Life Insurance Plans

In today's world, where uncertainty is an ever-present companion, safeguarding the financial well-being of our loved ones has become an essential aspect of responsible living. This is where life insurance steps in, offering a vital safety net that can provide peace of mind and ensure a secure future for those we care about.

Understanding Life Insurance: A Comprehensive Overview

Life insurance is a contract between an individual and an insurance company. It is a financial product designed to provide a payout, known as a death benefit, to the designated beneficiaries upon the insured person’s death. This benefit can serve various purposes, including covering funeral expenses, paying off debts, providing income for dependents, or even funding a child’s education.

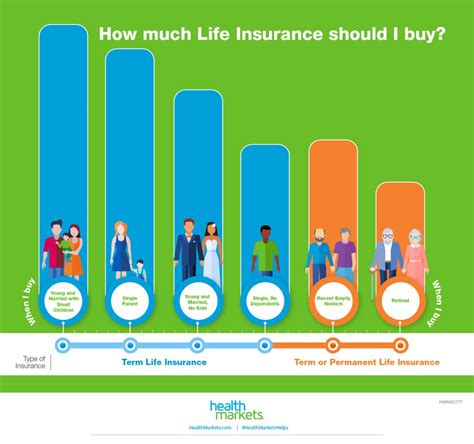

However, life insurance is not a one-size-fits-all proposition. There are several types of life insurance plans available, each catering to different needs and life stages. Let's delve into some of the most common types and explore their features and benefits.

Term Life Insurance

Term life insurance is often considered the most straightforward and affordable type of life insurance. It provides coverage for a specific period, known as the term, typically ranging from 10 to 30 years. During this term, the insured pays a fixed premium, and in the event of their death, their beneficiaries receive the death benefit. One of the key advantages of term life insurance is its flexibility; individuals can choose a term that aligns with their financial goals and responsibilities, such as covering mortgage payments or supporting children until they become independent.

| Term Length | Average Annual Premium (Example) |

|---|---|

| 10 Years | $300 - $500 |

| 20 Years | $400 - $700 |

| 30 Years | $500 - $1000 |

Term life insurance is particularly beneficial for individuals who require coverage for a defined period. For instance, a young couple starting their careers might opt for a 20-year term to cover their growing family's needs until their children are financially independent. As the term expires, individuals can reassess their financial situation and decide whether to renew the policy or explore other options.

Whole Life Insurance

Whole life insurance, often referred to as permanent life insurance, offers coverage for the insured’s entire life, provided premiums are paid as agreed. Unlike term life insurance, whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn if needed. This cash value grows tax-deferred, making whole life insurance an attractive option for those seeking long-term financial protection and potential tax benefits.

The premiums for whole life insurance are typically higher than term life insurance, as they cover both the death benefit and the cash value accumulation. However, the peace of mind that comes with lifelong coverage and the potential for financial growth make whole life insurance a popular choice for individuals seeking comprehensive financial planning.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows policyholders to adjust their premiums and death benefits within certain limits. This flexibility is particularly beneficial for individuals whose financial needs may fluctuate over time. Universal life insurance also accumulates cash value, similar to whole life insurance, but it offers more control over how premiums are allocated between the death benefit and cash value.

Policyholders can choose to pay a fixed premium, like in whole life insurance, or they can adjust their premium payments based on their financial situation. This adaptability makes universal life insurance a preferred choice for those who value control and the ability to adapt their financial strategies as life circumstances change.

Indexed Universal Life Insurance

Indexed universal life insurance is a variant of universal life insurance that links the policy’s cash value to a financial index, often the S&P 500. While the cash value is not directly invested in the stock market, it can benefit from market growth, providing potential for higher returns. However, it’s important to note that the policy’s performance is not guaranteed and can be influenced by market conditions.

Indexed universal life insurance offers a balance between the stability of traditional life insurance and the potential for higher returns. Policyholders can choose the level of risk they are comfortable with, making it a suitable option for those seeking a mix of financial protection and investment opportunities.

The Benefits of Life Insurance: A Secure Future

Life insurance serves as a powerful tool to ensure financial security and peace of mind. Here are some key benefits that make life insurance an essential component of any comprehensive financial plan:

- Financial Security for Beneficiaries: Life insurance provides a significant financial cushion for loved ones in the event of the insured's death. This can be especially crucial for families relying on the insured's income, as it can help cover daily expenses, pay off debts, and maintain their standard of living.

- Debt Repayment: Life insurance proceeds can be used to repay outstanding debts, such as mortgages, car loans, or credit card balances. This helps alleviate the financial burden on beneficiaries and ensures that the insured's legacy is not overshadowed by outstanding liabilities.

- Income Replacement: For families dependent on the insured's income, life insurance can serve as a replacement, providing a steady stream of income to support daily expenses and long-term financial goals. This is particularly valuable for families with young children or those facing significant financial obligations.

- Education Funding: Life insurance can be a powerful tool to fund a child's education. By including an education rider on the policy, parents can ensure that their children's educational expenses are covered, even in the event of their untimely demise.

- Legacy Building: Life insurance can be a way to leave a lasting legacy. The proceeds can be used to support charitable causes, fund business ventures, or establish trusts to benefit future generations.

Choosing the Right Life Insurance Plan: A Personalized Approach

Selecting the right life insurance plan is a highly personal decision that depends on various factors, including your age, health, financial situation, and long-term goals. Here are some key considerations to guide you in choosing the life insurance plan that best suits your needs:

Assess Your Needs

The first step in choosing a life insurance plan is to assess your specific needs. Consider the following questions:

- How much coverage do you need to support your family's financial obligations and goals?

- Do you have any outstanding debts that need to be repaid in the event of your death?

- Are you looking for coverage for a defined period (term life) or lifelong protection (whole or universal life)?

- Do you prioritize flexibility and control over premiums and death benefits (universal life) or the stability of guaranteed coverage (whole life)?

Evaluate Your Health and Lifestyle

Your health and lifestyle play a significant role in determining the type and cost of your life insurance policy. Insurers consider factors such as age, medical history, smoking status, and hazardous hobbies when assessing your risk profile. Generally, the healthier and younger you are, the more affordable your life insurance premiums will be.

Consider Your Budget

Life insurance premiums can vary widely depending on the type of policy, coverage amount, and your personal risk factors. It’s essential to choose a plan that fits comfortably within your budget. Remember, the goal is to find a balance between the coverage you need and what you can afford to pay over the long term.

Seek Professional Guidance

Navigating the world of life insurance can be complex, and it’s beneficial to seek advice from a qualified insurance professional. An experienced agent or financial advisor can help you understand the intricacies of different life insurance plans, assess your specific needs, and guide you toward a policy that aligns with your goals and budget.

The Impact of Life Insurance: Real-Life Stories

Life insurance is not just a financial product; it’s a safety net that has transformed the lives of countless individuals and families. Here are a few real-life stories that illustrate the impact of life insurance:

Story 1: Providing for a Growing Family

John and Sarah, a young couple with two children, understood the importance of financial security. They chose a 20-year term life insurance policy, ensuring that their family’s needs would be met in the event of either parent’s untimely demise. When Sarah passed away suddenly, the life insurance proceeds allowed John to continue providing for their children, pay off their mortgage, and even start a college fund.

Story 2: Building a Legacy

Emily, a successful businesswoman, opted for a whole life insurance policy with a substantial death benefit. As an only child, she wanted to ensure that her parents would be financially secure in their golden years. The policy’s cash value accumulation provided Emily with the flexibility to support her parents’ retirement needs and leave a lasting legacy for future generations.

Story 3: Overcoming Adversity

Michael, a single father, knew the importance of being prepared. He chose a universal life insurance policy that allowed him to adjust his premiums as his financial situation evolved. When Michael lost his job, he was able to reduce his premiums temporarily without compromising his family’s coverage. This flexibility helped him navigate a challenging period and maintain financial stability.

The Future of Life Insurance: Adapting to Change

The life insurance industry is evolving to meet the changing needs and expectations of policyholders. Here are some trends and developments shaping the future of life insurance:

- Digital Transformation: The rise of digital technology has transformed the way life insurance is purchased and managed. Online platforms and mobile apps offer convenient access to policy information, allowing policyholders to make informed decisions and track their coverage.

- Personalized Coverage: Insurers are increasingly offering customized life insurance plans that cater to individual needs. This includes flexible policies that can be tailored to specific goals, such as education funding or retirement planning.

- Health and Wellness Incentives: Some life insurance companies are incentivizing policyholders to adopt healthier lifestyles by offering discounts or rewards for maintaining a healthy weight, quitting smoking, or engaging in regular exercise. These initiatives promote overall well-being while also reducing the risk of premature death.

- Simplified Issue Policies: Traditional life insurance policies often require extensive medical examinations and health questionnaires. However, simplified issue policies are gaining popularity, offering coverage with fewer medical requirements and faster approval processes.

Conclusion: A Secure Future, One Policy at a Time

Life insurance is a powerful tool that empowers individuals to take control of their financial future and protect their loved ones. By understanding the different types of life insurance plans and their benefits, individuals can make informed decisions that align with their unique circumstances and goals.

Whether it's providing financial security for a growing family, building a legacy, or overcoming life's challenges, life insurance serves as a reliable companion on the journey toward a secure and prosperous future. So, take the time to explore your options, seek expert advice, and choose a life insurance plan that reflects your values and aspirations.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your financial obligations and goals. A general rule of thumb is to have coverage that is 10-15 times your annual income. However, it’s best to consult with a financial advisor or insurance professional to determine your specific needs.

Can I change my life insurance policy after purchasing it?

+Yes, you can often make changes to your life insurance policy, such as increasing or decreasing coverage, adjusting beneficiaries, or converting a term policy to a permanent one. However, changes may impact your premiums and require additional underwriting.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on your policy. Some policies may have a grace period, allowing you to make the payment within a certain timeframe without losing coverage. Others may lapse if payments are not made on time, requiring you to reapply for coverage.

Can I have more than one life insurance policy?

+Yes, you can have multiple life insurance policies. This may be beneficial if you have different financial goals or need coverage from multiple providers. However, it’s essential to carefully consider the total cost of premiums and ensure that your policies complement each other.