Dentist Insurance Plan

Welcome to a comprehensive guide exploring the world of Dentist Insurance Plans, a critical aspect of oral healthcare that often goes unnoticed by patients and even some dental professionals. This article aims to shed light on the intricacies of dentist insurance, providing an in-depth analysis of its importance, coverage options, and real-world applications. By understanding the ins and outs of these plans, both dentists and patients can make informed decisions about their oral health and financial security.

Understanding the Importance of Dentist Insurance Plans

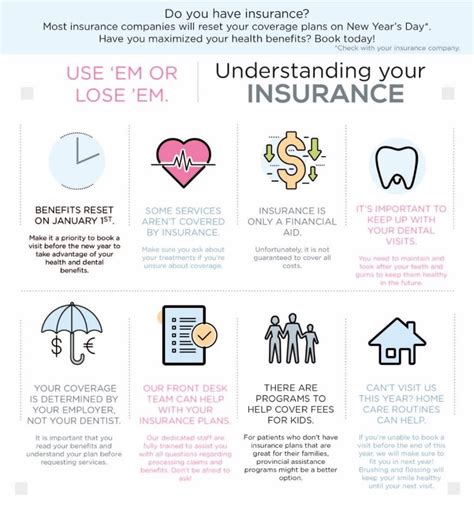

In the realm of healthcare, insurance plays a pivotal role in ensuring access to necessary medical services while managing financial risks. This principle holds true for dental care as well. Dentist Insurance Plans are designed to cover a range of oral health services, from routine check-ups and cleanings to more complex procedures like root canals and dental implants. By providing financial support for these services, insurance plans encourage regular dental visits, which are crucial for maintaining optimal oral health.

Moreover, dentist insurance plans can offer significant peace of mind to both patients and dentists. For patients, it alleviates the financial burden associated with unexpected dental issues, ensuring they can receive the care they need without worrying about the cost. For dentists, it provides a stable financial foundation, allowing them to focus on delivering the best possible care without being overly concerned about reimbursement.

The Impact on Oral Health

Regular dental check-ups and cleanings are essential for maintaining oral health. They help identify and prevent potential issues, such as gum disease, tooth decay, and oral infections. Early detection through these visits can lead to simpler, less invasive treatments, ultimately saving patients time, pain, and money in the long run.

Additionally, dentist insurance plans often cover preventive services like dental sealants and fluoride treatments, which can further protect teeth from decay and strengthen enamel. By encouraging patients to utilize these preventive measures, insurance plans play a proactive role in oral health management.

Financial Security and Peace of Mind

Financial stability is a key concern for both patients and dentists. For patients, unexpected dental bills can be a significant financial strain, especially for those without insurance. Dentist Insurance Plans help mitigate this risk by covering a portion or, in some cases, the full cost of dental treatments. This financial support ensures that patients can receive the care they need without compromising their overall financial health.

From a dentist's perspective, insurance plans provide a reliable source of reimbursement for the services they provide. This stability is crucial for the long-term success and sustainability of dental practices. It allows dentists to invest in advanced equipment, continue their professional development, and ultimately, deliver the highest standard of care to their patients.

Types of Dentist Insurance Plans: A Comprehensive Overview

Dentist Insurance Plans come in various forms, each offering unique coverage options and benefits. Understanding these different types is crucial for both patients and dentists to make informed choices about their oral healthcare.

Dental Health Maintenance Organizations (DHMO)

Dental HMOs are a popular choice for individuals seeking comprehensive dental coverage. These plans typically require patients to select a primary care dentist within their network, who coordinates all their dental care. DHMO plans often cover a wide range of services, including routine check-ups, X-rays, cleanings, and even more complex procedures like fillings and root canals.

One of the key advantages of DHMO plans is their focus on preventive care. They encourage regular dental visits by covering a significant portion of the costs associated with preventive services. This proactive approach helps identify and address oral health issues early on, potentially saving patients from more extensive and costly treatments down the line.

| Plan Type | DHMO |

|---|---|

| Primary Care Dentist | Required |

| Network Coverage | Broad |

| Preventive Care Emphasis | High |

| Cost | Affordable |

Preferred Provider Organizations (PPO)

PPO plans offer patients the flexibility to choose their dentist, whether in or out of the insurance network. These plans typically cover a wide range of services, often with higher reimbursement rates for in-network providers. While PPOs may have higher premiums compared to other plans, they provide the convenience of being able to visit any dentist, making them a popular choice for those who value flexibility.

PPO plans are particularly beneficial for patients who have established relationships with specific dentists or those who require specialized dental care. By allowing patients to choose their provider, PPOs ensure that individuals can continue receiving care from dentists they trust and feel comfortable with.

| Plan Type | PPO |

|---|---|

| Provider Choice | Flexible |

| Reimbursement Rates | Higher for In-Network |

| Premiums | Higher |

| Specialized Care | Convenient |

Dental Indemnity Plans

Dental indemnity plans, also known as fee-for-service plans, provide patients with the most flexibility in choosing their dentist. Under these plans, patients are reimbursed for a portion of their dental expenses, regardless of whether the dentist is in-network. This reimbursement is typically based on a predetermined fee schedule.

One of the key advantages of dental indemnity plans is the lack of restrictions on provider choice. Patients can visit any dentist they prefer, making it an ideal option for those who have specific dental needs or a strong preference for a particular provider. However, it's important to note that the reimbursement rates may vary based on the dentist's fees, and patients may be responsible for paying any amount exceeding the plan's coverage.

| Plan Type | Dental Indemnity |

|---|---|

| Provider Choice | Unrestricted |

| Reimbursement | Based on Fee Schedule |

| Premiums | Varies |

| Provider Fees | May Impact Reimbursement |

Dental Discount Plans

Dental discount plans, unlike traditional insurance plans, do not provide reimbursement for dental services. Instead, they offer members discounted rates on a variety of dental procedures. These plans are often more affordable than traditional insurance, making them an attractive option for those on a tight budget.

With a dental discount plan, members typically pay an annual or monthly fee to access a network of participating dentists who offer reduced rates on their services. While these plans don't provide coverage in the traditional sense, they can still be a cost-effective way for individuals to access essential dental care.

| Plan Type | Dental Discount |

|---|---|

| Discounts | Offers Reduced Rates |

| Premiums | Affordable |

| Network | Participating Dentists |

| Coverage | Discounts Only |

Key Considerations for Dentists: Choosing the Right Insurance Plan

For dentists, selecting the right insurance plan is a critical decision that can impact the success and sustainability of their practice. It’s not just about covering the financial risks associated with providing dental care; it’s about choosing a plan that aligns with their practice’s philosophy, patient base, and long-term goals.

Understanding Patient Needs

The first step in choosing an insurance plan is to understand the needs of your patient population. Consider factors such as their average income, existing health conditions, and oral health awareness. For instance, patients with lower incomes may benefit more from plans with lower premiums and higher coverage for essential services like cleanings and check-ups. On the other hand, patients with higher incomes may be more inclined to choose plans with a focus on specialized or cosmetic dentistry.

Evaluating Plan Coverage and Reimbursement

When evaluating insurance plans, dentists should pay close attention to the coverage offered and the reimbursement rates. Plans with comprehensive coverage for a wide range of services can be beneficial, especially for practices that offer a diverse array of treatments. Additionally, higher reimbursement rates can provide a more stable financial foundation for the practice, allowing for better cash flow and the ability to invest in advanced equipment and technologies.

Network Considerations

The network of providers is another crucial aspect to consider. Some plans may have a more limited network, which can restrict patient choice and potentially drive patients away. On the other hand, plans with a broader network can attract a larger patient base and provide more flexibility for patients who travel or have specific provider preferences.

Dentists should also consider the potential for network changes over time. Some insurance companies may periodically update their networks, which could impact the practice's patient base and revenue stream. It's important to choose a plan with a network that is likely to remain stable and provide consistent access to patients.

Administrative Burden and Claims Processing

The administrative burden associated with insurance plans can vary significantly. Some plans may require more paperwork and a more complex claims process, which can be time-consuming and resource-intensive for dental practices. Dentists should evaluate the administrative requirements of different plans and consider how these might impact their practice’s workflow and staff resources.

The Future of Dentist Insurance Plans: Innovations and Trends

The world of dentist insurance is constantly evolving, driven by advancements in dental technology, changing patient expectations, and shifts in the healthcare landscape. Here, we explore some of the key innovations and trends that are shaping the future of dentist insurance plans.

Telehealth and Virtual Consultations

The rise of telehealth services has revolutionized the way patients access healthcare, including dental care. Many insurance plans now cover virtual consultations, allowing patients to seek advice and guidance from their dentists without the need for an in-person visit. This not only improves access to care but also reduces the financial burden associated with unnecessary office visits.

In-Network Incentives

To encourage patients to utilize in-network providers, some insurance plans are offering incentives such as reduced copays or increased coverage for in-network visits. These incentives can be particularly beneficial for dentists, as they promote patient loyalty and provide a steady stream of patients. Additionally, these incentives can help control costs for both patients and insurance companies.

Expanded Coverage for Preventive Care

Preventive care is a cornerstone of oral health, and many insurance plans are now recognizing its importance by expanding coverage for preventive services. This includes not only routine check-ups and cleanings but also more specialized preventive measures like dental sealants and fluoride treatments. By investing in preventive care, insurance plans can help reduce the need for more costly and invasive procedures down the line.

Integration with Dental Technologies

The integration of insurance plans with advanced dental technologies is another emerging trend. Some insurance companies are now offering coverage for innovative treatments and technologies, such as digital X-rays, CAD/CAM dentistry, and 3D printing. By embracing these technologies, insurance plans can provide patients with access to the latest advancements in dental care, improving both the patient experience and treatment outcomes.

Data-Driven Decision Making

With the increasing availability of dental data, insurance companies are leveraging analytics to make more informed decisions about coverage and reimbursement. By analyzing data on patient demographics, treatment outcomes, and cost trends, insurance providers can identify areas for improvement and develop more effective coverage strategies. This data-driven approach can lead to more efficient and cost-effective insurance plans, ultimately benefiting both patients and dentists.

Conclusion: Empowering Oral Health Through Insurance

Dentist Insurance Plans are a vital component of the oral healthcare ecosystem, providing financial support and encouraging regular dental visits. By understanding the different types of plans, their coverage options, and the factors that influence their choice, both patients and dentists can make informed decisions that align with their unique needs and goals.

As the world of dentist insurance continues to evolve, embracing innovations and trends will be key to ensuring access to high-quality, affordable oral healthcare. Whether through the integration of technology, expanded coverage for preventive care, or data-driven decision-making, insurance plans have the potential to revolutionize the way we approach oral health.

How do I choose the right dentist insurance plan for my practice?

+

Choosing the right dentist insurance plan involves considering factors like your patient base, the services you offer, and your practice’s financial goals. Evaluate plans based on coverage, reimbursement rates, network size, and administrative burden. It’s also crucial to stay informed about industry trends and patient preferences to make the most beneficial choice for your practice.

What are the benefits of offering in-network incentives to patients?

+

In-network incentives, such as reduced copays or increased coverage, encourage patients to utilize your practice. This loyalty can lead to a more stable patient base and potentially higher revenue. Additionally, it can help control costs for patients, making dental care more accessible and affordable.

How can I stay updated with the latest trends in dentist insurance plans?

+

Staying informed about industry trends is crucial for both patients and dentists. Attend dental conferences, join professional organizations, and regularly review reputable dental publications and websites. Additionally, engage with colleagues and peers to discuss their experiences and insights into the latest insurance developments.