General Liability Small Business Insurance

General Liability Insurance: Protecting Your Small Business with Comprehensive Coverage

As a small business owner, safeguarding your venture against unforeseen circumstances is paramount. Among the various insurance options, General Liability Insurance stands out as a cornerstone of protection. This essential coverage safeguards your business from a wide range of risks, ensuring that you can focus on growth and innovation without the constant worry of potential liabilities.

In this comprehensive guide, we will delve into the intricacies of General Liability Insurance, exploring its importance, coverage, and how it can benefit your small business. Whether you're a startup or an established enterprise, understanding this form of insurance is crucial for long-term success and peace of mind.

Understanding General Liability Insurance

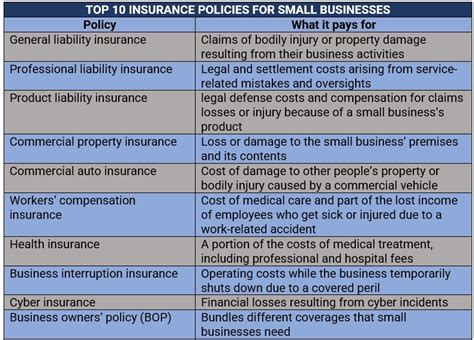

General Liability Insurance, often referred to as GL Insurance, is a vital policy that provides coverage for various types of claims against your business, protecting you from financial losses and legal expenses. It is designed to shield small businesses from the unexpected, ensuring they can weather the storms of litigation and unforeseen events.

This insurance coverage acts as a safety net, offering protection against a broad spectrum of risks, including bodily injury, property damage, personal and advertising injury, and even coverage for certain types of professional services. By investing in General Liability Insurance, small business owners can rest assured knowing they have a robust defense mechanism in place, ready to tackle any legal or financial challenges that may arise.

Key Coverage Areas

- Bodily Injury and Property Damage: General Liability Insurance covers claims arising from accidents or incidents that result in bodily harm or property damage. This includes slip-and-fall accidents, product defects, or any other situation where your business is held responsible.

- Personal and Advertising Injury: This coverage protects your business against claims of defamation, copyright infringement, or other forms of reputational harm. It ensures that your brand and reputation remain intact, even in the face of legal challenges.

- Professional Liability (for Select Professions): While General Liability Insurance typically doesn't cover professional services, certain policies offer an extension known as Professional Liability Insurance or Errors and Omissions Insurance. This provides coverage for mistakes or negligence in the provision of professional services, such as legal or medical advice.

By understanding these key coverage areas, small business owners can tailor their General Liability Insurance policies to fit their unique needs, ensuring comprehensive protection against a wide range of potential risks.

Why General Liability Insurance is Essential for Small Businesses

In the dynamic world of small business, unforeseen events can have a significant impact on your operations and finances. General Liability Insurance serves as a crucial safety net, offering several benefits that contribute to the overall stability and success of your venture.

Financial Protection and Peace of Mind

One of the primary advantages of General Liability Insurance is the financial protection it provides. In the event of a claim, your insurance policy will cover the costs associated with legal defense, settlements, and judgments. This means that even if you're faced with a significant lawsuit, your business finances won't be devastated, ensuring you can continue operating and planning for the future.

Furthermore, the peace of mind that comes with having General Liability Insurance is invaluable. Knowing that you're protected against a wide range of risks allows you to focus on what matters most: growing your business, innovating, and providing excellent products or services to your customers. It removes the constant worry of potential liabilities, allowing you to approach each day with confidence and clarity.

Building Trust and Credibility

In today's business landscape, credibility and trust are essential for success. Potential clients, partners, and investors often look for signs of stability and reliability when considering a business relationship. Having General Liability Insurance demonstrates your commitment to professional standards and risk management. It shows that you take your responsibilities seriously and are prepared for any challenges that may arise.

By investing in General Liability Insurance, you send a powerful message to your stakeholders: your business is well-managed, and you prioritize the protection of your customers, employees, and the public. This level of trust and credibility can be a decisive factor in securing new business opportunities and maintaining strong relationships with your network.

Customizing Your General Liability Insurance Policy

Every small business is unique, and your General Liability Insurance policy should reflect your specific needs and circumstances. When choosing a policy, it's essential to consider various factors to ensure you have the right coverage in place.

Assessing Your Business Risks

Start by conducting a thorough risk assessment of your business. Identify the potential hazards and liabilities associated with your industry, location, and operations. Consider factors such as the number of employees, the nature of your customer interactions, and any specific risks unique to your business model.

By understanding your business risks, you can make informed decisions about the coverage limits and additional endorsements you may need. For instance, if your business involves frequent customer interactions, you may want to consider higher limits for bodily injury and property damage claims. Similarly, if you operate in an industry prone to litigation, such as healthcare or legal services, you might opt for additional coverage for personal and advertising injury.

Tailoring Coverage Limits and Endorsements

General Liability Insurance policies typically offer flexibility in terms of coverage limits. You can choose the amount of protection that aligns with your business's financial capacity and the level of risk you're comfortable with. It's essential to strike a balance between adequate coverage and affordability.

In addition to the base policy, you can also opt for various endorsements or add-ons to customize your coverage further. These endorsements can provide additional protection for specific risks or expand the scope of your policy. For example, you might consider adding coverage for cyber liability, employment practices liability, or product liability, depending on your business's unique needs.

Working with an Insurance Professional

Navigating the world of insurance can be complex, especially when it comes to customizing your policy. Working with an experienced insurance professional can be invaluable in ensuring you make the right choices for your small business.

An insurance broker or agent can provide expert guidance, helping you understand the intricacies of General Liability Insurance and how it applies to your specific situation. They can assess your business risks, recommend suitable coverage limits and endorsements, and even negotiate with insurance providers to secure the best possible rates. By leveraging their expertise, you can have confidence in your insurance decisions and focus on running your business.

Case Studies: Real-World Examples of General Liability Insurance in Action

Understanding the importance of General Liability Insurance is one thing, but seeing its impact in real-world scenarios can provide valuable insight into its practical benefits. Let's explore a couple of case studies that highlight how General Liability Insurance has protected small businesses and mitigated potential disasters.

Protecting a Retail Store from a Slip-and-Fall Incident

Imagine a small retail store owner who prides themselves on creating a welcoming environment for their customers. One day, an unfortunate incident occurs when a customer slips on a wet floor and sustains an injury. The customer files a lawsuit against the store, seeking compensation for medical expenses and pain and suffering.

In this scenario, General Liability Insurance proves to be a lifeline for the business owner. The insurance policy covers the legal costs associated with defending the lawsuit, including attorney fees and court expenses. Additionally, the policy provides financial protection for any settlement or judgment that may result from the case. Without General Liability Insurance, the store owner could face significant financial strain, potentially threatening the viability of their business.

Defending a Small Business against Copyright Infringement Claims

A small graphic design studio has built a solid reputation for creating innovative and eye-catching logos and branding materials for its clients. However, one day, they receive a cease-and-desist letter from a large corporation, alleging that the studio's latest design infringes on their trademarked logo. The corporation demands compensation and threatens legal action.

In this case, the studio's General Liability Insurance policy, which includes coverage for personal and advertising injury, steps in to provide crucial protection. The policy covers the legal fees associated with defending the studio against the copyright infringement claims. Additionally, if the studio is found to be at fault, the insurance policy can provide financial support for any settlement or judgment. This allows the studio to focus on resolving the issue and maintaining its reputation without the added stress of financial uncertainty.

The Future of General Liability Insurance for Small Businesses

As the business landscape continues to evolve, so too does the role of General Liability Insurance. With the rise of new technologies, changing consumer behaviors, and an increasingly global marketplace, small businesses must stay agile and adapt to emerging risks.

Adapting to New Risks and Technologies

The digital age has brought about a host of new risks and challenges for small businesses. From data breaches and cyberattacks to the increased use of remote work and online collaboration, the potential for liability has expanded significantly. General Liability Insurance policies are evolving to address these new risks, offering coverage for cyber liability, data breaches, and other digital threats.

Additionally, with the rise of e-commerce and online sales, small businesses are increasingly exposed to potential product liability claims. General Liability Insurance policies are adapting to include coverage for product defects and related liabilities, ensuring that businesses can continue to innovate and bring their products to market with confidence.

Embracing Innovation and Staying Competitive

In today's competitive business environment, small businesses must stay ahead of the curve to remain relevant and successful. This often involves embracing innovation, whether it's adopting new technologies, developing cutting-edge products, or offering unique services. However, with innovation comes increased risk, and General Liability Insurance plays a vital role in supporting this journey.

By providing financial protection and peace of mind, General Liability Insurance allows small businesses to take calculated risks and pursue innovative ventures without fear of devastating financial consequences. It enables businesses to focus on growth, market penetration, and staying ahead of the competition, knowing that their insurance coverage has their back.

The Role of Insurance Providers in Supporting Small Businesses

Insurance providers have a critical role to play in supporting small businesses and helping them navigate the complexities of General Liability Insurance. By offering tailored policies, expert guidance, and competitive rates, insurance companies can become trusted partners in the small business ecosystem.

Additionally, insurance providers can assist small businesses in staying abreast of emerging risks and industry trends. Through educational resources, webinars, and industry insights, insurance companies can empower small business owners to make informed decisions about their insurance coverage and overall risk management strategies. This partnership approach ensures that small businesses are well-equipped to face the challenges of the future with confidence and resilience.

Frequently Asked Questions

What is the difference between General Liability Insurance and Professional Liability Insurance?

+

General Liability Insurance provides broad coverage for various types of claims, including bodily injury, property damage, and personal and advertising injury. It is suitable for a wide range of businesses. On the other hand, Professional Liability Insurance, also known as Errors and Omissions Insurance, is designed specifically for professionals such as lawyers, doctors, and consultants. It covers claims arising from mistakes or negligence in the provision of professional services.

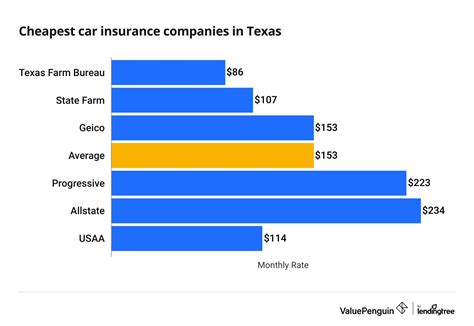

How much does General Liability Insurance typically cost for a small business?

+

The cost of General Liability Insurance can vary widely depending on factors such as the nature of your business, the level of risk, and the coverage limits you choose. On average, small businesses can expect to pay anywhere from 300 to 1,000 per year for a basic policy. However, it’s essential to assess your specific needs and risks to determine the appropriate coverage and pricing.

What are some common exclusions in General Liability Insurance policies?

+

General Liability Insurance policies typically exclude certain types of claims and risks. Common exclusions include intentional acts, contractual liabilities, employment-related practices, and pollution-related incidents. It’s crucial to carefully review the policy terms and conditions to understand what is and isn’t covered.

Can General Liability Insurance cover cyber-related risks and data breaches?

+

Yes, many General Liability Insurance policies now offer optional endorsements or add-ons that provide coverage for cyber-related risks and data breaches. These endorsements can include protection for network security, privacy liability, and even cyber extortion. It’s essential to discuss these options with your insurance provider to ensure you have adequate coverage for your digital operations.

How often should I review and update my General Liability Insurance policy?

+

It’s recommended to review your General Liability Insurance policy annually or whenever significant changes occur in your business. This includes changes in your operations, employee count, sales volume, or any other factors that may impact your risk profile. Regular policy reviews ensure that your coverage remains up-to-date and aligned with your business needs.