Health Insurance Marketplace

The Health Insurance Marketplace, often referred to as the Health Insurance Exchange, is a fundamental component of the Affordable Care Act (ACA) in the United States. It serves as a vital platform for individuals, families, and small businesses to access affordable health insurance options. With the implementation of the ACA, the marketplace has played a significant role in expanding healthcare coverage and improving accessibility for millions of Americans. In this comprehensive article, we will delve into the intricacies of the Health Insurance Marketplace, exploring its history, functionality, and the benefits it offers to individuals seeking comprehensive healthcare coverage.

A Brief History of the Health Insurance Marketplace

The concept of a health insurance marketplace emerged as a solution to address the challenges faced by individuals and families in obtaining affordable and comprehensive health coverage. Prior to the Affordable Care Act, many Americans struggled to find insurance plans that suited their needs and budgets, particularly those with pre-existing conditions or low incomes. The ACA aimed to rectify these issues by establishing a regulated and competitive marketplace where individuals could compare and purchase insurance plans.

The Health Insurance Marketplace was officially launched in 2014, alongside the implementation of key provisions of the ACA. Since its inception, the marketplace has undergone several significant updates and improvements to enhance user experience and expand coverage options. These updates have focused on streamlining the enrollment process, offering more tailored plan recommendations, and providing additional support for individuals with specific healthcare needs.

Understanding the Health Insurance Marketplace

The Health Insurance Marketplace operates as a centralized platform where individuals can compare and select health insurance plans from various providers. It is designed to be user-friendly and accessible, ensuring that even those with limited healthcare knowledge can navigate the process effectively. The marketplace is accessible both online and through dedicated assistance centers, making it convenient for individuals across the nation to explore their options.

Eligibility and Enrollment

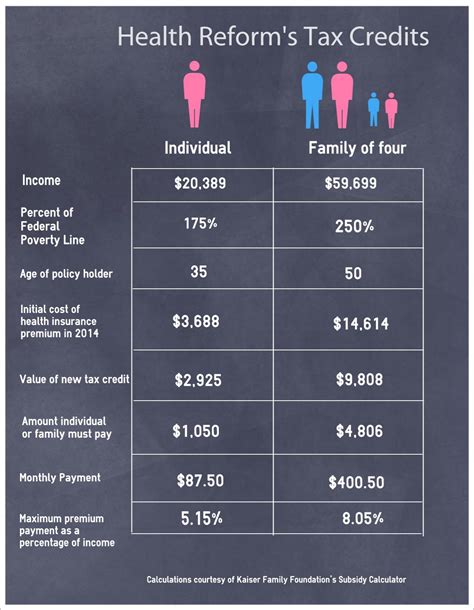

Eligibility for the Health Insurance Marketplace is determined by several factors, including income, family size, and citizenship status. Individuals and families with incomes below a certain threshold may qualify for premium tax credits and cost-sharing reductions, making insurance more affordable. Additionally, the marketplace offers special enrollment periods for qualifying life events, such as marriage, birth of a child, or loss of other coverage.

The enrollment process typically begins with creating an account on the marketplace website. Users are guided through a series of questions to determine their eligibility and recommended plans. The platform provides clear and concise information about each plan's coverage, costs, and benefits, allowing individuals to make informed choices based on their specific healthcare needs and financial situation.

Plan Options and Features

The Health Insurance Marketplace offers a diverse range of insurance plans to cater to the varied needs of its users. These plans are categorized into metal tiers, such as Bronze, Silver, Gold, and Platinum, based on the level of coverage and out-of-pocket costs. Each tier represents a different balance between premiums, deductibles, and copayments, providing individuals with flexibility to choose a plan that aligns with their healthcare utilization and financial preferences.

In addition to the metal tiers, the marketplace also offers catastrophic plans for individuals under 30 or those with hardship exemptions. These plans provide limited coverage but can be a more affordable option for those who rarely require medical services. Additionally, the marketplace may offer dental and vision plans, further expanding the range of healthcare options available to individuals.

| Plan Tier | Coverage Level | Out-of-Pocket Costs |

|---|---|---|

| Bronze | 60% | Lower Premiums, Higher Deductibles |

| Silver | 70% | Balanced Premiums and Deductibles |

| Gold | 80% | Higher Premiums, Lower Deductibles |

| Platinum | 90% | Highest Premiums, Lowest Deductibles |

Network Providers and Coverage

Each insurance plan offered on the Health Insurance Marketplace has a network of healthcare providers, including doctors, hospitals, and specialists. These networks vary between plans, and individuals should carefully review the network to ensure their preferred providers are included. The marketplace provides detailed information about each plan’s network, allowing users to make informed decisions based on their healthcare preferences and existing relationships with providers.

In addition to traditional healthcare services, the marketplace plans also cover essential health benefits, such as preventive care, hospitalization, maternity care, and prescription drugs. These benefits are standardized across all plans, ensuring that individuals receive comprehensive coverage regardless of their chosen provider.

Benefits and Advantages of the Health Insurance Marketplace

The Health Insurance Marketplace offers numerous benefits and advantages to individuals seeking affordable and comprehensive healthcare coverage. Here are some key advantages:

- Affordability: The marketplace provides access to a wide range of insurance plans, many of which are eligible for premium tax credits and cost-sharing reductions. These subsidies can significantly reduce the cost of coverage, making healthcare more affordable for individuals and families with lower incomes.

- Expanded Coverage: The ACA and the Health Insurance Marketplace have significantly expanded healthcare coverage for Americans. Individuals with pre-existing conditions are no longer denied coverage or charged higher premiums, ensuring that everyone has equal access to quality healthcare.

- Comparison and Choice: The marketplace allows individuals to compare different insurance plans side by side, evaluating factors such as coverage, costs, and provider networks. This transparency empowers individuals to make informed decisions and choose a plan that best suits their needs and budget.

- Special Enrollment Periods: The marketplace offers special enrollment periods for qualifying life events, ensuring that individuals can obtain coverage when they need it most. This flexibility is particularly beneficial for those experiencing changes in their personal or professional circumstances.

- Consumer Protections: The Health Insurance Marketplace operates under strict regulations and consumer protections. This ensures that insurance providers cannot discriminate based on health status or gender and provides consumers with the peace of mind that they are receiving fair and transparent treatment.

Navigating the Health Insurance Marketplace

Navigating the Health Insurance Marketplace can be a complex process, but several resources are available to assist individuals in making informed choices. Here are some tips and considerations to keep in mind:

- Start early: Open enrollment periods typically begin in the fall, so it's essential to start researching and comparing plans well in advance. This allows individuals to thoroughly evaluate their options and make a confident decision.

- Understand your needs: Assess your healthcare needs and consider factors such as regular medications, chronic conditions, and preferred providers. This will help you narrow down the most suitable plans and ensure you receive the coverage you require.

- Review plan details: Carefully review each plan's coverage, costs, and provider network. Pay attention to deductibles, copayments, and out-of-pocket maximums to understand the financial implications of each plan.

- Seek assistance: If you need help understanding the marketplace or choosing a plan, you can reach out to dedicated assistance centers or enroll the help of a licensed insurance agent. These professionals can provide guidance and ensure you select a plan that aligns with your needs.

- Stay informed: Stay updated on any changes or updates to the marketplace, as plans and coverage options may evolve from year to year. Regularly check the marketplace website and official sources for the latest information.

Future Implications and Ongoing Developments

The Health Insurance Marketplace continues to evolve and adapt to meet the changing needs of Americans. As healthcare policies and regulations evolve, the marketplace plays a crucial role in ensuring accessibility and affordability of healthcare coverage. Here are some future implications and ongoing developments to consider:

- Expanding Coverage Options: Efforts are being made to expand the range of insurance plans available on the marketplace, particularly in areas with limited options. This includes encouraging the participation of more insurance providers and exploring innovative plan designs to cater to diverse healthcare needs.

- Improving User Experience: Ongoing improvements are focused on enhancing the user experience of the marketplace website and enrollment process. This includes simplifying language, providing clearer explanations of plan features, and implementing user-friendly tools to assist individuals in making informed choices.

- Addressing Cost Concerns: The marketplace aims to address rising healthcare costs by implementing strategies to control premiums and out-of-pocket expenses. This may involve negotiating with insurance providers, promoting competition, and exploring cost-saving measures to make coverage more affordable for individuals.

- Advancing Healthcare Equity: The marketplace plays a vital role in promoting healthcare equity by ensuring that individuals with pre-existing conditions or low incomes have equal access to coverage. Ongoing efforts focus on eliminating healthcare disparities and ensuring that all Americans, regardless of their background, can obtain the healthcare they need.

What is the Health Insurance Marketplace, and how does it work?

+The Health Insurance Marketplace is a platform established by the Affordable Care Act to provide individuals, families, and small businesses with access to affordable health insurance options. It operates as a centralized hub where users can compare and select insurance plans from various providers. The marketplace simplifies the enrollment process, offers tailored plan recommendations, and provides comprehensive information to assist individuals in making informed choices.

Who is eligible to use the Health Insurance Marketplace?

+Eligibility for the Health Insurance Marketplace is based on factors such as income, family size, and citizenship status. Individuals and families with incomes below a certain threshold may qualify for premium tax credits and cost-sharing reductions. The marketplace also offers special enrollment periods for qualifying life events, such as marriage, birth of a child, or loss of other coverage.

What are the different plan options available on the Health Insurance Marketplace?

+The Health Insurance Marketplace offers a diverse range of insurance plans categorized into metal tiers (Bronze, Silver, Gold, Platinum) based on coverage and out-of-pocket costs. Each tier represents a different balance between premiums, deductibles, and copayments. The marketplace also offers catastrophic plans for individuals under 30 or with hardship exemptions and may provide dental and vision plans.

How do I choose the right insurance plan on the Health Insurance Marketplace?

+Choosing the right insurance plan involves evaluating your healthcare needs and financial situation. Consider factors such as regular medications, chronic conditions, and preferred providers. Review each plan’s coverage, costs, and provider network to ensure it aligns with your needs. Seek assistance from dedicated assistance centers or licensed insurance agents if needed.

Are there any consumer protections in place on the Health Insurance Marketplace?

+Yes, the Health Insurance Marketplace operates under strict regulations and consumer protections. Insurance providers cannot discriminate based on health status or gender, ensuring fair and transparent treatment for all consumers. Additionally, the marketplace offers special enrollment periods for qualifying life events, providing flexibility and coverage when needed.