Family Insurance Plan

Protecting our loved ones is a priority for all of us, and one of the most effective ways to do so is by investing in a comprehensive family insurance plan. In today's complex world, where unexpected events can happen at any time, having the right insurance coverage is crucial. A family insurance plan offers a safety net, providing financial stability and peace of mind during challenging times. In this article, we will delve into the world of family insurance, exploring its benefits, types of coverage, and how it can be tailored to meet the unique needs of your family.

Understanding the Importance of Family Insurance

Family insurance is a fundamental aspect of financial planning, offering a range of benefits that extend beyond mere monetary protection. It acts as a safeguard against various life events, ensuring that your family's well-being and financial stability are protected. Here's why family insurance is essential:

- Financial Security: Unexpected events such as accidents, illnesses, or natural disasters can lead to significant financial burdens. Family insurance provides a financial safety net, covering medical expenses, property damage, and even loss of income, ensuring your family's financial stability.

- Peace of Mind: Knowing that you have comprehensive insurance coverage allows you and your family to focus on what matters most – your health, happiness, and well-being. It removes the worry of unforeseen costs and provides a sense of security.

- Long-Term Planning: Family insurance is not just about short-term protection; it's an investment in your family's future. By including life insurance, you can ensure that your loved ones are financially secure even in the event of your untimely demise.

- Customized Coverage: Every family is unique, with different needs and priorities. Family insurance plans can be tailored to meet these specific requirements, offering personalized protection for your family's lifestyle and circumstances.

Types of Coverage in a Family Insurance Plan

A family insurance plan typically encompasses a range of coverage options, each designed to address specific needs. Here are some of the key types of coverage you can expect:

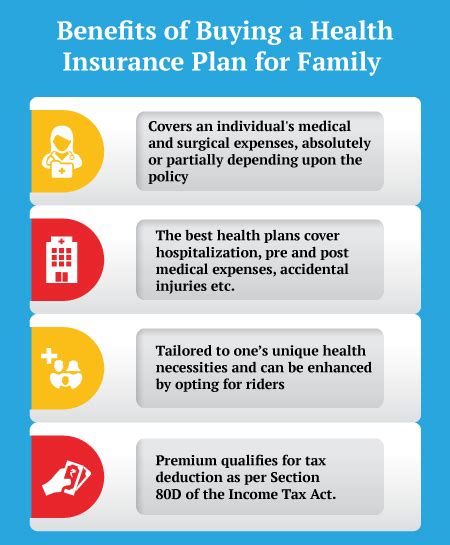

Health Insurance

Health insurance is a vital component of any family insurance plan. It provides coverage for medical expenses, including hospital stays, doctor visits, prescriptions, and even preventive care. With health insurance, you can access quality healthcare without worrying about the financial strain.

When choosing health insurance, consider factors such as the scope of coverage, deductibles, co-pays, and out-of-pocket maximums. Some plans may offer comprehensive coverage for a higher premium, while others provide more affordable options with slightly limited coverage.

Life Insurance

Life insurance is an essential aspect of family insurance, especially for those with dependents. It provides a financial safety net for your loved ones in the event of your untimely passing. Life insurance policies can offer a lump-sum payment, ensuring that your family's financial needs are met, such as paying off debts, covering funeral expenses, or providing ongoing income.

There are various types of life insurance, including term life, whole life, and universal life insurance. Term life insurance offers coverage for a specific period, typically 10-30 years, while whole life insurance provides lifelong coverage. Universal life insurance offers flexibility in terms of premiums and coverage amounts.

Homeowners or Renters Insurance

Whether you own a home or rent a property, having insurance for your dwelling is crucial. Homeowners insurance provides coverage for your home's structure, personal belongings, and liability protection. It covers damages caused by fires, storms, vandalism, and other perils, ensuring that your home and possessions are protected.

Renters insurance, on the other hand, is designed for individuals who rent their living space. It provides coverage for personal belongings, liability protection, and additional living expenses if your rental property becomes uninhabitable due to a covered event.

Auto Insurance

Auto insurance is mandatory in most regions and provides coverage for your vehicles. It protects against financial losses resulting from accidents, theft, or damage to your car. Auto insurance typically includes liability coverage, collision coverage, comprehensive coverage, and personal injury protection (PIP) or medical payments coverage.

When selecting auto insurance, factors such as your driving record, the make and model of your vehicle, and your state's legal requirements will influence the cost and scope of coverage.

Umbrella Insurance

Umbrella insurance is an additional layer of protection that provides liability coverage beyond your existing policies. It kicks in when the limits of your homeowners, auto, or other liability policies are exhausted. Umbrella insurance offers broader coverage and higher limits, ensuring that you are financially protected in the event of a major lawsuit or catastrophic event.

Tailoring Your Family Insurance Plan

Every family has unique needs and priorities, which is why it's essential to tailor your family insurance plan accordingly. Here are some factors to consider when customizing your insurance coverage:

Family Size and Composition

The size and composition of your family play a significant role in determining your insurance needs. For example, a family with young children may require more comprehensive health insurance and life insurance to ensure their financial security. On the other hand, an empty-nester couple may prioritize homeowners insurance and focus on protecting their assets.

Financial Situation and Goals

Your family's financial situation and long-term goals should guide your insurance decisions. Consider your current income, savings, and debt obligations. Evaluate how insurance coverage can help protect your assets and ensure financial stability in various scenarios. For instance, if you have significant savings, you may opt for a higher deductible to keep insurance premiums affordable.

Lifestyle and Risk Factors

Your family's lifestyle and the risks associated with it should be taken into account. If you live in an area prone to natural disasters, such as hurricanes or wildfires, you may need specialized coverage to protect your home and belongings. Similarly, if you have a teen driver in the family, auto insurance with comprehensive coverage may be a wise choice.

Existing Coverage and Policy Limits

Review your current insurance policies and assess their limits and exclusions. Ensure that you are not overinsured or underinsured. Consider adding additional coverage or increasing policy limits to adequately protect your family's interests.

Benefits of a Comprehensive Family Insurance Plan

Investing in a comprehensive family insurance plan offers a multitude of benefits that go beyond financial protection. Here are some key advantages:

- Comprehensive Coverage: A well-rounded family insurance plan provides a safety net for various aspects of your life, including health, home, auto, and life insurance. This ensures that you are protected against a wide range of risks.

- Peace of Mind: With comprehensive coverage, you can rest assured that your family's well-being is secured. You won't have to worry about financial burdens or the impact of unexpected events on your loved ones.

- Customized Protection: By tailoring your insurance plan to your family's needs, you can ensure that your specific concerns and priorities are addressed. This personalized approach gives you the confidence that you are adequately protected.

- Flexibility and Options: Family insurance plans offer a variety of coverage options, allowing you to choose the right level of protection for your circumstances. Whether you require extensive health insurance or additional liability coverage, you can find a plan that fits your requirements.

- Cost-Effectiveness: By bundling multiple insurance policies together, you may be eligible for discounts and reduced premiums. This can make comprehensive coverage more affordable and accessible for your family.

Real-Life Scenarios: The Impact of Family Insurance

To illustrate the importance and impact of family insurance, let's explore a few real-life scenarios:

Scenario 1: Medical Emergency

Imagine a family with a young child who suddenly falls ill and requires extensive medical treatment. Without health insurance, the family would face significant financial strain, potentially incurring tens of thousands of dollars in medical bills. However, with comprehensive health insurance coverage, the family can focus on their child's recovery without worrying about the financial burden.

Scenario 2: Home Fire

A family's home catches fire due to an electrical fault. The fire causes extensive damage to the structure and personal belongings. Without homeowners insurance, the family would have to bear the full cost of repairs and replacements, which could be financially devastating. However, with homeowners insurance, the insurance company covers the costs, allowing the family to rebuild their home and replace their possessions.

Scenario 3: Auto Accident

A family member is involved in a car accident, resulting in significant vehicle damage and minor injuries. Without auto insurance, the family would be responsible for paying for repairs and medical expenses out of pocket. However, with comprehensive auto insurance coverage, the insurance company covers the cost of repairs and provides medical payments coverage for any injuries sustained.

The Future of Family Insurance

The insurance industry is constantly evolving, and family insurance plans are no exception. As technology advances and consumer needs change, insurance providers are adapting to offer more innovative and tailored solutions. Here are some trends and future implications to consider:

- Digitalization and Convenience: Insurance companies are increasingly leveraging technology to enhance the customer experience. From online policy management to mobile apps for claim submission, digitalization brings convenience and efficiency to the insurance process.

- Personalized Coverage: With the advent of big data and analytics, insurance providers can offer more personalized coverage options. By analyzing individual risk factors and lifestyle choices, insurers can tailor policies to meet the unique needs of each family.

- Telemedicine and Remote Services: The rise of telemedicine and remote healthcare services has impacted the insurance industry. Some insurers now offer telemedicine benefits as part of their health insurance plans, providing convenient access to medical professionals and reducing healthcare costs.

- Sustainable and Eco-Friendly Options: As environmental concerns grow, insurance providers are exploring sustainable and eco-friendly coverage options. This includes offering incentives for homeowners to adopt renewable energy sources or providing discounts for eco-conscious driving habits.

- Artificial Intelligence and Automation: AI and automation are transforming the insurance industry, streamlining processes and improving efficiency. From automated claim processing to AI-powered risk assessment, these technologies enhance the accuracy and speed of insurance services.

Frequently Asked Questions

What is the difference between term life insurance and whole life insurance?

+Term life insurance provides coverage for a specific period, typically 10-30 years, and is more affordable. Whole life insurance offers lifelong coverage and accumulates cash value over time, making it more expensive.

How much health insurance coverage do I need for my family?

+The amount of health insurance coverage you need depends on various factors, including your family's medical history, age, and financial situation. It's recommended to consult with an insurance agent to determine the appropriate level of coverage.

Can I customize my auto insurance policy to suit my specific needs?

+Yes, auto insurance policies can be customized. You can choose the level of coverage, such as liability, collision, and comprehensive, and adjust deductibles and policy limits to fit your budget and risk tolerance.

Is it necessary to have umbrella insurance in addition to my existing policies?

+Umbrella insurance provides additional liability coverage beyond your primary policies. It is recommended for individuals with significant assets or those facing higher-than-average liability risks. Consult with an insurance professional to assess your specific needs.

How can I ensure my family insurance plan is up-to-date and meets our changing needs?

+Regularly review your family insurance plan and stay informed about any changes in your family's circumstances or the insurance market. Schedule periodic check-ins with your insurance agent to discuss updates, policy adjustments, and emerging coverage options.

In conclusion, a family insurance plan is a vital component of financial planning, offering protection, peace of mind, and a sense of security for your loved ones. By understanding the different types of coverage and tailoring your plan to your family’s unique needs, you can ensure that you are adequately protected against life’s uncertainties. Embrace the power of family insurance and take control of your family’s financial future.