Define D&O Insurance

Directors and Officers (D&O) insurance is a specialized form of liability coverage designed to protect the personal assets of company directors and officers from potential legal risks and financial losses arising from their decision-making roles within the organization. This critical coverage ensures that these individuals can effectively lead their companies without the fear of devastating financial consequences due to litigation.

D&O insurance acts as a safety net, shielding directors and officers from the financial burden of legal actions that may arise from their professional duties. These actions can include a wide range of scenarios, from shareholder lawsuits to regulatory investigations and even personal injury claims.

Understanding the Scope of D&O Insurance

D&O insurance is a comprehensive policy that offers protection against various types of claims. The scope of coverage typically includes:

- Personal Liability: Covers directors and officers for their individual actions, ensuring their personal assets are protected.

- Entity Coverage: Provides protection for the company itself, covering certain claims made against the organization.

- Defense Costs: Pays for the legal defense of directors and officers, regardless of the outcome of the case.

- Wrongful Acts: Covers a broad range of alleged wrongful acts, such as breach of duty, neglect, error, misstatement, misleading statement, and omission.

D&O insurance policies are typically tailored to the specific needs of the organization and its leadership, offering flexibility in coverage limits and additional endorsements to address unique risks.

Key Components of a D&O Policy

A D&O insurance policy is comprised of several key components, each designed to address specific risks and provide comprehensive protection:

- Side A Coverage: Protects directors and officers personally, providing coverage for their defense and any damages awarded against them. This coverage is particularly crucial as it is not dependent on the company's ability to indemnify them.

- Side B Coverage: Offers reimbursement to directors and officers for defense costs, indemnification payments, or settlement amounts when the company indemnifies them. Side B coverage is contingent on the company's indemnification obligation.

- Side C Coverage: Provides protection to the company itself, covering defense costs and damages for claims made against the organization. Side C coverage is triggered when directors and officers are named in a lawsuit, even if the company is not directly named.

- Optional Endorsements: Many D&O policies offer optional endorsements to enhance coverage. These can include employment practices liability, fiduciary liability, and cyber liability endorsements, providing additional protection for specific risks.

The choice of coverage limits and endorsements depends on the organization's unique risks and the directors' and officers' comfort level with potential exposure.

| Coverage Type | Description |

|---|---|

| Side A | Personal liability coverage for directors and officers. |

| Side B | Reimbursement for defense costs and indemnification when the company indemnifies directors and officers. |

| Side C | Coverage for the company, including defense costs and damages for claims against the organization. |

Real-World Applications of D&O Insurance

D&O insurance has proven its worth in various real-world scenarios, protecting directors and officers from devastating financial losses. Here are a few examples:

- Shareholder Lawsuits: A company experiences a decline in stock price, leading to a class-action lawsuit filed by shareholders. The directors and officers are named in the suit, and D&O insurance steps in to cover their defense costs and any damages awarded.

- Regulatory Investigations: A regulatory body initiates an investigation into a company's practices, focusing on the actions of its directors and officers. D&O insurance provides coverage for the legal expenses and potential fines associated with the investigation.

- Employment Practices Claims: A former employee sues the company, alleging wrongful termination and discrimination. D&O insurance, with an employment practices liability endorsement, covers the defense costs and any settlement or judgment amounts.

These real-world applications highlight the critical role D&O insurance plays in protecting the financial well-being of directors and officers, allowing them to focus on their leadership responsibilities without undue concern for personal financial risk.

Why D&O Insurance is Crucial for Business Leaders

D&O insurance is not just a legal requirement for certain businesses; it is a strategic necessity for any organization with directors and officers. Here's why:

- Risk Mitigation: D&O insurance provides a crucial risk management tool, protecting directors and officers from potential financial ruin due to legal actions.

- Attracting Talent: With D&O insurance in place, companies can attract top-tier talent for leadership positions, as these individuals seek the financial security it provides.

- Board Independence: D&O insurance allows boards of directors to make independent decisions without fear of personal financial repercussions, fostering a culture of sound governance.

- Legal Defense: In the event of a lawsuit, D&O insurance ensures that directors and officers have access to the best legal defense, regardless of their personal financial situation.

- Regulatory Compliance: Many regulatory bodies and stock exchanges require companies to have adequate D&O insurance, ensuring compliance with legal and industry standards.

By investing in D&O insurance, businesses demonstrate a commitment to protecting their leadership and ensuring the long-term stability and success of the organization.

The Future of D&O Insurance

As the business landscape evolves, so too does the need for innovative D&O insurance solutions. Here are some key trends and considerations for the future of this critical coverage:

- Emerging Risks: With the rise of new technologies and business models, such as artificial intelligence and blockchain, D&O insurance policies must adapt to cover potential risks associated with these innovations.

- Regulatory Changes: As regulations continue to evolve, especially in the realm of data privacy and cybersecurity, D&O insurance policies will need to keep pace to ensure compliance and adequate coverage.

- Cyber Risks: The increasing prevalence of cyber attacks and data breaches poses significant risks for directors and officers. D&O insurance policies will need to address these risks more comprehensively, often through separate cyber liability endorsements.

- Enhanced Coverage: As the complexity of business operations grows, D&O insurance policies will likely offer more extensive coverage, including higher limits and broader definitions of "wrongful acts."

By staying abreast of these trends and proactively addressing emerging risks, businesses can ensure their D&O insurance remains robust and effective in the face of an ever-changing business environment.

What are the key benefits of D&O insurance for company directors and officers?

+D&O insurance offers several critical benefits to company directors and officers, including protection of personal assets, coverage for legal defense costs, and indemnification for damages awarded in lawsuits. It provides peace of mind and financial security, allowing these individuals to focus on their leadership responsibilities without undue concern for personal financial risk.

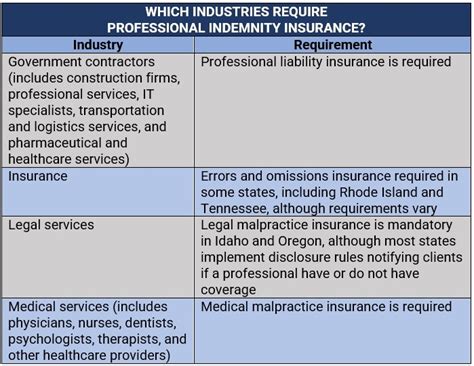

How does D&O insurance differ from general liability insurance?

+While general liability insurance covers a broad range of liability risks for a business, D&O insurance is specifically designed to protect the personal assets of directors and officers. General liability insurance typically covers claims related to bodily injury, property damage, and advertising injuries, whereas D&O insurance focuses on claims arising from the actions of company leadership, such as shareholder lawsuits and regulatory investigations.

What are some common exclusions in D&O insurance policies?

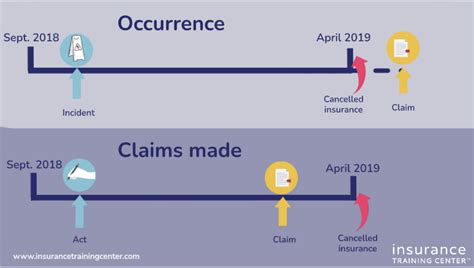

+Common exclusions in D&O insurance policies may include intentional acts, criminal conduct, personal capacity acts (acts unrelated to the individual’s role as a director or officer), and pre-existing conditions (claims arising from events that occurred before the policy was in place). It’s important to carefully review the policy’s exclusions to understand what is and isn’t covered.