Health Insurance In Nj

Health insurance is an essential aspect of modern life, providing individuals and families with access to necessary medical care and financial protection. In the state of New Jersey, residents have a range of options when it comes to choosing the right health insurance plan. This article aims to provide a comprehensive guide to health insurance in New Jersey, covering various aspects such as plan types, costs, coverage, and enrollment processes.

Understanding Health Insurance Options in New Jersey

New Jersey offers a diverse range of health insurance plans to cater to the diverse needs of its residents. The state’s insurance market is regulated to ensure that all plans meet certain standards and provide essential health benefits. Here are some key types of health insurance plans available in New Jersey:

Individual and Family Plans

Individual and family health insurance plans are designed for people who are not covered by an employer-sponsored plan. These plans offer a variety of coverage options, including different levels of deductibles, copayments, and out-of-pocket maximums. New Jersey residents can choose from a wide range of insurance carriers, allowing them to find a plan that suits their specific needs and budget.

Employer-Sponsored Plans

Many employers in New Jersey offer health insurance as a benefit to their employees. These plans are typically more cost-effective as employers often contribute to the premium costs. Employees have the option to enroll in these plans during the open enrollment period or during special enrollment periods if they experience certain life events, such as marriage, birth of a child, or loss of other coverage.

Government-Sponsored Plans

New Jersey participates in the federal government’s Affordable Care Act (ACA) marketplace, which provides access to affordable health insurance plans for individuals and families who may not have access to employer-sponsored coverage. Through the HealthCare.gov website, residents can compare and enroll in qualified health plans, taking advantage of potential tax credits and subsidies to reduce their monthly premiums.

Medicaid and NJ FamilyCare

New Jersey’s Medicaid program, known as NJ FamilyCare, provides health coverage to eligible low-income residents, including children, parents, pregnant women, and people with disabilities. The program offers comprehensive medical services and is an important safety net for those who may not be able to afford private insurance. Eligibility is determined based on income and family size, with certain groups automatically qualifying.

Medicare for Seniors

For residents aged 65 and older, Medicare is the primary source of health insurance. This federal program offers different parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). New Jersey seniors can choose to enroll in Original Medicare or explore Medicare Advantage plans, which are offered by private insurance companies and may include additional benefits.

| Plan Type | Description |

|---|---|

| Individual and Family Plans | Plans for those without employer coverage, offering various levels of coverage and costs. |

| Employer-Sponsored Plans | Health insurance provided by employers, often with employer contributions to premiums. |

| Government-Sponsored Plans | Affordable plans through the ACA marketplace, with potential tax credits and subsidies. |

| Medicaid (NJ FamilyCare) | Health coverage for eligible low-income residents, providing comprehensive medical services. |

| Medicare | Primary insurance for seniors, offering different parts and options, including Original Medicare and Medicare Advantage. |

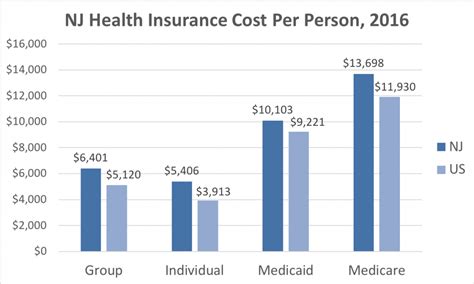

Cost and Coverage Considerations

When selecting a health insurance plan in New Jersey, understanding the costs and coverage options is crucial. Here are some key factors to consider:

Premiums and Out-of-Pocket Costs

Premiums are the regular payments made to maintain health insurance coverage. These costs can vary significantly depending on the plan’s features, such as the level of coverage, deductibles, and copayments. It’s essential to assess one’s healthcare needs and budget when choosing a plan with an affordable premium.

Additionally, health insurance plans often have out-of-pocket costs, which include deductibles (the amount paid before insurance coverage kicks in), copayments (fixed amounts paid for specific services), and coinsurance (a percentage of the cost of a service paid by the insured). Understanding these costs is vital to managing healthcare expenses effectively.

Coverage Details and Network Providers

Health insurance plans in New Jersey typically offer coverage for a range of medical services, including doctor visits, hospital stays, laboratory tests, prescription medications, and preventive care. However, the specific services covered and the extent of coverage can vary between plans. It’s important to review the plan’s summary of benefits and coverage to ensure that the necessary services are included.

Furthermore, health insurance plans often have networks of healthcare providers, such as doctors, hospitals, and pharmacies, with whom they have negotiated rates. Staying within the network can result in lower out-of-pocket costs, as services provided by out-of-network providers may not be fully covered or may incur higher expenses.

Specialty Services and Pre-Existing Conditions

Some individuals may require specialized medical care, such as mental health services, maternity care, or coverage for specific chronic conditions. It’s crucial to ensure that the chosen health insurance plan covers these specialty services adequately. Additionally, individuals with pre-existing conditions should be aware of their rights under the ACA, which prohibits insurance companies from denying coverage or charging higher premiums based on health status.

Dental and Vision Coverage

While some health insurance plans may include basic dental and vision coverage, it’s not a universal feature. Residents who prioritize dental and vision care should consider plans that offer these benefits or explore standalone dental and vision insurance options.

Enrollment and Open Enrollment Periods

Understanding the enrollment process and open enrollment periods is essential for obtaining health insurance coverage in New Jersey. Here’s what you need to know:

Open Enrollment for ACA Plans

The Affordable Care Act’s open enrollment period typically occurs annually, allowing individuals and families to enroll in or switch health insurance plans through the federal marketplace. In New Jersey, this period usually takes place in the fall, with specific dates announced each year. During this time, residents can compare plans, calculate potential tax credits, and select the best option for their needs.

It's important to note that missing the open enrollment period may result in limited options for obtaining health insurance coverage. However, qualifying life events, such as marriage, divorce, birth of a child, or loss of other coverage, can trigger special enrollment periods, allowing individuals to enroll outside of the regular open enrollment window.

Enrollment for Employer-Sponsored Plans

Enrollment in employer-sponsored health insurance plans typically occurs during the employer’s open enrollment period, which may vary depending on the company. During this time, employees can choose their health insurance coverage options, including adding family members to their plan. It’s essential to review the available plans and understand the enrollment deadlines to ensure timely coverage.

Continuous Coverage and Special Enrollment Periods

Maintaining continuous health insurance coverage is crucial to avoid gaps in protection. In New Jersey, individuals can maintain coverage through various means, such as employer-sponsored plans, individual plans, or government-sponsored programs like Medicaid or Medicare. Continuity of coverage helps ensure access to healthcare services without interruption.

In certain circumstances, individuals may qualify for special enrollment periods outside of the regular open enrollment window. These circumstances include, but are not limited to, loss of other coverage, changes in family status, or moving to a new state. Understanding the eligibility criteria for special enrollment periods is vital for accessing health insurance coverage when needed.

Resources and Assistance

Navigating the world of health insurance can be complex, but New Jersey residents have access to various resources and assistance programs to help them make informed decisions. Here are some valuable sources of information:

Official Government Websites

The HealthCare.gov website provides comprehensive information about the ACA marketplace, including available plans, eligibility criteria, and enrollment deadlines. Additionally, the NJ FamilyCare website offers detailed information about New Jersey’s Medicaid program, including eligibility requirements and enrollment procedures.

Insurance Agents and Brokers

Licensed insurance agents and brokers can be valuable resources when it comes to understanding health insurance options. They can provide personalized advice, compare plans, and assist with enrollment. Insurance agents are knowledgeable about the various plans available in New Jersey and can help individuals find the best fit for their needs and budget.

Community Health Centers and Clinics

Community health centers and clinics often provide low-cost or free medical services to underserved populations. These facilities can offer guidance on health insurance options and assist with enrollment, especially for those who may face language or cultural barriers.

Outreach and Education Programs

New Jersey conducts outreach and education programs to ensure that residents are aware of their health insurance options and understand the importance of coverage. These initiatives aim to reach diverse communities and provide accessible information about enrollment processes and available plans.

Conclusion: Empowering New Jersey Residents with Health Insurance Knowledge

Health insurance is a critical component of maintaining good health and financial stability. By understanding the various health insurance options, costs, coverage, and enrollment processes in New Jersey, residents can make informed decisions to protect themselves and their families. With the right knowledge and resources, New Jerseyans can navigate the complex world of health insurance and access the coverage they need to lead healthy lives.

How can I find out if I qualify for Medicaid in New Jersey?

+To determine your eligibility for Medicaid in New Jersey, you can visit the NJ FamilyCare website or contact your local county welfare agency. The eligibility criteria consider factors such as income, family size, and certain qualifying conditions. It’s important to review the specific guidelines and provide the necessary documentation to determine your eligibility.

What happens if I miss the open enrollment period for ACA plans?

+If you miss the open enrollment period for ACA plans, you may still have options for obtaining health insurance coverage. Qualifying life events, such as marriage, divorce, birth of a child, or loss of other coverage, can trigger special enrollment periods. These allow you to enroll outside of the regular open enrollment window. It’s important to be aware of these special circumstances and act promptly to ensure continuous coverage.

Are there any tax benefits associated with health insurance in New Jersey?

+Yes, there are potential tax benefits associated with health insurance in New Jersey. Through the Affordable Care Act, eligible individuals and families may qualify for tax credits and subsidies to reduce their monthly premiums. These tax benefits can significantly lower the cost of health insurance coverage, making it more accessible and affordable. It’s recommended to consult with a tax professional or use online tools to calculate potential tax credits.