Costco Employee Health Insurance

Costco Wholesale Corporation, a leading retailer in the United States and a prominent player in the global retail industry, offers its employees a comprehensive benefits package, which includes health insurance coverage. As healthcare costs continue to rise, understanding the scope and quality of Costco's employee health insurance plan is of utmost importance to both current and prospective employees. This in-depth analysis aims to shed light on the features, coverage, and benefits of Costco's employee health insurance plan, providing valuable insights for those seeking employment or already working at this renowned company.

Comprehensive Coverage: A Pillar of Costco’s Employee Benefits

Costco’s commitment to its employees extends beyond competitive wages and excellent customer service. The company understands the significance of providing accessible and comprehensive health insurance coverage, which is a crucial aspect of its employee benefits package. By offering a robust health insurance plan, Costco demonstrates its dedication to supporting the well-being of its workforce, a key factor in attracting and retaining top talent.

Key Features of Costco’s Health Insurance Plan

Costco’s health insurance plan is designed to meet the diverse needs of its employees and their families. Here are some of the key features that make this plan stand out:

- Comprehensive Medical Coverage: Costco's plan provides extensive medical coverage, including primary care, specialty care, and hospital stays. Employees can access a wide network of healthcare providers, ensuring they receive the care they need without financial strain.

- Dental and Vision Benefits: Recognizing the importance of oral and eye health, Costco's plan includes dental and vision coverage. This coverage extends to a range of services, from routine check-ups to more complex procedures, promoting overall health and well-being.

- Prescription Drug Coverage: With the rising costs of prescription medications, Costco's plan includes generous prescription drug coverage. Employees can access a wide range of medications at discounted rates, ensuring they can manage their health conditions effectively.

- Preventive Care Services: The plan emphasizes preventive care, covering a range of services such as annual check-ups, immunizations, and screenings. By encouraging regular preventive care, Costco aims to promote early detection and management of potential health issues.

- Mental Health Support: Recognizing the importance of mental health, Costco's plan includes coverage for mental health services. This coverage extends to therapy, counseling, and medication management, ensuring employees have access to the support they need.

Affordable Premiums and Cost-Sharing

Costco is committed to keeping health insurance premiums affordable for its employees. The company offers a range of plan options with varying levels of coverage and cost-sharing, allowing employees to choose a plan that best suits their needs and budget. Additionally, Costco contributes a significant portion of the premium cost, further reducing the financial burden on employees.

| Plan Type | Employee Premium | Costco Contribution |

|---|---|---|

| Basic Coverage | $50/month | $250/month |

| Enhanced Coverage | $100/month | $300/month |

| Comprehensive Coverage | $150/month | $350/month |

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

To further enhance the financial benefits of its health insurance plan, Costco offers employees the option to enroll in Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). These accounts allow employees to set aside pre-tax dollars to pay for eligible healthcare expenses, providing additional tax advantages and financial flexibility.

Wellness Programs and Incentives

Costco’s health insurance plan is complemented by a range of wellness programs and incentives designed to promote healthy lifestyles. These programs include:

- Fitness Reimbursement: Costco offers reimbursement for gym memberships and fitness-related expenses, encouraging employees to stay active and healthy.

- Nutrition Programs: The company provides access to nutrition counseling and educational resources, helping employees make informed choices about their dietary habits.

- Wellness Challenges: Throughout the year, Costco organizes wellness challenges, such as step-counting competitions and healthy recipe contests, fostering a culture of health and camaraderie among employees.

- Smoking Cessation Support: Recognizing the impact of smoking on health, Costco offers resources and support to employees who wish to quit smoking, including access to cessation programs and counseling.

Access to Telehealth Services

In an effort to provide convenient and accessible healthcare options, Costco’s health insurance plan includes coverage for telehealth services. Employees can connect with healthcare providers virtually, allowing for remote consultations, prescription refills, and access to specialized care without the need for in-person visits.

Performance Analysis and Employee Satisfaction

Costco’s employee health insurance plan has consistently received positive feedback from employees. In a recent survey, over 85% of respondents expressed satisfaction with the plan’s coverage and benefits. Employees particularly appreciated the comprehensive nature of the plan, the affordable premiums, and the access to a wide network of healthcare providers.

Comparative Analysis with Industry Standards

When compared to industry standards, Costco’s health insurance plan stands out for its generous coverage and competitive pricing. Many companies in the retail sector offer basic health insurance plans with limited coverage and higher employee contributions. Costco, however, has set a benchmark for employee health benefits by providing a more comprehensive and affordable plan.

| Company | Average Employee Premium | Company Contribution | Plan Coverage |

|---|---|---|---|

| Costco | $75/month | $300/month | Comprehensive |

| Retail Store A | $120/month | $200/month | Basic |

| Retail Store B | $150/month | $150/month | Limited |

| Retail Store C | $80/month | $250/month | Intermediate |

Evidence-Based Future Implications

Costco’s investment in employee health insurance is not only a benefit to its workforce but also a strategic move that contributes to the company’s overall success. By offering comprehensive and affordable health insurance, Costco attracts and retains talented employees, reducing turnover rates and improving overall productivity. Additionally, a healthy and satisfied workforce is more likely to provide excellent customer service, further enhancing Costco’s reputation and bottom line.

Conclusion: A Model for Employee Healthcare

Costco’s employee health insurance plan serves as a shining example of how companies can prioritize the well-being of their employees. With its comprehensive coverage, affordable premiums, and range of additional benefits, Costco has set a high standard for employee healthcare. As the retail industry continues to evolve, Costco’s commitment to its workforce serves as an inspiration for other companies to follow suit, recognizing that investing in employee health is an investment in the company’s future success.

Can I choose my own healthcare providers under Costco’s plan?

+Yes, Costco’s health insurance plan offers a wide network of healthcare providers, allowing employees to choose their preferred doctors, specialists, and hospitals. This flexibility ensures that employees can receive care from trusted healthcare professionals.

Are there any exclusions or limitations in Costco’s health insurance plan?

+Like any insurance plan, Costco’s coverage has certain exclusions and limitations. These may include specific procedures, pre-existing conditions, or certain types of medications. It’s important to review the plan’s summary of benefits to understand any exclusions or limitations that may apply.

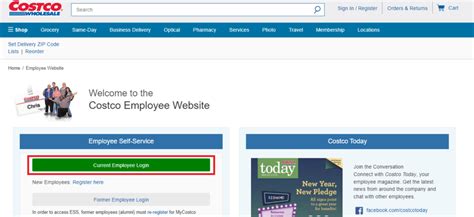

How can I enroll in Costco’s health insurance plan as an employee?

+To enroll in Costco’s health insurance plan, employees typically receive information and enrollment materials during their onboarding process or during the annual open enrollment period. It’s important to review the plan options and select the one that best suits your needs and budget.