General Liability Insurance Commercial

General liability insurance is a cornerstone of protection for businesses, providing a vital safety net against a myriad of potential risks. This coverage is particularly crucial for commercial entities, offering financial security and peace of mind in an inherently uncertain business landscape. With an array of potential liabilities, from property damage to bodily injury, and even advertising-related issues, having robust general liability insurance is not just a good idea; it's a necessity.

In this comprehensive guide, we will delve into the intricacies of general liability insurance for commercial ventures. We will explore its critical importance, the specific risks it covers, how it operates in practice, and why it is an indispensable component of any business's risk management strategy. Additionally, we will provide real-world examples and insights to help you understand and leverage this essential form of insurance to its fullest potential.

Understanding General Liability Insurance

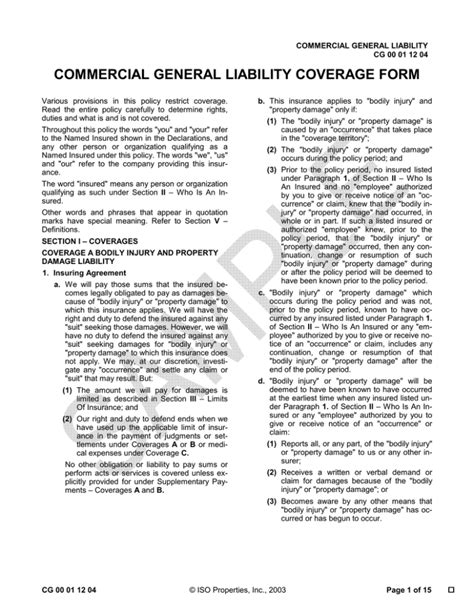

General liability insurance, often referred to as “commercial general liability insurance” (CGL) in the business context, is a form of coverage designed to protect businesses from a wide range of potential liabilities that could arise during the normal course of their operations. These liabilities could include, but are not limited to, bodily injury, property damage, personal and advertising injury, and medical payments.

This type of insurance acts as a vital safety net, providing financial protection and legal defense for businesses when they face lawsuits or claims arising from these liabilities. It is a cornerstone of risk management for commercial entities, helping them to navigate the uncertainties and potential pitfalls of the business world with confidence and resilience.

The Scope of Coverage

General liability insurance covers a broad spectrum of potential risks that a business might encounter. Here’s an overview of the key areas it typically addresses:

- Bodily Injury: This coverage applies when a customer, client, or even a passerby sustains an injury on your business premises or as a result of your products or services. For instance, if a customer slips and falls in your store, or if a defective product you sell causes an injury, general liability insurance can help cover the associated medical expenses and legal costs.

- Property Damage: If your business inadvertently causes damage to the property of others, this coverage comes into play. This could involve situations like a fire caused by your business that damages neighboring properties, or if your delivery vehicle accidentally collides with and damages another vehicle or building.

- Personal and Advertising Injury: This coverage relates to non-physical injuries, such as defamation, copyright infringement, or invasion of privacy. For example, if a competitor sues your business for false advertising or libel, general liability insurance can provide a financial buffer and legal support.

- Medical Payments: In the event that someone is injured on your business premises, this coverage can help cover their immediate medical expenses, regardless of who is at fault. This type of coverage is designed to offer quick assistance and can help reduce the need for lengthy legal proceedings.

It's important to note that general liability insurance typically covers third-party claims and does not extend to injuries or damages sustained by employees, which are typically covered under workers' compensation insurance.

Why Commercial Entities Need General Liability Insurance

For commercial ventures, general liability insurance is not just a prudent measure; it’s an essential component of their risk management strategy. Here’s why:

Protecting Your Business Assets

Businesses invest significant resources into their operations, from physical assets like buildings and equipment to intangible assets like brand reputation and intellectual property. General liability insurance helps protect these assets by providing financial coverage for potential liabilities. Without this insurance, a single lawsuit or claim could result in substantial financial losses, potentially threatening the viability of the entire business.

Building Customer and Client Trust

In today’s competitive business landscape, trust and reputation are invaluable assets. General liability insurance demonstrates a commitment to professional conduct and responsibility. It reassures customers and clients that the business is prepared to handle any unexpected incidents or accidents that might occur, fostering an environment of trust and confidence.

Meeting Legal and Regulatory Requirements

Many industries and jurisdictions have specific legal and regulatory requirements regarding insurance coverage. For instance, some industries, such as construction or healthcare, may require businesses to carry general liability insurance as a condition of operation. Additionally, contracts with clients or suppliers may stipulate that a business maintains a certain level of insurance coverage.

Attracting Investors and Partners

When seeking funding or partnerships, businesses are often scrutinized for their risk management strategies. Having comprehensive general liability insurance in place can enhance a business’s credibility and attractiveness to potential investors or partners. It signals a well-managed and responsible business operation.

Real-World Examples of General Liability Insurance in Action

Understanding the practical applications of general liability insurance can provide valuable insights into its importance and benefits. Here are a few real-world scenarios where this coverage has made a significant difference:

Scenario 1: Slip and Fall Incident

A customer slipped and fell in a retail store due to a recently mopped floor that was not properly marked with a warning sign. The customer sustained a broken arm and sued the store for negligence. The store’s general liability insurance covered the medical expenses, legal fees, and a settlement payment to the customer, mitigating the financial impact of the incident.

Scenario 2: Product Defect Claim

A manufacturing company produced a line of children’s toys that were found to have a design defect, causing them to break easily and pose a choking hazard. A parent sued the company after their child swallowed a small part from one of the toys. The company’s general liability insurance stepped in to cover the legal costs and the settlement, protecting the company’s financial stability.

Scenario 3: Advertising Dispute

A small business owner was sued by a competitor for false advertising after running a promotional campaign that the competitor claimed misrepresented the quality of their products. The business owner’s general liability insurance covered the legal fees and helped negotiate a settlement, allowing the business to continue operating without significant financial strain.

Choosing the Right General Liability Insurance

Selecting the appropriate general liability insurance policy is a critical decision for any commercial entity. Here are some key considerations to guide your choice:

Coverage Limits

General liability insurance policies come with coverage limits, which dictate the maximum amount the insurer will pay out for a covered claim. It’s essential to choose limits that align with your business’s risk profile and potential liabilities. Higher limits offer more protection but also typically come with a higher premium.

Policy Exclusions

All general liability insurance policies have exclusions - specific situations or claims that are not covered. It’s crucial to thoroughly review the policy’s exclusions to ensure that your business’s unique risks are adequately covered. If necessary, you can often purchase endorsements or additional coverage to address specific concerns.

Claims-Made vs. Occurrence Policies

There are two main types of general liability policies: claims-made and occurrence. A claims-made policy only covers claims made during the policy period, regardless of when the incident occurred. An occurrence policy, on the other hand, covers incidents that occur during the policy period, even if the claim is made after the policy has expired.

Deductibles and Self-Insured Retentions

Deductibles and self-insured retentions (SIRs) are amounts that the insured business must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible or SIR can lower your premium, but it also means your business will be responsible for a larger portion of any claim.

Best Practices for Managing General Liability Risks

While general liability insurance provides crucial protection, it’s equally important to implement proactive risk management strategies to minimize the likelihood and impact of potential liabilities. Here are some best practices to consider:

Regular Safety Audits

Conducting regular safety audits of your business premises and operations can help identify and address potential hazards before they lead to incidents or accidents. This could involve assessing slip and fall risks, electrical safety, fire safety, and other potential dangers.

Employee Training

Investing in comprehensive employee training can significantly reduce the risk of accidents and incidents. Ensure that your staff is well-versed in safety protocols, proper handling of equipment and materials, and emergency procedures. This not only helps prevent incidents but also demonstrates due diligence in the event of a claim.

Product Safety and Quality Control

If your business manufactures or sells products, implementing rigorous product safety and quality control measures is essential. This includes thorough testing, regular inspections, and adherence to industry standards and regulations. By ensuring the safety and quality of your products, you can significantly reduce the risk of product-related liabilities.

Professional Advice and Consultation

Seeking advice from insurance professionals, risk managers, and legal experts can provide valuable insights into your business’s unique risk profile and how to best manage it. These professionals can help you tailor your insurance coverage to your specific needs and provide guidance on risk mitigation strategies.

The Future of General Liability Insurance

The landscape of general liability insurance is continually evolving, driven by technological advancements, changing consumer behaviors, and emerging risks. Here are some key trends and considerations for the future:

Technological Disruption

The rise of e-commerce, remote work, and digital technologies has expanded the scope of potential liabilities for businesses. From cybersecurity risks to the increasing prevalence of product liability claims in the digital space, insurers and businesses alike must adapt to these new challenges.

Environmental and Social Responsibility

With growing consumer and regulatory focus on environmental and social responsibility, businesses are increasingly expected to demonstrate sustainable and ethical practices. This shift may influence the future of general liability insurance, with a potential focus on incentives and coverage for environmentally and socially responsible businesses.

Data-Driven Risk Assessment

Advanced analytics and data science are transforming the way risks are assessed and managed. Insurers are increasingly leveraging data to more accurately predict and manage risks, which could lead to more tailored and efficient insurance products in the future.

Collaboration and Partnership

The insurance industry is recognizing the value of collaboration and partnership with businesses to proactively manage risks. By working together, insurers and businesses can develop innovative solutions to emerging risks and create more resilient and sustainable operations.

Conclusion

General liability insurance is an indispensable tool for commercial entities, offering vital protection against a wide array of potential liabilities. By understanding the scope of coverage, the importance of this insurance, and how to choose the right policy, businesses can effectively manage their risks and safeguard their operations.

As we've seen through real-world examples, general liability insurance can be the difference between a minor setback and a devastating blow for a business. Combined with proactive risk management strategies, it empowers businesses to navigate the uncertainties of the commercial world with confidence and resilience.

What is the typical cost of general liability insurance for commercial businesses?

+

The cost of general liability insurance for commercial businesses can vary widely depending on factors such as the industry, the size and scope of operations, the location, and the specific coverage limits and deductibles chosen. On average, businesses can expect to pay between 500 and 1,000 per year for a basic policy, but premiums can range from a few hundred to several thousand dollars. It’s essential to shop around and obtain quotes from multiple insurers to find the best coverage at the most competitive price.

Does general liability insurance cover COVID-19-related claims or lawsuits?

+

Whether general liability insurance covers COVID-19-related claims or lawsuits depends on the specific policy and the circumstances of the claim. Some policies may exclude coverage for pandemic-related claims, while others may provide coverage depending on the nature of the claim and the policy’s terms and conditions. It’s crucial to review your policy carefully and, if necessary, consult with an insurance professional to understand your coverage in relation to COVID-19.

Can general liability insurance be tailored to my specific business needs?

+

Yes, general liability insurance can often be tailored to meet the specific needs of your business. This might involve adjusting coverage limits, adding endorsements or additional coverages for specific risks, or customizing the policy to address unique aspects of your operations. Working with an experienced insurance broker or agent can help you identify and address your business’s unique risk profile.

What happens if I don’t have general liability insurance and a claim is made against my business?

+

If you don’t have general liability insurance and a claim is made against your business, you will be personally responsible for covering the costs of the claim, which can include medical expenses, property damage, legal fees, and any settlements or judgments. This could potentially lead to significant financial strain or even bankruptcy for your business. It’s important to understand that general liability insurance is a vital component of any business’s risk management strategy and should not be overlooked.