Cheap Health Insurance With Dental

In today's world, having access to affordable health insurance that includes dental coverage is a priority for many individuals and families. With rising healthcare costs, finding a plan that offers comprehensive benefits at a reasonable price can be a challenging task. However, there are options available that provide quality coverage without breaking the bank. This article aims to guide you through the process of finding cheap health insurance with dental, offering insights and practical advice to help you make an informed decision.

Understanding the Importance of Dental Coverage

Dental health is an essential aspect of overall well-being. Poor oral hygiene can lead to various health issues, including gum disease, tooth decay, and even more serious complications such as cardiovascular problems. Regular dental check-ups and preventive care are crucial for maintaining good oral health. Therefore, having dental coverage as part of your health insurance plan is a wise investment.

Dental procedures can be expensive, especially if you require extensive treatments like root canals, dental implants, or orthodontics. Without insurance, these costs can quickly become unaffordable. By including dental coverage in your health insurance plan, you can access necessary dental care at a more manageable cost.

Exploring Affordable Health Insurance Options

When searching for cheap health insurance with dental, it’s important to understand that the term “cheap” is relative and depends on various factors, including your location, age, and the specific coverage you require. Here are some strategies to help you find an affordable plan:

Research Market Options

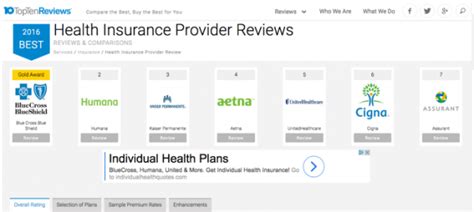

Start by researching the health insurance market in your area. Different providers offer a range of plans with varying levels of coverage and costs. Explore the options available from reputable insurers to get an idea of the prices and benefits on offer.

Look for providers that specialize in offering affordable health insurance packages. These companies often have more flexible plans and may provide discounts or promotions to attract new customers.

Compare Quotes

Obtain quotes from multiple insurers to compare the costs and coverage details. Pay attention to the dental benefits included in each plan. Some plans may have higher premiums but offer more comprehensive dental coverage, while others might have lower premiums with more limited benefits.

Consider using online comparison tools or seeking assistance from an insurance broker who can provide expert advice and help you navigate the complex world of health insurance.

Understand Your Needs

Before selecting a plan, assess your dental needs and those of your family members. If you or your loved ones have specific dental issues or require regular dental care, ensure the plan you choose covers these needs adequately.

Consider the frequency of dental check-ups, any potential upcoming procedures, and the cost of maintenance treatments like cleanings and X-rays. A plan that covers these essentials can save you significant out-of-pocket expenses.

Consider Discount Plans

In addition to traditional health insurance, discount plans can be a cost-effective alternative. These plans provide access to a network of dental providers who offer discounted rates on various services. While they may not provide the same level of coverage as insurance, they can be a viable option for those on a tight budget.

Discount plans often have lower monthly fees and can help you save on dental expenses, especially if you require frequent dental care.

Explore Government Programs

If you meet certain eligibility criteria, government-sponsored health insurance programs can be a great option for affordable coverage. Programs like Medicaid and the Children’s Health Insurance Program (CHIP) often include dental benefits and can provide comprehensive care at little to no cost.

Research the eligibility requirements and benefits offered by these programs to see if you or your family members qualify.

Maximizing Your Dental Benefits

Once you’ve found an affordable health insurance plan with dental coverage, it’s important to make the most of your benefits to ensure you receive the best possible care:

Choose In-Network Providers

Health insurance plans typically have a network of preferred providers. By choosing an in-network dentist, you can access lower rates and reduced out-of-pocket costs. Check your plan’s provider directory to find a dentist that suits your needs and is conveniently located.

Understand Your Coverage

Familiarize yourself with the specifics of your dental coverage. Know what procedures are covered, any annual limits or deductibles, and the copayment or coinsurance amounts you’ll be responsible for. This knowledge will help you budget for your dental expenses effectively.

Schedule Regular Check-Ups

Preventive care is often covered fully or at a reduced cost by health insurance plans. Take advantage of this by scheduling regular dental check-ups and cleanings. These appointments can help identify potential issues early on, preventing more complex and costly treatments down the line.

Utilize Preventive Services

Many health insurance plans offer additional preventive services such as fluoride treatments, dental sealants, and oral cancer screenings. These services can further enhance your oral health and reduce the risk of developing serious dental problems.

Ask About Discounts

Some dental providers offer discounts for patients who pay in full at the time of service or for those who have specific insurance plans. Don’t hesitate to inquire about any available discounts to reduce your out-of-pocket costs.

Future Implications and Considerations

When it comes to cheap health insurance with dental, it’s important to consider the long-term implications. While finding an affordable plan is a priority, ensuring that the plan meets your current and future needs is crucial.

Plan for Major Dental Procedures

If you anticipate needing major dental work in the future, such as braces or implants, ensure your plan covers these procedures or offers options to add such coverage for an additional fee. Planning ahead can save you from unexpected, high out-of-pocket costs.

Consider Age and Health Changes

As you age, your dental needs may change. Dental insurance plans often have age-based restrictions or premium increases. Ensure your plan accommodates any potential changes in your oral health or the oral health of your family members.

Stay Informed about Plan Updates

Health insurance plans can change over time. Keep yourself informed about any updates or changes to your plan’s benefits, including dental coverage. This way, you can make informed decisions about your dental care and budget accordingly.

| Plan Type | Average Monthly Premium | Dental Coverage |

|---|---|---|

| Traditional Health Insurance | $350 - $500 | Comprehensive, often includes preventive care and major procedures |

| Discount Plans | $10 - $50 | Offers discounts on dental services but may have limited coverage |

| Government Programs (e.g., Medicaid) | Varies, often little to no cost | Comprehensive coverage, including dental, for eligible individuals |

Can I add dental coverage to my existing health insurance plan?

+Yes, many health insurance providers offer the option to add dental coverage to your existing plan. Contact your insurer to inquire about adding dental benefits and understand the associated costs.

Are there any low-cost options for individual dental insurance?

+Yes, individual dental insurance plans are available, and some providers offer discounted rates for certain age groups or for those who pay annually. Research and compare plans to find the most affordable option for your needs.

What if I need specialized dental care, such as orthodontics?

+Specialized dental care like orthodontics is often covered by health insurance plans, but the extent of coverage can vary. Check your plan’s benefits and consider adding optional coverage if needed. Some plans may require a referral from a general dentist for specialized treatments.