Auto And Motorcycle Insurance

Auto and motorcycle insurance are essential components of vehicle ownership, providing financial protection and peace of mind for drivers and riders. With a wide range of coverage options and varying state regulations, understanding the intricacies of these insurance policies is crucial for making informed decisions. This comprehensive guide aims to explore the world of auto and motorcycle insurance, delving into the types of coverage, key considerations, and strategies to secure the best protection for your vehicle and yourself.

Understanding Auto Insurance

Auto insurance is a contract between you and the insurance company, designed to protect you against financial loss in the event of an accident, theft, or other vehicle-related incidents. It’s a legal requirement in most states, ensuring that all drivers on the road have some level of financial responsibility.

Key Components of Auto Insurance

Auto insurance policies typically consist of several key components, each offering different types of coverage:

- Liability Coverage: This is the most basic form of auto insurance, covering damages you cause to others’ property or injuries you cause to others. It’s divided into bodily injury liability and property damage liability.

- Comprehensive Coverage: Also known as “other than collision” coverage, this protects against damage caused by events other than collisions, such as fire, theft, vandalism, or natural disasters.

- Collision Coverage: This type of insurance covers the cost of repairing or replacing your vehicle after an accident, regardless of fault.

- Personal Injury Protection (PIP): PIP, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages.

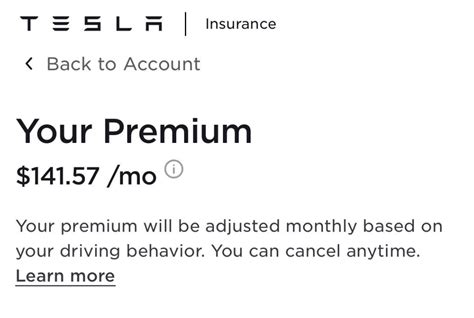

Factors Affecting Auto Insurance Rates

The cost of your auto insurance policy can vary significantly based on several factors, including:

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how often and for what purpose you drive, can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums.

- Driver’s Profile: Your age, gender, driving record, and years of driving experience play a significant role. Younger and less experienced drivers often pay higher premiums.

- Location: The area where you live and park your vehicle can influence rates due to factors like crime rates, traffic density, and the likelihood of natural disasters.

- Insurance Company and Policy: Different insurance companies offer varying rates and coverage options. The specific policy you choose, including deductibles and coverage limits, will also affect the cost.

| Factor | Impact on Rates |

|---|---|

| Vehicle Type | Varies widely; sports cars and luxury vehicles often cost more to insure. |

| Driver's Age | Younger drivers (under 25) and senior drivers (over 65) often pay higher premiums. |

| Driving Record | Clean records lead to lower rates; violations and accidents increase premiums. |

| Location | Urban areas and regions with high crime rates or natural disaster risks may have higher rates. |

| Insurance Company | Shop around for the best rates; different companies offer varying coverage and prices. |

Motorcycle Insurance: A Rider’s Perspective

Motorcycle insurance shares similarities with auto insurance but also has unique considerations due to the nature of riding. While not all states require motorcycle insurance, it’s a wise investment to protect yourself and your bike.

Coverage Options for Motorcyclists

Motorcycle insurance policies often offer the following types of coverage:

- Liability Coverage: Similar to auto insurance, this covers damages and injuries you cause to others.

- Comprehensive Coverage: Protects against damage from non-collision incidents, like theft or natural disasters.

- Collision Coverage: Covers repairs or replacement of your motorcycle after an accident.

- Medical Payments Coverage: Provides coverage for medical expenses incurred by you or your passengers in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if involved in an accident with an uninsured or underinsured rider.

- Accessories and Custom Parts Coverage: Covers the cost of repairs or replacement for any custom parts or accessories added to your bike.

Factors Affecting Motorcycle Insurance Rates

The cost of motorcycle insurance can be influenced by:

- Bike Type and Usage: The make, model, and purpose of your motorcycle (e.g., commuting, racing, touring) can impact rates. High-performance bikes often cost more to insure.

- Riding Experience: Your years of riding experience and any training certifications can affect premiums. New riders may pay higher rates.

- Safety Equipment: Using approved safety gear, such as helmets and protective clothing, can sometimes lead to discounts.

- Location : Similar to auto insurance, the area you ride in can influence rates.

| Factor | Impact on Rates |

|---|---|

| Bike Type | High-performance and custom bikes often have higher premiums. |

| Riding Experience | Inexperienced riders may face higher rates; safety courses can sometimes reduce premiums. |

| Safety Equipment | Using approved safety gear can lead to discounts on your policy. |

| Location | Urban areas and regions with high theft rates may have higher insurance costs. |

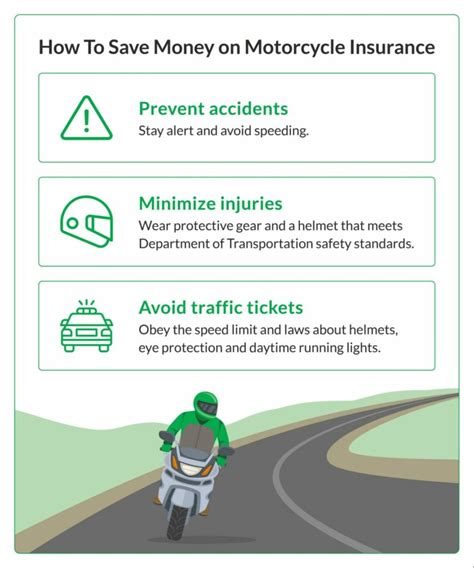

Strategies for Cost-Effective Coverage

Securing comprehensive insurance coverage doesn’t have to break the bank. Here are some strategies to help you find the best rates:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates and coverage options for your needs.

- Understand Your Needs: Assess your specific risks and coverage requirements. You may not need every type of coverage offered.

- Adjust Your Deductibles: Higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expense if needed.

- Safe Driving Practices: Maintain a clean driving record and practice defensive driving to avoid accidents and keep your premiums low.

- Bundle Policies: Insuring multiple vehicles or bundling auto and home insurance can often lead to significant savings.

- Review Annually: Regularly review your policy and shop around to ensure you’re still getting the best rates and coverage.

Conclusion: Navigating Auto and Motorcycle Insurance

Understanding the complexities of auto and motorcycle insurance is crucial for making informed decisions about your coverage. By familiarizing yourself with the different types of coverage, factors affecting rates, and cost-saving strategies, you can navigate the insurance landscape with confidence. Remember, the right insurance policy provides not only financial protection but also peace of mind, ensuring you’re prepared for whatever the road may bring.

What is the difference between comprehensive and collision coverage in auto insurance?

+Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters, while collision coverage specifically covers damage to your vehicle from an accident, regardless of fault.

Do I need motorcycle insurance if it’s not legally required in my state?

+While it may not be legally required, motorcycle insurance is highly recommended to protect yourself financially in the event of an accident or theft. It’s a wise investment for peace of mind.

How can I lower my auto insurance premiums if I have a young driver in my household?

+Consider adding your young driver to your existing policy, which may offer better rates than if they were to get their own policy. Additionally, maintaining a clean driving record and enrolling in approved driving courses can help lower premiums over time.