Home Insurances

Home insurance is an essential aspect of protecting one's residence and personal belongings. It provides financial security and peace of mind, covering a range of potential risks and unforeseen events that can occur within and around a home. In this comprehensive guide, we will delve into the world of home insurance, exploring its key components, benefits, and the factors that influence policy costs. We will also provide valuable insights and tips to help homeowners make informed decisions when choosing the right coverage for their specific needs.

Understanding the Basics of Home Insurance

Home insurance, often referred to as homeowners insurance or house insurance, is a contract between a homeowner and an insurance provider. This contract outlines the terms and conditions of coverage, including the types of risks insured against, the limits of coverage, and the premium to be paid. The primary purpose of home insurance is to protect homeowners from potential financial losses arising from damages to their property and possessions.

Home insurance policies typically consist of several components, each covering different aspects of a homeowner's needs. These components include:

- Dwelling Coverage: This part of the policy provides protection for the physical structure of the home, including the main residence and any attached structures like garages or porches. It covers damages caused by perils such as fire, windstorms, hail, and vandalism.

- Personal Property Coverage: Home insurance also covers the contents of the home, including furniture, appliances, electronics, and personal belongings. This coverage reimburses homeowners for losses or damages to their possessions due to covered perils.

- Liability Coverage: An essential aspect of home insurance is liability protection. This coverage safeguards homeowners against legal claims and lawsuits arising from accidents or injuries that occur on their property. It provides financial protection for medical expenses and legal defense costs.

- Additional Living Expenses (ALE): In the event of a covered loss that renders the home uninhabitable, ALE coverage steps in. It covers the additional costs incurred by the homeowner during the time it takes to repair or rebuild the home, such as temporary housing and meals.

- Optional Coverages: Homeowners can opt for additional coverages to tailor their policy to their specific needs. These may include coverage for high-value items, identity theft protection, or coverage for specific natural disasters like earthquakes or floods, which are often excluded from standard policies.

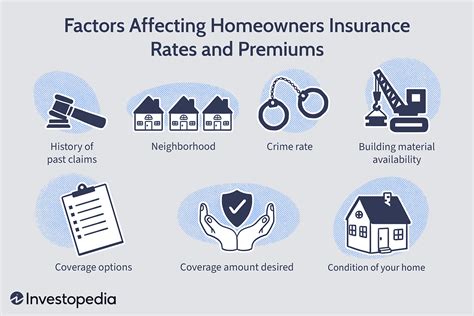

Factors Influencing Home Insurance Costs

The cost of home insurance policies can vary significantly based on several factors. Understanding these factors can help homeowners make more informed decisions when shopping for coverage and potentially negotiate better rates.

Location and Risk Factors

One of the primary determinants of home insurance costs is the location of the property. Insurance providers assess the risk associated with a particular area, considering factors such as crime rates, proximity to fire stations, and the prevalence of natural disasters like hurricanes or earthquakes. Areas with higher risk factors generally result in higher insurance premiums.

Home Value and Replacement Cost

The value of the home and the cost to rebuild or replace it in the event of a total loss are crucial considerations in determining insurance costs. Higher-value homes or those located in areas with high construction costs will typically require more expensive insurance policies.

Coverage Limits and Deductibles

Homeowners have the flexibility to choose their coverage limits and deductibles, which directly impact the cost of their insurance policy. Higher coverage limits and lower deductibles can result in increased premiums, while opting for lower limits and higher deductibles may reduce costs but require homeowners to pay more out-of-pocket in the event of a claim.

Claims History

Insurance providers carefully examine a homeowner’s claims history when determining policy costs. A history of frequent claims or major losses may lead to higher premiums or even policy non-renewal. Maintaining a clean claims record can help keep insurance costs down.

Discounts and Bundling

Insurance companies often offer discounts to encourage policyholders to take certain safety measures or bundle multiple policies. For instance, installing smoke detectors, security systems, or fire sprinklers may qualify homeowners for discounts. Additionally, bundling home insurance with other policies, such as auto insurance, can result in significant savings.

Choosing the Right Home Insurance Policy

Selecting the appropriate home insurance policy involves careful consideration of several factors, including:

- Coverage Options: Evaluate the different coverage options available and choose a policy that provides adequate protection for your specific needs. Consider the value of your home, the cost of rebuilding, and the replacement value of your personal belongings.

- Policy Limits and Deductibles: Determine the appropriate coverage limits and deductibles based on your financial situation and risk tolerance. Higher limits may provide more protection but result in higher premiums, while higher deductibles can reduce costs but require you to pay more out of pocket in the event of a claim.

- Additional Coverages: Assess whether you require additional coverages for specific risks. For example, if you live in an area prone to earthquakes or floods, consider purchasing separate policies to cover these perils.

- Insurance Provider Reputation: Research and choose a reputable insurance provider with a solid financial standing and a track record of prompt claim settlements. Check online reviews and ratings to gauge customer satisfaction.

- Customer Service and Claims Process: Ensure the insurance provider offers excellent customer service and a streamlined claims process. Consider factors such as response time, accessibility, and the availability of online tools for managing your policy.

Real-World Examples and Case Studies

To illustrate the impact of home insurance, let’s examine a few real-world scenarios:

Case Study 1: Fire Damage

Imagine a homeowner in a suburban area whose home suffers extensive damage due to a fire caused by an electrical malfunction. The homeowner has a comprehensive home insurance policy with a 1,000 deductible. The insurance provider assesses the damage and estimates the cost of rebuilding the home at 250,000. After applying the deductible, the homeowner receives a payout of $249,000, which covers the costs of rebuilding and replacing their belongings.

Case Study 2: Hurricane Damage

In a coastal region prone to hurricanes, a homeowner with a 300,000 home and a 500 deductible experiences significant damage during a hurricane. Their home insurance policy covers wind damage, but the policy excludes flood damage. The insurance company estimates the cost of repairs at 20,000, and after applying the deductible, the homeowner receives 15,000 to cover the necessary repairs.

Case Study 3: Liability Claim

A homeowner hosts a backyard party, and one of the guests slips and falls, injuring themselves. The guest sues the homeowner for medical expenses and pain and suffering. The homeowner’s liability coverage steps in, providing financial protection for the legal expenses and settlement costs, which amount to $50,000.

Performance Analysis and Expert Insights

Home insurance policies are designed to provide comprehensive protection, but their effectiveness can vary based on the specific circumstances of a claim. It is crucial for homeowners to understand the potential limitations and exclusions of their policies to ensure they have adequate coverage for their unique needs.

Insurance experts recommend regularly reviewing and updating home insurance policies to reflect changes in the value of the home and its contents. As the cost of construction materials and labor fluctuates, ensuring that the coverage limits are sufficient to rebuild the home in the event of a total loss is essential. Additionally, homeowners should consider inflation guard provisions, which automatically adjust coverage limits annually to keep pace with rising costs.

When selecting a home insurance provider, it is advisable to opt for a company with a strong financial rating and a reputation for prompt claim settlements. This ensures that in the event of a covered loss, the homeowner can receive timely compensation to begin the recovery process.

Future Implications and Industry Trends

The home insurance industry is evolving to meet the changing needs and risks faced by homeowners. As climate change continues to impact weather patterns, the frequency and severity of natural disasters are expected to increase. Insurance providers are adapting their policies to address these challenges, offering specialized coverage for specific perils and providing resources to help homeowners mitigate risks.

Additionally, the rise of smart home technology and the Internet of Things (IoT) is influencing the home insurance landscape. Insurance providers are exploring ways to integrate these technologies into their policies, offering discounts for smart home devices that enhance security and reduce the risk of losses. This trend is expected to continue, with insurers leveraging data analytics and machine learning to personalize coverage and premiums based on individual risk profiles.

Conclusion

Home insurance is a vital aspect of financial planning for homeowners, providing protection against a wide range of risks and potential losses. By understanding the components of home insurance policies, the factors influencing costs, and the importance of selecting the right coverage, homeowners can make informed decisions to safeguard their investments. As the industry continues to evolve, staying informed about emerging trends and advancements in home insurance will empower homeowners to make the most of their policies.

What is the average cost of home insurance in the United States?

+The average cost of home insurance in the U.S. varies based on several factors, including location, home value, and coverage limits. According to industry data, the national average for homeowners insurance premiums is around $1,200 per year. However, this average can range significantly, with some states having much higher or lower premiums.

Are there ways to lower home insurance costs?

+Yes, there are several strategies to reduce home insurance costs. These include increasing the deductible, maintaining a clean claims history, installing safety devices like smoke detectors and security systems, and bundling policies with the same insurer. Additionally, shopping around and comparing quotes from multiple insurers can help identify the most cost-effective coverage.

What should I do if I need to file a home insurance claim?

+If you need to file a home insurance claim, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves documenting the damage, providing estimates or receipts for repairs or replacements, and waiting for the insurance adjuster’s assessment. It’s important to follow the insurer’s instructions and provide all necessary documentation to ensure a smooth claims process.

Can I customize my home insurance policy to my specific needs?

+Absolutely! Home insurance policies can be tailored to your specific needs and circumstances. You can choose different coverage limits, deductibles, and optional coverages to create a policy that provides the protection you require. Additionally, many insurers offer endorsements or riders that allow you to add coverage for specific risks or valuable items, ensuring your policy aligns with your unique requirements.