Health Insurance Texas For Lowincome Adults

Health insurance is a vital aspect of healthcare, ensuring individuals have access to necessary medical services without facing financial hardship. In Texas, a state known for its diverse population and varying economic conditions, providing affordable health insurance options for low-income adults is crucial to promote overall well-being and prevent financial strain. This comprehensive guide aims to delve into the intricacies of health insurance coverage for low-income adults in Texas, shedding light on the available options, eligibility criteria, and the impact these programs have on the community.

Understanding Health Insurance Options for Low-Income Texans

Texas, the second-largest state in the U.S., presents a unique challenge when it comes to healthcare coverage. With a large population and a diverse range of income levels, ensuring that low-income adults have access to affordable health insurance is a complex task. Fortunately, several programs and initiatives are in place to address this need, offering a safety net for those who might otherwise struggle to obtain adequate healthcare.

Medicaid: A Lifeline for Low-Income Texans

Medicaid is a cornerstone of health insurance coverage for low-income individuals and families in the United States. In Texas, this program plays a vital role in providing healthcare services to those who might not be able to afford it otherwise. The Texas Health and Human Services (HHSC) manages Medicaid, which covers a wide range of services, including doctor visits, hospital stays, laboratory tests, and even some prescription medications.

Eligibility for Medicaid in Texas is primarily determined by income level and certain other criteria. The program is designed to assist those with limited financial means, ensuring they can access the healthcare they need without facing overwhelming costs. The income threshold for Medicaid varies based on factors such as family size and the applicant's age.

| Family Size | Income Threshold (Monthly) |

|---|---|

| 1 | $1,463 |

| 2 | $2,104 |

| 3 | $2,746 |

| 4 | $3,387 |

| 5 | $4,028 |

| 6 | $4,670 |

In addition to income, Medicaid in Texas also considers other factors such as disability status, pregnancy, and age. For instance, elderly individuals and those with disabilities often have lower income requirements to qualify for Medicaid.

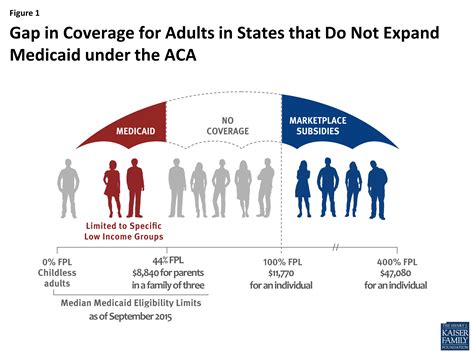

The Affordable Care Act (ACA) and Its Impact on Texas

The Affordable Care Act, often referred to as Obamacare, has significantly influenced the health insurance landscape in Texas. While the state has not expanded Medicaid under the ACA, other provisions of the law have benefited low-income adults. For instance, the ACA mandates that insurance companies cannot deny coverage to individuals with pre-existing conditions, which is a significant advantage for those who might have struggled to obtain insurance otherwise.

Furthermore, the ACA established the Health Insurance Marketplace, an online platform where individuals can compare and purchase health insurance plans. In Texas, this marketplace is run by the federal government, offering a range of plans from various insurance providers. Many of these plans are eligible for premium subsidies, making them more affordable for low-income individuals.

The impact of the ACA on Texas is evident in the number of uninsured residents. According to a report by the Kaiser Family Foundation, the uninsured rate in Texas has dropped significantly since the implementation of the ACA, indicating that more low-income adults are gaining access to healthcare.

Community Health Centers: A Vital Resource

Community Health Centers (CHCs) are an integral part of the healthcare system in Texas, especially for low-income individuals and families. These centers provide comprehensive primary healthcare services, often at reduced costs or on a sliding fee scale based on income and family size. CHCs are particularly beneficial for those who might not qualify for Medicaid or who are experiencing a gap in coverage.

The services offered at CHCs vary but typically include primary care, dental care, behavioral health services, and pharmacy services. Many CHCs also provide preventive care, such as immunizations and health screenings, which are crucial for maintaining overall health and preventing more serious health issues down the line.

The Texas Association of Community Health Centers (TACHC) represents and supports these vital healthcare providers across the state. TACHC advocates for policies that improve access to healthcare and ensures that CHCs have the resources they need to serve their communities effectively.

Navigating the Application Process

Understanding the eligibility criteria is just the first step in obtaining health insurance. The next crucial step is navigating the application process, which can sometimes be complex and overwhelming. However, with the right guidance and resources, this process can be streamlined and less daunting.

Applying for Medicaid: A Step-by-Step Guide

Applying for Medicaid in Texas involves several steps, but the process is designed to be as straightforward as possible. Here’s a step-by-step guide to help you through the application journey:

- Gather Your Documents: Before starting your application, ensure you have the necessary documents. This typically includes proof of identity, proof of Texas residency, and proof of income. For a comprehensive list of accepted documents, visit the HHSC Medicaid Application Information page.

- Choose Your Application Method: Texas offers several ways to apply for Medicaid, including online, by mail, or in person at a local HHSC office. The online application, available through the Your Texas Benefits website, is often the most convenient and fastest option.

- Complete the Application: Whether you're applying online or using a paper application, ensure you fill out all the required fields accurately. Provide detailed information about your income, family size, and any other relevant factors that might affect your eligibility.

- Submit Your Application: Once you've completed the application, submit it through the chosen method. If you're applying online, ensure you review and confirm all the details before submitting.

- Wait for a Decision: After submitting your application, HHSC will review your information and make a decision. This process can take several weeks, so be patient. You will receive a notice in the mail informing you of the decision.

- Appeal if Necessary: If your application is denied, you have the right to appeal the decision. The notice you receive will provide information on how to appeal. It's important to understand your rights and the appeal process to ensure you have access to the healthcare you need.

Exploring Other Health Insurance Options

While Medicaid is a vital program, it’s not the only option for low-income adults in Texas. Depending on your circumstances, you might also consider the following alternatives:

- Health Insurance Marketplace Plans: If you don't qualify for Medicaid, you can still explore health insurance plans through the Health Insurance Marketplace. These plans often have premium subsidies available, making them more affordable. You can compare plans and enroll during the annual Open Enrollment Period or if you experience a qualifying life event.

- Short-Term Health Insurance: Short-term health insurance plans offer temporary coverage and can be a good option if you're between jobs or experiencing a gap in coverage. These plans are typically more affordable than comprehensive plans but have limited benefits and may not cover pre-existing conditions.

- Employer-Provided Insurance: If you're employed, check with your employer about health insurance benefits. Many employers offer health insurance plans as part of their employee benefits package. These plans can often be more affordable than purchasing insurance on your own.

- Discounted Healthcare Programs: Some healthcare providers offer discounted rates or programs specifically for low-income individuals. These programs can provide access to necessary medical services at reduced costs. Research local healthcare providers or community health centers to see if they offer such programs.

The Impact of Health Insurance on Low-Income Communities

Access to health insurance has a profound impact on the well-being and economic stability of low-income communities. When individuals have health insurance, they are more likely to seek preventive care, which can lead to early detection and treatment of health issues, improving overall health outcomes. Additionally, having insurance can prevent financial catastrophe, as individuals are protected from the high costs of medical care.

Improved Health Outcomes

Health insurance plays a critical role in improving health outcomes for low-income adults. With insurance, individuals are more likely to visit a doctor regularly, receive necessary vaccinations, and manage chronic conditions effectively. This preventive approach to healthcare can lead to better overall health and a reduced risk of serious, costly health issues down the line.

Studies have shown that access to health insurance is associated with improved health status and reduced mortality rates. For instance, a study published in the Journal of the American Medical Association found that expanding Medicaid coverage led to significant improvements in health outcomes for low-income adults, including reduced rates of preventable hospitalizations and improved management of chronic conditions.

Financial Protection and Stability

One of the most significant benefits of health insurance for low-income adults is financial protection. Medical costs can quickly become unaffordable for those with limited financial means. Health insurance ensures that individuals are not faced with overwhelming medical bills, which can lead to financial hardship and even bankruptcy.

Furthermore, having health insurance can improve economic stability. When individuals have insurance, they are more likely to remain employed, as they don't have to worry about the financial burden of healthcare. This stability can lead to increased earnings and a better quality of life.

Community Benefits and Economic Impact

The impact of health insurance extends beyond the individual. Communities with high rates of insurance coverage often experience improved overall health, reduced strain on emergency rooms and public health facilities, and enhanced economic vitality. When more people have insurance, there is a reduced need for costly public health interventions, allowing resources to be directed toward other community needs.

Moreover, the economic impact of health insurance is significant. A well-insured community is more productive, with individuals able to work and contribute to the local economy. This, in turn, can lead to increased tax revenues and improved community infrastructure, benefiting all residents.

Conclusion: A Step Towards Healthier Communities

Health insurance is a critical component of a healthy, thriving community. In Texas, where a significant portion of the population faces economic challenges, ensuring that low-income adults have access to affordable health insurance is essential. Programs like Medicaid and initiatives through the Affordable Care Act provide a safety net, ensuring that no one is left without the healthcare they need.

By understanding the available options, eligibility criteria, and the application process, low-income adults in Texas can take control of their healthcare journey. With the right insurance coverage, individuals can focus on maintaining their health, improving their quality of life, and contributing to the vitality of their communities. As we continue to navigate the complex world of healthcare, it's important to remember that access to healthcare is a fundamental right, and we must work towards ensuring that everyone has the opportunity to live a healthy life.

Can I qualify for Medicaid if I’m not a U.S. citizen?

+Yes, certain non-citizens can qualify for Medicaid in Texas. To be eligible, you must be a lawfully present individual, such as a lawful permanent resident, asylee, refugee, or a person granted conditional entry. It’s important to provide documentation proving your lawful presence when applying.

What if I don’t have a stable income? How can I prove my eligibility for Medicaid?

+If you have an unstable or fluctuating income, you can still apply for Medicaid. The application process allows you to provide an estimate of your income based on your best knowledge. It’s important to be as accurate as possible, but the application also considers other factors beyond income, such as family size and certain expenses.

Are there any special Medicaid programs for pregnant women or new mothers?

+Yes, Texas offers a special Medicaid program called the Pregnancy Medicaid or Medicaid for Pregnant Women. This program provides healthcare coverage specifically for pregnant women and new mothers. The income threshold for this program is typically higher than for regular Medicaid, making it more accessible to expectant mothers.

How often do I need to renew my Medicaid coverage?

+Medicaid coverage is typically renewed on an annual basis. However, the renewal process may vary depending on your specific circumstances and the type of Medicaid program you’re enrolled in. It’s important to stay informed about your renewal dates and to provide any necessary updates to your information during the renewal process.