Low Income Insurance

Access to affordable healthcare is a critical issue that affects millions of individuals and families worldwide. Low-income insurance programs play a vital role in ensuring that those with limited financial means can still obtain the medical care they need. This article explores the concept of low-income insurance, its significance, and the impact it has on individuals and communities.

Understanding Low-Income Insurance

Low-income insurance, often referred to as subsidized health insurance or public health coverage, is a vital component of healthcare systems designed to provide financial assistance to individuals and families who cannot afford traditional private insurance plans. These programs are typically government-funded or supported and aim to bridge the gap in access to healthcare for vulnerable populations.

The primary objective of low-income insurance is to ensure that financial constraints do not become a barrier to receiving essential medical services. By offering affordable or even no-cost insurance options, these programs enable individuals to seek preventive care, manage chronic conditions, and access specialized treatments without facing overwhelming financial burdens.

Eligibility Criteria

Eligibility for low-income insurance programs is typically determined based on income levels, family size, and sometimes other factors such as age or disability status. Each program may have its own specific criteria, but generally, individuals and families whose incomes fall below a certain threshold are considered eligible. This threshold varies across different regions and countries, reflecting the unique economic and healthcare landscapes.

| Country/Region | Income Threshold (Annual) |

|---|---|

| United States | $12,760 for individuals, $26,200 for a family of four (as per 2023 federal poverty guidelines) |

| United Kingdom | £16,190 for single adults, £25,720 for a couple (as per 2023 National Living Wage thresholds) |

| Canada | Varies by province, e.g., Ontario: $20,000 for individuals, $30,000 for a family of three (as per 2022 Ontario Drug Benefit Program) |

| Australia | A$27,869 for singles, A$46,667 for couples (as per 2023 Centrelink income thresholds) |

It's important to note that eligibility criteria may be adjusted annually to account for inflation and changing economic circumstances. Additionally, some programs may offer sliding scale premiums or cost-sharing reductions based on income, allowing those with slightly higher incomes to still access affordable coverage.

Coverage and Benefits

Low-income insurance programs aim to provide comprehensive healthcare coverage to eligible individuals. The specific benefits and services covered can vary depending on the program and the region. However, most programs cover a wide range of essential healthcare services, including but not limited to:

- Primary care services: Regular check-ups, screenings, and treatment for common illnesses.

- Specialist consultations: Access to specialists for specific medical conditions or concerns.

- Hospitalization: Coverage for inpatient stays and related expenses.

- Prescription medications: Access to essential medications at reduced or no cost.

- Mental health services: Treatment for mental health conditions and access to counseling.

- Maternity care: Prenatal care, delivery, and postnatal support for expectant mothers.

- Pediatric care: Comprehensive healthcare for children, including immunizations and well-child visits.

- Dental and vision care: Basic dental and vision services to maintain oral and eye health.

Additionally, many low-income insurance programs also provide support for chronic disease management, substance abuse treatment, and access to preventive services such as vaccinations and cancer screenings. The goal is to promote overall health and well-being while preventing costly health complications down the line.

Impact and Benefits of Low-Income Insurance

The implementation of low-income insurance programs has had a significant positive impact on individuals, families, and communities. Here are some key benefits and outcomes associated with these initiatives:

Improved Access to Healthcare

Perhaps the most evident benefit is the improved access to healthcare that low-income insurance provides. Individuals who may have previously gone without medical attention due to financial constraints can now seek the care they need without fear of overwhelming medical bills. This increased access leads to better health outcomes and reduced healthcare disparities.

By providing coverage for preventive services, low-income insurance programs also encourage individuals to take a proactive approach to their health. Regular check-ups, screenings, and early intervention can help identify and manage health issues before they become more severe and costly to treat.

Financial Protection and Stability

Low-income insurance offers a critical layer of financial protection for vulnerable populations. The high cost of healthcare can be a significant burden for individuals and families living on a tight budget. With subsidized insurance, individuals can access necessary medical care without worrying about crippling medical debt.

This financial stability extends beyond healthcare costs. When individuals have access to affordable insurance, they are more likely to seek timely medical attention, which can prevent minor health issues from escalating into major, expensive complications. Additionally, the peace of mind that comes with having insurance coverage can reduce stress and improve overall well-being.

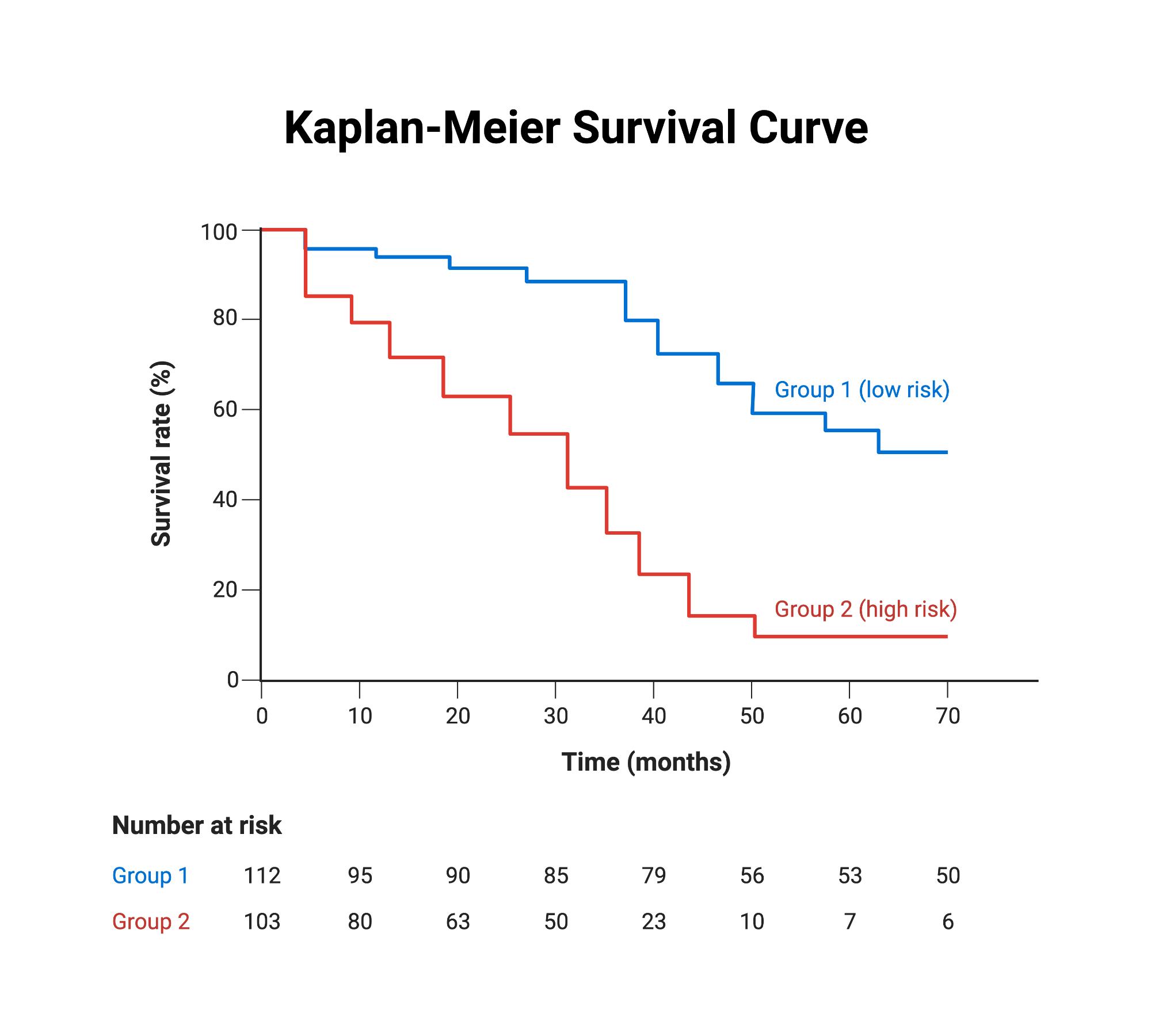

Enhanced Health Outcomes

Access to low-income insurance has been linked to improved health outcomes for individuals and communities. Studies have shown that these programs contribute to increased life expectancy, reduced infant mortality rates, and better management of chronic diseases. By ensuring timely access to healthcare, low-income insurance can help individuals maintain their health and avoid the debilitating effects of untreated conditions.

Moreover, low-income insurance programs often prioritize preventive care, which plays a crucial role in maintaining population health. Regular check-ups, immunizations, and screenings can help identify and address health issues early on, preventing the development of more serious conditions that require costly treatments.

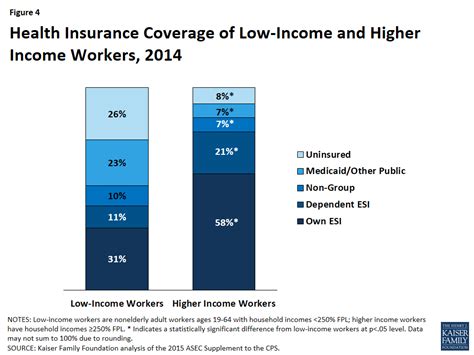

Reduced Healthcare Disparities

Low-income insurance plays a vital role in reducing healthcare disparities that often exist between different socioeconomic groups. By providing coverage to those who may otherwise be uninsured, these programs help bridge the gap in access to quality healthcare. This, in turn, leads to more equitable health outcomes and a reduction in health inequalities.

Additionally, low-income insurance programs often target specific vulnerable populations, such as children, pregnant women, and the elderly. By focusing on these groups, these initiatives help ensure that everyone, regardless of their financial situation, has the opportunity to receive the care they need to thrive.

Challenges and Future Directions

While low-income insurance programs have proven to be highly beneficial, they are not without their challenges. Some of the key issues that policymakers and healthcare providers face include:

Sustainability and Funding

One of the primary challenges is ensuring the long-term sustainability of low-income insurance programs. These initiatives require substantial funding to provide coverage for a large number of individuals. In times of economic downturn or budgetary constraints, sustaining these programs can be difficult.

To address this challenge, policymakers often explore innovative funding mechanisms, such as dedicated taxes or revenue streams, to ensure the stability of these programs. Additionally, efficient administration and cost-containment measures are crucial to maintaining the financial viability of low-income insurance.

Program Awareness and Enrollment

Despite the existence of low-income insurance programs, many eligible individuals remain unaware of their options or face barriers to enrollment. Effective outreach and education campaigns are essential to ensure that those in need are aware of the availability of these programs and understand the enrollment process.

Simplifying the enrollment process, utilizing community-based organizations, and providing multilingual resources can help overcome these barriers. Additionally, leveraging digital platforms and mobile technologies can make it easier for individuals to access information and apply for coverage.

Quality of Care and Provider Networks

Ensuring that low-income insurance programs provide access to high-quality healthcare is crucial. This includes maintaining robust provider networks and addressing any disparities in the quality of care received by those with low-income insurance compared to those with private coverage.

Policymakers and healthcare providers must work together to develop strategies that promote equal access to high-quality care. This may involve expanding provider networks, incentivizing healthcare professionals to serve vulnerable populations, and implementing quality improvement initiatives.

Addressing Complex Healthcare Needs

Low-income insurance programs often serve individuals and families with complex healthcare needs, including chronic conditions, mental health issues, and substance abuse disorders. Providing comprehensive and coordinated care for these populations can be challenging.

Integrated care models, which bring together different healthcare disciplines and providers, can help address these complex needs. By offering holistic care that considers the physical, mental, and social aspects of health, these models can improve outcomes and reduce the overall cost of care.

Conclusion

Low-income insurance programs are a crucial component of healthcare systems, ensuring that financial barriers do not prevent individuals from accessing essential medical care. These initiatives have a profound impact on the lives of vulnerable populations, improving access to healthcare, providing financial protection, and enhancing overall health outcomes.

While challenges exist, the continued development and refinement of low-income insurance programs are essential to building more equitable and resilient healthcare systems. By addressing these challenges and building upon the successes of these initiatives, we can work towards a future where everyone, regardless of their financial situation, has the opportunity to lead healthy and fulfilling lives.

How do I know if I’m eligible for low-income insurance?

+Eligibility criteria for low-income insurance programs vary by region and country. Generally, income levels, family size, and sometimes age or disability status are considered. You can check with your local healthcare authorities or visit their official websites to determine your eligibility. In some cases, you may also be able to use online eligibility calculators or contact a healthcare navigator for assistance.

Are there any costs associated with low-income insurance?

+Low-income insurance programs are designed to provide affordable or no-cost coverage to eligible individuals. However, some programs may have small premiums or cost-sharing requirements based on income. These costs are typically significantly lower than traditional private insurance plans. It’s important to review the specific details of the program you’re eligible for to understand any potential costs.

Can I choose my healthcare providers under low-income insurance?

+The ability to choose your healthcare providers under low-income insurance depends on the specific program and region. Some programs may have a restricted provider network, while others may offer more flexibility. It’s essential to review the provider options and network restrictions outlined by the program you’re enrolled in. If you have specific healthcare needs or preferences, you may want to consider this factor when choosing a low-income insurance program.

What happens if I need specialized medical care that’s not covered by low-income insurance?

+Low-income insurance programs aim to provide comprehensive coverage, but there may be instances where specialized medical care is not fully covered. In such cases, the program may offer resources or guidance on accessing alternative funding or support for specialized treatments. It’s important to discuss your specific healthcare needs with your healthcare provider and the program administrators to understand your options and any potential out-of-pocket costs.