Covid Tests With Insurance

Navigating COVID-19 Testing: Understanding Your Insurance Coverage

As the world continues to navigate the ongoing COVID-19 pandemic, access to accurate and timely testing has become crucial. With various testing options available, understanding your insurance coverage for COVID-19 tests is essential to ensure you receive the necessary care without unexpected financial burdens.

In this comprehensive guide, we will delve into the intricacies of COVID-19 testing and insurance, providing you with the knowledge to make informed decisions. From explaining the different types of tests to exploring insurance coverage, we aim to empower you with the information needed to protect your health and finances during these uncertain times.

Understanding COVID-19 Testing Options

Before we delve into insurance coverage, it's important to understand the different types of COVID-19 tests available. The two primary categories of tests are diagnostic tests and antibody tests, each serving distinct purposes in the detection and management of the virus.

Diagnostic Tests: Detecting Active Infections

Diagnostic tests are designed to identify active COVID-19 infections. These tests are crucial for diagnosing individuals who are currently sick and for guiding public health measures to contain the spread of the virus. There are two main types of diagnostic tests:

- Molecular Tests (PCR Tests): These tests detect the genetic material of the SARS-CoV-2 virus, the causative agent of COVID-19. PCR tests are highly accurate and are considered the gold standard for diagnosing active infections. They can be performed using nasal or throat swabs, saliva samples, or other respiratory specimens.

- Antigen Tests: Antigen tests detect specific proteins (antigens) on the surface of the virus. While they are generally less sensitive than PCR tests, they offer rapid results, often within minutes. Antigen tests are useful for quick screening in certain settings, such as schools or workplaces, but may require confirmation with a PCR test for a definitive diagnosis.

Diagnostic tests are typically ordered by healthcare providers based on an individual's symptoms, exposure history, or as part of contact tracing efforts. The results of these tests play a critical role in guiding isolation and treatment protocols.

Antibody Tests: Assessing Past Infections

Antibody tests, also known as serological tests, detect the presence of antibodies produced by the immune system in response to a COVID-19 infection. These tests do not diagnose active infections but rather provide information about an individual's immune response and potential immunity to the virus.

Antibody tests are particularly useful for understanding the prevalence of COVID-19 in a community, as they can identify individuals who have recovered from the infection and may have developed some level of immunity. However, it's important to note that the presence of antibodies does not guarantee complete protection against future infections.

There are two main types of antibody tests:

- IgM and IgG Antibody Tests: These tests detect two different types of antibodies: IgM (immunoglobulin M) and IgG (immunoglobulin G). IgM antibodies are typically produced early in an infection, while IgG antibodies are produced later and may persist for a longer duration. Combined IgM/IgG tests provide a more comprehensive assessment of an individual's immune response.

- Total Antibody Tests: Total antibody tests detect the presence of any type of antibody against SARS-CoV-2. These tests are simpler and more cost-effective but may not provide the same level of detail as IgM/IgG tests.

Antibody tests are often used in research settings or for population-level surveillance, but they may also be ordered by healthcare providers to assess an individual's immune status after a suspected or confirmed COVID-19 infection.

Insurance Coverage for COVID-19 Testing

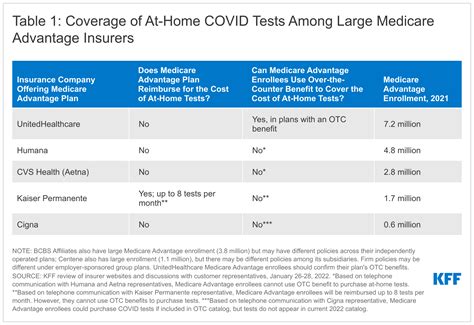

Now that we have a clearer understanding of the different types of COVID-19 tests, let's explore the insurance coverage landscape. The specifics of insurance coverage for COVID-19 testing can vary depending on your insurance provider, plan type, and state regulations. However, there are some general guidelines and mandates in place to ensure access to testing without excessive financial barriers.

The Families First Coronavirus Response Act (FFCRA)

In March 2020, the U.S. government passed the Families First Coronavirus Response Act (FFCRA), which included provisions to expand access to COVID-19 testing and related services. The FFCRA mandated that private health plans and Medicare cover the cost of COVID-19 diagnostic testing, including the associated healthcare provider visit, without imposing any cost-sharing requirements such as deductibles, copayments, or coinsurance.

This mandate applies to both insured individuals and those who are uninsured. Insured individuals are entitled to COVID-19 diagnostic testing coverage without having to meet their plan's deductible or pay any out-of-pocket expenses. Uninsured individuals are also protected, as the FFCRA requires healthcare providers to bill the government for the cost of testing, ensuring access to testing regardless of insurance status.

Coverage for Diagnostic Tests

Under the FFCRA and subsequent guidance from the Centers for Medicare & Medicaid Services (CMS), private health plans and Medicare are required to cover the cost of FDA-authorized COVID-19 diagnostic tests. This coverage includes:

- Test Administration: The cost of administering the test, including the collection of samples and the necessary laboratory processing.

- Healthcare Provider Visit: The cost of the healthcare provider's time and expertise in ordering and interpreting the test results. This coverage applies even if the test is self-administered, as long as it is ordered by a healthcare provider.

- Related Services: Any additional services or treatments that may be required due to the test result, such as isolation or quarantine measures, additional testing, or medical interventions.

It's important to note that coverage may vary depending on the specific circumstances and the type of test used. For example, some insurance plans may have restrictions on the frequency of testing or require pre-authorization for certain tests. It's always advisable to check with your insurance provider for the most up-to-date information on coverage policies.

Coverage for Antibody Tests

The coverage of antibody tests is less straightforward than that of diagnostic tests. While the FFCRA mandates coverage for diagnostic testing, it does not explicitly address antibody testing. However, many insurance providers have recognized the value of antibody tests in understanding the prevalence and immunity of COVID-19 and have expanded their coverage to include these tests.

Coverage for antibody tests can vary widely among insurance providers. Some plans may cover antibody tests without any cost-sharing, while others may require a copayment or have restrictions on the frequency of testing. It's crucial to review your insurance plan's benefits summary or contact your insurance provider directly to understand the specifics of antibody test coverage.

Out-of-Pocket Costs and Surprises

While the FFCRA and insurance coverage policies aim to minimize out-of-pocket expenses for COVID-19 testing, there are still potential scenarios where unexpected costs may arise. These situations can include:

- Emergency Department Visits: If you seek testing or treatment for COVID-19 symptoms in an emergency department, you may incur additional charges related to the emergency department visit itself, such as facility fees or physician charges.

- Non-Covered Tests: Some insurance plans may not cover certain types of COVID-19 tests, such as home testing kits or tests administered by non-preferred laboratories. In these cases, you may be responsible for the full cost of the test.

- Additional Services: While insurance coverage typically includes related services, there may be instances where additional procedures or treatments are required and not fully covered by your plan. These out-of-network or non-covered services can result in higher out-of-pocket expenses.

To avoid unexpected costs, it's essential to thoroughly understand your insurance coverage and ask questions before undergoing any testing or treatment. Many insurance providers offer online tools or customer service representatives who can provide detailed information about your plan's benefits and coverage policies.

Tips for Navigating COVID-19 Testing and Insurance

Navigating the complexities of COVID-19 testing and insurance coverage can be challenging, but with the right information and resources, you can make informed decisions and protect your health and finances. Here are some practical tips to guide you through the process:

Check Your Insurance Coverage

Before scheduling a COVID-19 test, take the time to review your insurance plan's coverage policies. Many insurance providers offer online resources or customer service hotlines where you can find detailed information about your benefits. Look for specific information regarding COVID-19 testing, including covered tests, out-of-pocket expenses, and any restrictions or requirements.

Seek Guidance from Healthcare Providers

Healthcare providers are an invaluable source of information when it comes to COVID-19 testing. Discuss your symptoms, concerns, and testing needs with your primary care physician or a healthcare professional. They can guide you towards the most appropriate type of test and provide information about the associated costs. Additionally, healthcare providers can help you navigate insurance-related questions and assist with any necessary pre-authorization processes.

Utilize In-Network Providers and Laboratories

To maximize your insurance coverage and minimize out-of-pocket expenses, it's generally advisable to utilize in-network healthcare providers and laboratories for COVID-19 testing. In-network providers have negotiated rates with your insurance provider, which can result in lower costs for you. Check your insurance plan's network directory or contact your insurance provider to find in-network options in your area.

Explore Government Resources

In addition to insurance coverage, there are government programs and initiatives aimed at expanding access to COVID-19 testing, particularly for underserved communities and those without insurance. Explore resources such as community testing sites, mobile testing units, or state-sponsored testing programs. These initiatives often provide free or low-cost testing, regardless of insurance status.

Stay Informed and Up-to-Date

The landscape of COVID-19 testing and insurance coverage is constantly evolving as new information and guidelines emerge. Stay informed by regularly checking reputable sources such as the Centers for Disease Control and Prevention (CDC), state health departments, and your insurance provider's website. Sign up for email updates or follow their social media accounts to receive the latest news and guidance.

Keep Records and Documentation

As you navigate the COVID-19 testing process, keep detailed records of all interactions, appointments, and expenses. This includes copies of test results, receipts, and any correspondence with healthcare providers or insurance companies. Proper documentation can be invaluable in resolving any billing disputes or insurance-related issues that may arise.

Conclusion: Empowering Yourself with Knowledge

In the ongoing battle against COVID-19, access to accurate and timely testing is a critical component of individual and public health. By understanding the different types of COVID-19 tests and their respective insurance coverage, you can make informed decisions about your health and finances. Remember, knowledge is power, and being well-informed can help you navigate the complexities of testing and insurance with confidence.

Stay vigilant, stay informed, and continue to prioritize your health and the health of those around you. Together, we can overcome the challenges posed by COVID-19 and emerge stronger on the other side.

FAQ

Are COVID-19 diagnostic tests covered by all insurance plans?

+Yes, the Families First Coronavirus Response Act (FFCRA) mandates that private health plans and Medicare cover the cost of COVID-19 diagnostic tests without imposing any cost-sharing requirements. This coverage applies to both insured and uninsured individuals.

What is the difference between a PCR test and an antigen test?

+PCR tests (molecular tests) detect the genetic material of the SARS-CoV-2 virus and are highly accurate. Antigen tests detect specific proteins on the virus’s surface and offer rapid results but may be less sensitive. PCR tests are considered the gold standard for diagnosing active infections.

Do insurance plans cover antibody tests for COVID-19?

+Coverage for antibody tests varies among insurance plans. While the FFCRA does not explicitly address antibody testing, many insurance providers have expanded their coverage to include these tests. It’s important to review your plan’s benefits summary or contact your insurance provider for specific information.

What should I do if I receive a surprise medical bill for COVID-19 testing?

+If you receive a surprise medical bill for COVID-19 testing, it’s important to verify the charges with your insurance provider. Contact your insurance company’s customer service department and provide them with details of the bill. They can help resolve any billing errors or provide guidance on appealing the charges.

Are there any government programs that offer free COVID-19 testing?

+Yes, there are government programs and initiatives aimed at providing free or low-cost COVID-19 testing. These include community testing sites, mobile testing units, and state-sponsored testing programs. Check with your state health department or local health authorities to find available options in your area.