Best Prices On Auto Insurance

In today's fast-paced world, staying protected and financially secure is a top priority for every individual. Auto insurance is a vital aspect of modern life, providing peace of mind and financial coverage in case of unexpected accidents or damages. With numerous insurance providers offering a range of policies, finding the best prices on auto insurance can be a daunting task. However, with the right approach and knowledge, you can navigate the market and secure the most affordable coverage for your vehicle.

Understanding Auto Insurance Policies

Before delving into the world of auto insurance prices, it’s crucial to grasp the fundamentals of these policies. Auto insurance policies are designed to protect you financially in the event of accidents, theft, or other vehicle-related incidents. They typically consist of various coverage types, each catering to specific needs and providing different levels of protection.

The main types of auto insurance coverage include:

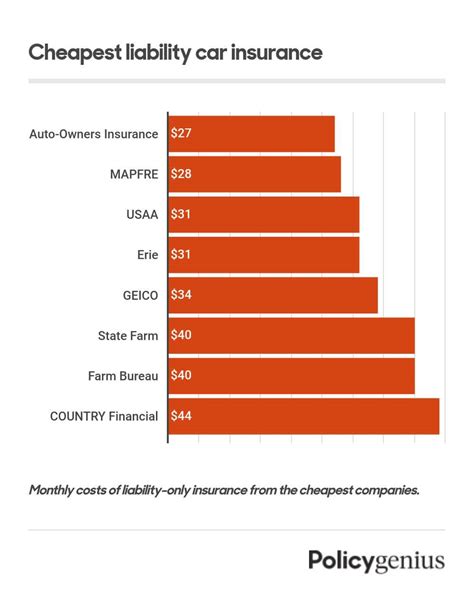

- Liability Coverage: This is the most basic form of insurance, covering damages you cause to others' property or injuries you inflict on others. It is legally required in most states and is essential for protecting your financial well-being.

- Collision Coverage: This coverage pays for repairs or replacements of your vehicle if you are involved in a collision, regardless of who is at fault. It is particularly beneficial for newer or more expensive vehicles.

- Comprehensive Coverage: This type of insurance provides protection against non-collision-related incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It offers a comprehensive safety net for your vehicle.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault. It is especially crucial in states with no-fault insurance laws.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

When shopping for auto insurance, it's essential to consider your specific needs and circumstances. Factors such as the age and value of your vehicle, your driving record, and the level of coverage you desire will influence the type of policy and price you should aim for.

Factors Affecting Auto Insurance Prices

The price of auto insurance policies can vary significantly depending on several key factors. Understanding these factors can help you make informed decisions when comparing quotes and finding the best deals.

Vehicle Type and Age

The make, model, and age of your vehicle play a significant role in determining insurance prices. Insurance companies consider the repair and replacement costs associated with different vehicles, as well as their safety ratings and theft rates. Generally, newer and more expensive vehicles tend to have higher insurance premiums.

For example, a luxury sports car with high-performance capabilities may attract a higher insurance premium compared to a standard sedan. Similarly, vehicles with advanced safety features or those less prone to theft may be eligible for discounts.

Driver’s Profile and History

Your driving record and personal profile are crucial factors in insurance pricing. Insurance companies analyze your driving history, including any accidents, claims, or traffic violations, to assess your risk level. A clean driving record with no major incidents typically results in lower insurance premiums.

Additionally, personal factors such as age, gender, marital status, and credit score can impact insurance prices. Younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk. However, certain life events, such as marriage or reaching a certain age, may lead to reduced rates.

Coverage and Deductibles

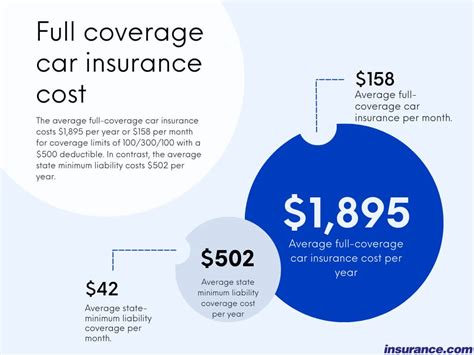

The level of coverage you choose and the associated deductibles can greatly affect your insurance prices. Comprehensive coverage and collision coverage, while offering more protection, tend to come with higher premiums. On the other hand, increasing your deductible (the amount you pay out of pocket before insurance kicks in) can lower your monthly premiums.

It's essential to strike a balance between coverage and affordability. Opting for higher deductibles may save you money in the short term, but it means you'll have to pay more out of pocket if you need to make a claim.

Location and Usage

Your geographic location and the intended usage of your vehicle also impact insurance prices. Insurance companies consider factors such as crime rates, traffic density, and weather conditions in your area. Areas with higher crime rates or frequent accidents may result in higher premiums.

Furthermore, the purpose for which you use your vehicle can affect insurance costs. If you primarily use your car for commuting to work or personal travel, your insurance rates may be lower compared to those who use their vehicles for business purposes or long-distance travel.

Tips for Finding the Best Auto Insurance Prices

Now that we’ve explored the key factors influencing auto insurance prices, let’s dive into some practical tips to help you find the best deals and secure the most affordable coverage for your vehicle.

Compare Multiple Quotes

The insurance market is highly competitive, and prices can vary significantly between providers. By obtaining multiple quotes from different insurance companies, you can compare prices and coverage options to find the best value. Online comparison tools and insurance brokers can simplify this process and provide a comprehensive overview of available options.

Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies together. For instance, if you have homeowners or renters insurance, consider combining it with your auto insurance to potentially save on both policies. Bundling can lead to significant cost savings, especially if you’re a loyal customer with a good claims history.

Utilize Discounts

Insurance companies often provide various discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: Insurance companies reward drivers with clean records and no recent accidents or violations. If you’ve maintained a good driving record, you may be eligible for this discount.

- Good Student Discount: Many insurance providers offer discounts to young drivers who maintain good grades in school. This discount recognizes the correlation between academic achievement and responsible driving.

- Loyalty Discount: If you’ve been a loyal customer with a single insurance provider for an extended period, you may qualify for a loyalty discount. Insurance companies appreciate long-term customers and often reward their loyalty with reduced rates.

- Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, or collision avoidance systems, may be eligible for discounts. Insurance companies recognize the reduced risk associated with these safety enhancements.

Adjust Coverage and Deductibles

Reviewing your coverage and deductible levels regularly can help you optimize your insurance costs. If you’ve been accident-free for an extended period or your vehicle has depreciated in value, you may consider reducing your coverage or increasing your deductible to save on premiums.

However, it's essential to strike a balance and ensure you have adequate coverage to protect your financial interests. Consult with an insurance professional to determine the right coverage and deductible levels for your specific circumstances.

Shop Around Regularly

Insurance prices can change over time, and new providers may offer more competitive rates. It’s a good practice to shop around and compare quotes annually or whenever you renew your policy. This ensures you’re not missing out on better deals and allows you to take advantage of any changes in the market.

Additionally, keep an eye out for special promotions or discounts offered by insurance companies. These offers can provide temporary savings and help you secure the best prices on auto insurance.

The Future of Auto Insurance Pricing

The auto insurance industry is evolving, and new technologies and trends are shaping the way prices are determined. Here’s a glimpse into the future of auto insurance pricing and how it may impact policyholders.

Telematics and Usage-Based Insurance

Telematics technology, which involves tracking driving behavior through devices or smartphone apps, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer insurance rates based on actual driving behavior rather than generalized risk assessments.

With telematics, insurance companies can analyze factors such as driving speed, acceleration, braking patterns, and mileage to determine a more accurate risk profile for individual drivers. This technology allows for more personalized insurance rates, rewarding safe drivers with lower premiums.

Data Analytics and Artificial Intelligence

Advancements in data analytics and artificial intelligence (AI) are transforming the way insurance companies assess risk and price policies. By analyzing vast amounts of data, including driving behavior, accident history, and external factors like weather and traffic conditions, insurance providers can make more accurate predictions and offer more precise pricing.

AI algorithms can identify patterns and correlations between different variables, allowing insurance companies to fine-tune their risk assessments and offer more tailored insurance products. This level of precision can benefit both insurance providers and policyholders by ensuring fair and accurate pricing.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced sensors and communication systems, is set to revolutionize auto insurance. Connected cars generate real-time data on vehicle performance, driver behavior, and surrounding conditions, providing insurance companies with a wealth of information to assess risk.

With connected car technology, insurance companies can offer more dynamic and personalized insurance rates. For instance, if a vehicle's sensors detect safe driving behavior, the insurance provider may offer instant discounts or rewards. Conversely, if risky driving patterns are identified, the insurance company can provide feedback and recommendations to improve driving habits.

Conclusion: Navigating the Auto Insurance Landscape

Finding the best prices on auto insurance requires a comprehensive understanding of the market, your specific needs, and the various factors that influence insurance premiums. By familiarizing yourself with the different types of coverage, exploring available discounts, and regularly comparing quotes, you can make informed decisions and secure the most affordable and suitable insurance policy for your vehicle.

As the auto insurance industry continues to evolve with technological advancements, policyholders can expect more personalized and data-driven pricing models. Telematics, data analytics, and connected car technology will play increasingly significant roles in shaping the future of auto insurance, offering more accurate risk assessments and tailored insurance products.

Stay informed, shop around, and take advantage of the latest innovations to ensure you're getting the best prices on auto insurance.

How do I choose the right level of coverage for my auto insurance policy?

+The right level of coverage depends on your specific needs and circumstances. Consider factors such as the age and value of your vehicle, your driving record, and your financial situation. Consult with an insurance professional to determine the coverage types and limits that provide adequate protection without unnecessary expenses.

Are there any ways to reduce my auto insurance premiums without compromising coverage?

+Yes, there are several strategies to reduce your premiums without sacrificing coverage. Consider increasing your deductible, which can lower your monthly premiums. Additionally, maintaining a clean driving record, taking advantage of available discounts, and bundling policies can lead to significant cost savings.

What should I look for when comparing auto insurance quotes?

+When comparing auto insurance quotes, pay attention to the coverage limits, deductibles, and any additional benefits or perks offered by each provider. Ensure that the quotes you receive cover all the essential aspects of your vehicle and driving needs. Compare prices, but also consider the reputation and financial stability of the insurance company.

How often should I review and update my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. Life events such as getting married, buying a new vehicle, or moving to a different location may impact your insurance needs. Regularly reviewing your policy ensures you have the right coverage and aren’t paying for unnecessary premiums.