Gap Auto Insurance

In the dynamic world of automotive insurance, where choices abound, understanding the nuances of each provider becomes paramount. This comprehensive guide aims to shed light on Gap Auto Insurance, dissecting its offerings, advantages, and real-world applications to help you make an informed decision for your vehicle's protection.

Understanding Gap Auto Insurance

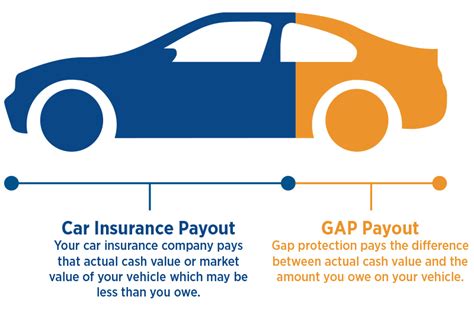

Gap Auto Insurance, a specialized coverage option, steps in to address a common gap in traditional auto insurance policies: the disparity between a vehicle’s actual cash value and its outstanding loan or lease balance. This gap often arises when a vehicle is totaled or stolen, leaving the owner with a financial shortfall. Gap insurance steps in to bridge this gap, providing a safety net for policyholders.

The Need for Gap Insurance

Consider a scenario: you’ve just purchased a new car, and within a few months, an unfortunate accident totals your vehicle. Your standard auto insurance policy covers the actual cash value of the car, which may be significantly less than the amount you still owe on your loan. This is where Gap Insurance becomes crucial, ensuring you’re not left with a substantial financial burden.

Gap Insurance, often offered as an add-on to your primary auto insurance policy, is particularly beneficial for new car buyers or those who have leased their vehicles. It ensures that, in the event of a total loss, the insurance company pays off the remaining balance on your loan or lease, providing financial relief and peace of mind.

How Gap Auto Insurance Works

Gap Insurance operates by covering the difference between your vehicle’s depreciated value and the amount you owe on your loan or lease. This difference, known as the “gap,” can be substantial, especially in the first few years of vehicle ownership. By purchasing Gap Insurance, you’re essentially ensuring that you won’t be held personally responsible for this gap if your vehicle is deemed a total loss.

| Coverage Scenario | Gap Insurance Benefit |

|---|---|

| Total Loss Due to Accident | Pays off remaining loan/lease balance |

| Vehicle Theft | Covers gap between value and debt |

| Vehicle Write-Off | Ensures no financial shortfall |

Benefits and Considerations of Gap Auto Insurance

While Gap Insurance offers significant advantages, it’s essential to understand its nuances and potential limitations to make an informed decision.

Key Advantages

Financial Protection: Gap Insurance provides a vital layer of financial protection, ensuring you’re not left with a substantial debt should your vehicle be totaled or stolen. This peace of mind is especially crucial for new car owners or those with substantial loans.

Affordability: Despite its comprehensive coverage, Gap Insurance is often surprisingly affordable, with many policies offering this coverage for a nominal additional premium.

Flexibility: Gap Insurance is typically offered as an add-on to your existing auto insurance policy, allowing you to customize your coverage to suit your specific needs and budget.

Considerations

Limited Coverage Period: Gap Insurance coverage often has a specific timeframe, typically lasting until your loan or lease is paid off. It’s essential to understand the coverage period and ensure it aligns with your financial situation.

Exclusions and Limitations: Like any insurance policy, Gap Insurance comes with its own set of exclusions and limitations. It's crucial to review the policy terms carefully to understand what's covered and what's not. For instance, some policies may not cover certain types of vehicles or may have specific requirements for the age or mileage of the vehicle.

When to Opt for Gap Insurance

Gap Insurance is particularly beneficial for individuals who have recently purchased a new vehicle or those who have leased their cars. In these scenarios, the vehicle’s value depreciates rapidly, and the gap between its actual cash value and the loan balance can be significant. By opting for Gap Insurance, you’re ensuring that you’re not personally liable for this gap, providing a financial safety net.

| Vehicle Ownership Scenario | Gap Insurance Recommendation |

|---|---|

| New Vehicle Purchase | Highly Recommended |

| Leased Vehicle | Essential |

| Older, Paid-Off Vehicle | Not Necessary |

Real-World Applications and Case Studies

To better understand the impact of Gap Insurance, let’s explore some real-world scenarios and case studies where this coverage has made a significant difference.

Case Study: John’s New Car

John, a recent graduate, purchases his first new car, excited about the prospect of reliable transportation. However, within a year, an unexpected accident totals his vehicle. John’s standard auto insurance policy covers the actual cash value of the car, but with a substantial loan balance remaining, he faces a significant financial burden. Fortunately, John had opted for Gap Insurance, which covered the difference, ensuring he could walk away from the accident debt-free.

Case Study: Sarah’s Lease

Sarah leases a luxury sedan, enjoying the perks of a new car without the long-term commitment. However, a year into her lease, her vehicle is stolen. With Gap Insurance, Sarah is relieved to find that the policy covers the remaining lease payments, ensuring she isn’t held liable for the stolen vehicle.

Case Study: Mike’s Old Car

Mike, a long-time car owner, has an older vehicle that he’s paid off entirely. While his standard auto insurance policy provides coverage for damages and accidents, he doesn’t opt for Gap Insurance as his vehicle’s value has depreciated significantly, and there’s no outstanding loan balance to worry about.

Comparative Analysis: Gap Auto Insurance vs. Standard Auto Insurance

While Standard Auto Insurance provides essential coverage for damages and liability, Gap Insurance fills a critical gap in this coverage, addressing the potential financial shortfall that arises when a vehicle is totaled or stolen. Let’s explore how these two types of insurance differ and complement each other.

Coverage Comparison

Standard Auto Insurance: Offers coverage for a range of scenarios, including liability, collision, comprehensive, and personal injury protection. It covers the actual cash value of your vehicle in the event of a total loss, but may not cover the entire loan or lease balance.

Gap Insurance: Specifically designed to cover the gap between your vehicle's depreciated value and the amount you owe on your loan or lease. It provides financial protection in the event of a total loss, ensuring you're not left with a substantial debt.

| Coverage Aspect | Standard Auto Insurance | Gap Insurance |

|---|---|---|

| Damage Coverage | Yes | No |

| Liability Coverage | Yes | No |

| Total Loss Protection | Up to ACV | Pays off loan/lease balance |

When to Choose Each

Standard Auto Insurance: Essential for all vehicle owners, providing broad coverage for various scenarios. It’s a foundational policy that every driver should have.

Gap Insurance: Highly recommended for new car buyers or those who have leased their vehicles. It provides an additional layer of protection, ensuring financial stability in the event of a total loss.

The Future of Gap Auto Insurance

As the automotive industry continues to evolve, with advancements in technology and changing consumer trends, the role of Gap Insurance is also likely to adapt. Here’s a glimpse into the potential future of this coverage.

Emerging Trends

Autonomous Vehicles: With the rise of self-driving cars, the insurance landscape is set to change. Gap Insurance may play a critical role in covering the potential financial losses associated with autonomous vehicles, especially during the transition period.

Shared Mobility: The sharing economy has transformed the way we use vehicles. With the rise of car-sharing and ride-sharing services, Gap Insurance could become even more relevant, providing protection for those who use vehicles for commercial purposes.

Potential Challenges

As with any insurance product, Gap Insurance may face challenges in the future. These could include changing consumer preferences, evolving regulations, and the impact of emerging technologies on vehicle values and depreciation rates.

Conclusion

Gap Auto Insurance is a specialized coverage option that addresses a critical gap in traditional auto insurance policies. By understanding its benefits, considerations, and real-world applications, you can make an informed decision about whether this coverage is right for you. As the automotive landscape continues to evolve, staying ahead of the curve with strategic insurance choices is essential for financial stability and peace of mind.

Is Gap Insurance Always Necessary?

+Gap Insurance is highly recommended for new car buyers and those who have leased their vehicles. It provides financial protection in the event of a total loss, ensuring you’re not left with a substantial debt. However, for older vehicles that are fully paid off, Gap Insurance may not be necessary as there’s no outstanding loan balance to worry about.

How Much Does Gap Insurance Cost?

+The cost of Gap Insurance can vary depending on several factors, including the value of your vehicle, the amount of your loan or lease, and your insurance provider. However, it’s often surprisingly affordable, with many policies offering this coverage for a nominal additional premium.

Can I Get Gap Insurance After My Loan is Paid Off?

+In most cases, Gap Insurance is designed to cover the gap between your vehicle’s value and the outstanding loan balance. Once your loan is paid off, the need for Gap Insurance diminishes as there’s no longer a gap to cover. However, it’s always best to consult with your insurance provider to understand your specific circumstances.