Quote For Progressive Car Insurance

In the realm of car insurance, Progressive has established itself as a prominent player, offering a wide range of coverage options to cater to diverse driver needs. This article aims to delve into the specifics of Progressive's car insurance policies, providing a comprehensive overview of the quote process, coverage options, and the factors that influence premium rates. By the end, readers should have a clear understanding of how Progressive calculates car insurance quotes and the various strategies they can employ to secure the best rates.

Understanding Progressive Car Insurance Quotes

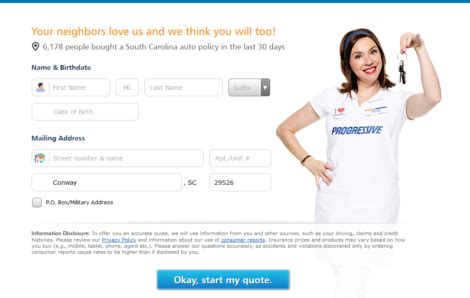

Progressive Insurance, a leading name in the auto insurance industry, provides a straightforward and personalized quote process. By leveraging advanced technologies, Progressive offers drivers a quick and efficient way to obtain insurance quotes tailored to their unique circumstances.

The quote process begins with a series of questions aimed at understanding the driver's background, vehicle details, and desired coverage. Progressive's online quote tool is designed to be user-friendly, guiding drivers through each step with clarity and simplicity. The information provided by the driver is then used to generate a personalized quote, taking into account various factors such as driving history, location, and the type of vehicle being insured.

Progressive's commitment to transparency is evident in its quote process, as drivers are provided with a detailed breakdown of their estimated premium, allowing them to make informed decisions about their coverage.

Factors Influencing Progressive Car Insurance Quotes

Several key factors play a significant role in determining Progressive’s car insurance quotes. These include:

- Driving History: Progressive takes into account a driver's history, including any accidents, traffic violations, and claims made. A clean driving record can lead to more favorable quotes.

- Vehicle Type: The make, model, and year of the vehicle being insured can impact the quote. Vehicles with higher safety ratings or those equipped with advanced safety features may result in lower premiums.

- Location: The area where the vehicle is primarily driven and parked can affect the quote. Areas with higher rates of accidents or theft may result in increased premiums.

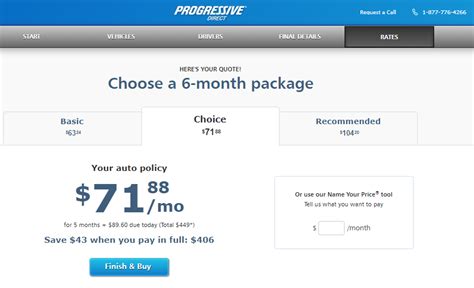

- Coverage Type and Limits: The level of coverage and the specific limits chosen by the driver influence the quote. Higher coverage limits and more comprehensive coverage options typically result in higher premiums.

- Deductibles: The deductible, or the amount the driver pays out of pocket before insurance coverage kicks in, can significantly impact the premium. Higher deductibles often lead to lower premiums, as the driver assumes more financial responsibility.

| Factor | Impact on Quote |

|---|---|

| Driving History | Clean records lead to lower quotes |

| Vehicle Type | Safer vehicles may result in lower premiums |

| Location | High-risk areas can increase premiums |

| Coverage Type and Limits | Higher coverage and limits result in higher premiums |

| Deductibles | Higher deductibles often mean lower premiums |

Progressive Car Insurance Coverage Options

Progressive offers a comprehensive range of car insurance coverage options to meet the diverse needs of its customers. These coverage options provide financial protection in the event of accidents, vehicle damage, or other unforeseen circumstances.

Liability Coverage

Liability coverage is a fundamental component of Progressive’s car insurance policies. It provides protection in the event that the insured driver is found at fault for an accident, covering the costs associated with injuries to others and damage to their property.

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by the insured driver.

- Property Damage Liability: Pays for the repair or replacement of vehicles or other property damaged in an accident caused by the insured driver.

Collision and Comprehensive Coverage

Collision and comprehensive coverage options offer additional protection for the insured vehicle.

- Collision Coverage: Covers the cost of repairing or replacing the insured vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: Provides protection against damage caused by non-collision events such as theft, vandalism, natural disasters, or collisions with animals.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, helps cover the medical expenses of the insured driver and their passengers after an accident, regardless of who is at fault.

Uninsured/Underinsured Motorist Coverage

This coverage protects the insured driver in the event of an accident with a driver who does not have adequate insurance coverage. It provides compensation for injuries and property damage sustained in such accidents.

Personal Injury Protection (PIP)

PIP coverage, available in certain states, provides additional medical and disability benefits to the insured driver and their passengers after an accident. It can also cover lost wages and funeral expenses.

Rental Car Reimbursement

Rental car reimbursement coverage helps cover the cost of renting a vehicle while the insured car is being repaired or replaced after an insured loss.

Roadside Assistance

Progressive offers roadside assistance coverage, providing emergency services such as towing, flat tire changes, and battery jump-starts.

Strategies to Lower Progressive Car Insurance Quotes

While Progressive’s quotes are tailored to individual circumstances, there are several strategies drivers can employ to potentially lower their insurance premiums.

Bundle Policies

Bundling multiple insurance policies, such as auto and home insurance, with Progressive can often lead to significant discounts. This strategy is particularly effective for those who own both a home and a vehicle.

Increase Deductibles

Opting for higher deductibles can result in lower premiums. However, it’s important to choose a deductible amount that the driver is comfortable paying out of pocket in the event of a claim.

Maintain a Clean Driving Record

A clean driving record is a significant factor in obtaining lower insurance quotes. Drivers should strive to avoid accidents, traffic violations, and claims, as these can increase insurance premiums.

Take Advantage of Discounts

Progressive offers a variety of discounts to its customers, including:

- Good Student Discount: Available for students who maintain a certain GPA.

- Multi-Car Discount: For households with multiple vehicles insured with Progressive.

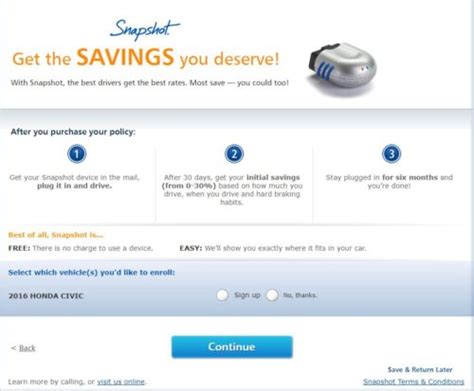

- Snapshot Discount: Based on driving behavior, with safer drivers receiving discounts.

- Homeowner Discount: For individuals who own their home and have homeowner's insurance.

Choose the Right Coverage

Selecting the appropriate coverage limits and options can impact the overall premium. It’s essential to choose coverage that provides adequate protection without being excessive.

Conclusion

Progressive Car Insurance offers a comprehensive suite of coverage options and a transparent quote process. By understanding the factors that influence quotes and employing strategies to lower premiums, drivers can make informed decisions about their car insurance coverage. Progressive’s commitment to providing customizable and competitive quotes makes it a popular choice for many drivers seeking reliable and affordable car insurance.

Frequently Asked Questions

Can I get a Progressive car insurance quote without providing personal information?

+No, Progressive requires certain personal and vehicle details to generate an accurate quote. However, the information provided is kept secure and is only used for the purpose of providing a quote.

How often should I review my Progressive car insurance policy and quote?

+It’s recommended to review your policy and quote annually, or whenever there are significant changes in your personal circumstances or vehicle usage. This ensures that your coverage remains adequate and that you’re not paying for unnecessary coverage.

What happens if I need to make changes to my Progressive car insurance policy after receiving a quote?

+You can contact Progressive to discuss any changes you wish to make to your policy. The changes may impact your premium, and Progressive will provide an updated quote based on the new information.