Home Insurance Fee

Home insurance is a vital aspect of protecting one's financial security and ensuring peace of mind for homeowners. The fee associated with home insurance, often referred to as the premium, is a crucial component that determines the cost of coverage and the overall financial commitment required to safeguard your home and belongings. In this comprehensive guide, we will delve into the factors influencing home insurance fees, explore the key components of a premium, and provide valuable insights to help you navigate the world of home insurance with confidence.

Understanding the Home Insurance Fee Structure

The fee for home insurance, or the premium, is the amount you pay to an insurance company to secure coverage for your home and its contents. This fee is typically paid on a monthly, quarterly, or annual basis, depending on the policy and your preferences. The premium is calculated based on a variety of factors, each contributing to the overall cost of your home insurance.

Factors Influencing Home Insurance Fees

Several key factors come into play when determining the fee for home insurance. Understanding these factors can help you make informed decisions and potentially negotiate better rates. Here are some of the primary considerations:

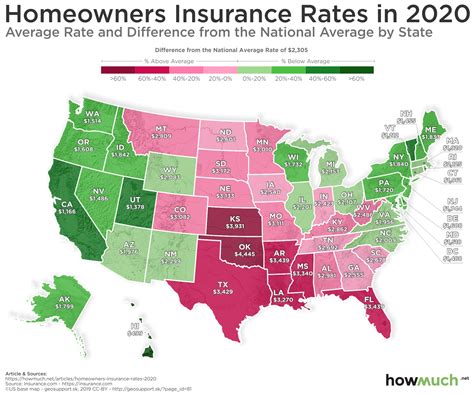

- Location and Risk Assessment: The geographical location of your home plays a significant role in determining the premium. Areas prone to natural disasters, such as hurricanes, floods, or earthquakes, tend to have higher insurance costs. Insurance companies assess the risk associated with your location and adjust the premium accordingly.

- Home Value and Coverage Amount: The value of your home and the coverage amount you require are directly linked to the premium. Higher-value homes and extensive coverage levels often result in increased insurance fees. It's essential to strike a balance between adequate coverage and affordability.

- Construction Type and Age: The construction materials and age of your home can impact the premium. Homes built with fire-resistant materials or those that adhere to modern safety standards may attract lower insurance costs. Older homes, especially those with outdated electrical or plumbing systems, may require higher premiums due to increased risk.

- Claim History and Credit Score: Your personal claim history with insurance companies can influence the fee. A history of frequent claims may lead to higher premiums or even policy cancellations. Additionally, your credit score can be a factor, as insurance companies often use it as an indicator of financial responsibility.

- Deductibles and Coverage Options: The deductible you choose can significantly impact your premium. A higher deductible typically results in a lower premium, as you agree to pay a larger portion of the claim out of pocket. Additionally, the coverage options you select, such as additional endorsements or riders, can affect the overall fee.

Breaking Down the Home Insurance Premium

To better understand the fee structure of home insurance, let's explore the various components that make up the premium:

- Base Premium: The base premium is the starting point for your home insurance policy. It covers the basic coverage for your home and its contents, including liability protection. This amount is determined by factors like the location, construction type, and the chosen coverage limits.

- Optional Coverages: Beyond the base premium, you have the option to customize your policy with additional coverages. These may include specific endorsements for valuable items like jewelry or art, coverage for natural disasters like floods or earthquakes, or even identity theft protection. Each additional coverage comes with an extra cost, added to the base premium.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before the insurance coverage kicks in. A higher deductible can result in a lower premium, as it reduces the insurer's potential payout. It's important to choose a deductible that aligns with your financial capabilities and risk tolerance.

- Policy Fees and Taxes: Along with the premium, you may encounter additional fees and taxes associated with your home insurance policy. These can include administrative fees, state taxes, or surcharges for specific coverage types. These fees are typically added to the premium amount and are subject to change based on local regulations.

| Component | Description |

|---|---|

| Base Premium | The starting cost for basic coverage |

| Optional Coverages | Additional endorsements or riders for specialized protection |

| Deductibles | The amount you pay before insurance coverage begins |

| Policy Fees and Taxes | Administrative fees, state taxes, and surcharges |

Optimizing Your Home Insurance Fee

Now that we've explored the factors and components that influence the home insurance fee, let's discuss some strategies to optimize your premium and potentially reduce costs:

Review and Shop Around

Regularly reviewing your home insurance policy and shopping around for better rates is essential. Insurance companies frequently update their rates and policies, so it's beneficial to stay informed and compare options. Consider using online tools or seeking assistance from insurance brokers to compare quotes from multiple providers.

Bundle and Save

Many insurance companies offer bundle discounts when you combine multiple policies, such as home and auto insurance. By insuring multiple aspects of your life with the same provider, you may qualify for significant savings. Bundle discounts can lower your overall insurance costs and provide added convenience.

Improve Your Home's Safety

Implementing safety measures in your home can reduce the risk of accidents and claims, leading to lower insurance fees. Consider installing smoke detectors, fire sprinklers, burglar alarms, or even smart home security systems. These improvements not only enhance your safety but can also make you eligible for discounts with certain insurance providers.

Raise Your Deductible

Increasing your deductible is a straightforward way to lower your premium. By opting for a higher deductible, you assume more financial responsibility in the event of a claim. While this strategy may not be suitable for everyone, it can result in substantial savings on your insurance fees.

Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance premium. Maintaining a good credit score can help you qualify for lower rates. Keep up with your financial obligations, pay bills on time, and monitor your credit report for accuracy to ensure a positive credit standing.

Explore Discounts and Promotions

Insurance companies often offer discounts and promotions to attract new customers or reward loyalty. These discounts can be based on various factors, such as occupation, membership in certain organizations, or even the installation of specific safety devices. Stay informed about available discounts and inquire about potential savings when renewing or purchasing a policy.

The Future of Home Insurance Fees

As technology advances and insurance companies adopt innovative approaches, the future of home insurance fees is likely to undergo significant changes. Here are some potential developments and implications for the industry:

Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes data from sensors and devices, is expected to play a more prominent role in home insurance. Usage-based insurance, where premiums are calculated based on actual usage and behavior, may become more prevalent. This approach could reward homeowners who take proactive measures to reduce risks, such as installing smart home devices or implementing energy-efficient practices.

Artificial Intelligence and Risk Assessment

Artificial Intelligence (AI) is transforming the insurance industry by enhancing risk assessment and claim management processes. AI algorithms can analyze vast amounts of data, including historical claim patterns, weather data, and property characteristics, to predict risks more accurately. This advanced risk assessment could lead to more precise premium calculations, benefiting both insurers and policyholders.

Personalized Insurance Products

The future of home insurance may see the development of highly personalized insurance products tailored to individual needs. Insurance companies could offer customizable coverage options, allowing homeowners to select specific endorsements and riders based on their unique circumstances and preferences. This level of customization could result in more efficient and cost-effective insurance solutions.

Incorporating Sustainability and Resilience

As sustainability and resilience become increasingly important, home insurance fees may reflect these values. Insurance companies may offer incentives and discounts for homeowners who adopt sustainable practices, such as installing renewable energy systems or implementing energy-efficient home upgrades. By encouraging sustainable behaviors, insurers can contribute to a greener future while also reducing risks associated with climate change.

Frequently Asked Questions

How often should I review my home insurance policy and fees?

+It is recommended to review your home insurance policy and fees annually, especially when renewing your policy. This allows you to stay updated on any changes in coverage, premiums, or available discounts. Additionally, major life events such as home renovations, purchasing valuable items, or relocating may warrant a policy review to ensure adequate coverage.

Can I negotiate my home insurance fees with the provider?

+While negotiating insurance fees may not always be possible, it's worth discussing with your insurance provider. Some companies may offer flexibility in pricing, especially if you have a long-standing relationship or a positive claim history. It's beneficial to inquire about potential discounts or adjustments to your policy to find the best fit for your needs.

What happens if I cannot afford the home insurance fees?

+If you're facing financial challenges and cannot afford the home insurance fees, it's important to communicate with your insurance provider. They may be able to offer payment plans, extended due dates, or suggest alternative coverage options that better fit your budget. It's crucial to maintain some form of insurance coverage to protect your home and assets.

Are there any government programs or assistance for home insurance fees?

+In certain regions or for specific circumstances, government programs or grants may be available to assist with home insurance fees. These programs often target low-income households or areas prone to natural disasters. It's advisable to research and contact local government agencies or non-profit organizations to explore potential assistance options.

How do I choose the right home insurance coverage and fees for my needs?

+Choosing the right home insurance coverage involves assessing your specific needs and evaluating the available options. Consider factors such as the value of your home, the contents you want to protect, and any unique circumstances like living in a high-risk area. Compare quotes from multiple providers, read policy details carefully, and seek advice from insurance professionals to ensure you select a policy that offers adequate coverage at a reasonable fee.

In conclusion, understanding the fee structure of home insurance is essential for making informed decisions and securing the best coverage for your home. By considering the factors that influence premiums and optimizing your policy through various strategies, you can navigate the world of home insurance with confidence. Stay informed, review your options regularly, and leverage the power of technology and sustainability to shape a brighter future for home insurance fees.