Home Insurance Coverage

Securing adequate home insurance coverage is a crucial aspect of protecting one's biggest investment and ensuring peace of mind. With the diverse range of insurance options available, it's essential to understand the nuances of coverage to make informed decisions. This comprehensive guide aims to delve into the world of home insurance, exploring the different types of coverage, the factors that influence policy costs, and the key considerations for homeowners to make sure their assets are adequately protected.

Understanding Home Insurance Coverage

Home insurance, also known as homeowners insurance, is a policy that provides financial protection for homeowners against damages or losses to their property and its contents. It offers coverage for a wide range of scenarios, including natural disasters, theft, and accidental damage. Understanding the various types of coverage available is the first step in ensuring your home and belongings are adequately insured.

Types of Home Insurance Coverage

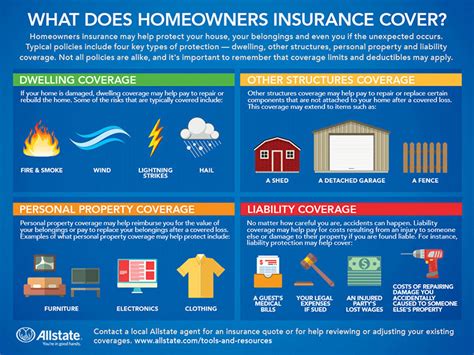

Home insurance policies can vary significantly in terms of the types of coverage they offer. Here’s an overview of the most common types of home insurance coverage:

- Dwelling Coverage: This is the cornerstone of any home insurance policy, providing coverage for the physical structure of your home. It protects against damages caused by events such as fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This coverage protects the contents of your home, including furniture, electronics, clothing, and other personal belongings. It ensures that if these items are damaged or stolen, you’ll receive compensation to replace them.

- Liability Coverage: Liability insurance is a vital aspect of home insurance, as it provides protection in the event that someone is injured on your property or you are found legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses (ALE): In the event that your home becomes uninhabitable due to a covered loss, this coverage reimburses you for the additional costs incurred while you temporarily reside elsewhere.

- Medical Payments Coverage: This coverage provides financial assistance for medical expenses incurred by guests who are injured on your property, regardless of fault.

- Endorsements and Riders: These are add-ons to your policy that provide coverage for specific items or situations. For instance, you can purchase a rider for high-value items like jewelry or artwork, ensuring they are adequately insured.

Factors Influencing Home Insurance Costs

The cost of home insurance policies can vary significantly based on several factors. Understanding these influences can help homeowners make more informed decisions when selecting a policy.

- Location: The geographic location of your home plays a significant role in determining insurance costs. Areas prone to natural disasters like hurricanes, earthquakes, or floods will generally have higher insurance premiums.

- Home Value and Size: The value and size of your home are key factors in calculating insurance premiums. Larger homes with more expensive materials and features will typically require higher coverage limits, leading to increased costs.

- Construction Type: The construction type and materials used in your home can impact insurance rates. Homes built with fire-resistant materials or reinforced against natural disasters may qualify for lower premiums.

- Age of the Home: Older homes may have outdated electrical systems or plumbing, which can increase the risk of accidents and lead to higher insurance costs. However, some older homes may benefit from historical preservation discounts.

- Claims History: Insurers take into account your past claims history when setting rates. Frequent claims can lead to higher premiums or even policy cancellation, so it’s essential to only file claims for significant losses.

- Security Features: Homes equipped with advanced security systems, fire alarms, and sprinkler systems may qualify for discounts on insurance policies as these features reduce the risk of losses.

- Deductibles: Choosing a higher deductible can lower your insurance premiums, but it’s important to ensure the deductible is an amount you can afford to pay out of pocket in the event of a claim.

Key Considerations for Homeowners

When it comes to selecting the right home insurance coverage, there are several critical factors homeowners should keep in mind:

- Adequate Coverage Limits: Ensure that your policy provides sufficient coverage limits for your home and its contents. Review your policy regularly, especially after significant home improvements or purchases of high-value items.

- Policy Exclusions: Carefully review the exclusions listed in your policy. Some common exclusions include damage caused by floods, earthquakes, and poor maintenance. Consider purchasing additional coverage if these risks are present in your area.

- Deductibles and Payment Options: Evaluate the deductible amount that best fits your financial situation. Additionally, consider the payment options offered by insurers, as some may provide discounts for paying annually or semi-annually.

- Bundling Discounts: Bundling your home insurance with other policies, such as auto insurance, can often result in significant savings. Many insurers offer multi-policy discounts, so it’s worth exploring these options.

- Discounts and Special Programs: Look for insurers that offer discounts for factors like being claims-free, having certain safety features, or being a member of specific organizations. Some insurers also provide special programs for senior citizens or veterans.

Performance Analysis and Future Implications

The performance of home insurance policies can vary based on the insurer and the specific coverage chosen. When selecting a policy, it’s crucial to consider the insurer’s financial stability and claims handling reputation. Independent rating agencies like AM Best and Standard & Poor’s provide financial strength ratings for insurance companies, which can be a valuable indicator of an insurer’s ability to pay claims.

Furthermore, as the landscape of natural disasters and technological advancements evolves, the future of home insurance coverage is likely to adapt. Insurers are increasingly incorporating technology into their policies, offering smart home discounts and utilizing AI-powered risk assessment tools. Additionally, the rise of climate change-related disasters has prompted insurers to reevaluate their coverage and pricing strategies, potentially leading to higher premiums for homeowners in high-risk areas.

| Home Insurance Carrier | AM Best Rating |

|---|---|

| State Farm | A++ (Superior) |

| Allstate | A+ (Superior) |

| Liberty Mutual | A (Excellent) |

| Chubb | A++ (Superior) |

| Progressive | A- (Excellent) |

How often should I review my home insurance policy?

+It’s recommended to review your policy annually, especially after significant life events or home improvements. Regular reviews ensure your coverage remains adequate and up-to-date.

What should I do if I have a claim?

+If you experience a covered loss, contact your insurer immediately to report the claim. Provide detailed information and be prepared to work with the insurer’s claims adjusters to navigate the claims process.

Are there any ways to lower my home insurance premiums?

+Yes, there are several strategies to reduce premiums. These include increasing your deductible, bundling policies, installing security systems, and maintaining a claims-free record. Additionally, shopping around and comparing quotes can help you find the best rates.