Healthcare Medical Insurance

The healthcare industry is a vital sector that affects every individual's life, and at its core lies the concept of medical insurance, which plays a pivotal role in ensuring access to essential healthcare services. In today's dynamic healthcare landscape, understanding the intricacies of medical insurance is more crucial than ever. This comprehensive guide aims to unravel the complexities, providing an in-depth analysis of medical insurance, its significance, and its impact on healthcare delivery.

Unraveling the World of Medical Insurance

Medical insurance, also known as health insurance, is a contractual agreement between an individual or a group and an insurance provider. This agreement ensures that the insured party receives financial protection and access to necessary healthcare services in the event of illness, injury, or other specified medical conditions. It is a fundamental component of healthcare systems worldwide, offering peace of mind and essential coverage to individuals and families.

The Need for Medical Insurance

In an increasingly complex healthcare environment, the need for medical insurance is multifaceted. Firstly, it provides a safety net, ensuring that individuals can access the necessary medical care without incurring prohibitive costs. This is especially crucial in countries where healthcare expenses can be a significant financial burden, potentially leading to financial ruin.

Secondly, medical insurance promotes preventative care. Many insurance plans cover routine check-ups, vaccinations, and screenings, encouraging individuals to take a proactive approach to their health. By detecting potential health issues early, insurance can help prevent more serious and costly health complications down the line.

Lastly, medical insurance fosters a more efficient healthcare system. By spreading the financial risk across a large population, insurance companies can better manage costs and resources. This, in turn, can lead to more accessible and affordable healthcare services for all.

Understanding Insurance Plans

Medical insurance plans come in various forms, each tailored to meet different needs and budgets. Here’s a breakdown of some common types:

- Indemnity Plans: Also known as fee-for-service plans, these provide the most flexibility, allowing policyholders to choose their healthcare providers. The insurance company then reimburses a percentage of the costs based on a predetermined schedule.

- Managed Care Plans: These plans offer a more structured approach, often with a network of preferred providers. Common types include Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). While they may have more restrictions, they often offer lower out-of-pocket costs.

- Catastrophic Plans: Designed for younger, healthier individuals, these plans have low premiums but high deductibles. They are primarily intended to cover major, unexpected medical expenses.

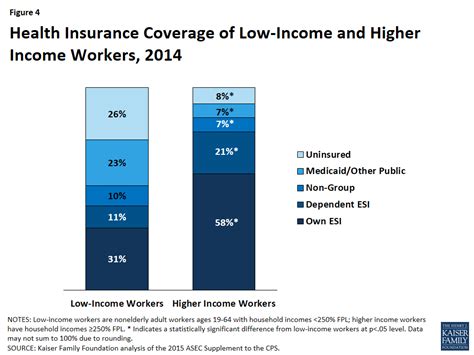

- Medicaid and Medicare: Government-funded programs that provide healthcare coverage for specific populations, such as low-income individuals, the elderly, and those with disabilities.

Each type of plan has its own set of advantages and disadvantages, and the choice depends on an individual's specific needs, health status, and financial situation.

Key Features of Medical Insurance

Medical insurance policies are complex, and it’s essential to understand their key features to make informed decisions. Here are some crucial aspects:

- Premiums: The amount paid regularly (usually monthly) to maintain the insurance coverage.

- Deductibles: The amount an insured person must pay out-of-pocket before the insurance company starts reimbursing. Higher deductibles often result in lower premiums.

- Co-payments (Co-pays): A fixed amount paid by the insured at the time of receiving a covered medical service. Co-pays can vary depending on the type of service.

- Coinsurance: This is the percentage of the total cost of a covered medical service that the insured person must pay. For instance, a policy with an 80/20 coinsurance means the insurance company pays 80% of the cost, and the insured pays the remaining 20%.

- Out-of-Pocket Maximum: The maximum amount an insured person has to pay in a year for covered services. After reaching this limit, the insurance company pays for all covered services for the rest of the year.

- Network of Providers: Many insurance plans have a network of preferred healthcare providers. Using these providers often results in lower out-of-pocket costs.

- Pre-authorization: Some procedures or services require pre-authorization from the insurance company before they can be covered.

The Impact of Medical Insurance on Healthcare Delivery

Medical insurance plays a pivotal role in shaping the healthcare landscape. By providing financial coverage, it ensures that individuals have access to a wide range of healthcare services, from primary care to specialized treatments and medications. This access can lead to better health outcomes and a higher quality of life for policyholders.

Furthermore, medical insurance can drive innovation in healthcare. Insurance companies, in their quest to manage costs effectively, often incentivize the adoption of new technologies and treatments. This can lead to more efficient and effective healthcare practices, benefiting both patients and providers.

However, the relationship between medical insurance and healthcare delivery is complex. While insurance provides access, it can also introduce challenges, such as administrative burdens and potential barriers to care. Navigating these complexities requires a nuanced understanding of the healthcare system and the role insurance plays within it.

| Insurance Type | Average Premium Cost |

|---|---|

| Indemnity Plans | $450 - $800/month |

| Managed Care Plans (HMOs/PPOs) | $350 - $600/month |

| Catastrophic Plans | $150 - $300/month |

The Future of Medical Insurance

As we move forward, the landscape of medical insurance is set to evolve, influenced by advancements in technology, changing healthcare needs, and shifts in global healthcare policies. Here are some key trends and developments that are shaping the future of medical insurance:

Digital Transformation

The integration of digital technologies is revolutionizing the medical insurance industry. Online platforms and mobile apps are now common, offering policyholders convenient access to their insurance information, claims status, and even virtual consultations with healthcare professionals. This digital transformation enhances efficiency, reduces administrative burdens, and improves the overall customer experience.

Personalized Medicine and Precision Health

The concept of personalized medicine, where healthcare is tailored to the individual, is gaining traction. Insurance companies are exploring ways to incorporate genetic testing and advanced analytics to develop more targeted and effective healthcare plans. By understanding an individual’s unique health risks and needs, insurance providers can offer more comprehensive and personalized coverage.

Value-Based Care

There is a growing shift towards value-based care models, where the focus is on the quality and outcomes of healthcare rather than the volume of services provided. This approach aims to improve patient health while also managing costs effectively. Insurance companies are incentivizing healthcare providers to adopt value-based care, rewarding them for achieving positive health outcomes rather than simply providing more services.

Global Healthcare Trends

The global healthcare landscape is also influencing the future of medical insurance. With the rise of cross-border healthcare services and medical tourism, insurance companies are expanding their coverage to include international treatments and procedures. Additionally, global health initiatives and policies are shaping the availability and accessibility of medical insurance, especially in regions with developing healthcare systems.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are transforming how insurance companies operate. These technologies are being used to predict healthcare needs, identify potential fraud, and develop more accurate risk assessment models. By leveraging data-driven insights, insurance providers can offer more competitive pricing, enhance fraud detection, and improve the overall efficiency of their operations.

Prevention and Wellness

There is a growing emphasis on prevention and wellness in the healthcare industry, and insurance companies are playing a pivotal role in this shift. Many insurance plans now offer incentives and rewards for policyholders who engage in healthy behaviors, such as regular exercise, healthy eating, and preventive screenings. By encouraging a proactive approach to health, insurance providers aim to reduce the incidence of costly chronic diseases.

Collaborative Partnerships

Insurance companies are forming strategic partnerships with healthcare providers, pharmaceutical companies, and technology firms to enhance the delivery of healthcare services. These collaborations aim to improve access to care, streamline processes, and reduce costs. For instance, some insurance providers are partnering with telemedicine companies to offer virtual healthcare services to their policyholders.

Addressing Healthcare Disparities

The future of medical insurance also involves a commitment to addressing healthcare disparities. Insurance companies are developing targeted initiatives to improve access to care for underserved populations, such as those in rural areas or with limited financial means. This includes expanding coverage for essential health benefits and offering affordable plans that meet the unique needs of diverse communities.

Consumer-Centric Approach

The modern insurance landscape is increasingly consumer-centric. Insurance companies are focusing on delivering a personalized and seamless experience to their policyholders. This involves offering flexible plan options, providing transparent pricing and coverage information, and ensuring timely claim processing. By putting the consumer at the heart of their operations, insurance providers aim to build trust and long-term relationships with their customers.

Environmental and Social Factors

Insurance companies are also recognizing the impact of environmental and social factors on health. They are incorporating these factors into their risk assessment models and developing initiatives to promote health and well-being in communities. For example, some insurance providers are offering discounts to policyholders who live in environmentally friendly housing or engage in community wellness programs.

What is the average cost of medical insurance per month in the United States?

+The average monthly cost of medical insurance in the U.S. can vary widely depending on factors such as age, location, and the scope of coverage. On average, an individual might pay anywhere from 350 to 800 per month, while family plans can range from 700 to 1,500 or more. However, these are just estimates, and the actual cost can be significantly higher or lower based on individual circumstances.

How do I choose the right medical insurance plan for me?

+Choosing the right medical insurance plan involves considering several factors. These include your health status and needs, the network of providers offered by the plan, the cost of premiums and out-of-pocket expenses, and the types of services and benefits covered. It’s often beneficial to consult with insurance brokers or financial advisors who can guide you through the process and help you find a plan that best suits your needs and budget.

What happens if I can’t afford medical insurance?

+If you’re unable to afford traditional medical insurance, there are several options to consider. You might be eligible for government-funded programs like Medicaid or Medicare, which offer healthcare coverage to specific populations. Additionally, some states have programs that provide discounted or subsidized insurance plans for low-income individuals and families. It’s important to research and understand your options to ensure you have access to necessary healthcare services.

Can medical insurance cover mental health services?

+Yes, many medical insurance plans now cover a range of mental health services, including therapy, counseling, and medication. This coverage is a result of increased awareness about the importance of mental health and the recognition of mental health issues as a significant healthcare concern. However, the extent of coverage can vary, so it’s essential to review your specific insurance plan to understand what mental health services are included and any potential limitations or restrictions.

How do I make a claim on my medical insurance policy?

+Making a claim on your medical insurance policy typically involves several steps. First, ensure that the service or treatment you’re seeking is covered by your plan. Then, you’ll need to provide the necessary documentation, such as medical records and invoices, to your insurance provider. The process can vary depending on your insurance company and the type of claim, so it’s beneficial to familiarize yourself with your policy’s guidelines and, if needed, seek assistance from the insurance provider’s customer service team.