replacement Cost | Pays to rebuild your home at current market rates, regardless of the original cost. |

| Actual Cash Value | Reimburses you for the cost of your home minus depreciation. |

| Guaranteed Replacement Cost | Covers the cost of rebuilding, even if it exceeds your policy limits. |

Personal Property Coverage

Another crucial aspect of homeowners insurance is personal property coverage, which protects your belongings against damage or loss. This coverage extends to items like furniture, electronics, clothing, and other personal items within your home. It’s important to note that personal property coverage often has limits and exclusions, so it’s essential to understand what’s covered and what isn’t. For instance, high-value items like jewelry or artwork may require additional coverage.

Liability Coverage

Liability coverage is a vital component of homeowners insurance, as it provides protection against claims and lawsuits resulting from accidents or injuries that occur on your property. This coverage helps cover medical expenses and legal fees if someone is injured on your premises or if your actions cause harm to others. It’s crucial to ensure that your liability limits are sufficient to cover potential claims, as they can be costly.

Expanding Your Coverage

While the core coverages provide a solid foundation, there are several additional options to consider that can enhance your protection and cater to specific needs.

Additional Living Expenses

Additional living expenses (ALE) coverage kicks in when your home becomes uninhabitable due to a covered loss, such as a fire or severe storm. This coverage reimburses you for the additional costs you incur while living elsewhere during the repairs or rebuilding process. ALE coverage can include expenses like temporary housing, meals, and other necessary costs beyond your usual living expenses.

Personal Liability

Building upon the basic liability coverage, personal liability coverage offers an extended layer of protection. It provides coverage for accidents or injuries that occur away from your home, such as if your dog bites someone in a public place. Personal liability coverage can be particularly important for those who frequently engage in activities outside their home or have a high-risk occupation.

Umbrella Insurance

Umbrella insurance is an additional layer of liability coverage that goes beyond the limits of your standard homeowners insurance policy. It provides extra protection in the event of catastrophic losses or large liability claims. Umbrella insurance can be beneficial for homeowners with significant assets or those who engage in high-risk activities, as it offers an added safety net.

Home Business Coverage

If you operate a home-based business, home business coverage is essential. This coverage protects your business assets, inventory, and equipment from damage or theft. It also extends liability coverage to your business operations, covering potential claims or lawsuits related to your business activities.

Specialized Coverages

Certain homeowners may require specialized coverages to address unique risks or circumstances. These specialized coverages are designed to provide tailored protection for specific situations.

Flood Insurance

Flood insurance is a separate policy that provides coverage for damage caused by flooding. Standard homeowners insurance policies typically do not cover flood damage, so if you live in a flood-prone area, it’s crucial to have this additional coverage. Flood insurance is available through the National Flood Insurance Program (NFIP) and private insurers.

Earthquake Insurance

Earthquake insurance is another specialized coverage that provides protection against damage caused by earthquakes. Earthquakes can cause significant damage to homes, and this coverage ensures that you have the financial means to repair or rebuild your home if such an event occurs. It’s important to note that earthquake insurance is often an optional add-on to your standard homeowners policy.

Scheduled Personal Property

Scheduled personal property coverage is designed for high-value items that may exceed the limits of your standard personal property coverage. This coverage provides an additional layer of protection for items like jewelry, artwork, antiques, and collectibles. By scheduling these items, you can ensure they are adequately insured and covered for their full value.

Understanding Policy Limits and Deductibles

When selecting homeowners insurance coverage, it’s crucial to understand the policy limits and deductibles. Policy limits refer to the maximum amount your insurance company will pay for a covered loss, while deductibles are the portion of the loss that you must pay out of pocket before your insurance coverage kicks in.

It's essential to choose policy limits and deductibles that align with your financial situation and the value of your home and belongings. Higher policy limits and lower deductibles provide more extensive coverage but may result in higher premiums. On the other hand, lower policy limits and higher deductibles can keep premiums more affordable but may leave you with more out-of-pocket expenses in the event of a loss.

Conclusion: Making Informed Choices

Navigating the world of homeowners insurance coverage can be complex, but by understanding the various options available, you can make informed decisions to protect your home and assets effectively. From core coverages like dwelling and personal property protection to specialized coverages for unique circumstances, there’s a range of choices to cater to your specific needs.

Remember, it's crucial to review your policy regularly and update it as your circumstances change. Life events such as home renovations, acquiring high-value items, or starting a home business may require adjustments to your coverage. By staying informed and working with a trusted insurance agent, you can ensure that your homeowners insurance provides the peace of mind and financial protection you need.

How often should I review my homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually or whenever your circumstances change significantly. Regular reviews ensure that your coverage remains up-to-date and aligned with your needs.

What factors can influence the cost of my homeowners insurance?

+Several factors can impact the cost of your homeowners insurance, including the location and value of your home, the level of coverage you choose, your claims history, and the insurance company you select. It’s essential to shop around and compare quotes to find the best coverage at a competitive price.

Can I bundle my homeowners insurance with other policies to save money?

+Yes, bundling your homeowners insurance with other policies, such as auto insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts, so it’s worth exploring this option to reduce your overall insurance costs.