Florida Dmv Insurance Verification

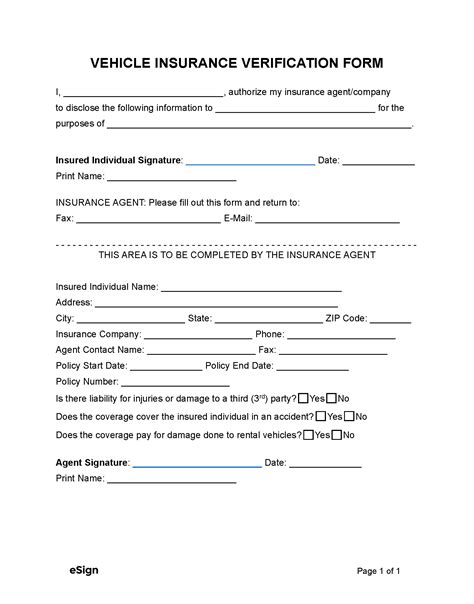

The Florida Department of Highway Safety and Motor Vehicles (DHSMV) is a vital agency responsible for ensuring road safety and enforcing vehicle regulations throughout the state. One of its critical functions is verifying insurance coverage for all registered vehicles, a process known as Florida DMV Insurance Verification. This process is designed to protect the public and ensure that drivers are financially responsible for any accidents or damages that may occur.

Florida's insurance verification system is a comprehensive and efficient process, ensuring that every registered vehicle on the state's roads is adequately insured. This system plays a crucial role in promoting safe driving practices and protecting the rights of all road users. Let's delve deeper into how Florida's DMV handles insurance verification and its impact on the state's road safety.

Understanding Florida’s Insurance Verification Process

Florida has a unique approach to insurance verification, utilizing an Electronic Insurance Verification System (EIVS). This system is an automated process that electronically verifies insurance coverage for all registered vehicles in the state. The EIVS is an efficient and accurate way to ensure that every vehicle on Florida’s roads meets the minimum insurance requirements.

When a vehicle is registered or renewed, the DHSMV requires the owner to provide proof of insurance coverage. This proof is then submitted electronically to the EIVS, which cross-references the information with the insurance provider's database. The system instantly verifies the insurance policy's validity, coverage type, and policy limits.

The EIVS also continuously monitors registered vehicles for insurance lapses. If a policy is canceled or expires, the system immediately notifies the DHSMV, which then takes appropriate action. This real-time monitoring ensures that vehicles remain insured throughout their registration period.

The DHSMV has stringent policies in place for vehicles found to be uninsured. If a vehicle is identified as lacking insurance coverage, the DHSMV can suspend the vehicle's registration and impose penalties on the owner. These penalties include fines and the requirement to obtain and maintain insurance coverage before the registration can be reinstated.

Benefits of Florida’s Insurance Verification System

Florida’s EIVS offers several advantages over traditional manual verification processes:

- Efficiency: The electronic system verifies insurance coverage within seconds, streamlining the registration process and reducing administrative burdens.

- Accuracy: By directly connecting with insurance providers' databases, the EIVS ensures accurate and up-to-date information, minimizing the risk of errors.

- Real-Time Monitoring: Continuous monitoring of insurance coverage helps prevent uninsured vehicles from operating on Florida's roads, enhancing road safety.

- Penalties and Enforcement: The DHSMV's swift action against uninsured vehicles acts as a deterrent, encouraging drivers to maintain adequate insurance coverage.

Florida’s Minimum Insurance Requirements

Florida has established minimum insurance requirements to ensure that drivers are financially responsible for accidents and damages. These requirements are outlined in the state’s Motor Vehicle No-Fault Law, also known as the Personal Injury Protection (PIP) law.

The minimum insurance coverage in Florida includes:

| Coverage Type | Minimum Coverage |

|---|---|

| Personal Injury Protection (PIP) | $10,000 per person |

| Property Damage Liability | $10,000 per accident |

PIP coverage provides compensation for medical expenses and lost wages for the policyholder and their passengers in the event of an accident, regardless of fault. Property damage liability coverage protects against damages to other people's property caused by the insured vehicle.

Drivers must also carry uninsured motorist coverage, which provides protection in the event of an accident with an uninsured or underinsured driver. This coverage is designed to ensure that the policyholder is not left financially vulnerable in such situations.

Tips for Maintaining Insurance Compliance

To ensure compliance with Florida’s insurance requirements and avoid penalties, drivers should consider the following:

- Understand Your Policy: Review your insurance policy to ensure it meets Florida's minimum coverage requirements. Be aware of any changes or updates to your policy.

- Keep Your Insurance Up-to-Date: Ensure that your insurance policy is continuously in effect and that there are no lapses in coverage. Set reminders to renew your policy before it expires.

- Inform Your Insurer: If you sell or transfer ownership of a vehicle, notify your insurance provider immediately to avoid unnecessary coverage and potential penalties.

- Stay Informed: Stay updated on any changes to Florida's insurance laws and requirements. The DHSMV's website provides valuable resources and information on insurance regulations.

Impact of Insurance Verification on Road Safety

Florida’s insurance verification process has had a significant positive impact on the state’s road safety. By ensuring that all vehicles are adequately insured, the DHSMV has contributed to a reduction in the number of uninsured motorists on Florida’s roads.

The real-time monitoring and enforcement of insurance coverage have made it difficult for uninsured drivers to evade detection. This, in turn, has led to a decrease in the number of accidents caused by uninsured drivers, reducing the financial burden on innocent victims and the state's healthcare system.

Furthermore, the EIVS has streamlined the insurance verification process, making it more accessible and efficient for both drivers and the DHSMV. This efficiency has contributed to a more effective overall road safety strategy in Florida.

Future Implications and Potential Improvements

As technology advances, the DHSMV can explore further enhancements to its insurance verification system. Potential improvements could include:

- Mobile App Integration: Developing a mobile app that allows drivers to easily manage and verify their insurance coverage, enhancing accessibility and convenience.

- AI and Machine Learning: Utilizing advanced technologies to further automate and improve the accuracy of insurance verification, reducing the risk of errors.

- Data Sharing and Collaboration: Collaborating with other states and insurance providers to share data and improve the overall effectiveness of insurance verification systems nationwide.

By staying at the forefront of technological advancements, the DHSMV can continue to enhance road safety and ensure that Florida remains a leader in insurance verification practices.

Conclusion

Florida’s DMV insurance verification process, through its efficient and accurate EIVS, plays a crucial role in promoting road safety and financial responsibility. By ensuring that all vehicles are adequately insured, the DHSMV protects the rights of all road users and reduces the potential financial burden on victims of accidents caused by uninsured drivers.

As Florida continues to prioritize road safety, the insurance verification system will remain a key component in its overall strategy. By staying informed, drivers can ensure compliance with insurance requirements and contribute to a safer driving environment for everyone.

What happens if my vehicle is found to be uninsured in Florida?

+If your vehicle is found to be uninsured, the DHSMV can suspend your vehicle’s registration and impose fines. You will be required to obtain and maintain insurance coverage before your registration can be reinstated.

How often do I need to verify my insurance coverage with the DHSMV?

+Insurance coverage verification is typically done when you register or renew your vehicle’s registration. However, it’s essential to keep your insurance up-to-date at all times to avoid any lapses in coverage.

Can I drive my vehicle if my insurance policy is temporarily lapsed due to non-payment?

+No, driving a vehicle with a lapsed insurance policy is illegal in Florida. It’s crucial to renew your insurance coverage as soon as possible to avoid penalties and ensure compliance with the law.