Home Insurance Estimate

Home insurance is an essential aspect of protecting your most valuable asset. As a homeowner, you want to ensure that you have adequate coverage to safeguard your property and belongings from various risks. Obtaining a home insurance estimate is the first step towards securing the right insurance plan tailored to your specific needs. This article will delve into the factors that influence home insurance estimates, providing you with a comprehensive understanding of the process and the key considerations to make an informed decision.

Understanding the Basics of Home Insurance Estimates

Home insurance estimates are a crucial part of the insurance journey, as they provide an initial assessment of the coverage and costs involved in insuring your home. These estimates are influenced by several factors, each playing a significant role in determining the overall cost and scope of your insurance policy.

The primary purpose of home insurance is to provide financial protection against potential losses and damages that may occur to your home and its contents. These losses can arise from a variety of events, including natural disasters, accidents, theft, or even liability claims. By obtaining an estimate, you gain insight into the coverage options available to you and can make informed choices to ensure your home is adequately protected.

Key Factors Influencing Home Insurance Estimates

When requesting a home insurance estimate, insurance providers take into account several critical factors to assess the risk associated with insuring your property. These factors contribute to the overall cost and coverage of your policy. Here are some of the key considerations that influence home insurance estimates:

- Location and Geographical Factors: The geographical location of your home plays a significant role in determining insurance estimates. Areas prone to natural disasters such as hurricanes, earthquakes, or floods may have higher insurance costs due to the increased risk of damage. Additionally, factors like crime rates and the proximity to fire stations or hydrants can also impact the estimate.

- Age and Condition of the Home: The age and condition of your home are crucial considerations. Older homes may require more extensive coverage due to potential structural issues or outdated systems. Insurance providers may offer discounts for homes that have been well-maintained and updated with modern safety features.

- Construction Materials and Design: The materials used in constructing your home and its design can impact insurance estimates. Homes built with fire-resistant materials or featuring storm-proof designs may qualify for lower insurance rates. Conversely, homes with certain architectural features or construction materials that are more susceptible to damage may have higher insurance costs.

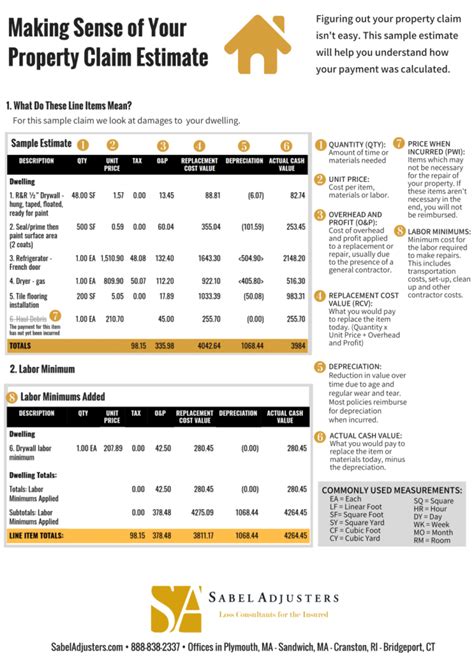

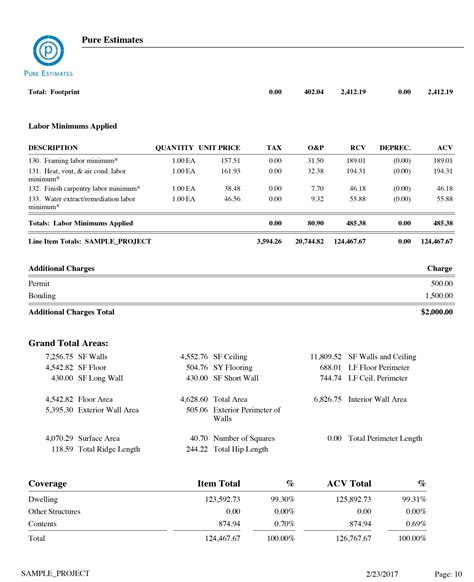

- Replacement Cost: The replacement cost of your home is a critical factor in determining insurance estimates. This refers to the cost of rebuilding your home and replacing its contents in the event of a total loss. Insurance providers will assess the value of your home and its contents to determine the appropriate coverage limits.

- Coverage Options and Deductibles: The coverage options you choose and the deductibles you select will impact your insurance estimate. Comprehensive coverage options, such as additional living expenses or personal liability coverage, may increase your premium. Additionally, opting for higher deductibles can reduce your premium but requires you to pay a larger portion out of pocket in the event of a claim.

- Claim History: Your personal claim history and the claim history of the property itself can influence insurance estimates. A history of frequent claims may result in higher premiums or even difficulty in securing insurance coverage. Insurance providers consider the risk associated with insuring a property with a history of frequent claims.

- Discounts and Bundling Options: Insurance providers often offer discounts to encourage certain behaviors or to reward loyal customers. Discounts may be available for factors such as having a security system installed, being claim-free for a certain period, or bundling multiple insurance policies (e.g., home and auto insurance) with the same provider.

Obtaining an Accurate Home Insurance Estimate

To obtain an accurate home insurance estimate, it is essential to provide comprehensive and truthful information to your insurance provider. Here are some steps to ensure you receive an estimate tailored to your specific needs:

Prepare the Necessary Information

Before requesting an estimate, gather all relevant information about your home. This includes details such as the square footage, the year it was built, any recent renovations or upgrades, and the value of your personal belongings. Additionally, have your current insurance policy (if you have one) readily available to compare coverage and premiums.

Contact Multiple Insurance Providers

To get a well-rounded view of the insurance market, it is advisable to contact multiple insurance providers. This allows you to compare quotes and coverage options from different companies. Each provider may have different risk assessment criteria, so obtaining multiple estimates can help you find the best fit for your needs.

Discuss Coverage Options

When speaking with insurance providers, take the opportunity to discuss the various coverage options available. Understand the differences between replacement cost coverage and actual cash value coverage. Consider the additional benefits offered by comprehensive coverage options, such as personal liability protection or coverage for specific high-value items.

Review Policy Exclusions and Limitations

While reviewing the insurance estimates, pay close attention to the policy exclusions and limitations. Certain events or damages may not be covered by standard home insurance policies. For example, some policies may exclude coverage for flood damage or require additional coverage for specific natural disasters. Ensure that you are aware of any limitations to avoid any surprises in the event of a claim.

Understand Deductibles and Premium Costs

Deductibles and premium costs are crucial aspects of home insurance estimates. Deductibles represent the amount you will need to pay out of pocket before your insurance coverage kicks in. Higher deductibles can lower your premium, but it is important to choose a deductible amount that you can afford in the event of a claim. Review the premium costs for each estimate and consider the overall value and coverage provided by each policy.

The Importance of Regular Policy Reviews

Home insurance estimates are not set in stone, and it is essential to regularly review and update your insurance policy. As your circumstances and the value of your home change, so should your insurance coverage. Here’s why regular policy reviews are crucial:

- Changing Circumstances: Life events such as renovations, additions to your home, or changes in personal belongings can impact your insurance needs. Regular policy reviews ensure that your coverage remains up-to-date and aligns with your current situation.

- Market Fluctuations: The insurance market is dynamic, and rates can fluctuate over time. By reviewing your policy periodically, you can take advantage of any potential discounts or promotional offers that may become available.

- Coverage Adjustments: As you gain a better understanding of your insurance needs, you may realize that certain coverage options are more relevant to your situation. Regular reviews allow you to make adjustments to your policy, ensuring you have the right level of protection.

- Claim History: If you have made a claim in the past, it is important to review your policy to understand any changes in coverage or premium costs. Claims can impact your insurance rates, and regular reviews help you stay informed about any adjustments.

Maximizing Value with Home Insurance

While home insurance estimates provide a starting point for understanding coverage and costs, it is important to consider ways to maximize the value of your insurance policy. Here are some strategies to get the most out of your home insurance:

Explore Discounts and Bundling Options

Insurance providers often offer a variety of discounts to encourage certain behaviors or to reward loyal customers. Some common discounts include multi-policy discounts (bundling home and auto insurance), safety discounts for having security systems or fire-resistant features, and loyalty discounts for long-term customers. By exploring these options, you can potentially reduce your insurance costs.

Consider Umbrella Policies

If you have significant assets or face a higher risk of liability claims, consider an umbrella policy. An umbrella policy provides additional liability coverage beyond your standard home insurance policy. It offers protection for situations where your regular policy’s liability limits may be exceeded. This extra layer of protection can provide peace of mind and ensure you are adequately covered in the event of a major liability claim.

Review Deductibles and Coverage Limits

Regularly reviewing your deductibles and coverage limits is crucial to ensuring you have the right balance of protection and affordability. Higher deductibles can lower your premium, but it is important to choose a deductible amount that you can comfortably afford in the event of a claim. Additionally, review your coverage limits to ensure they align with the current value of your home and belongings. As the value of your property increases, you may need to adjust your coverage limits to maintain adequate protection.

Utilize Preventative Measures

Taking proactive measures to prevent potential risks can not only reduce the likelihood of claims but also potentially lower your insurance costs. Install security systems, maintain your home’s safety features, and implement measures to mitigate the risk of natural disasters. Insurance providers often offer discounts for homes with enhanced safety features, so investing in preventative measures can pay off in the long run.

Stay Informed and Educated

Home insurance can be complex, and staying informed about your policy and coverage options is essential. Read your policy documents thoroughly and understand the exclusions and limitations. Keep up-to-date with industry news and changes in insurance regulations that may impact your coverage. Educating yourself empowers you to make informed decisions and ensures you are maximizing the value of your home insurance.

| Insurance Provider | Estimated Annual Premium | Coverage Highlights |

|---|---|---|

| Provider A | $1,200 | Replacement cost coverage, optional flood insurance, and 24/7 customer support. |

| Provider B | $1,350 | Actual cash value coverage, comprehensive coverage options, and flexible payment plans. |

| Provider C | $1,100 | Replacement cost coverage, discounts for security systems, and additional living expenses coverage. |

These estimates provide a glimpse into the range of insurance options available. It is important to note that actual premiums may vary based on individual circumstances and the specific coverage chosen.

FAQ

How often should I review my home insurance policy?

+

It is recommended to review your home insurance policy annually or whenever significant changes occur in your life or home circumstances. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

Can I negotiate my home insurance premium?

+

While insurance premiums are primarily based on risk assessment, you can negotiate with your insurance provider by discussing your specific circumstances and any potential discounts or adjustments that may apply to your policy.

What factors can lead to an increase in my home insurance premium?

+

Factors such as a history of frequent claims, changes in your home’s value or construction, or an increase in local crime rates can lead to an increase in your home insurance premium. It’s important to stay informed about these factors and discuss them with your insurance provider.