Difference Between Hmo And Ppo Insurance

Understanding the differences between Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) is crucial for anyone seeking comprehensive health insurance coverage. These two prevalent types of health plans offer distinct benefits and drawbacks, catering to different individual needs and preferences. By delving into the specifics of each plan, we can make more informed decisions about our healthcare coverage.

HMOs: A Network-Based Approach to Healthcare

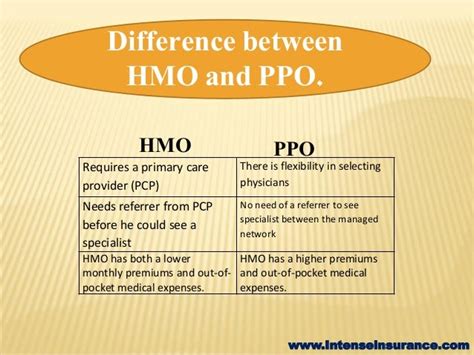

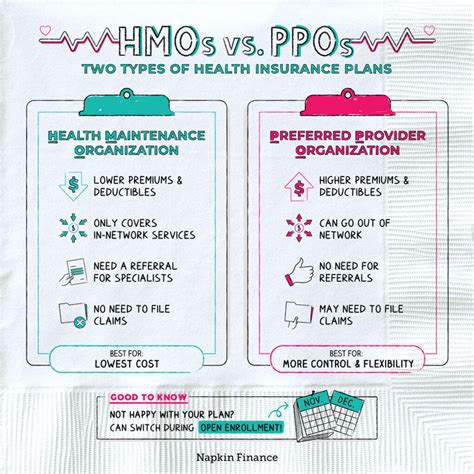

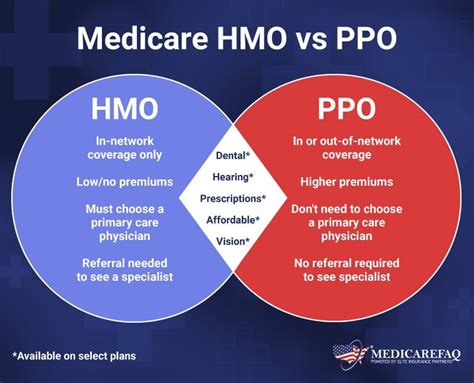

HMOs, a staple in the healthcare industry, have been a trusted choice for many individuals and families seeking comprehensive medical coverage. These plans operate on a network-based model, where members are assigned a primary care physician (PCP) who acts as their primary point of contact for all healthcare needs. This PCP serves as a gatekeeper, referring patients to specialists within the HMO network as necessary. The network of providers in an HMO is typically more limited compared to other plans, but this structure allows for tighter coordination of care and often results in lower out-of-pocket costs for members.

One of the key advantages of HMOs is their emphasis on preventative care. With a focus on maintaining good health, HMOs often cover a wide range of preventive services, such as annual check-ups, immunizations, and screenings, at little to no cost to the member. This proactive approach to healthcare not only benefits the overall health of the individual but also contributes to cost savings in the long run by catching potential health issues early on.

Key Features of HMOs:

- Primary Care Physician (PCP): Members must choose a PCP within the HMO network, who coordinates all healthcare services and referrals to specialists.

- Network-Based Care: HMO members are required to utilize in-network providers to receive the full benefits of the plan. Out-of-network care may not be covered or could result in higher out-of-pocket costs.

- Low Out-of-Pocket Costs: HMOs often have lower deductibles and copayments compared to other plans, making routine healthcare more affordable.

- Emphasis on Preventative Care: HMOs cover a comprehensive range of preventive services, encouraging members to stay on top of their health.

When to Choose an HMO:

HMOs are an excellent option for individuals who:

- Prefer a more structured healthcare approach with a designated PCP.

- Value affordable, routine healthcare and comprehensive preventive care coverage.

- Are comfortable with the HMO’s provider network and do not anticipate the need for frequent out-of-network care.

PPOs: Flexibility and Choice in Healthcare Coverage

Preferred Provider Organizations (PPOs) offer a more flexible approach to healthcare coverage, providing members with a broader network of healthcare providers to choose from. Unlike HMOs, PPOs do not require members to select a primary care physician or obtain referrals for specialist care. This flexibility allows individuals to seek care from any healthcare provider within the PPO network without prior authorization.

One of the standout features of PPOs is the freedom they offer to members. With a larger network of providers to choose from, individuals can select the healthcare professionals that best suit their needs and preferences. Additionally, PPOs typically cover a wider range of services compared to HMOs, making them a suitable choice for those with more complex or specialized healthcare requirements.

Key Features of PPOs:

- Flexible Provider Choice: PPO members can choose any in-network provider without the need for a referral or prior authorization.

- Broad Network: PPO networks are typically larger and more diverse, offering members a greater selection of healthcare providers.

- Coverage for Out-of-Network Care: While using in-network providers is more cost-effective, PPOs also provide coverage for out-of-network care, although at a higher out-of-pocket cost.

- Comprehensive Service Coverage: PPOs often cover a wider range of services, including specialized care and treatments, making them suitable for individuals with diverse healthcare needs.

When to Choose a PPO:

PPOs are an ideal choice for individuals who:

- Value flexibility and the ability to choose their healthcare providers without restrictions.

- Require access to a diverse range of healthcare specialists and services.

- Are willing to pay slightly higher premiums for the increased flexibility and comprehensive service coverage.

Comparative Analysis: HMO vs. PPO

When deciding between an HMO and a PPO, it’s essential to weigh the specific needs and priorities of the individual or family seeking coverage. HMOs offer a more structured and cost-effective approach, particularly for those who value preventive care and routine healthcare services. The assigned PCP in an HMO plan ensures coordinated care and often results in lower out-of-pocket expenses.

On the other hand, PPOs provide a more flexible and comprehensive healthcare coverage option. With a broader network of providers and the freedom to choose specialists without referrals, PPOs cater to individuals with diverse healthcare needs. While PPOs may have slightly higher premiums, they offer the advantage of covering out-of-network care, providing peace of mind for those who travel frequently or require specialized medical attention.

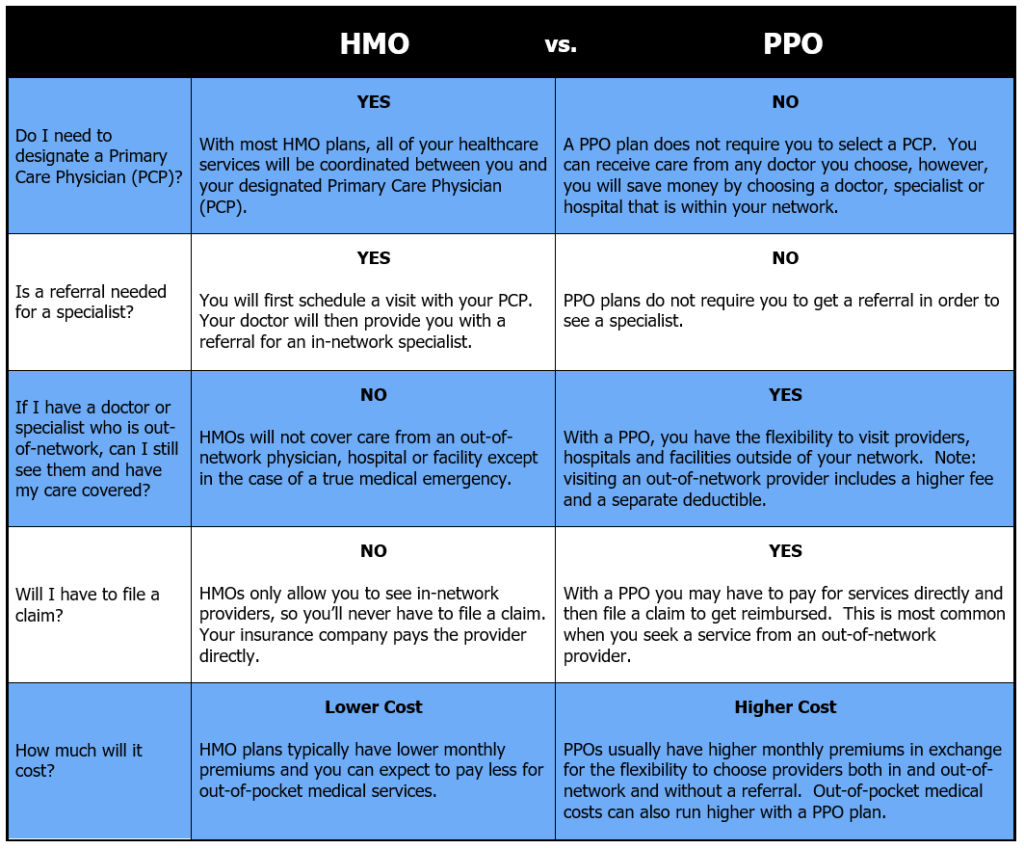

| Category | HMO | PPO |

|---|---|---|

| Provider Network | Limited network of providers | Larger and more diverse network |

| Provider Choice | Members must choose a PCP and obtain referrals for specialists | Members can choose any in-network provider without referrals |

| Out-of-Network Coverage | Limited or no coverage for out-of-network care | Provides coverage for out-of-network care, but at a higher cost |

| Preventative Care | Emphasizes preventative care with comprehensive coverage | Also covers preventative services, but with some variations |

| Cost | Lower premiums and out-of-pocket costs | Slightly higher premiums and out-of-pocket costs |

The Future of HMO and PPO Plans

As the healthcare industry continues to evolve, both HMOs and PPOs are adapting to meet the changing needs of consumers. One notable trend is the increasing focus on value-based care, where healthcare providers are incentivized to deliver high-quality, cost-effective care. This shift is driving HMOs and PPOs to place greater emphasis on preventive care and coordinated healthcare delivery, ensuring that members receive the right care at the right time.

Additionally, technological advancements are playing a significant role in shaping the future of health insurance plans. Telehealth services, for instance, are becoming increasingly popular, offering convenient and accessible healthcare options for members. Both HMOs and PPOs are integrating telehealth into their networks, providing members with the flexibility to receive medical advice and treatment remotely.

Furthermore, the rise of consumer-directed health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), is influencing the design of HMOs and PPOs. These plans empower individuals to take a more active role in managing their healthcare expenses, encouraging cost-conscious decision-making. As a result, HMOs and PPOs are incorporating more consumer-friendly features, such as transparent pricing and cost-sharing options, to attract and retain members.

Conclusion

Understanding the differences between HMOs and PPOs is a crucial step in selecting the right health insurance plan. Both plans offer unique benefits and cater to different healthcare needs and preferences. Whether it’s the structured, cost-effective approach of HMOs or the flexible, comprehensive coverage of PPOs, individuals can make informed decisions to ensure they receive the care they need while managing their healthcare expenses effectively.

As the healthcare landscape continues to evolve, staying informed about the latest trends and advancements in health insurance plans is essential. By staying up-to-date with the evolving features and benefits of HMOs and PPOs, individuals can make confident choices that align with their healthcare priorities and financial goals.

What is the main difference between an HMO and a PPO plan?

+The primary distinction lies in the provider network and flexibility of choice. HMOs have a more limited network and require members to choose a primary care physician (PCP) and obtain referrals for specialists. PPOs, on the other hand, offer a larger network and allow members to choose any in-network provider without referrals.

Which plan is more cost-effective, HMO or PPO?

+HMOs generally have lower premiums and out-of-pocket costs due to their structured network and coordinated care approach. PPOs, while offering more flexibility, may have slightly higher premiums and out-of-pocket expenses.

Do HMOs and PPOs cover out-of-network care?

+HMOs typically do not cover out-of-network care, or they may offer limited coverage at a higher cost. PPOs, however, provide coverage for out-of-network care, although at a higher out-of-pocket expense compared to in-network care.

Which plan is better for specialized or complex medical needs?

+PPOs are generally a better fit for individuals with specialized or complex medical needs due to their larger provider network and the ability to choose specialists without referrals. HMOs may require referrals and have a more limited network, which could be less suitable for complex cases.

Can I switch between HMO and PPO plans?

+Switching between HMO and PPO plans is possible, but it often depends on the specific insurance carrier and the timing of your enrollment period. It’s best to review your options and timing carefully before making any changes to your health insurance plan.