Full Auto Insurance

Welcome to this comprehensive guide on the often-overlooked aspect of vehicle ownership: full auto insurance. While many drivers are familiar with the concept of insurance, understanding the intricacies of full coverage is essential for ensuring both legal compliance and personal financial protection. In this article, we delve into the specifics of full auto insurance, exploring its benefits, costs, and the peace of mind it provides.

Understanding Full Auto Insurance

Full auto insurance, often referred to as comprehensive coverage, is a comprehensive policy that goes beyond the basic liability insurance. It provides a more extensive layer of protection, offering coverage for a wider range of incidents and situations. Unlike liability-only insurance, which primarily covers damages to other parties involved in an accident, full coverage extends its reach to include protection for your own vehicle, regardless of fault.

In the intricate world of auto insurance, understanding the nuances of full coverage is akin to deciphering a complex puzzle. It is a safeguard against the unforeseen, ensuring that you are not left financially vulnerable in the face of unexpected events. From natural disasters to vandalism, full auto insurance aims to provide a safety net, offering peace of mind and financial stability.

Key Benefits of Full Coverage

The benefits of full auto insurance are multifaceted and far-reaching. Here’s a breakdown of some of the most significant advantages:

- Collision Coverage: This component of full coverage ensures that your vehicle is protected in the event of a collision, regardless of who is at fault. Whether you’re involved in a fender bender or a more severe accident, collision coverage helps cover the costs of repairing or replacing your vehicle.

- Comprehensive Protection: As the name suggests, comprehensive coverage extends beyond collisions. It includes protection against a wide range of incidents, such as theft, vandalism, natural disasters like hailstorms or floods, and even damage caused by animals. This comprehensive protection provides a safety net for unforeseen circumstances.

- Medical Payments: In addition to vehicle damage, full auto insurance often includes medical payments coverage. This provision ensures that you and your passengers’ medical expenses are covered in the event of an accident, regardless of fault. It provides a vital safety net for unexpected medical costs, ensuring prompt access to necessary care.

- Uninsured/Underinsured Motorist Protection: Full coverage policies often include provisions for uninsured or underinsured motorist protection. This safeguard steps in when you’re involved in an accident with a driver who either lacks insurance or has inadequate coverage. It ensures that you’re not left bearing the financial burden in such scenarios.

- Rental Car Coverage: In the event that your vehicle is damaged and requires repairs, full auto insurance may include rental car coverage. This benefit provides a temporary replacement vehicle, ensuring that your daily routine and mobility are not significantly disrupted.

The Cost of Full Auto Insurance

While the benefits of full auto insurance are substantial, it’s essential to consider the cost implications. Full coverage policies tend to be more expensive than basic liability-only insurance. The premium for full coverage is influenced by various factors, including the make and model of your vehicle, your driving history, and the specific coverage limits and deductibles you choose.

When comparing quotes for full auto insurance, it's crucial to strike a balance between comprehensive coverage and affordability. While it's tempting to opt for the lowest premium, ensuring that you have adequate coverage for your specific needs is equally important. Working with a reputable insurance provider and seeking expert advice can help you navigate the complexities of coverage and pricing.

Factors Influencing Premiums

The cost of full auto insurance is influenced by a multitude of factors. Here’s a breakdown of some of the key elements that insurance providers consider when determining premiums:

- Vehicle Type: The make, model, and year of your vehicle play a significant role in determining the cost of full coverage. High-performance vehicles, luxury cars, and SUVs often command higher premiums due to their increased repair costs and potential for higher-risk driving.

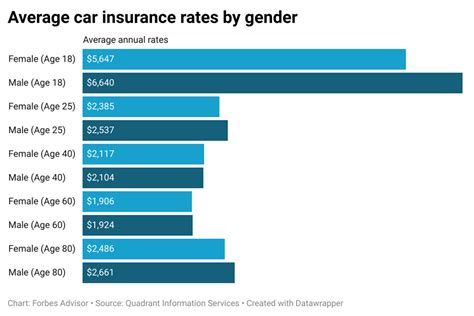

- Driver Profile: Your driving history and personal profile are crucial factors in premium calculation. Factors such as your age, gender, and driving record (including any accidents or violations) influence the perceived risk associated with insuring you. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Coverage Limits and Deductibles: The level of coverage you choose, including the limits for collision, comprehensive, and liability coverage, directly impacts your premium. Higher coverage limits typically result in higher premiums. Additionally, the deductible you select also influences the cost. A higher deductible can lower your premium, but it means you’ll bear a larger portion of the costs in the event of a claim.

- Location and Usage: The area where you reside and the primary use of your vehicle also affect premiums. Urban areas with higher population densities and increased traffic often result in higher premiums due to the higher likelihood of accidents. Similarly, if your vehicle is primarily used for commuting or business purposes, you may face higher rates compared to those who primarily use their vehicles for leisure.

Performance Analysis: Real-World Examples

To illustrate the impact of full auto insurance, let’s examine a real-world scenario. Imagine a driver, let’s call them John, who resides in a suburban area and owns a mid-range sedan. John has a clean driving record and is considering upgrading his basic liability-only insurance to full coverage.

| Coverage Type | Basic Liability | Full Coverage |

|---|---|---|

| Collision | None | Included |

| Comprehensive | None | Included |

| Medical Payments | None | Included |

| Uninsured/Underinsured Motorist | None | Included |

| Rental Car Coverage | None | Included |

In this scenario, John's basic liability-only insurance provides minimal protection, covering only damages to other parties in the event of an accident. However, with full coverage, John gains a comprehensive safety net, ensuring protection for his vehicle and himself in a wide range of situations.

Comparative Analysis

Let’s delve deeper into the financial implications of John’s decision to upgrade to full coverage. We’ll compare the estimated costs and benefits of both coverage types:

- Basic Liability: John’s current insurance policy has a premium of 600 annually. However, it offers limited protection, leaving him vulnerable to significant out-of-pocket expenses in the event of an accident or unforeseen incident.</li> <li><strong>Full Coverage:</strong> Upgrading to full coverage, John's premium increases to 1,200 annually. While this represents a substantial increase, it provides a comprehensive safety net, offering peace of mind and financial protection. In the event of an accident or unexpected incident, John’s out-of-pocket expenses are significantly reduced, ensuring he can quickly recover and get back on the road.

This comparative analysis highlights the value of full auto insurance. While the premium for full coverage is higher, it offers a more comprehensive level of protection, reducing the financial burden in the face of unexpected events. It's a trade-off between peace of mind and financial stability, ensuring that drivers like John can navigate the complexities of vehicle ownership with confidence.

Future Implications and Industry Insights

As the auto insurance industry evolves, the role of full coverage is becoming increasingly significant. With advancements in technology and a growing focus on safety, the demand for comprehensive protection is on the rise. Here are some key industry insights and future implications to consider:

- Technology Integration: The integration of advanced technologies, such as telematics and connected car systems, is revolutionizing the auto insurance industry. These technologies provide real-time data on driving behavior, vehicle performance, and potential risks. As a result, insurance providers are leveraging this data to offer more personalized and dynamic coverage options. Full coverage policies may become even more tailored to individual driving habits and risk profiles, ensuring a more accurate and fair assessment of premiums.

- Safety Features and Discounts: The auto industry is continuously developing innovative safety features, from advanced driver-assistance systems (ADAS) to autonomous driving capabilities. Insurance providers are recognizing the impact of these safety features and offering discounts for vehicles equipped with such technologies. As full coverage policies evolve, we can expect to see incentives and discounts for vehicles with advanced safety features, encouraging drivers to prioritize safety and reduce the overall risk profile.

- Environmental Considerations: With a growing focus on sustainability and environmental consciousness, the auto insurance industry is also adapting. Insurance providers are exploring ways to incentivize and reward drivers who opt for eco-friendly vehicles or adopt sustainable driving practices. Full coverage policies may incorporate incentives for electric or hybrid vehicles, promoting a greener and more sustainable future for the industry.

FAQ

What is the difference between full auto insurance and liability-only insurance?

+

Full auto insurance, or comprehensive coverage, provides a more extensive level of protection compared to liability-only insurance. While liability-only insurance primarily covers damages to other parties involved in an accident, full coverage extends its reach to include protection for your own vehicle, regardless of fault. It offers collision coverage, comprehensive protection against various incidents, medical payments coverage, and uninsured/underinsured motorist protection.

How much does full auto insurance cost?

+

The cost of full auto insurance varies based on numerous factors, including the make and model of your vehicle, your driving history, and the specific coverage limits and deductibles you choose. Full coverage policies tend to be more expensive than basic liability-only insurance. It’s essential to compare quotes from different providers and consider the balance between comprehensive coverage and affordability.

What factors influence the premium for full auto insurance?

+

The premium for full auto insurance is influenced by various factors, such as the type of vehicle you own, your driver profile (including age, gender, and driving record), the coverage limits you select, and the location and primary usage of your vehicle. Urban areas with higher population densities and increased traffic often result in higher premiums due to the higher likelihood of accidents.

Is full auto insurance worth the cost?

+

The value of full auto insurance depends on individual circumstances and risk tolerance. While it offers a comprehensive safety net and peace of mind, it also comes at a higher premium. It’s essential to weigh the benefits of full coverage against your financial situation and the potential risks you face. Consulting with an insurance expert can help you make an informed decision based on your specific needs.

Can I customize my full auto insurance policy?

+

Yes, full auto insurance policies can often be customized to meet your specific needs and budget. You can choose the coverage limits, deductibles, and additional endorsements to tailor the policy to your preferences. Working with an insurance provider, you can create a comprehensive yet affordable coverage plan that aligns with your driving habits and financial goals.