Homeowners Insurance Ca

Homeowners insurance is a crucial aspect of homeownership, offering financial protection and peace of mind to millions of individuals across the United States. However, the insurance landscape can vary significantly from state to state, with unique challenges and considerations. In this comprehensive guide, we delve into the world of homeowners insurance in the state of California, known for its diverse landscapes, seismic activity, and a range of natural hazards. By understanding the intricacies of homeowners insurance in the Golden State, you can make informed decisions to safeguard your most valuable asset.

Understanding the California Homeowners Insurance Market

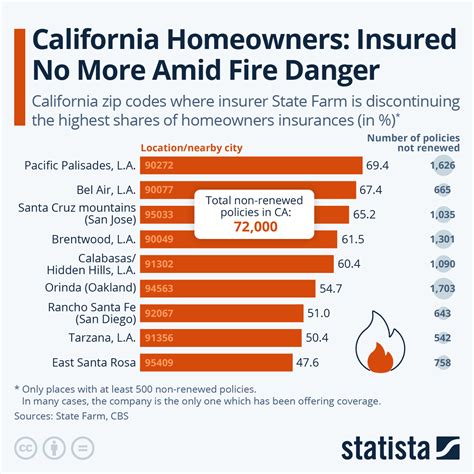

California, with its diverse geography and dynamic weather patterns, presents a unique set of risks for homeowners. From wildfires raging across the dry landscapes to earthquakes shaking the ground, and from floods inundating coastal areas to hailstorms damaging properties, the Golden State faces a multitude of natural perils. These risks make homeowners insurance an essential tool for financial protection and peace of mind.

The California homeowners insurance market is characterized by its complexity. Insurers carefully assess a multitude of factors to determine premiums and coverage, including the location of the property, its age and construction materials, the specific coverage limits chosen, and the presence of any additional risk factors such as proximity to fire-prone areas or fault lines. This complexity can make it challenging for homeowners to navigate and understand their insurance options fully.

Moreover, California has a unique history with homeowners insurance, particularly regarding natural disasters. In the past, insurers have faced significant financial losses due to widespread disasters like the Oakland Hills fire in 1991 and the Northridge earthquake in 1994. These events led to increased scrutiny and regulation of the insurance industry, with the state stepping in to provide coverage when private insurers withdrew from high-risk areas.

The California Fair Access to Insurance Requirements (FAIR) Plan, for instance, is a state-mandated program that offers basic coverage to homeowners who cannot obtain insurance through the standard market due to their property's high-risk nature. While it provides a safety net for some homeowners, it also underscores the challenges and complexities of the California insurance landscape.

The Importance of Understanding Coverage and Limits

Homeowners insurance in California typically comprises several key components, each offering distinct protection. These include:

- Dwelling Coverage: This is the core of your homeowners insurance policy, providing protection for the physical structure of your home. It covers the cost of repairs or rebuilding if your home is damaged or destroyed due to a covered peril.

- Personal Property Coverage: This coverage safeguards the belongings inside your home, such as furniture, electronics, and clothing. It reimburses you for losses or damage caused by covered perils, ensuring you can replace your possessions.

- Liability Coverage: This aspect of your policy protects you from financial loss if someone is injured on your property or if your actions off-site cause harm to others. It covers legal fees and any settlements or judgments against you.

- Additional Living Expenses (ALE): In the event your home becomes uninhabitable due to a covered loss, ALE coverage reimburses you for the additional costs of temporary housing and living expenses until you can return to your home.

- Medical Payments to Others: This coverage provides payment for medical expenses if someone is injured on your property, regardless of fault. It offers a quick and straightforward way to cover these costs without going through the liability coverage.

However, it's crucial to understand that homeowners insurance policies have limits and exclusions. For instance, standard policies often exclude coverage for certain natural disasters like earthquakes and floods, which require additional coverage through separate policies.

Additionally, policy limits can vary significantly, and it's essential to choose limits that adequately reflect the value of your home and possessions. Underestimating these limits can leave you financially vulnerable in the event of a significant loss.

Factors Influencing Homeowners Insurance Rates in California

California homeowners insurance rates are influenced by a variety of factors, each playing a role in determining the cost of your policy. These factors include:

Location and Risk Factors

The location of your home is a critical factor in determining your insurance rates. Areas prone to natural disasters like wildfires, earthquakes, or floods are considered high-risk and can lead to higher premiums. Insurers carefully assess the risk profile of each area, considering factors like the proximity to fire-prone brush, the likelihood of flooding, and the frequency of seismic activity.

Construction and Age of the Home

The construction materials and age of your home can also impact your insurance rates. Homes built with fire-resistant materials or located in areas with effective fire suppression systems may enjoy lower rates. Similarly, newer homes are often considered less risky, as they are built to modern safety standards and may feature advanced construction techniques.

Coverage Limits and Deductibles

The coverage limits you choose can significantly affect your premium. Higher limits generally result in higher premiums, as they represent a greater financial exposure for the insurer. Similarly, the deductible you select can impact your premium. Choosing a higher deductible can lower your premium, but it also means you’ll pay more out of pocket in the event of a claim.

Claims History and Credit Score

Your claims history is a crucial factor in determining your insurance rates. Filing multiple claims, even if they are small, can lead to higher premiums or even policy cancellation. Insurers also consider your credit score, as statistical evidence suggests a correlation between creditworthiness and the likelihood of filing an insurance claim.

Discounts and Mitigation Efforts

California homeowners can take advantage of various discounts to lower their insurance premiums. These may include:

- Bundling Home and Auto Insurance: Many insurers offer discounts when you bundle your homeowners and auto insurance policies.

- Safety and Security Features: Homes with security systems, fire alarms, and sprinkler systems may qualify for discounts, as these features can help prevent or mitigate losses.

- Loyalty Discounts: Staying with the same insurer for an extended period may result in loyalty discounts.

- Mitigation Efforts: Taking steps to reduce the risk of loss, such as installing fire-resistant roofing or reinforcing your home against earthquakes, can lead to lower premiums.

Navigating the California Insurance Landscape

Given the complexity of the California insurance market, it’s essential to approach your insurance needs with careful consideration and expert guidance. Here are some tips to help you navigate this landscape:

Assess Your Risks

Begin by assessing the unique risks your home faces. Consider factors like proximity to fire-prone areas, fault lines, or flood zones. Understanding these risks will help you choose the right coverage and prepare for potential challenges.

Understand Your Coverage Options

Take the time to understand the various coverage options available to you. Standard policies may not provide sufficient protection, especially in high-risk areas. Consider supplemental coverage for earthquakes and floods, as these are often excluded from standard policies.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurers. Each insurer has its own risk assessment methodology, so rates can vary significantly. By comparing quotes, you can find the best coverage at the most competitive price.

Work with a Trusted Insurance Agent

Consider working with a trusted insurance agent who understands the California market. A knowledgeable agent can guide you through the complexities of homeowners insurance, help you choose the right coverage, and advocate for you in the event of a claim.

Review Your Policy Regularly

Your insurance needs may change over time, so it’s essential to review your policy annually. Consider factors like changes in your home’s value, the addition of new possessions, or improvements to your home’s safety features. Regular reviews ensure your coverage remains adequate and up-to-date.

Conclusion: Protecting Your California Home

Homeowners insurance in California is a vital tool for safeguarding your home and possessions. By understanding the unique challenges and complexities of the Golden State’s insurance landscape, you can make informed decisions to protect your most valuable asset. From assessing your risks to choosing the right coverage and working with trusted professionals, every step matters in ensuring your home’s security and your financial well-being.

Frequently Asked Questions

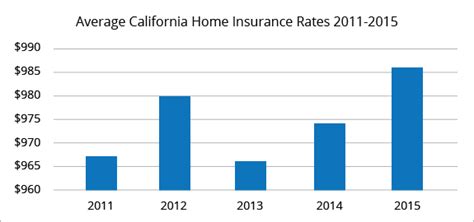

What is the average cost of homeowners insurance in California?

+The average cost of homeowners insurance in California can vary significantly depending on several factors, including the location, the value of the home, and the coverage limits chosen. According to recent data, the average annual premium for homeowners insurance in California is around 1,000, but this can range from as low as 700 to over $2,000 in certain high-risk areas.

Are earthquakes covered by standard homeowners insurance policies in California?

+No, earthquakes are typically not covered by standard homeowners insurance policies in California. Due to the high risk of seismic activity in the state, insurers often exclude earthquake coverage from standard policies to manage their exposure to financial losses. To obtain coverage for earthquake damage, you will need to purchase a separate earthquake insurance policy.

What should I do if my home is located in a high-risk area for natural disasters in California?

+If your home is located in a high-risk area for natural disasters, such as wildfire-prone regions or flood zones, it’s crucial to take additional steps to protect yourself. Consider purchasing separate insurance policies for specific risks, like wildfire or flood insurance. You should also implement mitigation measures to reduce the risk of loss, such as installing fire-resistant materials or raising your home above the base flood elevation.

How can I lower my homeowners insurance premiums in California?

+There are several strategies you can employ to lower your homeowners insurance premiums in California. These include:

- Bundling your homeowners and auto insurance policies to take advantage of multi-policy discounts.

- Installing safety and security features like fire alarms, sprinkler systems, and security cameras.

- Increasing your deductible, which can reduce your premium but requires you to pay more out of pocket in the event of a claim.

- Maintaining a good credit score, as it is often considered in insurance risk assessments.

- Regularly reviewing and updating your policy to ensure you’re not overinsured or underinsured.

What should I do if my homeowners insurance claim is denied in California?

+If your homeowners insurance claim is denied in California, it’s important to understand the reasons for the denial and your options moving forward. Review the denial letter carefully, as it should outline the specific reasons for the denial. If you believe the denial is unjustified, you can appeal the decision by providing additional evidence or documentation to support your claim. You may also consider seeking legal advice or mediation to resolve the dispute.