Rx Insurance

Rx Insurance, also known as prescription drug insurance, is an essential component of healthcare coverage, ensuring individuals have access to necessary medications without facing financial burden. In today's healthcare landscape, understanding the intricacies of prescription drug plans is crucial for making informed decisions about one's health and finances. This comprehensive guide aims to unravel the complexities of Rx Insurance, offering a detailed analysis of its workings, benefits, and potential pitfalls.

The Foundation of Rx Insurance

Rx Insurance forms a vital part of many health insurance plans, offering coverage for prescription medications. These plans can be standalone or integrated into broader medical insurance policies, providing a safety net for individuals who require regular or occasional use of prescription drugs.

The foundation of Rx Insurance lies in the understanding that prescription medications are a significant expense, often necessary for managing chronic conditions, recovering from illnesses, or maintaining overall health. Without insurance coverage, the cost of these medications can be prohibitive, leading to potential health complications and financial strain.

Here's a breakdown of how Rx Insurance typically functions:

- Prescription Coverage: Rx Insurance covers a wide range of prescription drugs, from common over-the-counter medications to specialized drugs for rare conditions. The level of coverage depends on the specific plan and the tier or category the drug falls into.

- Drug Tiers: Prescription drugs are often categorized into tiers, with each tier representing a different level of cost-sharing between the insurance provider and the patient. Typically, tier 1 includes generic drugs, which are the most affordable and have the lowest out-of-pocket costs. Tier 2 and 3 drugs are brand-name medications with varying levels of cost-sharing, while tier 4 might include specialty drugs with the highest out-of-pocket costs.

- Cost-Sharing: Patients typically pay a portion of the drug cost through copayments or coinsurance. A copayment is a fixed amount, e.g., $10 per prescription, while coinsurance is a percentage of the drug's cost, such as 20% of the total price. The patient's share can vary based on the drug's tier and the specific insurance plan.

- Prescription Deductibles: Similar to medical insurance, Rx Insurance may have a deductible. This means the patient pays a certain amount out of pocket before the insurance coverage kicks in. Deductibles can vary by plan and may be separate from the medical insurance deductible.

- Formulary Lists: Insurance providers maintain a list of covered drugs, known as a formulary. This list can change periodically, and it's essential for patients to understand which drugs are covered and at what level to avoid unexpected costs.

- Prior Authorization: Some medications, especially specialty drugs, may require prior authorization from the insurance company before they can be prescribed. This process ensures that the medication is medically necessary and cost-effective.

Benefits of Rx Insurance

The advantages of Rx Insurance are multifaceted and can significantly impact an individual’s health and financial well-being.

Access to Essential Medications

The primary benefit of Rx Insurance is providing access to essential medications that might otherwise be financially out of reach. For individuals with chronic conditions, such as diabetes, heart disease, or mental health disorders, prescription medications are often a necessity for managing their health.

For example, a person with type 2 diabetes may require insulin and other medications to regulate their blood sugar levels. Without insurance coverage, the cost of these medications could exceed $1,000 per month, a burden that many cannot afford. Rx Insurance ensures that individuals can obtain these vital medications without compromising their financial stability.

Financial Protection

Rx Insurance offers a layer of financial protection against the high cost of prescription drugs. Even with cost-sharing, the insurance coverage reduces the out-of-pocket expenses for patients. This protection is especially crucial for individuals who require long-term medication or those who face unexpected health issues.

Consider a patient undergoing cancer treatment. The cost of chemotherapy drugs can be astronomical, often reaching tens of thousands of dollars. With Rx Insurance, the patient's out-of-pocket costs are significantly reduced, making treatment more accessible and manageable.

Peace of Mind

Knowing that prescription medications are covered provides peace of mind for both patients and their families. It eliminates the stress and anxiety associated with worrying about the affordability of necessary medications. This psychological benefit is often overlooked but is a significant aspect of overall well-being.

Navigating the Complexities of Rx Insurance

While Rx Insurance offers numerous benefits, it is not without its complexities and potential challenges. Understanding these intricacies is essential for making the most of your prescription drug coverage.

Understanding Formulary Changes

Insurance providers regularly update their formularies, which can lead to changes in drug coverage. It’s important to stay informed about these changes, especially if you’re taking a specific medication long-term. Sudden formulary updates can result in your medication being moved to a higher tier, increasing your out-of-pocket costs.

For instance, if your insurance company decides to move a popular brand-name antidepressant from tier 2 to tier 3, your copayment or coinsurance for that medication might increase significantly. Staying informed about these changes can help you plan and potentially discuss alternatives with your healthcare provider.

Managing Specialty Drugs

Specialty drugs, often used for complex or rare conditions, can be extremely expensive. These medications may require prior authorization, and their coverage can vary widely between insurance plans. It’s crucial to understand your plan’s coverage for specialty drugs if you or a family member requires such treatment.

An example of a specialty drug is a biologic medication used to treat rheumatoid arthritis. These medications can cost upwards of $30,000 per year. Without adequate insurance coverage, managing a condition like rheumatoid arthritis could become financially devastating.

Utilizing Mail-Order Pharmacies

Many insurance providers offer incentives for using mail-order pharmacies, especially for maintenance medications. These pharmacies often provide a 90-day supply of medication at a lower cost compared to retail pharmacies. This option can save money and reduce the frequency of pharmacy visits.

For example, if you require a maintenance medication for high blood pressure, ordering a 90-day supply through a mail-order pharmacy might cost you $30, compared to $40 for a 30-day supply at a retail pharmacy. This savings can add up over time, making it a more cost-effective option.

Exploring Generic and Biosimilar Options

Generic and biosimilar medications are often significantly cheaper than their brand-name counterparts, and they can provide substantial savings. Generic drugs have the same active ingredient as the brand-name version, while biosimilars are highly similar to the original biologic drug. Both offer an effective and more affordable alternative.

For instance, a generic version of a widely prescribed cholesterol-lowering medication can cost around $40 for a 30-day supply, compared to $250 for the brand-name version. This difference in price can make a substantial impact on your prescription drug costs.

Maximizing Rx Insurance Benefits

To make the most of your Rx Insurance, it’s important to actively manage your prescription drug coverage. Here are some strategies to consider:

Review Your Plan’s Formulary

Familiarize yourself with your insurance plan’s formulary. This list of covered drugs can help you understand which medications are covered and at what cost. Regularly review the formulary to stay informed about any changes that might impact your medication costs.

Discuss Medication Options with Your Healthcare Provider

Your healthcare provider can offer valuable insights into medication choices. They can advise on the most effective and cost-efficient options, especially if a medication is not covered by your insurance or has a high out-of-pocket cost. They might suggest a different brand or a generic alternative that provides similar benefits.

Utilize Mail-Order Pharmacies for Maintenance Medications

If your insurance plan offers this option, consider using mail-order pharmacies for maintenance medications. These pharmacies often provide discounts for 90-day supplies, reducing your overall prescription costs and the frequency of pharmacy visits.

Explore Discount Programs and Coupons

Various discount programs and coupon services can provide savings on prescription medications. These programs, often sponsored by pharmaceutical companies or independent organizations, can offer discounts or even free trials for specific medications. While these programs might not work for every medication, they can provide significant savings when applicable.

Understand Your Plan’s Coverage for Specialty Drugs

If you require specialty drugs, understand your plan’s coverage for these medications. Specialty drugs can be extremely costly, and their coverage can vary widely between insurance plans. Know your out-of-pocket maximums and any specific requirements for obtaining these medications.

Keep an Eye on Drug Shortages and Price Fluctuations

Drug shortages and price fluctuations can impact your medication costs. Stay informed about these issues, especially if you rely on a specific medication. In some cases, drug shortages can lead to temporary increases in price, so being aware of these situations can help you plan and potentially explore alternative treatments.

The Future of Rx Insurance

The landscape of Rx Insurance is evolving, driven by advancements in healthcare technology, changing pharmaceutical markets, and shifting healthcare policies. As we look ahead, several trends and developments are shaping the future of prescription drug coverage.

Increased Focus on Value-Based Care

The healthcare industry is shifting towards value-based care, where the focus is on the quality and outcomes of treatment rather than the quantity of services provided. This shift is expected to influence Rx Insurance, with a growing emphasis on the value and effectiveness of prescription medications. Insurance providers may increasingly prioritize medications that offer the best outcomes for patients, leading to potential changes in formulary designs.

Integration of Digital Health Technologies

Digital health technologies, including telemedicine and mobile health apps, are becoming increasingly integrated into healthcare. These technologies can play a role in Rx Insurance by improving medication adherence, providing remote patient monitoring, and offering convenient access to healthcare services. For instance, telemedicine platforms can facilitate virtual consultations with healthcare providers, making it easier for patients to discuss prescription concerns and receive refills.

Expansion of Biosimilar and Generic Medications

The use of biosimilar and generic medications is expected to grow, driven by their cost-effectiveness and the expiration of patents on several blockbuster drugs. Biosimilars, which are highly similar to original biologic drugs, offer a more affordable alternative for patients requiring complex treatments. The increased availability of these medications is likely to reduce overall prescription drug costs, benefiting both patients and insurance providers.

Emerging Trends in Pharmaceutical Research and Development

Advancements in pharmaceutical research and development are leading to the creation of innovative medications, including gene therapies and personalized medicines. These new treatment modalities can offer transformative benefits for patients with rare or complex conditions. However, they often come with high price tags. As these treatments gain approval and enter the market, insurance providers will need to navigate the challenges of covering these costly yet potentially life-changing medications.

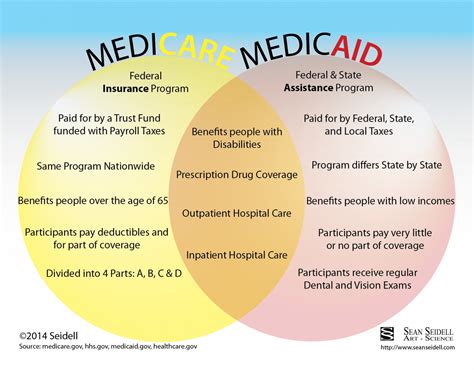

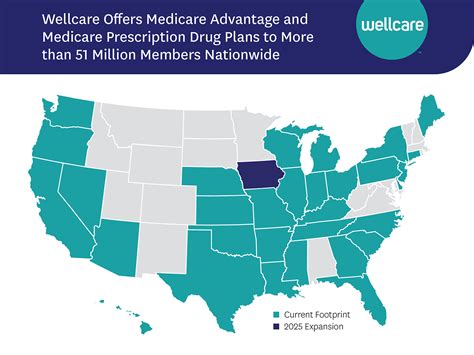

Policy Changes and Reform

Healthcare policies and reforms at the national and state levels can significantly impact Rx Insurance. Changes in legislation, such as the expansion of Medicaid or the introduction of new prescription drug pricing regulations, can influence the affordability and coverage of prescription medications. Staying informed about these policy changes is crucial for understanding their potential impact on your Rx Insurance coverage.

Conclusion

Rx Insurance is a critical component of comprehensive healthcare coverage, providing access to essential medications and financial protection against the high cost of prescription drugs. By understanding the intricacies of Rx Insurance, individuals can make informed decisions about their healthcare and effectively manage their prescription drug needs. As the healthcare landscape continues to evolve, staying informed about the latest trends and developments in Rx Insurance will be key to navigating this complex yet vital aspect of healthcare.

How do I choose the right Rx Insurance plan for my needs?

+Choosing the right Rx Insurance plan involves considering several factors. First, understand your prescription needs. If you require long-term medications, ensure the plan covers those drugs affordably. Look at the drug tiers and cost-sharing structures to determine the out-of-pocket costs. Consider the plan’s formulary and whether it includes the medications you use. Finally, compare plans based on their overall benefits, including any incentives for using mail-order pharmacies or discounts for specific medications.

What happens if my medication is not on the insurance formulary?

+If your medication is not on the insurance formulary, you may have to pay more out of pocket for that drug. However, you can discuss alternatives with your healthcare provider or explore the possibility of getting the medication added to the formulary. Sometimes, a prior authorization process can be initiated to demonstrate the medical necessity of the drug.

Are there any ways to save money on prescription drugs if I don’t have insurance coverage?

+Yes, there are several strategies to save money on prescription drugs without insurance. Explore generic or biosimilar alternatives, which are often significantly cheaper than brand-name drugs. Utilize discount programs or coupon services offered by pharmaceutical companies or independent organizations. Some pharmacies also offer loyalty programs or price-matching guarantees, which can provide savings. Additionally, consider purchasing medications from reputable online pharmacies, which may offer competitive prices.