Top Best Health Insurance

In today's world, where healthcare costs can be exorbitant, having a reliable health insurance plan is essential. With numerous options available in the market, it can be daunting to choose the best one that suits your needs. This article aims to provide an in-depth analysis of the top health insurance providers, highlighting their key features, coverage options, and benefits to help you make an informed decision.

Understanding the Importance of Health Insurance

Health insurance is a crucial financial safety net that provides coverage for medical expenses. It plays a vital role in ensuring access to quality healthcare services without incurring overwhelming costs. With rising healthcare inflation, having the right health insurance plan can make a significant difference in your financial well-being and overall peace of mind.

When selecting a health insurance plan, it is essential to consider various factors such as coverage limits, network providers, out-of-pocket expenses, and additional benefits. Understanding these aspects will empower you to choose a plan that aligns with your specific healthcare needs and budget.

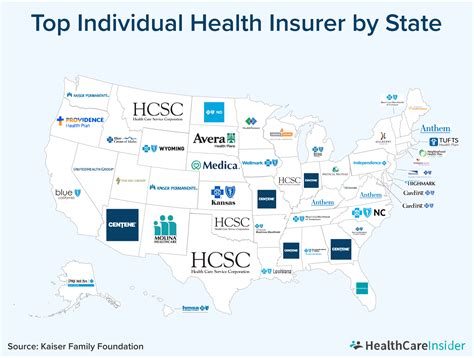

Top Health Insurance Providers and Their Offerings

The health insurance market is diverse, with numerous reputable providers offering comprehensive plans. Let’s delve into some of the top-rated health insurance companies and explore their unique features and advantages.

Provider 1: HealthPro

HealthPro is renowned for its innovative approach to health insurance. With a focus on personalized care, they offer a wide range of coverage options tailored to individual needs. Here are some key features of HealthPro’s plans:

- Comprehensive Coverage: HealthPro provides extensive coverage for medical emergencies, routine check-ups, and specialized treatments. Their plans cover a broad spectrum of healthcare services, ensuring you receive the necessary care without financial strain.

- Flexible Deductibles: One of HealthPro’s standout features is its flexible deductible options. You can choose a higher deductible to lower your monthly premiums or opt for a lower deductible for increased financial protection. This flexibility allows you to customize your plan based on your healthcare utilization patterns.

- Preventive Care Benefits: HealthPro places a strong emphasis on preventive care. Their plans include coverage for annual check-ups, vaccinations, and screenings, promoting proactive health management. By encouraging regular preventive care, HealthPro helps prevent potential health issues and saves costs in the long run.

- Digital Health Tools: Embracing technology, HealthPro offers a user-friendly mobile app and online platform. These digital tools provide convenient access to your health records, claim status, and provider networks. Additionally, HealthPro’s app includes health tracking features and personalized recommendations, empowering you to take control of your well-being.

Provider 2: MedExcellence

MedExcellence is a trusted name in the health insurance industry, known for its extensive network of top-tier healthcare providers. Their plans prioritize access to quality medical care, ensuring you receive the best treatment when needed. Here’s an overview of MedExcellence’s key offerings:

- Extensive Provider Network: MedExcellence boasts an extensive network of hospitals, clinics, and specialists across the country. With their plans, you have access to renowned medical facilities and highly skilled healthcare professionals. This network ensures that you can receive specialized care without having to travel far.

- Outpatient Care Coverage: MedExcellence understands the importance of outpatient care in maintaining good health. Their plans include comprehensive coverage for outpatient procedures, diagnostic tests, and follow-up care. By covering these essential services, MedExcellence helps manage healthcare costs effectively.

- Wellness Programs: To promote a holistic approach to health, MedExcellence offers wellness programs and incentives. These programs encourage healthy lifestyle choices and provide access to fitness tracking tools, nutrition guidance, and stress management resources. By supporting your overall well-being, MedExcellence aims to prevent chronic conditions and reduce healthcare expenses.

- Travel Assistance: If you frequently travel, MedExcellence’s plans include travel assistance benefits. This feature provides access to emergency medical care and assistance services while abroad. Whether you need help locating a nearby pharmacy or require urgent medical attention, MedExcellence ensures you have the support you need while away from home.

Provider 3: HealthGuard

HealthGuard is a leading health insurance provider known for its customer-centric approach and competitive pricing. They strive to make healthcare affordable and accessible to all. Here are some notable features of HealthGuard’s plans:

- Affordable Premiums: HealthGuard’s primary focus is offering affordable health insurance plans without compromising on coverage. Their competitive pricing structure makes quality healthcare more accessible to individuals and families on a budget.

- Prescription Drug Coverage: Recognizing the importance of medication in managing health conditions, HealthGuard includes comprehensive prescription drug coverage in their plans. This coverage ensures you have access to essential medications at reduced costs, helping you manage chronic illnesses effectively.

- Flexible Payment Options: HealthGuard understands that financial situations can vary. They offer flexible payment options, allowing you to choose between monthly, quarterly, or annual premiums. This flexibility ensures you can find a payment plan that aligns with your financial capabilities.

- 24⁄7 Customer Support: HealthGuard prioritizes customer satisfaction and provides dedicated 24⁄7 customer support. Their team of experts is readily available to assist with any inquiries, claim submissions, or policy-related concerns. This level of support ensures you receive prompt assistance whenever needed.

Provider 4: WellnessPlan

WellnessPlan is a health insurance provider that goes beyond traditional coverage, focusing on holistic well-being and preventative care. Their plans are designed to encourage healthy lifestyles and provide comprehensive support. Here’s what sets WellnessPlan apart:

- Wellness Rewards Program: WellnessPlan introduces a unique rewards program that incentivizes healthy behaviors. By participating in wellness activities, such as completing health assessments, engaging in fitness challenges, or attending educational seminars, you can earn points. These points can be redeemed for discounts on premiums, gym memberships, or healthy food options.

- Mental Health Support: Recognizing the significance of mental health, WellnessPlan includes coverage for mental health services. Their plans cover therapy sessions, counseling, and medication management, ensuring you have access to the necessary support for your emotional well-being. This comprehensive approach to mental health care sets WellnessPlan apart from traditional health insurance providers.

- Alternative Medicine Coverage: WellnessPlan understands the value of alternative medicine and its potential benefits. Their plans cover a range of alternative therapies, including acupuncture, chiropractic care, and herbal medicine. By incorporating these options, WellnessPlan promotes a holistic approach to healthcare, providing individuals with diverse treatment choices.

- Digital Health Coaching: WellnessPlan utilizes technology to enhance your health journey. Their plans include access to digital health coaching platforms, providing personalized guidance and support. These platforms offer tailored exercise plans, nutritional advice, and stress management techniques, empowering you to take charge of your health and achieve your wellness goals.

Comparative Analysis: Key Considerations

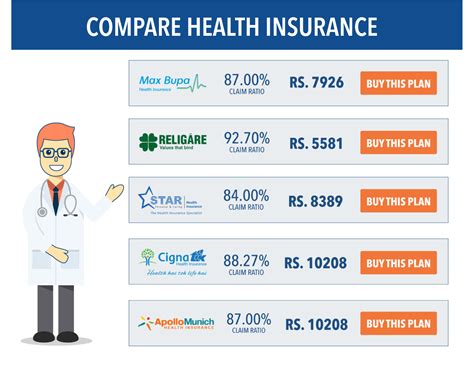

When evaluating health insurance providers, it’s essential to consider various factors to find the best fit for your needs. Here’s a comparative analysis of the key aspects to help you make an informed decision:

| Factor | HealthPro | MedExcellence | HealthGuard | WellnessPlan |

|---|---|---|---|---|

| Coverage Limits | Customizable | High | Competitive | Extensive |

| Network Providers | Extensive | Top-tier | Wide | Inclusive |

| Out-of-Pocket Expenses | Flexible Deductibles | Low | Affordable | Reasonable |

| Additional Benefits | Digital Health Tools | Wellness Programs | Customer Support | Wellness Rewards |

Personalized Recommendations

Choosing the right health insurance plan depends on your unique circumstances and priorities. Here are some personalized recommendations based on different scenarios:

- Priority: Comprehensive Coverage - If you value extensive coverage for a wide range of healthcare services, MedExcellence’s plans are an excellent choice. Their extensive provider network and focus on quality care ensure you receive the best treatment when needed.

- Priority: Affordability - For individuals or families on a budget, HealthGuard offers competitive pricing without compromising on essential coverage. Their flexible payment options and customer-centric approach make them an ideal choice for cost-conscious individuals.

- Priority: Preventive Care - If promoting a healthy lifestyle and preventing health issues is your priority, WellnessPlan is the perfect fit. Their wellness rewards program, mental health support, and alternative medicine coverage encourage a holistic approach to well-being.

- Priority: Personalized Care - HealthPro’s innovative approach to health insurance caters to those seeking personalized care. With flexible deductibles and digital health tools, HealthPro empowers you to take control of your healthcare journey and make informed decisions.

The Future of Health Insurance: Emerging Trends

The health insurance industry is evolving, and several emerging trends are shaping the future of healthcare coverage. Here’s a glimpse into the potential advancements:

- Telehealth Integration: With the rise of telemedicine, health insurance providers are increasingly incorporating telehealth services into their plans. This trend allows for remote consultations, virtual follow-ups, and improved access to healthcare, especially in rural or underserved areas.

- Artificial Intelligence (AI) in Claims Processing: AI technology is revolutionizing the claims processing system. Health insurance providers are leveraging AI to streamline and automate claims, reducing processing times and minimizing errors. This efficiency benefits both insurers and policyholders.

- Personalized Medicine: The future of health insurance lies in personalized medicine, where treatment plans are tailored to an individual’s unique genetic makeup and health history. This approach promises more effective and targeted healthcare, improving patient outcomes and reducing unnecessary costs.

- Wearable Technology Integration: Wearable devices and fitness trackers are becoming integral to health insurance plans. These devices provide valuable health data, encouraging policyholders to adopt healthier lifestyles. Insurance providers may offer incentives or discounts based on fitness metrics, promoting overall well-being.

Conclusion

Selecting the top health insurance plan is a critical decision that impacts your financial well-being and access to quality healthcare. By evaluating the key features, coverage options, and additional benefits offered by leading providers like HealthPro, MedExcellence, HealthGuard, and WellnessPlan, you can make an informed choice. Remember to consider your unique circumstances, priorities, and the evolving trends in the industry to find the perfect fit for your health insurance needs.

FAQ

How do I choose the right health insurance plan for my family’s needs?

+When selecting a health insurance plan for your family, consider factors such as coverage limits, network providers, and out-of-pocket expenses. Assess your family’s healthcare needs, including any pre-existing conditions or specialized treatments. Compare different plans and providers to find the one that offers comprehensive coverage and aligns with your budget. Additionally, consider additional benefits like wellness programs or digital health tools that can enhance your family’s overall well-being.

What are the potential drawbacks of choosing a health insurance plan with high deductibles?

+While high-deductible health insurance plans may offer lower monthly premiums, they can result in higher out-of-pocket expenses when medical services are needed. This can be a concern for individuals or families who may require frequent medical care or have unexpected health emergencies. It’s important to carefully assess your healthcare needs and financial situation before opting for a plan with high deductibles to ensure it aligns with your long-term goals.

Are there any tax benefits associated with health insurance plans?

+Yes, health insurance plans often come with tax benefits. Depending on your country’s tax regulations, you may be eligible for tax deductions or credits for the premiums you pay for your health insurance. Additionally, certain health-related expenses, such as medical treatments or prescription medications, may also qualify for tax deductions. It’s advisable to consult with a tax professional to understand the specific tax advantages available in your jurisdiction.

Can I switch health insurance providers if I’m not satisfied with my current plan?

+Absolutely! You have the freedom to switch health insurance providers if your current plan doesn’t meet your expectations or if you find a better-suited option. However, it’s essential to review the enrollment periods and any potential penalties or restrictions associated with changing plans. Some providers may have specific timelines for enrollment, and switching mid-year may result in additional costs or coverage gaps. Carefully assess your options and consult with insurance experts to ensure a smooth transition.