Employee Benefits Insurance

Employee benefits insurance, also known as group insurance, is a vital component of any comprehensive employee benefits package. It provides a safety net for employees and their families, offering financial protection and support during challenging times. With the rising costs of healthcare and the increasing importance of work-life balance, offering robust employee benefits has become a strategic advantage for organizations. This article delves into the world of employee benefits insurance, exploring its significance, key components, and the impact it has on both employees and employers.

Understanding Employee Benefits Insurance

Employee benefits insurance is a collective term for various insurance policies that are offered to employees as part of their employment package. These policies are designed to mitigate financial risks associated with healthcare, disability, retirement, and other life events. By providing insurance coverage, employers demonstrate their commitment to employee well-being and offer a valuable tool to attract and retain talented individuals.

The concept of employee benefits insurance has evolved significantly over the years. Initially, it was primarily focused on providing basic healthcare coverage. However, modern employee benefits packages have expanded to include a wide range of insurance options, addressing diverse needs and life stages. This evolution reflects the changing dynamics of the workforce and the growing recognition of the importance of comprehensive employee support.

Key Components of Employee Benefits Insurance

Health Insurance

Health insurance is often the cornerstone of employee benefits packages. It provides coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and specialized treatments. The specific coverage and benefits vary depending on the plan chosen by the employer, but they generally aim to cover a significant portion of healthcare costs.

Health insurance plans can be tailored to meet the needs of different employee demographics. For instance, younger employees may prioritize plans with lower premiums and higher deductibles, while older employees might prefer plans with richer benefits and lower out-of-pocket expenses. Offering a range of health insurance options ensures that employees can choose a plan that aligns with their personal healthcare needs and financial situation.

| Health Insurance Type | Description |

|---|---|

| HMO (Health Maintenance Organization) | A cost-effective plan with a network of healthcare providers. Requires referrals for specialist care. |

| PPO (Preferred Provider Organization) | Offers more flexibility with a broader network, but may have higher premiums. |

| POS (Point of Service) | Combines features of HMO and PPO, allowing for choice between in-network and out-of-network providers. |

Disability Insurance

Disability insurance provides financial protection to employees who become unable to work due to illness or injury. It ensures that they can continue to receive a portion of their income during their recovery period. This coverage is particularly crucial as it helps employees maintain their financial stability and focus on their health without the added stress of financial worries.

There are two primary types of disability insurance: short-term and long-term. Short-term disability insurance typically covers a period of a few months, providing partial income replacement for temporary disabilities. Long-term disability insurance, on the other hand, covers more extended periods, often lasting several years, and is designed for severe and long-lasting disabilities.

| Disability Insurance Type | Description |

|---|---|

| Short-Term Disability (STD) | Covers temporary disabilities, typically for a period of a few months. |

| Long-Term Disability (LTD) | Provides income replacement for extended periods, often lasting several years. |

Life Insurance

Life insurance is a critical component of employee benefits, providing financial security to employees’ families in the event of their untimely death. It offers a lump-sum payment to the beneficiary, which can be used to cover funeral expenses, outstanding debts, or provide ongoing financial support.

Employers typically offer basic life insurance coverage as part of their benefits package, with the option for employees to purchase additional coverage if desired. This flexibility allows employees to tailor their life insurance to their specific needs and the needs of their loved ones.

| Life Insurance Type | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, often 10-30 years. It is a cost-effective option for employees with specific financial goals. |

| Whole Life Insurance | Provides lifetime coverage with a fixed premium. It includes a cash value component that grows over time, offering additional financial benefits. |

Retirement Plans

Employee benefits insurance packages often include retirement plans, which are long-term savings and investment vehicles designed to secure employees’ financial future. These plans encourage employees to save for their retirement by offering tax advantages and, in some cases, employer contributions.

Common retirement plans include 401(k)s, defined benefit plans, and individual retirement accounts (IRAs). Each plan has its own set of rules and benefits, allowing employees to choose the plan that best suits their financial goals and risk tolerance.

| Retirement Plan Type | Description |

|---|---|

| 401(k) | A popular plan where employees contribute pre-tax dollars, often with employer matching contributions. Offers investment options. |

| Defined Benefit Plan | Provides a guaranteed benefit upon retirement, based on factors like years of service and salary. Managed by the employer. |

| IRA (Individual Retirement Account) | A tax-advantaged savings account where individuals can contribute annually. Offers flexibility and various investment options. |

The Impact of Employee Benefits Insurance

Employee Well-being and Satisfaction

Offering a comprehensive employee benefits insurance package has a significant positive impact on employee well-being and satisfaction. It demonstrates the organization’s commitment to its workforce and provides peace of mind, knowing that they and their families are protected during difficult times.

Health insurance, for instance, reduces the financial burden of medical expenses, allowing employees to focus on their health without worrying about the cost. Disability insurance ensures that employees can maintain their financial stability during periods of illness or injury, reducing stress and promoting a quicker recovery. Life insurance provides financial security for families, offering comfort and support during a time of grief.

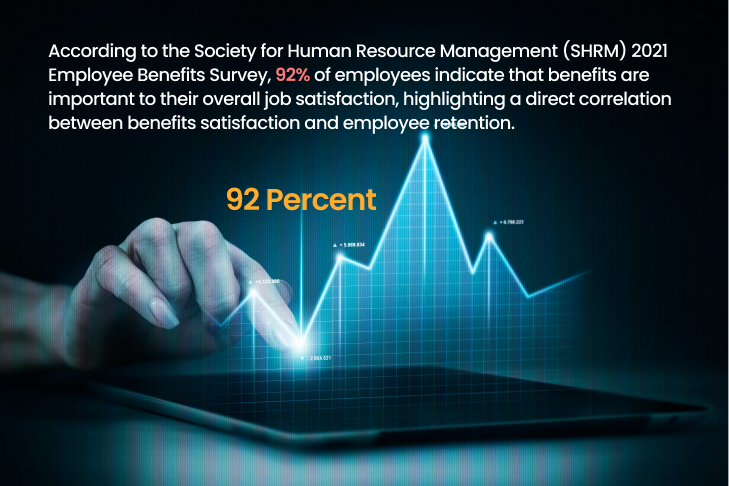

Attracting and Retaining Top Talent

In today’s competitive job market, employee benefits insurance has become a critical tool for attracting and retaining talented employees. Job seekers often prioritize organizations that offer robust benefits packages, as they recognize the value of comprehensive insurance coverage.

By providing a range of insurance options, employers can cater to the diverse needs of their workforce. This flexibility ensures that employees feel valued and understood, leading to increased job satisfaction and loyalty. Additionally, offering competitive benefits can help organizations stand out in the market, attracting top talent and reducing employee turnover.

Productivity and Performance

Employee benefits insurance not only supports employees’ well-being but also has a direct impact on their productivity and performance. When employees have access to comprehensive insurance coverage, they are more likely to focus on their work and less on financial worries.

Health insurance, for example, encourages employees to prioritize their health, leading to fewer sick days and higher productivity. Disability insurance ensures that employees can take the necessary time off to recover without the fear of financial hardship. Retirement plans motivate employees to plan for their future, fostering a culture of long-term thinking and commitment to the organization.

Legal and Regulatory Compliance

Offering employee benefits insurance is not only a strategic advantage but also a legal and regulatory requirement in many regions. Governments often mandate certain types of insurance coverage, such as workers’ compensation, to protect employees’ rights and ensure their financial security.

By providing a comprehensive benefits package, employers demonstrate their compliance with these regulations and avoid potential legal issues. It also fosters a positive relationship with employees, as they feel their rights and well-being are being respected and protected.

Conclusion

Employee benefits insurance is a cornerstone of modern employment, offering a wide range of advantages to both employees and employers. From health and disability insurance to life insurance and retirement plans, these benefits provide financial security and peace of mind to employees, ultimately enhancing their well-being and job satisfaction.

For employers, investing in employee benefits insurance is a strategic move. It helps attract and retain top talent, boosts productivity, and ensures compliance with legal and regulatory requirements. In today's competitive business landscape, offering a robust employee benefits package is not just a nice-to-have but a necessity for organizations aiming to thrive and sustain their success.

What are the key benefits of offering employee benefits insurance?

+Offering employee benefits insurance provides several advantages, including improved employee well-being, increased job satisfaction, and higher retention rates. It also helps attract top talent and ensures legal and regulatory compliance.

How do employee benefits insurance plans vary between companies?

+Employee benefits insurance plans can vary widely between companies. Factors such as industry, company size, and location play a role in determining the specific insurance offerings. Some companies may prioritize health insurance, while others may focus on retirement plans or disability coverage.

What are the potential challenges in implementing employee benefits insurance programs?

+Implementing employee benefits insurance programs can present challenges, including the cost of premiums, the complexity of plan administration, and ensuring compliance with ever-changing regulations. However, with proper planning and expert guidance, these challenges can be effectively managed.