Cheap Health Insurance In Wa State

When it comes to finding affordable health insurance options in Washington State, it's important to navigate the available plans and providers effectively. This comprehensive guide will delve into the specifics of obtaining cheap health insurance in WA state, providing an in-depth analysis of coverage, costs, and tips for making informed decisions. From understanding the local healthcare landscape to exploring various insurance plans, we aim to empower residents with the knowledge needed to secure quality healthcare at an affordable price.

Understanding Health Insurance Options in WA

Washington State offers a range of health insurance plans tailored to meet the diverse needs of its residents. To secure cheap health insurance, it’s crucial to understand the different coverage options available and how they align with individual requirements. Here’s an overview of the key players in the WA health insurance market.

Public Health Insurance Programs

Washington State provides several publicly funded health insurance programs designed to assist residents who may not have access to private insurance. These programs include:

- Apple Health (Medicaid): A government-funded health insurance program for low-income individuals and families. It covers a wide range of medical services, including doctor visits, hospital stays, and prescription drugs. Eligibility is based on income and household size.

- Children’s Health Insurance Program (CHIP): This program provides low-cost health coverage for children in families who earn too much to qualify for Medicaid but cannot afford private insurance. CHIP offers comprehensive benefits, including routine check-ups, immunizations, and dental care.

- WA Healthplanfinder: A state-run marketplace where residents can compare and purchase qualified health plans. It offers both Medicaid and private insurance options, allowing individuals to find the most suitable and affordable coverage for their needs.

Private Health Insurance Providers

In addition to public programs, Washington State is home to numerous private health insurance providers. These companies offer a variety of plans with different coverage levels and price points. Some of the major private insurance providers in WA include:

- Regence BlueShield: A leading health insurer in the Pacific Northwest, Regence provides a range of health plans, including individual, family, and employer-sponsored options. Their plans often include robust coverage for preventive care and specialty services.

- Premera Blue Cross: As one of the largest health insurers in the state, Premera offers a wide selection of health plans with various deductible and copayment options. They are known for their comprehensive network of providers and focus on customer satisfaction.

- BridgeSpan Health: A subsidiary of Regence BlueShield, BridgeSpan specializes in offering affordable health insurance plans to individuals and families. Their plans often feature lower premiums and a strong focus on preventive care.

- Kaiser Permanente: This integrated healthcare system provides both insurance coverage and direct medical care through their own network of hospitals and clinics. Kaiser Permanente plans often include a high level of coordination and convenience, making them a popular choice for many WA residents.

Factors Influencing Health Insurance Costs in WA

The cost of health insurance in Washington State can vary significantly depending on several key factors. Understanding these influences is crucial when searching for cheap health insurance options. Here are the primary factors that impact insurance costs in WA:

Plan Type and Coverage Level

The type of health insurance plan and the level of coverage it provides are major determinants of cost. In general, plans with higher coverage levels, such as those offering comprehensive benefits and lower out-of-pocket expenses, tend to be more expensive. Conversely, plans with higher deductibles and copayments are often more affordable but may require greater financial responsibility from the insured.

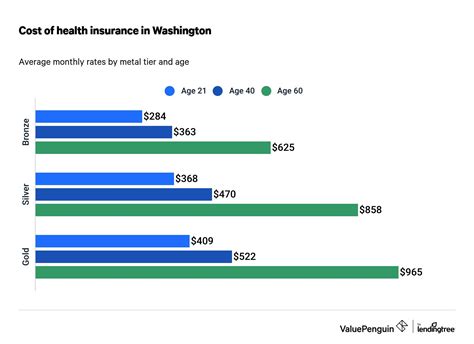

Age and Health Status

Health insurance costs can vary based on the age and health status of the insured individual. Younger, healthier individuals often qualify for lower premiums, while older individuals or those with pre-existing health conditions may face higher costs. It’s important to note that in Washington State, health insurance companies are prohibited from denying coverage or charging higher premiums based solely on pre-existing conditions, thanks to the Affordable Care Act (ACA) protections.

Location

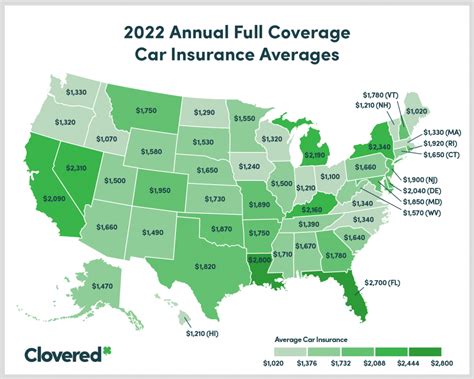

The cost of health insurance can vary significantly depending on the region within Washington State. Urban areas, such as Seattle and its surrounding suburbs, often have higher healthcare costs and insurance premiums compared to more rural areas. This is primarily due to differences in the cost of living and the availability of healthcare services.

Tobacco Use

In Washington State, as in many other states, health insurance companies are allowed to charge tobacco users higher premiums. This practice is intended to incentivize individuals to quit smoking and improve their overall health. If you’re a tobacco user, it’s important to consider the potential impact on your insurance costs and explore strategies to quit smoking, which can lead to better health and potentially lower insurance premiums.

Tips for Finding Cheap Health Insurance in WA

Securing cheap health insurance in Washington State requires a strategic approach. Here are some valuable tips to help you navigate the process and find the most affordable coverage that meets your needs:

Compare Plans and Providers

Take the time to thoroughly research and compare different health insurance plans and providers. Utilize online resources, such as the WA Healthplanfinder marketplace, to explore a wide range of options. Compare coverage levels, provider networks, and out-of-pocket costs to find the plan that best fits your healthcare needs and budget.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans often come with lower premiums, making them an attractive option for those seeking cheap health insurance. However, it’s important to carefully evaluate your healthcare needs and financial situation before choosing an HDHP. These plans require you to pay a higher deductible before your insurance coverage kicks in, so they may not be suitable if you anticipate frequent or costly medical expenses.

Take Advantage of Public Programs

If you meet the eligibility criteria, consider enrolling in public health insurance programs like Apple Health (Medicaid) or the Children’s Health Insurance Program (CHIP). These programs offer comprehensive coverage at little to no cost, making them an excellent option for low-income individuals and families. Exploring these options can provide significant savings and peace of mind.

Shop During Open Enrollment

In Washington State, the annual open enrollment period for individual and family health plans typically runs from November 1 to December 15. During this time, you can enroll in a new health insurance plan or make changes to your existing coverage. It’s crucial to plan ahead and review your options during this period to ensure you secure the most suitable and affordable plan for the upcoming year.

Explore Short-Term Health Insurance Plans

If you’re between jobs, recently graduated, or facing a temporary gap in coverage, short-term health insurance plans can provide a cost-effective solution. These plans offer limited coverage for a set period, typically ranging from a few months to a year. While they may not offer the same level of comprehensive benefits as traditional plans, they can help bridge the gap and provide essential coverage during transitional periods.

Future Outlook and Innovations in WA Health Insurance

The landscape of health insurance in Washington State is continuously evolving, driven by advancements in technology, changing healthcare needs, and policy reforms. Here’s a glimpse into the future of health insurance in WA and some potential innovations to watch out for:

Telehealth and Digital Health Services

The COVID-19 pandemic has accelerated the adoption of telehealth services, allowing patients to access healthcare remotely. In the future, we can expect to see further integration of digital health tools and telehealth services into traditional health insurance plans. This could lead to more convenient and accessible healthcare, especially for individuals in rural or underserved areas.

Value-Based Care Models

Value-based care models, which focus on providing high-quality care while controlling costs, are gaining traction in the healthcare industry. These models reward healthcare providers for achieving positive health outcomes rather than simply billing for services rendered. In the future, we may see more health insurance plans in Washington State adopting value-based care models, potentially leading to more efficient and affordable healthcare.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are becoming increasingly popular. These plans give individuals more control over their healthcare spending and encourage them to make informed decisions about their health. In the future, we can anticipate seeing more insurance providers in WA offering consumer-driven plans, providing residents with greater flexibility and cost savings.

Integration of Social Determinants of Health

Social determinants of health, such as socioeconomic status, education, and environmental factors, play a significant role in an individual’s overall health and well-being. In the future, we may see health insurance plans in Washington State incorporating strategies to address these social determinants. This could involve partnering with community organizations, providing resources for social services, or offering incentives for healthy behaviors, ultimately leading to improved population health and potentially lower healthcare costs.

Conclusion

Finding cheap health insurance in Washington State requires a careful understanding of the available options and the factors influencing costs. By comparing plans, exploring public programs, and staying informed about emerging trends, you can navigate the health insurance landscape effectively and secure the coverage you need at a price you can afford. Remember, health insurance is an essential investment in your well-being, and with the right plan, you can access quality healthcare without breaking the bank.

Can I qualify for Medicaid (Apple Health) in Washington State?

+

Eligibility for Medicaid (Apple Health) in Washington State is primarily based on income and household size. To qualify, your income must be at or below a certain threshold, which varies depending on your family size. You can check your eligibility and apply through the WA Healthplanfinder website or by contacting your local Department of Social and Health Services (DSHS) office.

What is the difference between an HMO and a PPO health plan?

+

An HMO (Health Maintenance Organization) plan typically requires you to choose a primary care physician (PCP) and obtain referrals for specialist care. HMO plans often have lower out-of-pocket costs but may have a more limited network of providers. On the other hand, a PPO (Preferred Provider Organization) plan allows you to see any healthcare provider, but you may pay more if you choose providers outside the preferred network. PPO plans offer more flexibility but often come with higher premiums and out-of-pocket expenses.

Are there any discounts or subsidies available for health insurance in WA?

+

Yes, Washington State offers various discounts and subsidies to help make health insurance more affordable. If you purchase a qualified health plan through the WA Healthplanfinder marketplace, you may be eligible for premium tax credits and cost-sharing reductions based on your income. These subsidies can significantly lower your monthly premiums and out-of-pocket costs. Additionally, some insurance providers offer discounts for healthy lifestyle choices or for enrolling in automatic payment plans.

Can I switch health insurance plans outside of the open enrollment period in WA?

+

In Washington State, you can switch health insurance plans outside of the open enrollment period under certain circumstances. These include losing your current coverage due to a job loss or change in employment, getting married or divorced, having a baby or adopting a child, or moving to a new area. These life events are considered “qualifying events” and allow you to enroll in a new plan outside of the standard open enrollment period. However, it’s important to act promptly and review your options carefully to ensure a seamless transition.

What should I look for in a health insurance plan if I have a chronic condition?

+

If you have a chronic condition, it’s crucial to choose a health insurance plan that provides comprehensive coverage for your specific healthcare needs. Look for plans with a strong network of providers that include specialists in your condition. Consider plans with lower out-of-pocket costs for prescription medications and specialty services. Additionally, review the plan’s coverage for preventive care, as regular check-ups and screenings can help manage your condition effectively.