Amex Insurance Claim

Insurance claims can be a complex and often daunting process, especially when it comes to travel-related incidents. American Express (Amex), a renowned financial services company, offers various insurance plans to its cardholders, providing peace of mind during their travels. This article aims to delve into the intricacies of filing an Amex insurance claim, offering a comprehensive guide to help you navigate the process smoothly.

Understanding Amex Insurance Coverage

Before we dive into the claim process, it’s essential to grasp the coverage provided by Amex’s insurance plans. Amex offers a range of travel-related insurance benefits, including:

- Trip Cancellation/Interruption Insurance: This coverage reimburses you for non-refundable trip expenses if your travel plans are disrupted due to unforeseen circumstances such as illness, severe weather, or other covered reasons.

- Travel Accident Insurance: Provides accidental death and dismemberment coverage while traveling.

- Baggage Delay Insurance: Reimburses you for essential purchases when your checked baggage is delayed by a certain period.

- Rental Car Insurance: Offers collision damage waiver coverage for rental vehicles, protecting you from unexpected expenses.

- Medical Emergency Insurance: Covers emergency medical expenses incurred during your trip.

It's important to note that the specific coverage and terms may vary depending on the type of Amex card you hold and the region you're traveling in. Always refer to your card's benefits guide or contact Amex's customer service for accurate and up-to-date information.

Filing an Amex Insurance Claim: Step-by-Step Guide

Now that we understand the coverage let’s explore the process of filing an Amex insurance claim.

Step 1: Gather the Necessary Information and Documentation

Before initiating the claim process, ensure you have the following information and documents ready:

- Your Amex card number and the date of the incident.

- Details of the incident, including dates, locations, and a description of what occurred.

- Receipts or proof of purchase for any non-refundable trip expenses or emergency medical treatments.

- Contact information of any involved parties, such as healthcare providers, rental car companies, or travel agencies.

- Any relevant police reports, medical records, or other official documents pertaining to the incident.

Organizing and having these details readily available will streamline the claim process and help you provide accurate information to Amex's insurance team.

Step 2: Contact Amex’s Insurance Department

The next step is to get in touch with Amex’s insurance department. You can typically find the contact information on the back of your Amex card or by visiting their website. Amex provides various methods to reach out, including:

- Phone: Call the dedicated phone number for insurance claims. Ensure you have your card details and the necessary documentation ready when you call.

- Online: Visit the Amex website and navigate to the insurance claims section. You may be able to initiate the claim process online and upload the required documents.

- Email: Send an email to the insurance claims team, providing all the necessary details and attachments.

When contacting Amex, be prepared to provide a detailed account of the incident and have your card details at hand. Their insurance team will guide you through the specific steps required for your claim.

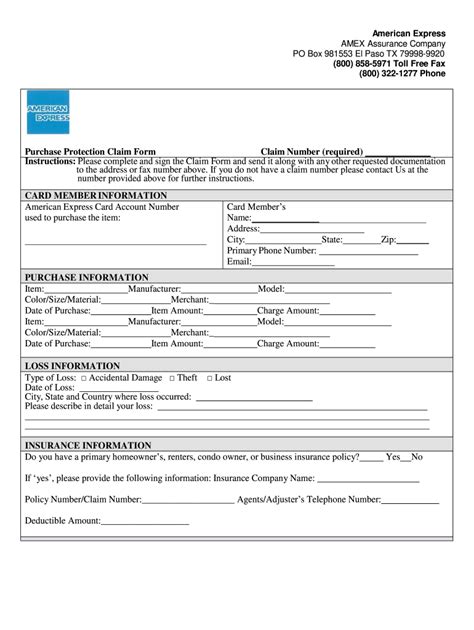

Step 3: Complete the Insurance Claim Form

Amex will provide you with an insurance claim form to fill out. This form will vary depending on the type of claim you’re making. Ensure you read the instructions carefully and provide accurate and complete information.

The claim form will typically require you to:

- Describe the incident in detail, including dates, locations, and any relevant circumstances.

- List the expenses incurred and provide supporting documentation, such as receipts or invoices.

- Include contact information for any involved parties and provide their statements if applicable.

- Attach any relevant official documents, such as police reports or medical records.

Once you've completed the form and gathered all the necessary attachments, you can submit it to Amex's insurance department through the preferred method they provide, whether by mail, email, or secure upload on their website.

Step 4: Await Claim Review and Decision

After submitting your claim, Amex’s insurance team will review your case. The review process can vary in duration, depending on the complexity of your claim and the volume of claims being processed.

During the review, Amex's team will assess your claim based on the coverage provided by your Amex card and the terms and conditions of the insurance plan. They may request additional information or documentation if needed to make an informed decision.

It's important to remain patient during this stage, as thorough reviews ensure fair and accurate claim settlements.

Step 5: Receive Claim Decision and Settlement

Once your claim has been reviewed, Amex will notify you of their decision. If your claim is approved, they will provide you with the settlement details, including the amount and the method of reimbursement.

Amex offers various reimbursement methods, such as direct deposit, check, or even a credit to your Amex card account. The chosen method will depend on your preference and the specifics of your claim.

If your claim is denied, Amex will provide a detailed explanation, citing the reasons for the decision. You may have the option to appeal the decision if you believe there was an error or if you can provide additional supporting evidence.

Tips for a Successful Amex Insurance Claim

To increase your chances of a successful claim, consider the following tips:

- Read the Fine Print: Familiarize yourself with the terms and conditions of your Amex insurance coverage. Understand the exclusions and limitations to ensure your claim falls within the eligible criteria.

- Act Promptly: File your claim as soon as possible after the incident. Amex may have specific time frames within which claims must be submitted.

- Provide Comprehensive Documentation: Ensure you have all the necessary documentation to support your claim. This includes receipts, invoices, and any official reports related to the incident.

- Be Detailed: When describing the incident, provide a clear and detailed account. Include all relevant information to help Amex’s team understand the circumstances accurately.

- Stay Organized: Keep track of all communications with Amex’s insurance team. Note down important dates, reference numbers, and any instructions provided.

By following these tips and staying proactive throughout the process, you can ensure a smoother and more successful Amex insurance claim experience.

Conclusion: Amex Insurance Claims Made Easy

Filing an Amex insurance claim doesn’t have to be a daunting task. By understanding the coverage provided by your Amex card and following the step-by-step guide outlined above, you can navigate the process with confidence.

Remember to gather all the necessary information and documentation, reach out to Amex's insurance team, and complete the claim form accurately. Stay patient during the review process, and don't hesitate to seek clarification if needed.

With Amex's comprehensive insurance plans and a well-prepared claim, you can rest assured that your travel-related incidents will be handled efficiently and fairly.

FAQ

How long does it typically take for Amex to review and decide on an insurance claim?

+The review process can vary depending on the complexity of the claim and the volume of claims being processed. Typically, Amex aims to provide a decision within 30 to 45 days from the date of submission. However, it’s best to stay in touch with their insurance team for regular updates.

Can I appeal an insurance claim decision made by Amex?

+Yes, if you believe there was an error in the decision or if you have additional evidence to support your claim, you can appeal the decision. Contact Amex’s insurance team to discuss the appeal process and provide any new information.

What happens if I lose my Amex card during a trip, and I need to file an insurance claim?

+In the event of a lost or stolen card, contact Amex immediately to report the incident and request a replacement card. They will provide you with the necessary steps to file an insurance claim for any eligible expenses incurred due to the loss.