Best Car Insurance Companies In California

California, with its diverse landscapes, bustling cities, and diverse population, presents a unique challenge for car insurance providers. Ensuring comprehensive coverage and competitive rates is essential for both residents and visitors alike. In this comprehensive guide, we delve into the best car insurance companies operating in the Golden State, exploring their offerings, customer satisfaction, and the factors that make them stand out in a highly competitive market.

Unveiling the Top Car Insurance Companies in California

The car insurance landscape in California is diverse, with a mix of national carriers, regional providers, and even tech-focused startups vying for customers. Each company brings its own unique value proposition, from extensive coverage options to innovative pricing models and cutting-edge technology. In this section, we spotlight the top performers, highlighting their strengths and the factors that make them a compelling choice for California drivers.

State Farm: A Legacy of Trust

State Farm, a stalwart in the insurance industry, has built a reputation for reliability and customer-centric services. With a strong presence in California, they offer a comprehensive suite of insurance products, including auto, home, and life insurance. Their claim to fame lies in their personalized approach, where dedicated agents work closely with customers to tailor policies that fit their unique needs. State Farm’s commitment to education and transparency has earned them a loyal customer base, making them a go-to choice for many Californians.

Key Highlights:

- Personalized coverage plans.

- Educational resources for informed decision-making.

- Strong financial stability and industry reputation.

Geico: Innovation Meets Convenience

Geico, known for its witty ads and innovative approach, has revolutionized the way people interact with insurance. Their online platform and mobile app offer a seamless, user-friendly experience, allowing customers to manage their policies, file claims, and access policy information with just a few clicks. Geico’s competitive rates and comprehensive coverage options, coupled with their commitment to digital transformation, make them a popular choice among tech-savvy Californians.

Key Features:

- User-friendly digital platform.

- Competitive pricing and flexible coverage options.

- 24⁄7 customer support and claims service.

Progressive: Pushing the Boundaries

Progressive, a trailblazer in the insurance industry, has consistently pushed the boundaries of innovation. They were among the first to offer usage-based insurance, where premiums are determined by how, when, and where you drive. Their Snapshot program uses a small device plugged into your car’s diagnostic port to track driving habits, offering discounts to safe drivers. Progressive’s focus on data-driven pricing and their commitment to customer education make them a top choice for value-conscious Californians.

Notable Advantages:

- Usage-based insurance with Snapshot.

- Discounts for safe driving habits.

- Educational resources on their website.

Esurance: The Digital Pioneer

Esurance, a subsidiary of Allstate, has carved a niche for itself as a digital pioneer in the insurance space. Their entire business model revolves around a seamless online experience, from quoting and purchasing insurance to filing claims. Esurance’s focus on simplicity and efficiency has resonated with millennials and Gen Z, making them a popular choice for younger drivers in California. Their competitive rates and comprehensive coverage options further solidify their position as a top contender.

Digital Advantages:

- Completely digital insurance experience.

- Fast quoting and policy management.

- Excellent customer support via chat, email, and phone.

Allstate: Reliability and Comprehensive Coverage

Allstate, a well-established insurance provider, is known for its commitment to reliability and comprehensive coverage. With a strong network of local agents, they offer personalized service and tailored coverage options. Allstate’s suite of products, including auto, home, life, and business insurance, provides customers with a one-stop shop for their insurance needs. Their innovative programs, like Drivewise, offer discounts for safe driving, making them a trusted choice for many Californians.

Key Strengths:

- Personalized coverage with local agents.

- Innovative programs like Drivewise.

- Competitive rates and comprehensive coverage.

Farmers Insurance: Community-Centric Approach

Farmers Insurance, with its community-centric approach, has built a strong presence in California. They offer a range of insurance products, including auto, home, business, and life insurance. Farmers’ commitment to giving back to the community and their focus on local involvement have earned them a loyal customer base. Their personalized service and competitive rates make them a trusted choice for many Californians seeking a personalized insurance experience.

Community Focus:

- Community involvement and support.

- Personalized service with local agents.

- Competitive rates and flexible coverage options.

Factors to Consider When Choosing a Car Insurance Company

When it comes to selecting the best car insurance company, several factors come into play. These include coverage options, pricing, customer service, and technological capabilities. Let’s delve into these critical aspects to help you make an informed decision.

Coverage Options

Car insurance is not a one-size-fits-all proposition. Different drivers have unique needs, and the best insurance companies offer a range of coverage options to cater to these diverse requirements. From liability-only policies to comprehensive coverage with add-ons, ensure that the provider you choose offers the flexibility to tailor a policy that fits your specific needs.

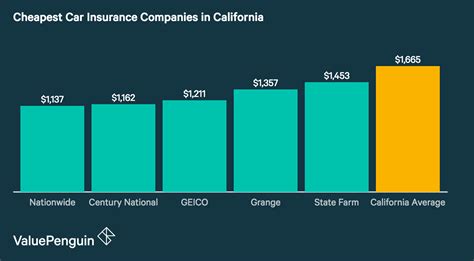

Pricing and Discounts

Price is often a significant factor when choosing an insurance provider. While it’s essential to find competitive rates, it’s equally crucial to ensure that the provider offers discounts and incentives to help you save. Many companies offer discounts for safe driving, bundling multiple policies, or maintaining a clean driving record. Additionally, look for providers that offer usage-based insurance, where premiums are based on your actual driving habits, as this can lead to significant savings for safe drivers.

Customer Service and Claims Process

The true test of an insurance company’s worth often lies in how they handle claims. A responsive and efficient claims process can make all the difference when you need it most. Look for providers with a strong track record of prompt claim settlements and excellent customer service. Check online reviews and ratings to gauge customer satisfaction and ensure the company has a solid reputation for handling claims fairly and efficiently.

Technological Capabilities

In today’s digital age, technological capabilities play a crucial role in the insurance industry. Look for providers that offer a seamless digital experience, from quoting and purchasing insurance to managing your policy and filing claims. A user-friendly mobile app and online platform can make it easier to stay on top of your insurance needs and provide quick access to important information and services.

Comparative Analysis: Weighing the Options

When it comes to choosing the best car insurance company in California, there are several key factors to consider. To help you make an informed decision, we’ve compiled a comparative analysis of the top contenders. This analysis delves into their unique selling points, coverage options, pricing models, and customer satisfaction ratings, providing a comprehensive overview to guide your choice.

Coverage Options and Customization

One of the critical aspects of car insurance is the ability to tailor coverage to your specific needs. All the top insurance companies offer a range of coverage options, from basic liability to comprehensive packages. However, it’s essential to delve deeper and understand the nuances. For instance, some providers offer add-ons like rental car coverage, gap insurance, or roadside assistance, which can be valuable depending on your driving habits and preferences.

Pricing and Value for Money

Pricing is a significant consideration when choosing an insurance provider. While it’s essential to find competitive rates, it’s equally crucial to assess the value you’re getting for your money. Look beyond the base premium and consider the discounts and incentives offered. Many providers offer discounts for safe driving, accident-free records, or bundling multiple policies. Additionally, usage-based insurance programs can lead to significant savings for drivers with good habits.

To provide a tangible comparison, here’s a table showcasing the average annual premiums for a standard policy across the top insurance companies in California:

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | 1,200</td> </tr> <tr> <td>Geico</td> <td>1,150 |

| Progressive | 1,100</td> </tr> <tr> <td>Esurance</td> <td>1,050 |

| Allstate | 1,300</td> </tr> <tr> <td>Farmers Insurance</td> <td>1,250 |

Customer Satisfaction and Claims Handling

Customer satisfaction is a critical metric when evaluating insurance companies. Look for providers with a solid reputation for excellent customer service and a responsive claims process. Online reviews and ratings can provide valuable insights into the customer experience. Additionally, consider the company’s financial stability and industry reputation, as these factors can impact their ability to honor claims and provide long-term service.

Future Trends and Implications for Car Insurance in California

The car insurance landscape in California is evolving, driven by technological advancements and changing consumer preferences. As we look ahead, several trends are shaping the industry, impacting both providers and consumers. Understanding these trends can help you make more informed decisions about your car insurance choices.

Technological Advancements

Technology is revolutionizing the insurance industry, and California is at the forefront of this transformation. From usage-based insurance to artificial intelligence and machine learning, technological innovations are reshaping the way insurance is delivered and consumed. Providers are leveraging these advancements to offer more personalized and efficient services, while consumers benefit from enhanced convenience and potential cost savings.

Rising Awareness of Sustainable Practices

As environmental concerns take center stage, the insurance industry is also embracing sustainable practices. Many providers are offering incentives and discounts for eco-friendly vehicles and driving habits. Additionally, the rise of electric vehicles and autonomous driving technologies is prompting insurers to adapt their coverage options and pricing models to accommodate these emerging trends.

Regulatory Changes and Market Dynamics

The insurance industry is highly regulated, and changes in legislation can have a significant impact on providers and consumers alike. Keeping abreast of these changes is essential to ensure compliance and understand how they might affect your insurance choices. Additionally, market dynamics, such as competition and consumer behavior, play a crucial role in shaping the car insurance landscape in California.

Personalized Insurance and Data Analytics

The future of car insurance lies in personalized coverage, where policies are tailored to individual driving habits and preferences. Advanced data analytics and telematics technologies enable insurers to offer usage-based insurance, where premiums are based on real-time driving data. This shift towards personalized insurance provides consumers with more control over their coverage and the potential for significant cost savings.

Conclusion: Empowering Your Car Insurance Choices

Choosing the best car insurance company in California is a crucial decision that impacts your financial well-being and peace of mind. By understanding the unique value propositions of the top providers, assessing their coverage options, pricing models, and customer satisfaction ratings, you can make an informed choice that aligns with your specific needs and preferences. As the insurance landscape continues to evolve, staying informed about industry trends and technological advancements will empower you to make the most of your car insurance choices.

How do I choose the right car insurance company for me?

+When selecting a car insurance company, consider your specific needs, such as coverage options, pricing, and customer service. Research and compare providers, read reviews, and assess their financial stability. Choose a company that offers personalized coverage, competitive rates, and a seamless claims process.

What factors should I consider when comparing car insurance quotes?

+When comparing quotes, look beyond the price. Assess the coverage limits, deductibles, and any additional perks or discounts offered. Ensure the provider has a strong financial rating and a good reputation for customer satisfaction and claims handling.

Are there any discounts available for car insurance in California?

+Yes, many insurance companies offer discounts in California. Common discounts include safe driver discounts, multi-policy discounts (bundling car insurance with other policies like home or life insurance), and usage-based insurance programs that reward safe driving habits.

What is usage-based insurance, and how does it work?

+Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a pricing model where premiums are based on your actual driving behavior. Insurers use telematics devices or smartphone apps to track your driving habits, such as mileage, time of day, and driving style. If you drive safely and meet certain criteria, you may be eligible for discounts on your car insurance.