Insurance For Rv

When you're an RV owner, it's essential to understand the unique insurance needs that come with this type of vehicle. An RV, or recreational vehicle, is more than just a means of transportation; it's a home away from home, and protecting it requires a different approach compared to standard auto or home insurance policies. In this comprehensive guide, we'll delve into the world of RV insurance, exploring the specific coverages, benefits, and considerations to help you make informed decisions about protecting your investment.

Understanding RV Insurance: The Basics

RV insurance is a specialized form of coverage designed to address the unique risks and requirements associated with owning and operating a recreational vehicle. Unlike traditional auto insurance, which primarily focuses on vehicles used for daily transportation, RV insurance takes into account the additional aspects of an RV’s use, such as living quarters, storage capabilities, and the potential for long-term travel.

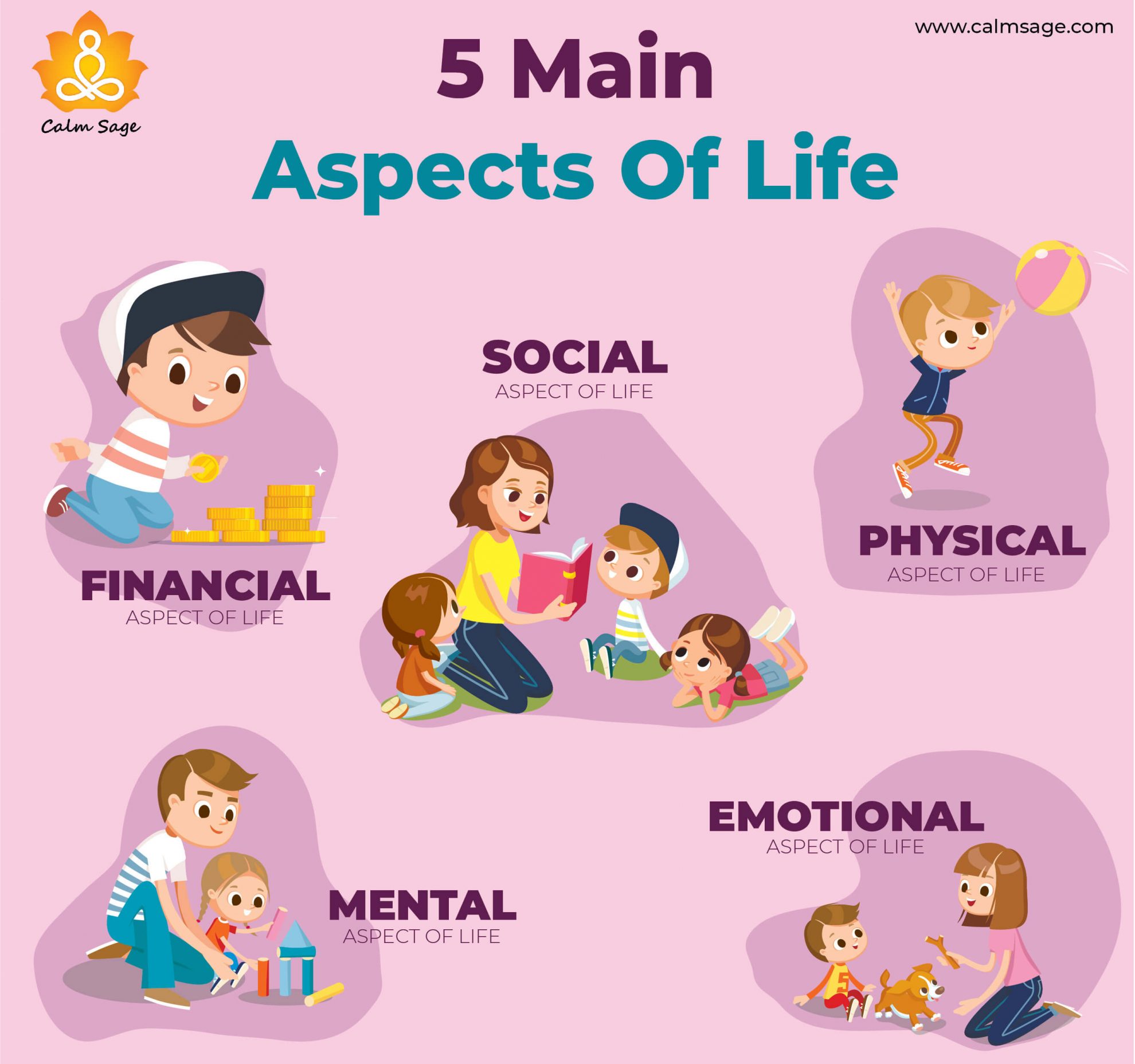

Here are some key aspects to consider when understanding RV insurance:

- Coverage Types: RV insurance policies offer a range of coverage options, including liability, collision, comprehensive, and personal property coverage. Liability coverage protects you in case of accidents, while collision and comprehensive coverages safeguard your RV against physical damage.

- Full-Timer Policies: If you plan to live in your RV full-time, you'll need a policy tailored to your specific needs. Full-timer RV insurance provides broader coverage for your personal belongings and may include additional benefits like personal liability coverage.

- Valuable Items: RVs often house valuable personal belongings. Ensure your policy covers these items adequately, especially if you have expensive electronics, jewelry, or other high-value possessions.

- Medical Expenses: Consider adding medical payments coverage to your policy to cover medical expenses for you and your passengers in the event of an accident.

- Emergency Roadside Assistance: This coverage provides essential support in case of breakdowns, flat tires, or other unexpected situations while on the road.

Tailoring Your RV Insurance Coverage

One of the advantages of RV insurance is the flexibility to customize your policy to fit your unique needs. Here’s how you can tailor your coverage:

Vehicle Value and Coverage Limits

RV insurance policies often offer different coverage limits based on the value of your vehicle. It’s crucial to accurately assess the current market value of your RV to ensure you have adequate coverage. If your RV is a custom build or has significant modifications, consult with your insurer to determine the appropriate coverage limits.

Coverage Add-Ons

RV insurance providers frequently offer a variety of optional add-ons to enhance your coverage. These may include:

- Total Loss Replacement: This add-on provides a new RV if your vehicle is declared a total loss due to an accident or other covered event.

- Vacation Liability: Additional liability coverage for when you're using your RV as a temporary vacation home.

- Personal Effects Coverage: Extends coverage for personal belongings inside your RV beyond the standard limits.

- Emergency Expense Coverage: Reimburses you for additional living expenses if your RV becomes uninhabitable due to a covered loss.

Discounts and Savings

Just like with other types of insurance, RV insurance providers offer various discounts to help reduce your premium. Some common discounts include:

- Multi-Policy Discounts: Bundling your RV insurance with other policies, such as auto or home insurance, can result in significant savings.

- Safety Equipment Discounts: Installing safety features like fire extinguishers, smoke detectors, and security systems may qualify you for reduced premiums.

- Loyalty Discounts: Insurers often reward long-term customers with loyalty discounts, so consider sticking with the same provider for your insurance needs.

- Usage-Based Discounts: Some insurers offer discounts based on your RV's usage, such as the number of miles driven or the frequency of trips.

Comparing RV Insurance Providers

When it comes to choosing an RV insurance provider, it’s essential to compare multiple options to find the best fit for your needs. Here are some factors to consider:

Reputation and Financial Stability

Look for insurance companies with a solid reputation and strong financial stability. This ensures they’ll be able to honor their commitments and pay out claims promptly.

Coverage Options

Compare the coverage options offered by different providers. Ensure they provide the specific coverages you require, whether it’s full-timer policies, valuable items coverage, or add-ons like total loss replacement.

Claims Process

Research the claims process of each insurer. Look for providers with a streamlined and efficient claims process, as this can make a significant difference in the event of an accident or loss.

Customer Service

Evaluate the customer service reputation of the insurance companies. Responsive and helpful customer service can provide peace of mind and make it easier to navigate any insurance-related issues.

Price and Discounts

Compare prices and the availability of discounts to find the most cost-effective option. Remember, the cheapest policy may not always offer the best value, so strike a balance between price and comprehensive coverage.

Real-World Examples: RV Insurance in Action

To better understand the impact of RV insurance, let’s explore a couple of real-world scenarios:

Accidental Damage

Imagine you’re on a camping trip in your RV when a sudden storm hits. High winds cause a tree branch to fall on your RV, damaging the roof and interior. With comprehensive RV insurance coverage, you can file a claim to cover the repairs, ensuring your RV is back in top condition without breaking the bank.

Full-Timer Lifestyle

If you’ve decided to embrace the full-timer lifestyle and live in your RV year-round, a specialized full-timer policy becomes essential. This type of coverage ensures your personal belongings and the structure of your RV are adequately protected, providing peace of mind as you explore new places.

Future Considerations: Emerging Trends in RV Insurance

As the RV industry continues to evolve, so do the insurance options available. Here are some future considerations to keep in mind:

Electric RVs

With the rise of electric vehicles, we can expect to see more electric RVs on the market. Insurers will need to adapt their policies to address the unique risks and benefits associated with this new technology.

Connected RV Technology

RV manufacturers are increasingly integrating advanced technology into their vehicles. This includes features like built-in navigation systems, smart home integration, and advanced safety systems. Insurers may offer discounts or additional coverages to incentivize the adoption of these safety-focused technologies.

Rental and Sharing Economy

The sharing economy has made it easier for RV owners to rent out their vehicles to others. Insurers may develop specific policies or endorsements to cover this new use case, ensuring both the owner and renter are adequately protected.

| RV Insurance Provider | Coverage Highlights |

|---|---|

| Provider A | Specializes in full-timer policies, offering comprehensive coverage for those living in their RVs full-time. |

| Provider B | Known for their flexible add-on options, allowing customization of coverage based on individual needs. |

| Provider C | Provides extensive emergency roadside assistance coverage, ensuring prompt support in case of breakdowns. |

Frequently Asked Questions

What is the average cost of RV insurance?

+The average cost of RV insurance varies based on factors such as the type of RV, its value, and your coverage limits. Generally, you can expect to pay between 500 and 1,500 annually for a basic policy. However, the cost can increase or decrease depending on your specific circumstances and the coverage options you choose.

Can I get RV insurance if I only use it occasionally for vacations?

+Absolutely! RV insurance policies are designed to accommodate both full-time RV users and those who only use their RVs for occasional vacations. You can customize your coverage to match your usage patterns and ensure you have the protection you need when hitting the open road.

What happens if I’m involved in an accident while driving my RV?

+If you’re involved in an accident while driving your RV, your RV insurance policy’s liability coverage will come into play. This coverage helps protect you from financial losses if you’re found at fault in the accident. It covers damages to other vehicles, property, and injuries sustained by other parties involved. It’s important to contact your insurance provider promptly after an accident to initiate the claims process.

Are there any discounts available for RV insurance?

+Yes, RV insurance providers offer various discounts to help reduce your premium. Common discounts include multi-policy discounts (bundling your RV insurance with other policies), safety equipment discounts (for installing certain safety features), loyalty discounts (for long-term customers), and usage-based discounts (based on your RV’s usage patterns). Be sure to inquire about these discounts when obtaining quotes from different providers.

Can I insure my custom-built RV?

+Absolutely! RV insurance providers understand that many RV owners have customized their vehicles to suit their unique needs. When insuring a custom-built RV, it’s important to accurately assess its current market value and choose coverage limits that adequately protect your investment. Consult with your insurer to ensure you have the right coverage for your custom-built RV.