Free Home Insurance Quote

Home insurance is a vital aspect of protecting your most valuable asset—your home. It provides financial security and peace of mind, ensuring that you and your loved ones are covered in the event of unexpected disasters or accidents. Obtaining a free home insurance quote is a simple yet crucial step towards securing the right coverage for your needs. In this comprehensive guide, we will delve into the world of home insurance, exploring the factors that influence quotes, the benefits of different coverage options, and how to navigate the process to find the best policy for your home.

Understanding the Essentials of Home Insurance

Home insurance, also known as homeowner's insurance, is a contract between you and an insurance company. This contract outlines the specific risks and damages covered by the policy, as well as the financial obligations of both parties. It is designed to protect homeowners from a wide range of potential losses, including damage to the physical structure of the home, personal belongings, and liability for injuries that occur on the property.

Key Components of a Home Insurance Policy

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and permanent fixtures. It provides financial protection in the event of damage caused by perils such as fire, storms, or vandalism.

- Personal Property Coverage: This covers the contents of your home, such as furniture, electronics, and clothing. It ensures that if these items are damaged or stolen, you will receive compensation to replace them.

- Liability Coverage: This safeguards you against legal claims and lawsuits resulting from accidents or injuries that occur on your property. It provides coverage for medical expenses and potential legal fees.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage provides funds to cover temporary housing and other living expenses until you can return home.

Factors Influencing Home Insurance Quotes

When requesting a home insurance quote, it's essential to understand the various factors that insurance companies consider. These factors determine the level of risk associated with insuring your home and, consequently, the cost of your policy. Here are some key considerations:

Location and Property Characteristics

The location of your home plays a significant role in determining your insurance quote. Areas prone to natural disasters like hurricanes, earthquakes, or wildfires may have higher insurance costs. Additionally, the physical characteristics of your home, such as its age, construction materials, and any unique features, can impact the quote.

Coverage Limits and Deductibles

Your chosen coverage limits and deductibles directly affect your insurance quote. Higher coverage limits, which provide more extensive protection, will result in a higher premium. Conversely, opting for a higher deductible, which means you pay more out-of-pocket before insurance coverage kicks in, can lower your monthly premium.

Home's Replacement Cost

The estimated cost to rebuild your home from the ground up is a crucial factor in determining your insurance quote. This replacement cost estimate considers factors like construction materials, labor costs, and the size of your home.

Personal Factors

Your personal circumstances and history can influence your insurance quote. For instance, your credit score may impact the rate you receive, as it is seen as an indicator of financial responsibility. Additionally, your claims history and the number of years you've been with a particular insurance company can affect your premium.

Comparing Coverage Options and Benefits

When obtaining home insurance quotes, it's essential to compare not only the prices but also the coverage options and benefits offered by different providers. Here's a breakdown of some key coverage types and their advantages:

HO-3 (Standard Homeowners Insurance)

The HO-3 policy is the most common type of home insurance. It provides broad coverage for both the structure of your home and your personal belongings. This policy typically covers damages caused by perils such as fire, windstorms, hail, and vandalism. It also includes liability coverage and protection for additional living expenses.

HO-5 (Comprehensive or Open Perils Policy)

The HO-5 policy provides more extensive coverage than the HO-3. It covers all perils except those specifically excluded in the policy. This means that it offers broader protection for your home and belongings, making it ideal for those with valuable assets or unique property features.

HO-8 (Older Home Insurance)

Designed for older homes or homes that have been significantly renovated, the HO-8 policy provides coverage based on the actual cash value of the home and its contents. It is suitable for homes that may not be worth rebuilding to their original condition due to age or depreciation.

Additional Endorsements and Riders

Many home insurance policies offer additional endorsements or riders that can be added to your policy to provide extra coverage for specific items or situations. For example, you can add coverage for high-value items like jewelry, artwork, or musical instruments. Additionally, you can opt for coverage for specific perils, such as flood or earthquake insurance, which are typically not included in standard policies.

The Process of Obtaining a Free Home Insurance Quote

Getting a free home insurance quote is a straightforward process that can be done online or over the phone. Here's a step-by-step guide to help you navigate the process:

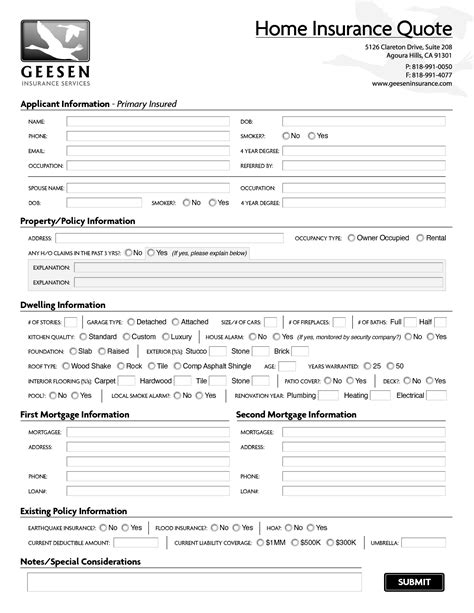

Step 1: Gather Information

Before requesting a quote, gather essential information about your home and its characteristics. This includes details such as the year the home was built, its square footage, the type of construction, and any recent renovations or upgrades. Additionally, have your personal information ready, including your name, address, and contact details.

Step 2: Choose Your Coverage Options

Decide on the coverage limits and deductibles that align with your needs and budget. Consider the replacement cost of your home and the value of your personal belongings. Remember that choosing higher coverage limits and lower deductibles will result in a higher premium.

Step 3: Request Quotes from Multiple Providers

It's beneficial to obtain quotes from several insurance providers to compare prices and coverage options. You can use online quote comparison tools or directly contact insurance companies to request quotes. Provide the necessary information about your home and coverage preferences to receive accurate quotes.

Step 4: Evaluate the Quotes

Once you have multiple quotes, carefully review and compare them. Look at the coverage limits, deductibles, and any additional benefits or endorsements offered. Consider the reputation and financial stability of the insurance companies. Ensure that the quotes cover all the risks you want to protect against.

Step 5: Contact an Insurance Agent

If you have questions or need further clarification, don't hesitate to reach out to an insurance agent. They can provide personalized advice and guide you through the policy details. An agent can also help you understand any complex terms or coverage exclusions.

Step 6: Choose the Right Policy

After evaluating the quotes and seeking expert advice, select the home insurance policy that best meets your needs and budget. Remember to review your policy annually to ensure it continues to provide adequate coverage as your circumstances change.

Frequently Asked Questions (FAQ)

What is the average cost of home insurance?

+The average cost of home insurance can vary widely depending on factors such as location, property value, and coverage limits. According to industry data, the national average premium for home insurance in the United States is approximately $1,300 per year. However, it's essential to obtain personalized quotes to get an accurate estimate for your specific circumstances.

Can I bundle my home insurance with other policies to save money?

+Yes, bundling your home insurance with other policies, such as auto insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts, so it's worth exploring this option to lower your overall insurance costs.

What should I do if I'm unsure about the coverage limits I need?

+If you're uncertain about the coverage limits for your home insurance, it's advisable to consult with an insurance agent or broker. They can assess your specific needs and recommend appropriate coverage limits based on the value of your home and its contents. It's important to ensure that you have adequate coverage without overspending on unnecessary protections.

Conclusion

Obtaining a free home insurance quote is the first step towards safeguarding your home and ensuring financial protection for you and your family. By understanding the factors that influence quotes and comparing coverage options, you can make an informed decision about your home insurance policy. Remember, home insurance is not a one-size-fits-all solution, so tailor your policy to meet your unique needs and circumstances. With the right coverage, you can have peace of mind knowing that your home is protected against life’s unexpected events.