Does Your Credit Score Affect Your Car Insurance

When it comes to the intricate world of personal finance, the interplay between various aspects can often be surprising. One such aspect is the relationship between your credit score and car insurance. It's a topic that many might not immediately associate, but it plays a crucial role in determining your insurance premiums. In this article, we delve deep into this connection, exploring the factors, the implications, and offering expert insights to help you navigate this complex terrain.

The Credit Score and Car Insurance Nexus

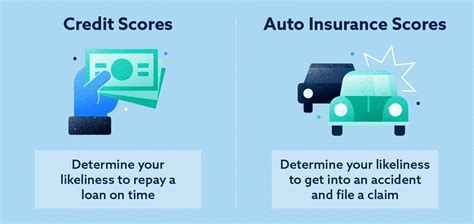

Your credit score, a three-digit number representing your creditworthiness, is an essential factor in numerous financial decisions. It influences your ability to secure loans, mortgages, and even rental agreements. However, its impact extends beyond these traditional domains, reaching into the realm of car insurance.

In the United States, insurers often utilize credit-based insurance scores as a tool to assess the risk associated with insuring a particular individual. This practice, while controversial, is legal in most states and has been a standard part of the insurance industry's underwriting process for several decades. Insurers argue that credit scores are predictive of an individual's likelihood to file insurance claims, and thus, can be used to gauge the risk they pose as a policyholder.

How Does Credit Scoring Work in Car Insurance?

The insurance industry uses a specific type of credit score known as an insurance score or credit-based insurance score. This score is derived from information in your credit report and is designed to predict how you’ll manage your insurance responsibilities. It’s important to note that this score is distinct from your traditional FICO credit score, although the underlying data may overlap.

Insurance scores consider various credit-related factors, including your payment history, the length of your credit history, the types of credit you use, and the amount of credit you have available. Additionally, they may take into account factors like the number of credit inquiries and the balance-to-limit ratio on your credit cards. These scores are then used by insurers to categorize individuals into risk groups, with those in higher-risk groups typically facing higher insurance premiums.

The use of credit scores in car insurance is not without its critics. Consumer advocates and privacy experts have raised concerns about the fairness and accuracy of this practice. They argue that credit scores may not accurately reflect an individual's propensity to file claims and that using them could result in discrimination against certain groups, particularly those with lower incomes or limited credit histories.

Impact on Insurance Premiums

The impact of your credit score on car insurance premiums can be significant. Studies have shown that individuals with lower credit scores often pay considerably more for their car insurance than those with higher scores. According to a report by the Consumer Federation of America, the difference in premiums between drivers with excellent credit and those with poor credit can be as much as 90% or more.

| Credit Score Range | Average Annual Premium |

|---|---|

| Excellent (720+) | $900 |

| Good (690-719) | $1,100 |

| Average (630-689) | $1,400 |

| Poor (550-629) | $1,800 |

| Very Poor (300-549) | $2,500 |

These numbers illustrate the financial burden that individuals with lower credit scores may face when it comes to car insurance. The difference in premiums can amount to thousands of dollars over the life of a policy, making credit scores a significant factor in the overall cost of car ownership.

Understanding the Factors That Affect Your Insurance Score

To better navigate the relationship between your credit score and car insurance, it’s essential to understand the specific factors that influence your insurance score. While the exact calculation can vary between insurers and credit bureaus, here are some of the key components:

Payment History

Your track record of making timely payments on bills and loans is a significant factor. Late payments, especially those that result in a collection or charge-off, can significantly harm your insurance score. Insurers view consistent on-time payments as a positive indicator of financial responsibility.

Length of Credit History

The longer your credit history, the more data insurers have to assess your financial reliability. A longer credit history can be beneficial, especially if it demonstrates a pattern of responsible financial behavior.

Types of Credit

The mix of credit types you have can also impact your insurance score. Insurers typically prefer to see a diverse range of credit types, including credit cards, mortgages, auto loans, and personal loans. A well-rounded credit portfolio can indicate financial stability and responsibility.

Amount of Credit Used

The amount of credit you have available and the extent to which you’re utilizing it can be a factor. High credit utilization (the percentage of your total credit limit that you’re currently using) can be seen as a negative indicator, as it may suggest financial strain or difficulty managing credit.

Credit Inquiries

Each time a lender or insurer checks your credit, it’s recorded as a “hard inquiry” on your credit report. Too many hard inquiries in a short period can signal that you’re taking on excessive debt or are a higher risk, which can negatively impact your insurance score.

Improving Your Credit Score for Better Car Insurance Rates

Given the significant impact your credit score can have on your car insurance premiums, it’s understandable that many individuals would want to take steps to improve their creditworthiness. Here are some strategies to consider:

Pay Bills on Time

Making timely payments on all your bills is the single most important factor in maintaining a good credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Reduce Credit Card Balances

Keeping your credit card balances low, ideally below 30% of your total credit limit, can positively impact your credit score. It demonstrates that you’re using credit responsibly and aren’t overextended financially.

Build a Diverse Credit Portfolio

If you have a limited credit history, consider adding different types of credit to your portfolio. This could include a credit card, a personal loan, or a small auto loan. A diverse credit mix can signal to insurers that you’re a responsible borrower.

Limit New Credit Applications

Each time you apply for new credit, a hard inquiry is recorded on your credit report. Too many hard inquiries in a short period can be detrimental to your credit score. Space out your applications for new credit to avoid this issue.

Monitor Your Credit Report

Regularly check your credit report for any errors or signs of identity theft. You’re entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Utilize this benefit to stay informed about your credit health.

The Future of Credit-Based Insurance Scoring

The use of credit scores in car insurance is a practice that has sparked ongoing debate and scrutiny. While insurers defend the practice as a necessary risk assessment tool, critics argue that it disproportionately affects certain groups and may not accurately predict insurance claims.

In recent years, there has been a growing movement towards the use of alternative data in insurance scoring. Some insurers are exploring the use of non-traditional data points, such as driving behavior data collected through telematics devices or mobile apps. This shift towards behavior-based insurance scoring could potentially reduce the reliance on credit scores and provide a more accurate assessment of an individual's risk profile.

Additionally, there are ongoing discussions and efforts at the state and federal levels to regulate the use of credit scores in insurance. Some states have already enacted laws that restrict or prohibit the use of credit scores in certain types of insurance, while others are considering similar measures. The future of credit-based insurance scoring remains uncertain, but these developments suggest a potential shift towards a more equitable and predictive approach to assessing insurance risk.

FAQs

Are there any states where insurers cannot use credit scores for car insurance?

+Yes, as of my last update in January 2023, California, Hawaii, and Massachusetts have laws that prohibit the use of credit scores in car insurance. Other states, like Maryland and Michigan, have restricted the use of credit scores in certain circumstances.

How can I check my insurance score?

+Insurance scores are not publicly available, and insurers typically don’t share them with consumers. However, you can request a copy of your credit report from the major credit bureaus to get an idea of the factors that may be influencing your insurance score.

Do all car insurance companies use credit scores in their underwriting process?

+No, not all insurers use credit scores. Some companies have chosen not to use credit-based insurance scores in their underwriting process, while others may use it as a secondary factor alongside other risk indicators.

Can I negotiate my car insurance premium based on my credit score?

+It’s worth discussing your credit score and its impact on your premium with your insurance agent or company. While they may not be able to change your premium immediately, they could provide insights into how your credit score influences your rates and offer suggestions for improving your insurance score over time.