Elephant Insurance Insurance

In today's ever-evolving insurance landscape, Elephant Insurance stands out as a unique and intriguing player. With a name that captures attention and a range of innovative services, this insurance provider has carved a niche for itself in the competitive world of personal and commercial coverage. This article aims to delve deep into Elephant Insurance, exploring its history, unique offerings, and the factors that contribute to its growing popularity.

A Journey into Elephant Insurance: Origins and Evolution

Elephant Insurance, officially known as Elephant Insurance Company, was founded in 2009 with a vision to revolutionize the insurance industry. Headquartered in Virginia, USA, the company started its journey with a simple yet powerful mission: to provide straightforward and affordable insurance solutions to individuals and businesses.

The brainchild of a group of experienced insurance professionals, Elephant Insurance sought to challenge traditional insurance models. They aimed to create a transparent and customer-centric platform, leveraging technology to offer personalized coverage plans. Over the years, the company has expanded its reach, now providing a comprehensive range of insurance products, from auto and home insurance to life and business coverage.

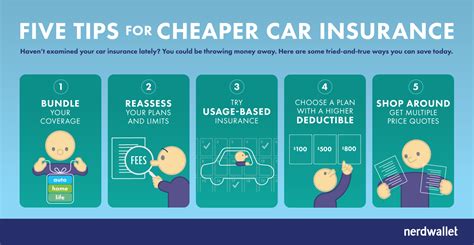

What sets Elephant Insurance apart is its focus on education and empowerment. The company believes that an informed customer is its best asset. Thus, they have developed an extensive online resource center, offering guides, tips, and tools to help customers understand their insurance needs better. This approach has not only enhanced customer satisfaction but has also positioned Elephant Insurance as a trusted advisor in the insurance space.

Elephant Insurance’s Unique Offerings: A Deep Dive

Elephant Insurance’s product portfolio is extensive and tailored to meet diverse needs. Let’s explore some of their key offerings:

Auto Insurance: A Comprehensive Approach

Elephant Insurance’s auto insurance plans are designed to offer comprehensive protection. They provide coverage for liability, collision, comprehensive damage, and personal injury protection. What’s unique is their focus on customization. Customers can choose from a range of add-ons, such as rental car coverage, gap insurance, and roadside assistance, ensuring their plan is tailored to their specific needs.

One notable feature is their "Vanishing Deductible" program. For each year a customer remains claim-free, Elephant Insurance rewards them by reducing their deductible by $100, up to a maximum of $500. This incentive not only encourages safe driving but also provides substantial savings over time.

Home Insurance: Protecting Your Haven

Elephant Insurance’s home insurance plans offer protection for homeowners and renters alike. Their policies cover a range of perils, including fire, theft, vandalism, and natural disasters. Additionally, they provide liability coverage, protecting policyholders from legal claims and lawsuits.

A standout feature is their "Replacement Cost" coverage. In the event of a total loss, Elephant Insurance ensures that customers receive enough to rebuild their home or replace their belongings, without any depreciation deductions. This provides a significant peace of mind for homeowners.

Life Insurance: Securing Your Legacy

Elephant Insurance’s life insurance plans are designed to provide financial security for families. They offer term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. During this time, the policyholder’s beneficiaries receive a tax-free death benefit if the policyholder passes away.

What makes Elephant Insurance's life insurance unique is their focus on simplicity and affordability. Their online application process is quick and straightforward, and they offer competitive rates, making life insurance accessible to a wider range of individuals.

Business Insurance: Covering the Foundations

Elephant Insurance’s business insurance plans are tailored to protect small and medium-sized enterprises. They offer a range of coverage options, including general liability, property insurance, professional liability, and workers’ compensation. This ensures that businesses are protected against a wide array of potential risks.

A notable feature is their "Business Owner's Policy" (BOP), which combines general liability and property insurance into one package, providing a cost-effective solution for small businesses. Additionally, Elephant Insurance offers specialized coverage for specific industries, such as contractors, retailers, and professionals, ensuring that their unique needs are met.

The Elephant Experience: Customer Satisfaction and Service

At the heart of Elephant Insurance’s success is its commitment to customer satisfaction. The company prides itself on its responsive and knowledgeable customer service team. Available 24⁄7, they provide timely assistance, ensuring that customers’ queries and concerns are addressed promptly.

Elephant Insurance's online platform is user-friendly and intuitive. Customers can easily manage their policies, make payments, and file claims directly from their online accounts. The company also offers a mobile app, allowing customers to access their insurance information on the go.

Moreover, Elephant Insurance's claims process is designed to be efficient and stress-free. They offer a dedicated claims hotline, providing immediate assistance in the event of an accident or loss. Their claims adjusters are known for their professionalism and prompt settlements, ensuring that customers receive the support they need during challenging times.

Industry Recognition and Awards

Elephant Insurance’s dedication to innovation and customer satisfaction has not gone unnoticed. The company has received numerous accolades and industry recognition. Some of the notable awards include:

- J.D. Power Award for Outstanding Customer Service: Recognized for its exceptional customer service, Elephant Insurance has consistently ranked high in customer satisfaction surveys.

- National Association of Insurance Commissioners (NAIC) Award: Honored for its commitment to consumer protection and ethical business practices, Elephant Insurance has demonstrated a high level of integrity in its operations.

- Insurance Innovation Awards: Elephant Insurance has been a recipient of several innovation awards, recognizing its use of technology to enhance customer experience and streamline processes.

The Future of Elephant Insurance: Expanding Horizons

As Elephant Insurance continues to grow, its focus remains on innovation and customer-centricity. The company is actively exploring new technologies, such as artificial intelligence and machine learning, to further enhance its services.

One area of focus is the development of predictive analytics. By analyzing vast amounts of data, Elephant Insurance aims to identify potential risks and provide proactive solutions. This not only benefits customers by offering tailored coverage but also helps the company to manage risks more effectively.

Additionally, Elephant Insurance is committed to expanding its reach and product offerings. They are actively exploring new markets and insurance products, ensuring that they remain a competitive and comprehensive insurance provider.

In conclusion, Elephant Insurance has established itself as a dynamic and customer-focused insurance provider. With its unique offerings, commitment to education, and focus on innovation, it continues to make its mark in the insurance industry. As it evolves, Elephant Insurance remains dedicated to empowering its customers and providing them with the protection and peace of mind they deserve.

Frequently Asked Questions

What sets Elephant Insurance apart from other insurance providers?

+Elephant Insurance distinguishes itself through its customer-centric approach, innovative use of technology, and commitment to education. They offer personalized coverage plans, an extensive resource center, and a responsive customer service team, ensuring a superior customer experience.

How does Elephant Insurance ensure competitive pricing for its insurance plans?

+Elephant Insurance focuses on efficiency and technology to keep costs down. By utilizing online platforms and streamlined processes, they are able to offer competitive rates while maintaining high-quality coverage. Additionally, their emphasis on customer education helps policyholders make informed choices, potentially reducing the need for certain coverages and lowering costs.

What is Elephant Insurance’s claim process like, and how long does it typically take to settle a claim?

+Elephant Insurance’s claim process is designed to be efficient and stress-free. They offer a dedicated claims hotline, providing immediate assistance. The company’s claims adjusters are known for their professionalism and prompt settlements. While the time to settle a claim can vary depending on the complexity of the case, Elephant Insurance aims to resolve claims as quickly as possible, typically within a few weeks.