Term Insurance India

In the dynamic landscape of financial planning and protection, term insurance emerges as a vital component, especially in the Indian context. This article delves into the intricacies of term insurance, shedding light on its significance, features, and the impact it can have on individuals and families in India.

Understanding Term Insurance

Term insurance is a type of life insurance policy that provides coverage for a specified period, often referred to as the term of the policy. It is designed to offer financial protection to the policyholder’s dependents in the event of their untimely demise during the policy term. Unlike other life insurance policies that accumulate cash value, term insurance focuses solely on providing a death benefit.

In India, where families often rely on a single breadwinner, term insurance plays a crucial role in ensuring financial security. It offers a cost-effective way to secure the future of loved ones, providing a substantial sum assured in the event of an unfortunate incident. This article aims to explore the various aspects of term insurance, helping individuals make informed decisions about their financial well-being.

Key Features of Term Insurance

Term insurance policies in India come with a range of features that make them an attractive choice for financial planning.

Affordable Premiums

One of the most appealing aspects of term insurance is its affordability. Compared to other life insurance policies, term insurance policies typically offer lower premiums. This makes it accessible to a wider range of individuals, regardless of their income level. The premium amount is determined based on factors such as the policyholder’s age, health status, and the chosen sum assured.

For instance, a healthy 30-year-old individual can secure a term insurance policy with a sum assured of ₹50 lakhs for a premium as low as ₹5,000 per year. This affordability ensures that individuals can prioritize their financial protection without straining their budgets.

High Sum Assured

Term insurance policies are known for offering high sum assured amounts, providing comprehensive coverage. The sum assured is the amount that the policyholder’s nominees will receive in the event of their death during the policy term. This sum can range from a few lakhs to several crores, depending on the policyholder’s requirements and affordability.

By opting for a higher sum assured, individuals can ensure that their dependents are financially secure and can maintain their standard of living even in their absence. This feature is especially crucial for individuals with families, as it provides a safety net against unforeseen circumstances.

Customizable Policies

Term insurance policies in India offer a high degree of customization, allowing individuals to tailor their coverage to their specific needs. Policyholders can choose the term of the policy, ranging from 10 to 30 years or more, depending on their preferences and financial goals.

Additionally, riders or add-ons can be included to enhance the policy's benefits. These riders can include critical illness coverage, accidental death benefit, or waiver of premium in case of disability. By adding these riders, individuals can further strengthen their financial protection and ensure a comprehensive safety net for their loved ones.

Tax Benefits

Term insurance policies also offer tax benefits under the Indian Income Tax Act. Premiums paid towards term insurance are eligible for tax deductions under Section 80C, up to ₹1.5 lakhs per year. Additionally, the death benefit received by the nominees is tax-free under Section 10(10D) of the Income Tax Act.

These tax benefits make term insurance an attractive option for individuals looking to optimize their tax planning while securing their financial future. By investing in term insurance, individuals can enjoy the dual benefit of financial protection and tax savings.

Performance and Market Trends

The term insurance market in India has witnessed significant growth over the past decade, with an increasing number of individuals recognizing the importance of financial protection. This growth can be attributed to several factors, including rising awareness, improving economic conditions, and the introduction of innovative products by insurance companies.

Market Growth and Penetration

According to a report by the Insurance Regulatory and Development Authority of India (IRDAI), the term insurance market in India grew at a CAGR of 25% from 2015 to 2020. This growth is expected to continue, with projections indicating a further expansion in the coming years. The increasing penetration of term insurance is a positive sign, indicating that more individuals are taking proactive steps to secure their financial futures.

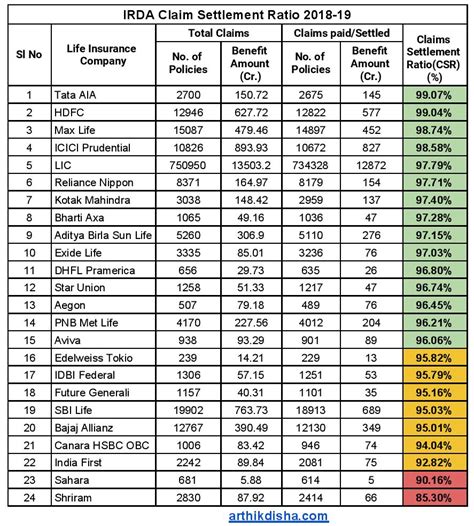

The table below provides a snapshot of the term insurance market growth in India over the past few years:

| Year | Premium Income (in crores) | Policy Sales (in lakhs) |

|---|---|---|

| 2018 | ₹5,200 | 32.5 |

| 2019 | ₹6,800 | 40.2 |

| 2020 | ₹8,500 | 48.7 |

Innovative Products and Features

Insurance companies in India have been introducing innovative term insurance products to cater to the diverse needs of policyholders. These products often come with unique features, such as increasing sum assured options, return of premium benefits, and flexible payment options.

For example, some term insurance policies offer the option to increase the sum assured annually, keeping pace with inflation and rising financial needs. Others provide a return of premium benefit, where a portion of the premiums paid is returned to the policyholder if the policy matures without a claim.

These innovative features not only enhance the value proposition of term insurance but also encourage more individuals to consider it as a viable financial protection option.

Online Term Insurance

The rise of digital platforms and online insurance providers has further revolutionized the term insurance landscape in India. Online term insurance policies offer convenience, simplicity, and often more competitive pricing. Policyholders can compare various options, calculate premiums, and purchase policies from the comfort of their homes.

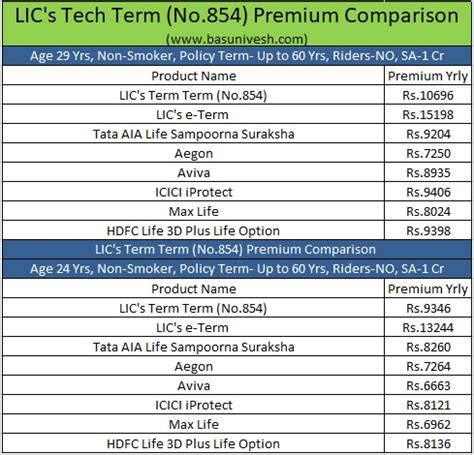

The table below compares the premium rates of online term insurance policies offered by three leading insurance companies in India for a 30-year-old individual with a sum assured of ₹1 crore:

| Insurance Company | Premium (per year) |

|---|---|

| Company A | ₹6,200 |

| Company B | ₹6,500 |

| Company C | ₹6,800 |

Real-Life Examples and Case Studies

Understanding the impact of term insurance through real-life examples can provide valuable insights into its significance. Here are a few case studies highlighting how term insurance has made a difference in the lives of individuals and their families.

Securing the Future of a Young Family

Mr. Sharma, a 35-year-old software engineer, decided to purchase a term insurance policy with a sum assured of ₹1 crore. With a young family and a mortgage to pay off, Mr. Sharma wanted to ensure that his wife and children would be financially secure even if something were to happen to him.

Unfortunately, Mr. Sharma passed away due to a sudden illness a few years later. His term insurance policy provided his family with the much-needed financial support, covering their mortgage payments, children's education expenses, and daily living costs. The sum assured allowed his wife to continue their planned lifestyle, ensuring that their children's future was not compromised.

Providing Peace of Mind for Senior Citizens

Mrs. Singh, a 60-year-old retired teacher, wanted to ensure that her children and grandchildren would not face financial difficulties in the event of her untimely demise. Despite her age, she was able to secure a term insurance policy with a sum assured of ₹20 lakhs, which provided her with peace of mind.

When Mrs. Singh passed away, her term insurance policy ensured that her children received the sum assured, which they used to cover her final expenses and provide financial support to her grandchildren. The policy's death benefit helped ease the financial burden during a difficult time, allowing the family to grieve without the added stress of financial worries.

Covering Unexpected Medical Expenses

Mr. Patel, a 42-year-old businessman, had a term insurance policy with a sum assured of ₹75 lakhs. He suffered a critical illness that required extensive medical treatment and hospitalization. Fortunately, his term insurance policy included a critical illness rider, which provided him with a lump sum benefit to cover his medical expenses.

The critical illness rider allowed Mr. Patel to focus on his recovery without worrying about the financial strain of his medical treatment. He was able to access the funds quickly, ensuring that his health received the necessary attention without compromising his financial stability.

Future Implications and Industry Insights

The term insurance market in India is expected to continue its upward trajectory, driven by increasing awareness, rising incomes, and evolving consumer preferences. Here are some key future implications and industry insights:

Digital Transformation

The insurance industry in India is undergoing a digital transformation, with more insurance companies embracing online platforms and digital technologies. This shift is expected to enhance customer experience, improve efficiency, and make term insurance more accessible to a wider audience.

Customized Solutions

Insurance companies are likely to continue developing innovative term insurance products with customized features. These products will cater to the diverse needs of policyholders, offering flexibility and tailored benefits. From increasing sum assured options to incorporating health and lifestyle-related riders, insurance providers will strive to meet the evolving demands of customers.

Regulatory Changes

The Insurance Regulatory and Development Authority of India (IRDAI) plays a crucial role in shaping the insurance industry. Future regulatory changes may impact the term insurance landscape, potentially introducing new guidelines, standards, or consumer protection measures. Insurance companies will need to adapt to these changes and ensure compliance while maintaining their focus on customer satisfaction.

Industry Collaboration and Partnerships

Insurance companies may explore partnerships and collaborations to enhance their term insurance offerings. These collaborations could involve technology companies, healthcare providers, or other financial institutions, enabling insurance providers to offer more comprehensive and integrated solutions. Such partnerships can lead to innovative products, improved customer experience, and expanded market reach.

Conclusion

Term insurance in India represents a powerful tool for financial planning and protection. With its affordable premiums, high sum assured, customizable features, and tax benefits, term insurance offers a comprehensive solution for individuals and families. The growing market, innovative products, and real-life success stories highlight the importance of term insurance in securing the financial future of loved ones.

As the insurance industry continues to evolve, individuals can look forward to more tailored and accessible term insurance options. By staying informed and actively managing their financial protection, individuals can ensure a secure and prosperous future for themselves and their families.

How does term insurance differ from other life insurance policies?

+Term insurance differs from other life insurance policies in that it provides coverage for a specified term, offering a death benefit without accumulating cash value. In contrast, whole life or endowment policies provide both death benefits and cash value accumulation over time.

What are the key factors that influence term insurance premiums?

+Term insurance premiums are influenced by factors such as the policyholder’s age, health status, chosen sum assured, and the term of the policy. Generally, younger individuals with good health and a lower sum assured can expect more affordable premiums.

Can term insurance policies be renewed or extended beyond the initial term?

+Yes, many term insurance policies offer the option to renew or extend the coverage beyond the initial term. Renewal or extension terms may vary depending on the insurance company and the policy terms and conditions.