Fdic Insured High Yield Savings Account

In today's financial landscape, navigating the myriad of savings options can be daunting. However, for those seeking a secure and profitable haven for their hard-earned money, FDIC-insured high-yield savings accounts emerge as a reliable choice. This article delves into the intricacies of these accounts, offering a comprehensive guide to help you make informed decisions about your financial future.

Understanding FDIC-Insured High-Yield Savings Accounts

FDIC-insured high-yield savings accounts are a type of savings vehicle that combines the security of Federal Deposit Insurance Corporation (FDIC) coverage with the potential for higher interest rates. This unique combination makes them an attractive option for individuals and businesses looking to grow their savings while maintaining a safety net.

The Federal Deposit Insurance Corporation, or FDIC, is a U.S. government corporation providing deposit insurance to depositors in commercial banks and savings banks. FDIC insurance covers the balance of each depositor's account, dollar-for-dollar, up to the legal limit, which is currently $250,000 per ownership category.

High-yield savings accounts are designed to offer a higher rate of return compared to traditional savings accounts. They achieve this by providing access to funds that are invested in money market instruments, which typically offer better interest rates than standard savings accounts. This means that your money works harder for you, generating more interest over time.

| Account Type | FDIC Insurance | Interest Rates |

|---|---|---|

| High-Yield Savings | Up to $250,000 | Competitive, often higher than traditional accounts |

| Traditional Savings | Up to $250,000 | Lower interest rates |

By offering both FDIC insurance and competitive interest rates, these accounts strike a balance between security and profitability. This makes them an excellent choice for those seeking a risk-averse approach to savings while still aiming to maximize their returns.

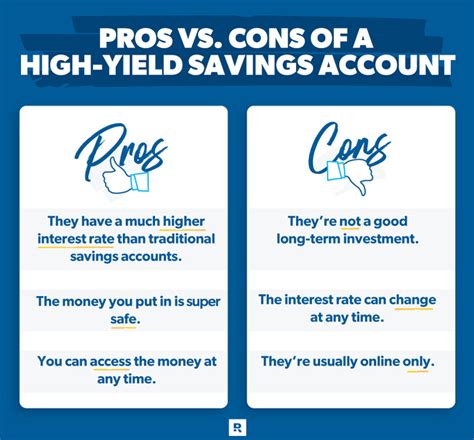

Key Features and Benefits of FDIC-Insured High-Yield Savings Accounts

FDIC-insured high-yield savings accounts come with a range of features and benefits that set them apart from traditional savings accounts. Understanding these aspects is crucial when deciding whether this type of account aligns with your financial goals.

FDIC Insurance

One of the most significant advantages of FDIC-insured high-yield savings accounts is the protection offered by the Federal Deposit Insurance Corporation. FDIC insurance ensures that, in the unlikely event of a bank failure, your deposits are safeguarded up to $250,000 per ownership category. This provides a layer of security that traditional savings accounts might not offer, giving you peace of mind knowing your savings are protected.

Competitive Interest Rates

High-yield savings accounts are known for their competitive interest rates, which are often significantly higher than those offered by traditional savings accounts. This means your money grows faster, allowing you to reach your savings goals more efficiently. The exact interest rate can vary depending on market conditions and the financial institution, but you can expect a consistent, steady return on your investment.

Flexibility and Accessibility

These accounts offer a high degree of flexibility and accessibility. You can typically make deposits and withdrawals easily, either online or through the bank’s mobile app. Many institutions also provide the option of linking your high-yield savings account to your checking account, allowing for seamless transfers between the two. This flexibility makes it convenient to manage your finances and ensures your savings remain liquid when needed.

No Fees or Minimum Balances

A significant benefit of FDIC-insured high-yield savings accounts is the absence of fees or minimum balance requirements. This means you can open and maintain the account without worrying about additional costs, making it an attractive option for those with varying financial situations. It’s worth noting that while some institutions may have certain account requirements, these are often minimal and designed to encourage responsible savings habits.

Easy Account Management

With most high-yield savings accounts, managing your finances is straightforward and user-friendly. Online and mobile banking platforms often provide real-time access to your account information, allowing you to monitor your savings and make transactions with ease. Additionally, many institutions offer digital tools and resources to help you track your progress and set savings goals, making it simpler to stay on top of your financial health.

Choosing the Right FDIC-Insured High-Yield Savings Account

When selecting an FDIC-insured high-yield savings account, it’s essential to consider several factors to ensure the account aligns with your financial needs and goals. Here are some key considerations to guide your decision-making process.

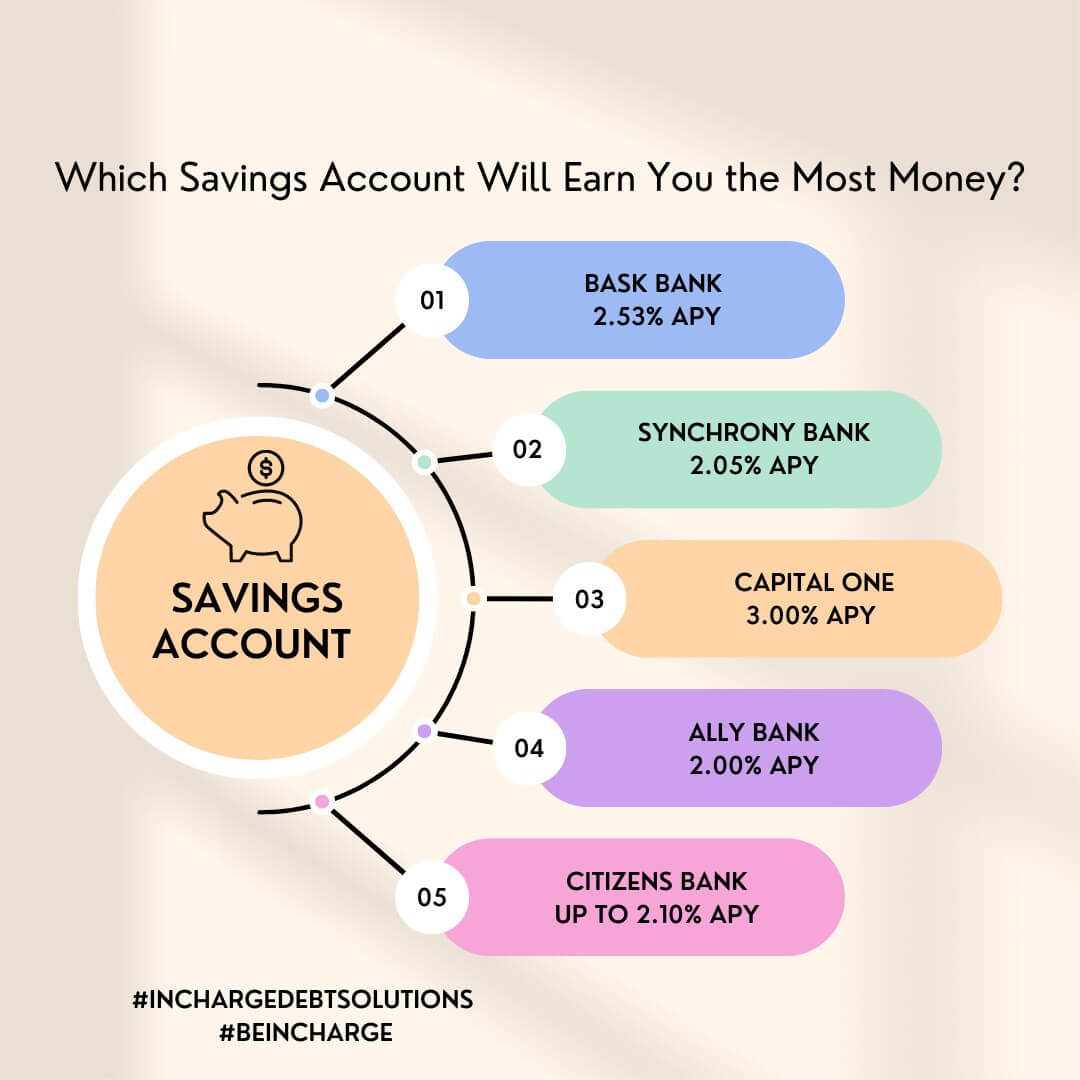

Interest Rates and APY

Interest rates are a critical factor when choosing a high-yield savings account. Look for accounts that offer competitive Annual Percentage Yield (APY) rates, which represent the actual interest you’ll earn on your savings over a year. Higher APY rates mean your money grows faster, so it’s worth comparing rates across different institutions to find the best option for your savings.

| Institution | APY |

|---|---|

| Bank A | 2.25% |

| Bank B | 2.00% |

| Bank C | 2.50% |

Account Fees and Minimum Balances

While many high-yield savings accounts don’t have fees or minimum balance requirements, it’s essential to verify this with the financial institution. Some banks may have specific requirements or charges associated with their accounts, so be sure to review the fine print to avoid unexpected costs. Opting for an account with no fees or minimum balance requirements can provide more flexibility and help you maximize your savings potential.

Accessibility and Convenience

Consider the accessibility and convenience of the account. Look for institutions that offer easy online and mobile banking options, allowing you to manage your finances on the go. Additionally, ensure the bank has a robust network of ATMs to minimize fees when withdrawing cash. The ease of access and convenience can significantly impact your overall satisfaction with the account.

Customer Service and Support

When choosing a high-yield savings account, it’s crucial to consider the quality of customer service and support offered by the financial institution. Look for banks with a solid reputation for customer satisfaction, responsive support teams, and comprehensive resources to help you navigate any issues that may arise. A bank with excellent customer service can provide peace of mind and make managing your finances a more pleasant experience.

Maximizing Your Savings with High-Yield Accounts

FDIC-insured high-yield savings accounts can be a powerful tool for growing your savings. By taking advantage of the competitive interest rates and FDIC insurance, you can ensure your money works harder for you while remaining secure. Here are some strategies to help you maximize your savings potential with these accounts.

Set Clear Savings Goals

Before opening a high-yield savings account, it’s essential to establish clear savings goals. Whether you’re saving for a down payment on a house, a dream vacation, or an emergency fund, having defined goals will help you stay focused and motivated. Break down your savings target into manageable milestones, and set a timeline to achieve them. This clarity will guide your savings strategy and make it easier to track your progress.

Automate Your Savings

One of the most effective ways to maximize your savings is by automating the process. Many financial institutions offer the option to set up automatic transfers from your checking account to your high-yield savings account. By automating your savings, you can ensure consistent contributions without the need for manual effort. This approach also helps you build a habit of saving, making it easier to reach your financial goals over time.

Take Advantage of Compound Interest

Compound interest is a powerful concept that can significantly boost your savings over time. When you earn interest on your initial deposit and the interest earned, your savings grow exponentially. High-yield savings accounts often offer compound interest, so the longer you leave your money in the account, the more it can grow. To maximize compound interest, consider leaving your savings untouched for extended periods and taking advantage of the compounding effect.

Explore Additional Savings Options

While high-yield savings accounts are an excellent starting point, there are other savings vehicles that can complement your financial strategy. Consider exploring options like certificates of deposit (CDs) or money market accounts, which offer different interest rates and terms. By diversifying your savings portfolio, you can potentially increase your overall returns and find the right balance between security and growth.

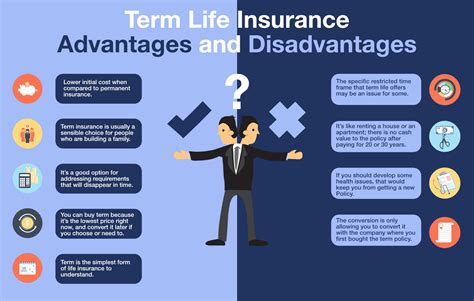

Potential Challenges and Considerations

While FDIC-insured high-yield savings accounts offer numerous advantages, it’s essential to be aware of potential challenges and considerations. Understanding these aspects can help you make more informed decisions and ensure a smoother savings journey.

Limited Withdrawal Flexibility

High-yield savings accounts often come with certain restrictions on withdrawals. While you can typically make unlimited deposits, there may be limits on the number of withdrawals you can make per month. This is known as a “transaction limit” and is designed to encourage savings rather than frequent withdrawals. It’s crucial to understand these limits and plan your withdrawals accordingly to avoid any unexpected fees or penalties.

Interest Rate Fluctuations

Interest rates on high-yield savings accounts can fluctuate over time, often in response to changes in the market or the broader economy. While these accounts generally offer competitive rates, it’s essential to keep an eye on rate trends. If interest rates drop, your earnings may be affected. Conversely, if rates increase, you may benefit from higher returns. Staying informed about market conditions can help you make strategic decisions about your savings.

Comparing Different Institutions

When researching high-yield savings accounts, you’ll find a wide range of options from various financial institutions. It’s crucial to compare different banks and their offerings to find the best fit for your needs. Consider factors such as interest rates, account fees, minimum balance requirements, and customer service reputation. Taking the time to compare and contrast can help you identify the account that aligns most closely with your financial goals.

Understanding FDIC Insurance Limits

While FDIC insurance provides a robust safety net for your savings, it’s important to understand the limits of this coverage. As mentioned earlier, FDIC insurance covers up to $250,000 per ownership category. If you have savings that exceed this amount, you may need to consider spreading your funds across multiple accounts or ownership categories to ensure they’re fully insured. Understanding these limits is crucial to maximizing the protection offered by FDIC insurance.

Conclusion

FDIC-insured high-yield savings accounts offer a compelling blend of security and profitability, making them an excellent choice for individuals and businesses looking to grow their savings. By combining the peace of mind of FDIC insurance with competitive interest rates, these accounts provide a reliable avenue for building wealth. Throughout this article, we’ve explored the key features, benefits, and considerations associated with high-yield savings accounts, offering a comprehensive guide to help you make informed decisions about your financial future.

Remember, when choosing a high-yield savings account, it's essential to consider your unique financial goals and circumstances. By setting clear savings goals, automating your savings, and taking advantage of compound interest, you can maximize your savings potential. Additionally, staying informed about market trends and account terms will help you navigate any challenges that may arise. With the right strategy and a well-chosen high-yield savings account, you can confidently grow your savings and work towards achieving your financial aspirations.

What is FDIC insurance, and how much does it cover?

+FDIC insurance, provided by the Federal Deposit Insurance Corporation, protects depositors’ funds in case of a bank failure. It covers up to $250,000 per ownership category, ensuring your savings are secure.

How do high-yield savings accounts earn interest?

+High-yield savings accounts earn interest by investing funds in money market instruments, which offer higher interest rates than traditional savings accounts. This allows your savings to grow faster.

Are there any fees associated with high-yield savings accounts?

+Many high-yield savings accounts do not have fees or minimum balance requirements. However, it’s essential to review the account terms and conditions to ensure there are no unexpected charges.

Can I have multiple high-yield savings accounts with different banks?

+Yes, you can have multiple high-yield savings accounts with different banks. This can be beneficial for spreading your funds and potentially earning higher interest rates. Just ensure you stay within the FDIC insurance limits.